BLOG

How Financial Services Brands Can Become Relentlessly Relevant

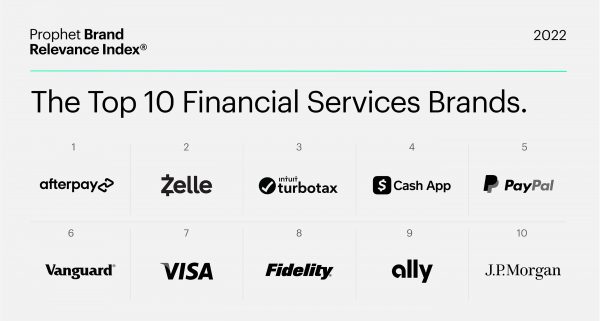

Prophet has released its latest Prophet Brand Relevance Index ® and it’s clear that banks, insurers and other financial services firms need to do more to energize their brands. This has been true for large and traditional financial services brands for several years running, though newer digital-native brands and fintechs have gained traction quickly, both in the market and the Brand Relevance Index.

At a high level, it’s clear that consumers are increasingly willing to give new and emerging brands a chance and will reward those that offer compelling value or a winning experience. In some cases, the edge comes from building a better mousetrap (e.g., easier payment transactions); in others, it’s more about articulating clear values and attracting people who share them.

For this year’s study, Prophet’s BRI team updated the methodology with more detailed questions about how consumers engage with brands emotionally (the heart) or intellectually (the head). Not surprisingly, financial services brands rate more highly in the latter category, particularly in areas like dependability, consistency and filling important needs. The best brands, however, are capable of connecting through both the head and heart, which is how they become brands consumers can’t live without.

Looking at our rankings, we can identify what differentiates the top brands across all sectors and how financial services firms might bolster their brands and become relentlessly relevant.

Top Ranked Financial Services Brands Showcased Two Things

1) A Clear Purpose That Creates Relevance and Passion

USAA, the top-ranked financial services brand in our index at #10, might show the way forward for financial services firms. It has a clearly articulated purpose and mission and a strong customer-centric orientation. Put simply, USAA knows its job and whom it serves. That clarity results in stronger emotional connections with customers, as evidenced by USAA’s top heart score among financial services brands. Online bank Ally (#87) also communicates a notably customer-centric value prop in its marketing efforts, which helps explain its relatively high heart rankings for the category.

Once an organization has made clear what it is and who it’s for, it can reorient the customer experience with a laser focus on customer needs, as well as align the organization around the vision. Our latest research into customer-centricity shows what success looks like for banks and other financial institutions and some recommendations for how they can achieve it.

2) A Sharp Focus and Frictionless Experiences

Among our top 10 brands, Peloton (#2), Spotify (#3) and PlayStation (#7) all have well-defined value propositions and deliver people exactly what they want again and again. Within financial services, highly focused and easy-to-use apps – such as Afterpay (#11), Zelle (#39), CashApp (#52) and PayPal (#56) – that do one thing (or just a few things) very well far outrank financial supermarkets. The same is true for TurboTax (#46), digital insurer Lemonade (#100) and trading app Robinhood (#107).

These brands are relevant because customers know the value they receive for engaging. Highly effective – even elegant – experiences that remove friction from core transactions are also part of the success equation. For these brands to continue growing, they must retain the focus even as they add more services.

Afterpay and Robinhood are very much “of the moment” brands, so it will be interesting to see how their relevance rises or falls in future surveys. For traditional firms to compete more effectively against these “less is more” experiences, they need to ensure their transformation investments are aligned to innovation and growth.

All Head, More Heart

Consumers understand the usefulness of and need for financial services firms. They provide vital services that are indispensable to the daily lives (not to mention the long-term plans) of countless people and businesses worldwide. But they are, for the most part, not very inspiring and rarely make emotional connections with consumers.

“There’s a real opportunity for banks, insurers and investment firms to meet people where they are emotionally.”

After two years of widespread financial uncertainty and with more consumers looking to boost their financial confidence, there’s a real opportunity for banks, insurers and investment firms to meet people where they are emotionally. Insurers that have offered premium holidays and discounted rates for people driving less are on the right track. So too are banks looking to lead on sustainable finance and “greening” the economy, provided their commitments are backed up with meaningful action. Financial services brands that can show some emotion and empathy and demonstrate their human values will have the best chance to increase their relevance.

For newer financial services players, the growth challenge starts with retaining customers and expanding their offerings once they’ve reached a critical mass. How far will inspiring brands take them if they can’t master the practical, “head” side of customer relationships?

More established brands should look for ways to emulate the energy of their newer competitors, injecting some emotion into their customer relationships. At the same time, they should seek to refine their operations to achieve the optimal balance of head and heart.

FINAL THOUGHTS

It’s safe to say that uncommon growth – the type of growth that is purposeful, transformational and sustainable over time – in financial services won’t be possible without increasing brand relevance. Consider how banking, insurance and investment brands increasingly compete with companies from outside the sector, including many that are absolute masters at brand relevance. The top-ranked brand in our study this year was Apple – a technology company that has become a leading player in mobile payments and has an expanding pool of customers for the Apple Card. Their presence makes brand relevance a strategic imperative for incumbent financial services companies.

These are just a sampling of our findings. To see where your brand ranked, you can find the full 2022 Prophet Brand Relevance Index ® here.

Related Thinking

Brand Equity – Brand Value_1_A