CASE STUDY

Addiko Bank

Regaining brand reputation & customer trust

Challenge

How do you revitalize a bank that’s had serious reputation issues? Following the fallout from the financial crisis and being nationalized by the state, Austria’s Hypo Alpe-Adria-Bank (Hypo Bank) was dealing with serious legacy issues. By the time Advent International, a private equity investor, and the European Bank for Reconstruction and Development (EBRD) acquired it in 2015, consumers’ consideration of Hypo was very low.

Solutions

The new owners knew it needed a brand-new bank, and in January of 2016, Prophet was enlisted to help rebuild it from the ground up. In a matter of weeks, we worked with bank executives to rename it Addiko. A clear signal of change, the new brand name gave the bank a blank slate and a second chance with consumers.

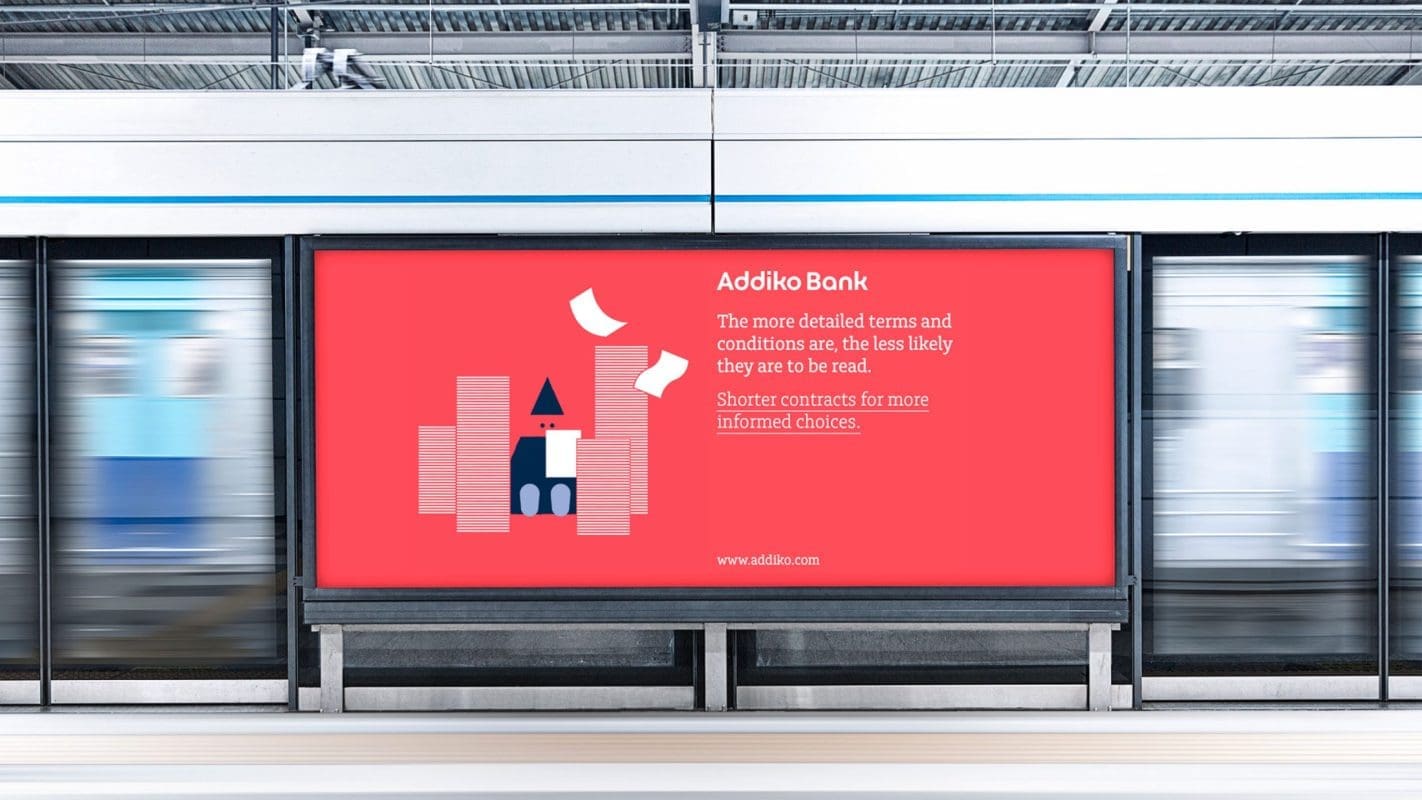

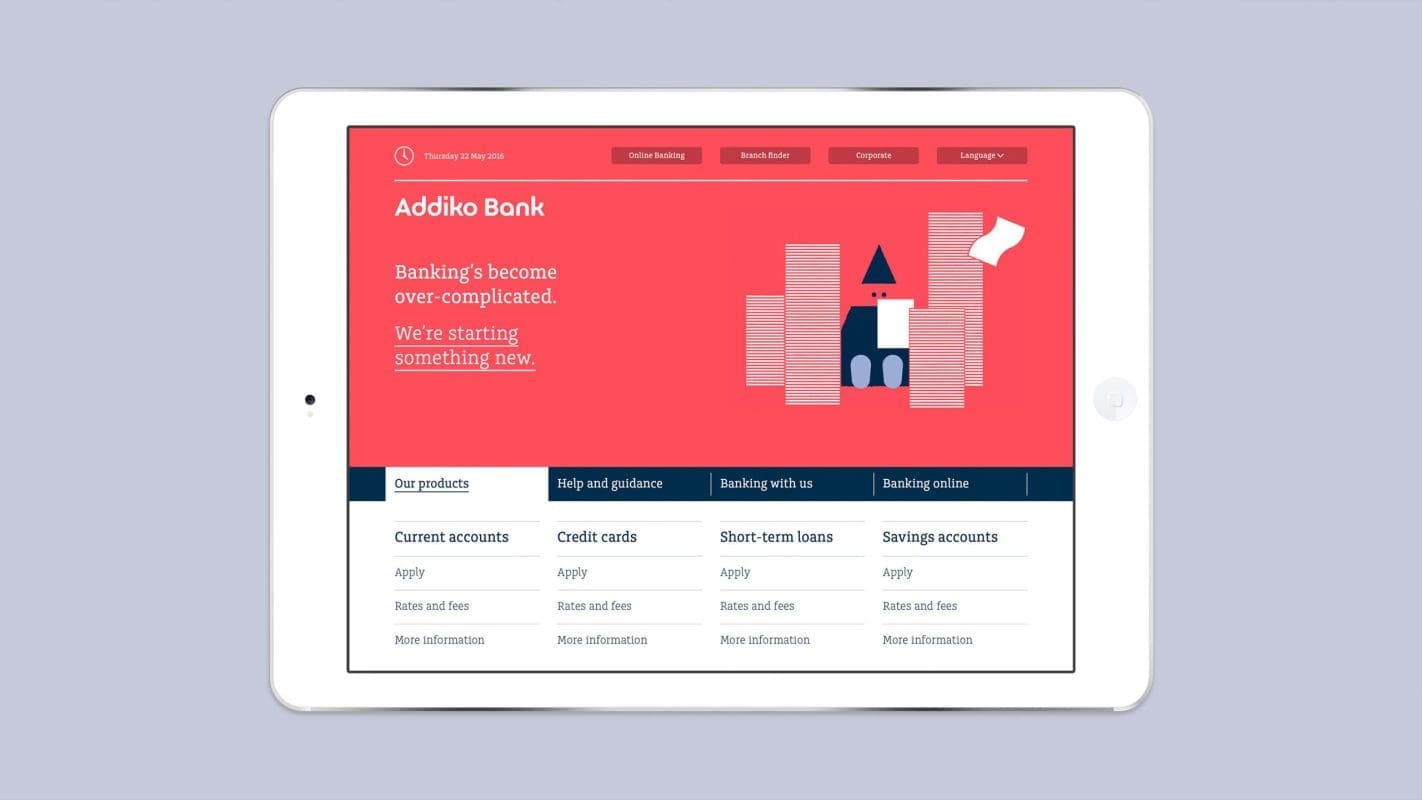

Our research uncovered a crucial customer insight that people in Croatia, Serbia and Slovenia felt confused by overly complex banking products. We realized that while most banks pile on more products and paperwork, customers actually want less. They want a simpler, hassle-free way of banking. This led to Addiko’s new brand promise: Straightforward banking that focuses on essentials. That meant becoming more efficient, with shorter queues, and more digital and mobile options. And it called for communicating simply, eliminating jargon, shortening contracts and avoiding asterisks. A clever graphic character, cleanly drawn, walked consumers through the changes, as did a complete advertising campaign.

We also helped Addiko coach employees to “acknowledge and tackle” the challenges they faced. This approach to straightforward banking, which stands for a proactive, optimistic and down-to-earth way of doing business, has become the bank’s mantra.

Results

Since its launch Addiko has seen a robust turnaround, posting positive net results and a listing on the Vienna Stock Exchange, confirming the demand for a specialist player that challenges the traditional universal banks with a simpler and focused model.

Serving its clients with convenience and speed, not only is Addiko now a strong and profitable retail and SME bank, it’s an award-winning one too after scooping six Transform Europe Awards, acknowledging the brand’s transformational journey. The Financial Brand also named it among the most beautiful brand identities in banking.

Addiko’s CEO said, “Strategy is about making choices. It’s about deliberately choosing to be different and we decided to be straightforward. But the Addiko brand does not only represent a name change. It is our new business strategy, our unique positioning, our desire to introduce and implement new, higher business standards, and a new corporate culture. But first and foremost, it is our commitment to improving and changing the way we feel banking should be done. The Addiko brand and this transformation is the starting point for building a better bank. A straightforward bank.”

With brand recognition levels far surpassing that of its predecessor, as well as higher levels of employee retention and customer loyalty than its main competitors, Addiko is on a successful path toward continued growth, with a commitment to improving and changing the way banking should be done.

“The diversity of the Prophet team ensured a very vibrant creative environment, generating genuinely very different alternative creative routes, rather than variations on a single idea.”

Razvan Munteanu

CEO at Addiko Bank

Impact

48.6%

brand awareness in the market 3 months after launch

10.94%

customer consideration after 3 months in market

5x

increase in GAP compared to market average