BLOG

Digital Transformation in Southeast Asia: Three Key Aspects that Accelerate Growth

Our research shows that optimism, commitment and ambition are powering major regional gains.

With the backdrop of the COVID-19 crisis, there is more pressure for digital transformation to accelerate in many organizations. In our latest global study, Altimeter, a Prophet company surveyed more than 600 key executives, including 100 in Southeast Asia (SEA) across Singapore, Indonesia and Vietnam, about how they are pursuing digital transformation and the impact of the pandemic.

Our study reveals interesting differences between digital transformation efforts and sentiment in Southeast Asia versus the rest of the world. (Download the full SEA report here)

There are three distinct aspects that made Southeast Asia companies’ digital transformation journey stand out.

1. Optimism: Accelerating Digital Transformation Amid COVID-19 Crisis

While the rest of the world is becoming more risk-averse amid the crisis, SEA expresses optimism about the future. In fact, a significantly higher number of companies have accelerated their digital transformation initiatives and are focused on growth.

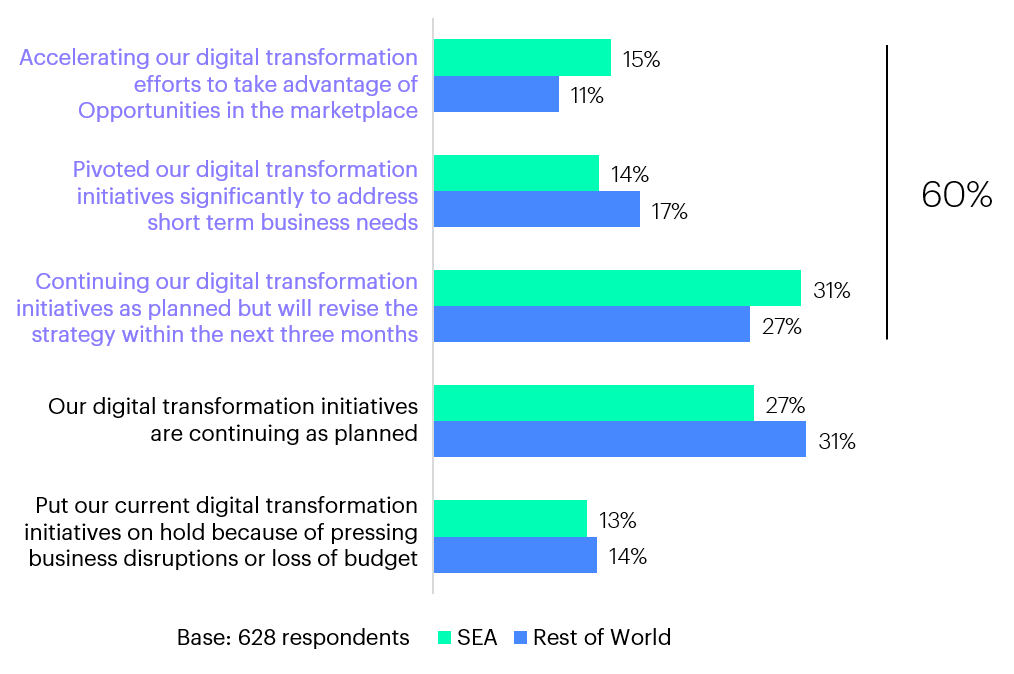

Figure 1: Digital Transformation Initiatives Shifted Amidst COVID-19

“How have your digital transformation initiatives shifted because of the spread of COVID-19”

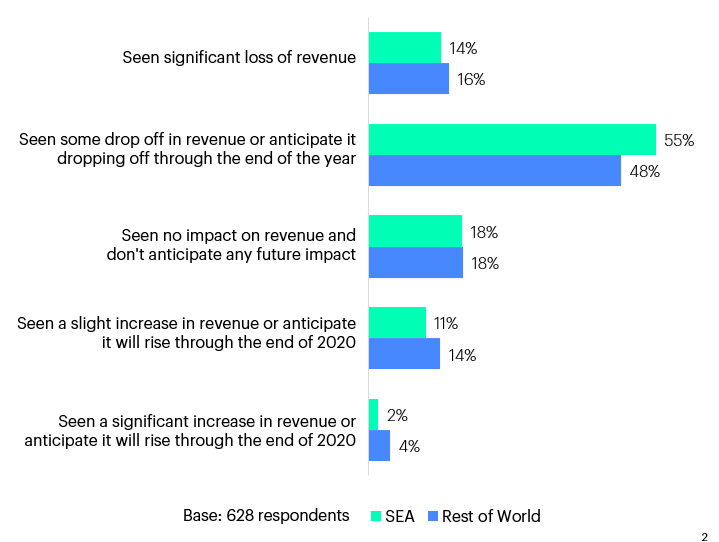

Similar to the rest of the world, SEA companies have seen or are anticipating drop-offs of revenue as a result of COVID-19; however, the impact is less significant. Thanks to the massive and quick preventive measures enacted by the government at an early stage, Vietnam is suffering the least financially during COVID-19. Specifically, 27 percent of respondents stated that they have seen no impact on revenue or don’t anticipate any future impact, followed by Indonesia (15%) and Singapore (13%)

Figure 2: The Impact of COVID-19 on Financial Performance

“What impact has COVID-19 had on your financial performance?”

Vietnam’s commitment to transform digitally had already started before the pandemic with the launch of the National Public Service Portal and Resolution for Industry 4.0. It accelerated during the COVID-19 outbreak when offline economic activities slowed down because of strong government policies. In June 2020, the country launched a National Digital Transformation Roadmap to further advance digital transformation around three key pillars i.e. e-government, e-economy and e-society. The Singapore government also launched similar initiatives offering subsidies and grants to help companies embark or accelerate its digital transformation programs.

“While the rest of the world is becoming more risk-averse amid the crisis, SEA expresses optimism about the future.”

2. Commitment: Focused Executive Sponsorship to Carry out Change

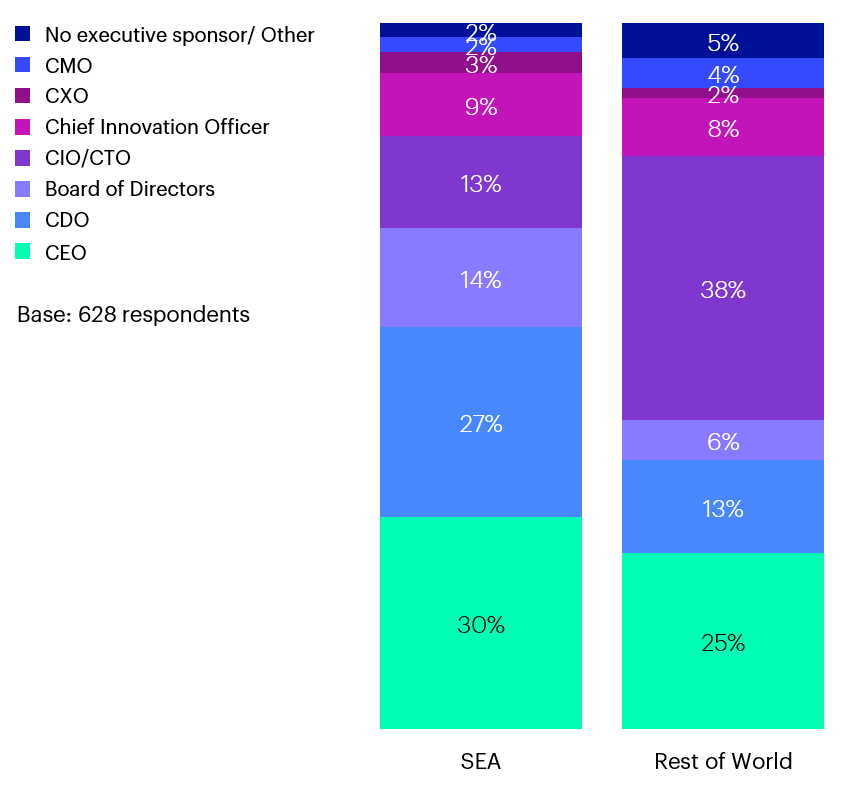

There is stronger executive sponsorship on digital transformation in SEA. Here, digital transformation is primarily driven by the CEO (30% in SEA vs. 25% in rest of the world), and twice as likely to be owned by the CDO (27% in SEA vs. 13% in rest of the world) or Board of Directors (14% in SEA vs. 6% in rest of the world).

Figure 3: Executive Sponsorship for Digital Transformation

“Which executive officially owns or sponsors the digital transformation initiative”

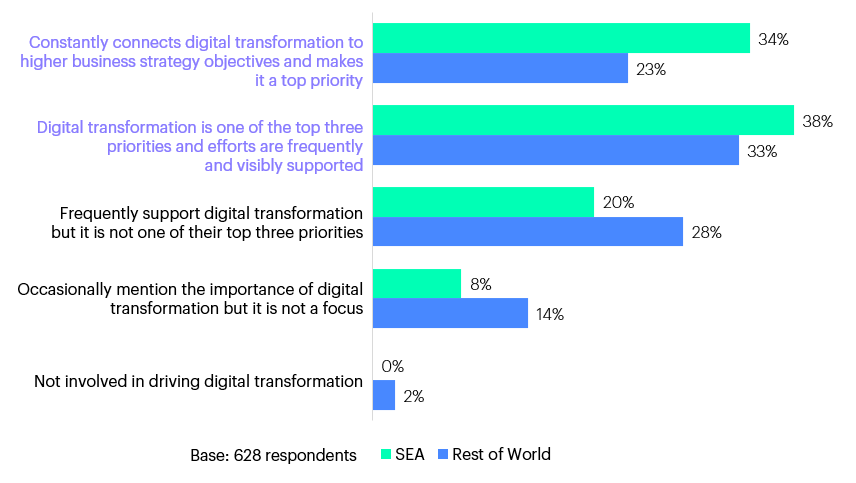

Leaders in SEA not only sponsor digital transformation in spirit, but understand its importance and follow through with frequent and visible support. Seventy-two percent of the executives in SEA see digital transformation as one of their top three business priorities. Thirty-four percent say digital transformation is constantly connected to higher business strategy and a top priority (vs. 23% in the rest of the world).

Figure 4: Nature of Executive Leadership

“Which of these statements best describes the nature of executive leadership in your organization”

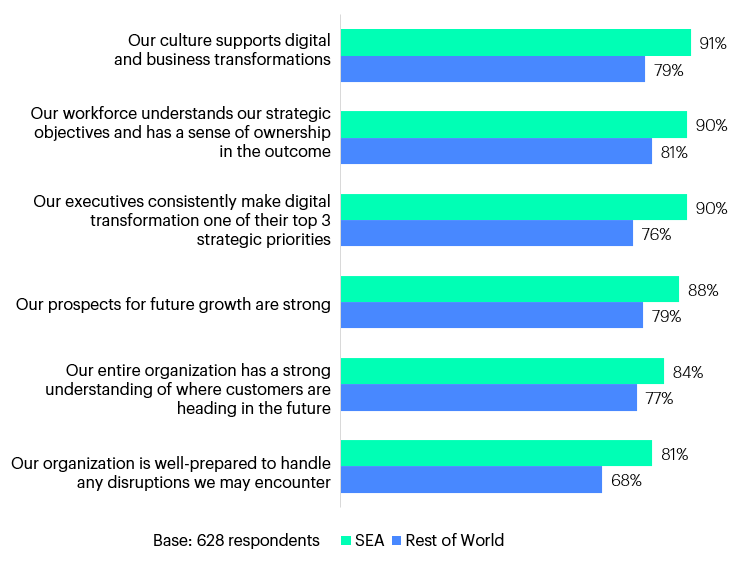

With strong leadership, digital transformation is optimistically embraced throughout organizations in SEA. When asked about their sentiment towards digital transformation, SEA companies appear to be more optimistic across multiple aspects — stronger culture, engaged workforce and stronger prospects. Leadership’s confidence in digital transformation is stronger than other global countries, with 90 percent leadership support vs. 76 percent in the rest of the world.

Figure 5: Overall Sentiment Towards Digital Transformation

“Please indicate how much you agree with each of the following statements, from 1 (strongly disagree) to 5 (strongly agree), T2B%”

3. Ambition: Investing in Technologies to Drive Exponential Growth

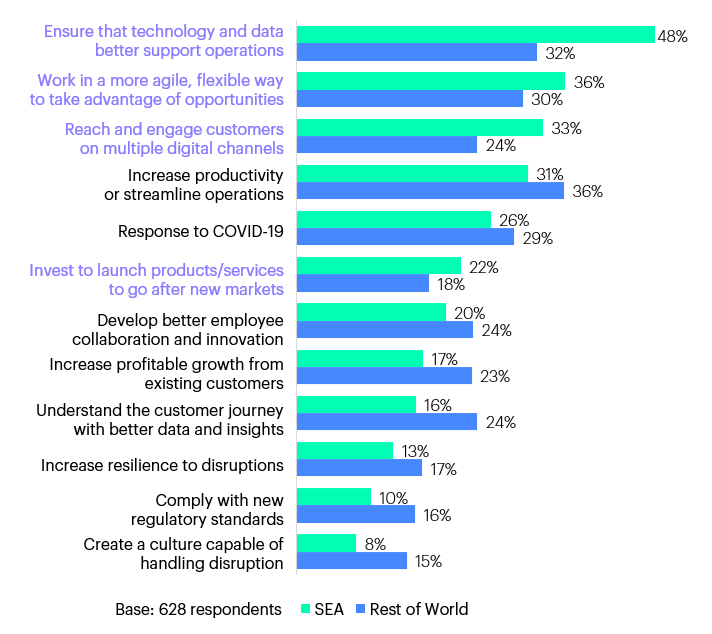

Comprising some of the world’s fastest-growing markets, digital transformation in SEA is about efficient market expansion and customer acquisition supported by agile and flexible operations, innovation and technologies.

The SEA market is highly diverse in terms of language, culture and behavior. Digital transformation ensures that the technology and data are in place to better support operations (48% in SEA vs. 32% in rest of the world), and allow agility and flexibility to quickly capture opportunities (36% in SEA vs. 30% in the rest of the world). With a more positive market outlook, SEA companies are less concerned about ‘playing defense’ with initiatives like creating a culture to handle disruption (8% in SEA vs. 15% in the rest of the world).

Figure 6: Top Drivers of Digital Transformation

“What are the key drivers of digital transformation within your organization?”

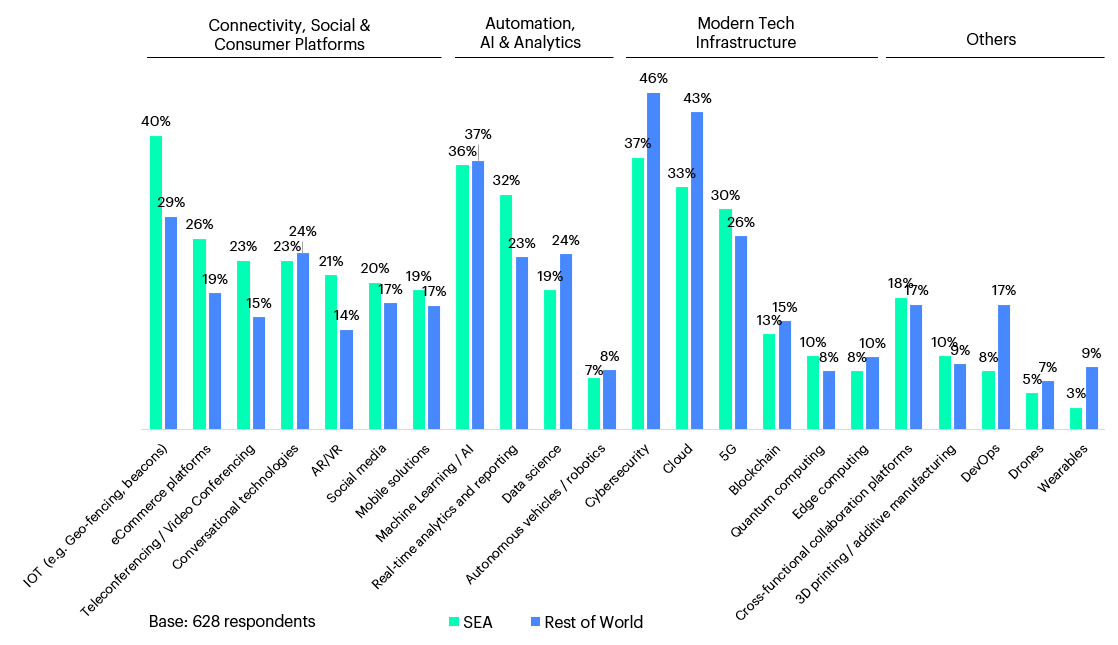

Thanks to higher proliferation of mobile devices and more affordable networks, internet users in SEA had exceeded 300M by 2019. In order to meet the growing demand of this community, technology investments in SEA are more about connectivity and social & consumer platforms.

E-commerce and ride-hailing are the most promising sectors in SEA, supported by investments from China and U.S. tech giants e.g. Alibaba, Tencent, Didi and Amazon. Relevant technologies are receiving higher attention than the rest of the world. Forty percent of respondents selected IoT as their investment priority (vs. 29% in the rest of the world), 26 percent selected e-commerce platform (vs. 19% in the rest of world), and 21 percent selected AR/VR (vs. 14% in the rest of world).

Figure 7: Prioritized Technology Investments

“What are your top priorities for technology investments in 2020”

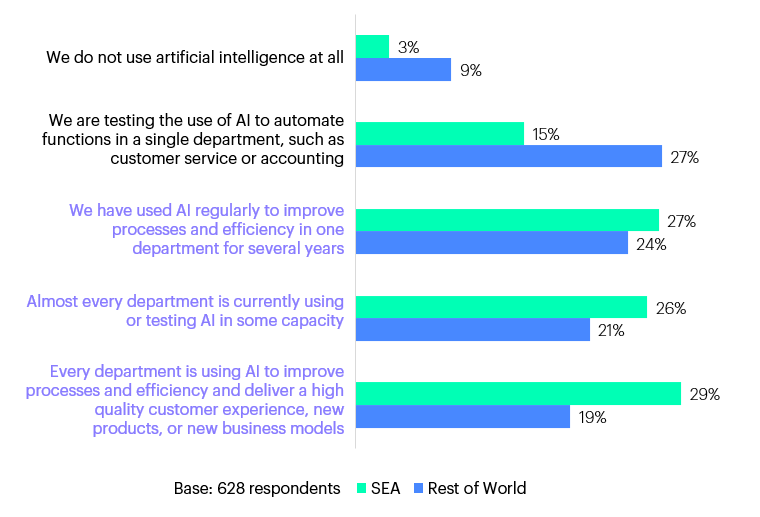

While global companies are still at the testing or infancy stage of using AI, it is increasingly implemented on a regular basis and adopted in SEA. The majority of the respondents are leveraging AI extensively in driving new products, business models and customer experiences, much higher than the global (29% in SEA vs. 19% in rest of the world).

Figure 8: Use of Artificial Intelligence Within Organization

“To what extent do you use artificial intelligence (including machine learning, computer vision, natural language process, robotics, or deep learning) within your organization”

One major source of momentum is the booming of fintech and digital banking, the biggest adopters who use AI technology to enable mobile payment and fast lending services.

From a country perspective, Singapore is taking a substantial lead in AI development and adoption, fuelled by investments from the government on both software and physical infrastructure e.g., joint-innovation on intelligent robots, increased data storage capacity, open data and open government platforms, as well as high-speed network and advanced IT security. Other countries such as the Philippines, Malaysia, Vietnam and Indonesia are lagging, but gradually catching up.

However, SEA is still catching up on developing more modern tech infrastructure e.g. cloud and cybersecurity (see Figure 7).

FINAL THOUGHTS

Regardless of financial challenges, COVID-19 has in fact presented more opportunities for companies in Southeast Asia to accelerate their digital transformation agendas. As the fourth largest trading and consuming region in the world, with one of the largest young and digitally savvy segments, companies in SEA should keep investing in building new digital capabilities and technologies to stay competitive, while conveying a strong strategic vision and executive leadership. Last but not least, it is important to increase efforts on modernizing IT infrastructure to catch up with other leading markets in the world.

Download the full PDF report, or get in touch to learn more about how to accelerate your digital transformation in SEA to drive uncommon growth.