BLOG

Introducing the Innovation Maturity Model for Financial Services

Prophet’s Innovation Maturity Model helps organizations establish and operate high-powered innovation engines.

Innovation – more and more – is what every financial services company seeks as the primary means of driving growth. That’s true because innovation is increasingly what separates market leaders from also-rans.

But for all the investments in innovation, most organizations struggle to generate the returns they’re looking for or produce the growth that innovation is supposed to unleash. For more on the barriers to innovation and – more importantly – how to get over them, read our recent research report, Winning the Innovation Game in Banking.)

In the intensely competitive financial services sector, it is not enough to innovate every now and then. Rather the goal is to establish a rigorous practice of innovation and to make it a standard part of ongoing operations. The vision is to establish a high-performing innovation engine that continually identifies innovation opportunities, explores those ideas via prototyping and gated investments and efficiently moves meaningful innovations to market. Such a disciplined process is necessary to avoid the common pitfalls that make repeatable innovation an elusive target for many companies.

Introducing… the Innovation Maturity Model

To help banks, insurers, and investment managers industrialize their approach to innovation, Prophet created the innovation maturity model. This model helps organizations:

- Assess their own innovation capabilities and opportunities

- Identify the barriers – technological, process, human, cultural – inhibiting innovation

- Establish tangible innovation goals and actionable plans to overcome those barriers

- Define a roadmap to establishing repeatable innovation capabilities

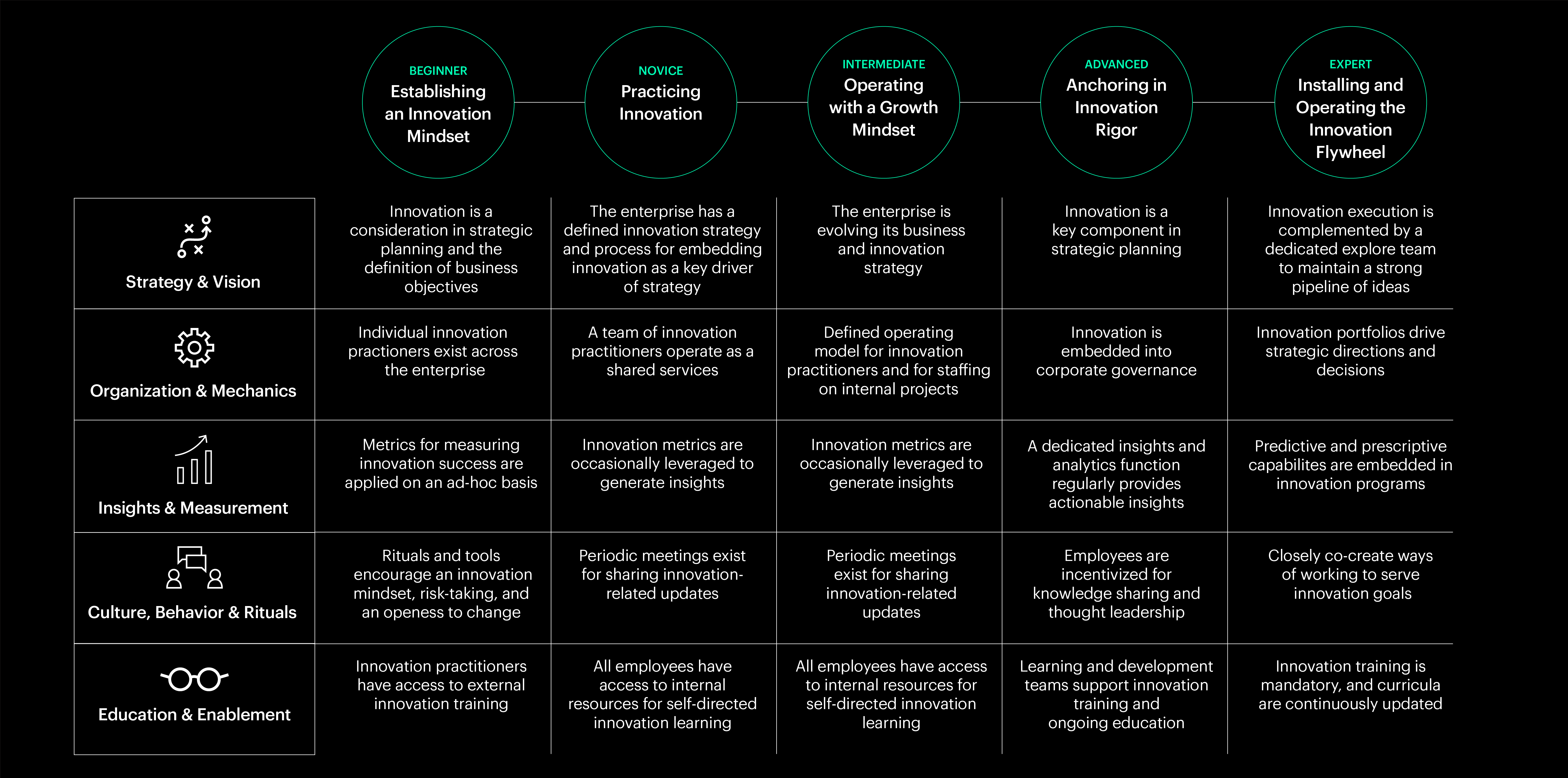

The innovation maturity model inspects five dimensions of the business that are critical to enabling innovation:

- Strategy and Vision

- Organization and Mechanics

- Insights and Measurement

- Culture, Behaviors and Rituals

- Education and Enablement

Within each of these areas, the model defines varying levels of maturity – beginner, novice, intermediate, advanced, expert – so organizations can understand where they are today and what to aim for tomorrow. For instance, an organization with expert-level capabilities in organization and mechanics would involve the entire enterprise in using innovation portfolios to drive strategic directions and decisions, with all employees aligned to the innovation strategy and with specific responsibilities to drive that strategy forward.

In terms of education and enablement, beginner firms will be those that provide access to and funding for external training for dedicated innovation practitioners. Intermediate firms will have innovation teams in place to help drive behavioral change across the organization and support wider education efforts. At the expert level, innovation training and education will be a mandatory part of onboarding and learning and development programs, with continuously updated curricula and regular use of outside resources for insight and inspiration.

The innovation maturity model reflects our market experience in terms of what works in driving breakthrough innovations. Further, it’s designed to establish cultures that prize risk-taking and experimentation and instill operational discipline relative to innovation. Such organizations are capable of both acting like a startup and investing like venture capital firms. As we highlight in our report, “Winning the Innovation Game in Banking”, it’s a matter of building a portfolio of innovation ideas based on deep customer insight and then rapidly testing and refining those ideas through pilots and MVP launches into the market.

The Many Forms of Innovation

Because innovation can take many forms, our innovation maturity model provides the core insights that can point the organization in the right long-term direction. To put the model into context, consider how the organizations below are evaluating the different ways to set up their innovation engines and flywheels.

- Allianz: An ‘Always On’ Dedicated Innovation Center: Allianz has launched dedicated innovation centers to engage a range of partners, including FinTechs, start-ups and firms in other sectors, to develop entirely new insurance solutions for specific industries, including travel and automotive. This looks like a winning strategy considering the pressure on insurers to innovate in the face of intensifying risks from climate change, relentless cyber threats and the growing protection and retirement savings gaps.

- JP Morgan Chase: A Condensed Annual Innovation Event:

JP Morgan Chase fills its innovation pipeline in creative ways, too. It holds an annual Innovation Week, bringing together employees in more than 400 events focused on generating new applications for artificial intelligence, machine learning and other enabling technologies, while highlighting specific business issues, opportunities, and current technology trends. It also held a digital innovation competition to generate transformative ideas to enhance the client and advisor experience. Such broad-based approaches reinforce that innovation is part of everyone’s job.

Vanguard: A Culture of Innovation and Commitment to Outside Partnerships: In wealth and asset management, Vanguard has promoted a culture of innovation by empowering employees to drive meaningful change. Further, it’s working with partners, such as American Express, to develop new offerings that give customers increased flexibility.

FINAL THOUGHTS

Prophet’s innovation maturity model helps organizations design the innovation engine they need based on their objectives, customer base, product set and cultures, as well as to establish the right operational model for repeatable innovation. For more insights, read our latest report Building Business Resilience with Innovation.

We’d be delighted to speak with you regarding your firm’s innovation outlook and objectives and how our Innovation maturity model can help you achieve them.