BLOG

How Financial Services Brands Can Position Themselves for the Next Growth Cycle

When charting your next growth move, here are three ways smart financial services brands are already preparing for what comes next.

So far, this economic cycle is so loaded with 1970s throwbacks like soaring gasoline prices, inflation, and interest rates that we half expect to see a resurgence of the Burt Reynolds mustache and tie-dye ponchos. Whether we are at the beginning of the next Great Recession or just a minor downturn, history tells us that when brands scale back investments in growth, they typically end up with regrets. This is because when the next growth cycle begins, they tend to trail the field as competitors capture significant opportunities.

For financial services companies, the current times seem particularly dire. CMOs in this industry are increasingly less optimistic, with 44% of those in banking, insurance and finance saying they are less upbeat about the U.S. economy compared to 39% of all CMOs. No one is happy about saying goodbye to the sizzling stock market, red-hot housing sales or consumer spending swagger.

Scary? Maybe. Time to invest in growth? History resoundingly says yes.

Research shows that companies who double down on defensive plays tend to limp out of recessions. But those that fare best invest in new markets, products and services. A “Harvard Business Review” analysis of companies in the Great Recession of 2008 to 2010 found that 17% of the 4,700 public companies studied fared quite poorly, either becoming bankrupt, private or acquired.

Though the majority muddled through, 9% emerged from the downturn as elite success stories, outperforming competitors by at least 10% in sales and profits growth. Why? In simple terms, they stayed focused and invested in areas of relatively lower opportunity costs.

“You cannot overtake 15 cars in sunny weather… but you can when it’s raining.”

– Ayrton Senna, Formula One Champion

This is a lesson in how firms build resiliency in uncertain times. They evolve and make intelligent choices, ultimately emerging stronger than competitors.

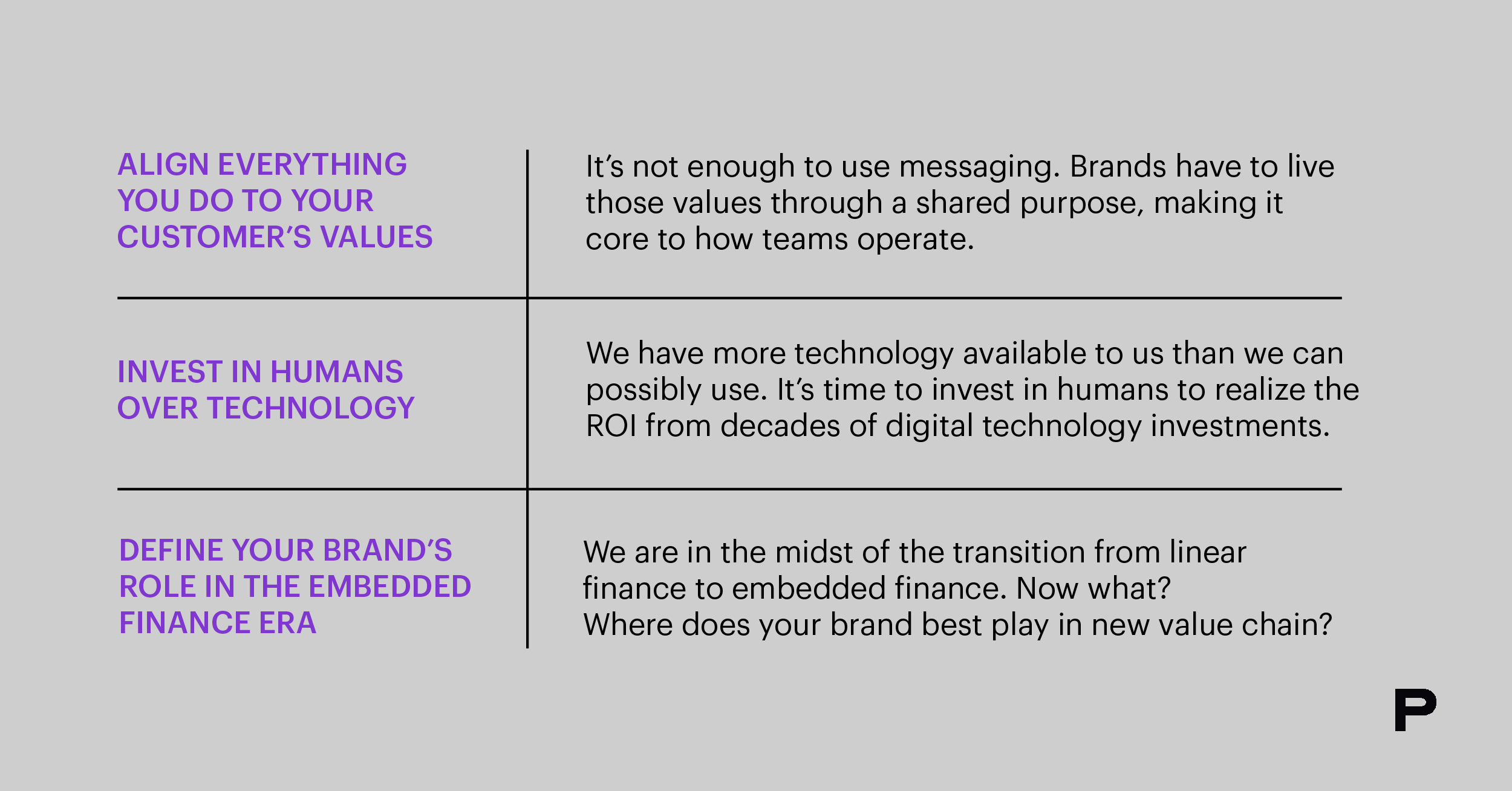

So what should you do now? We believe those financial services brands that lean into these three areas are more likely to tap into uncommon growth once the economic engines reverse course.

Below is a summary of each of the three areas. In future articles, we will dive deeper into each to provide actionable recommendations to set your organization up for uncommon growth.

Align Everything You Do to Your Customer’s Values

“Three classes of factors affect what an organization can and cannot do: its resources, its processes and its values.”

― Clayton M. Christensen, “The Innovator’s Dilemma: When New Technologies Cause Great Firms to Fail”

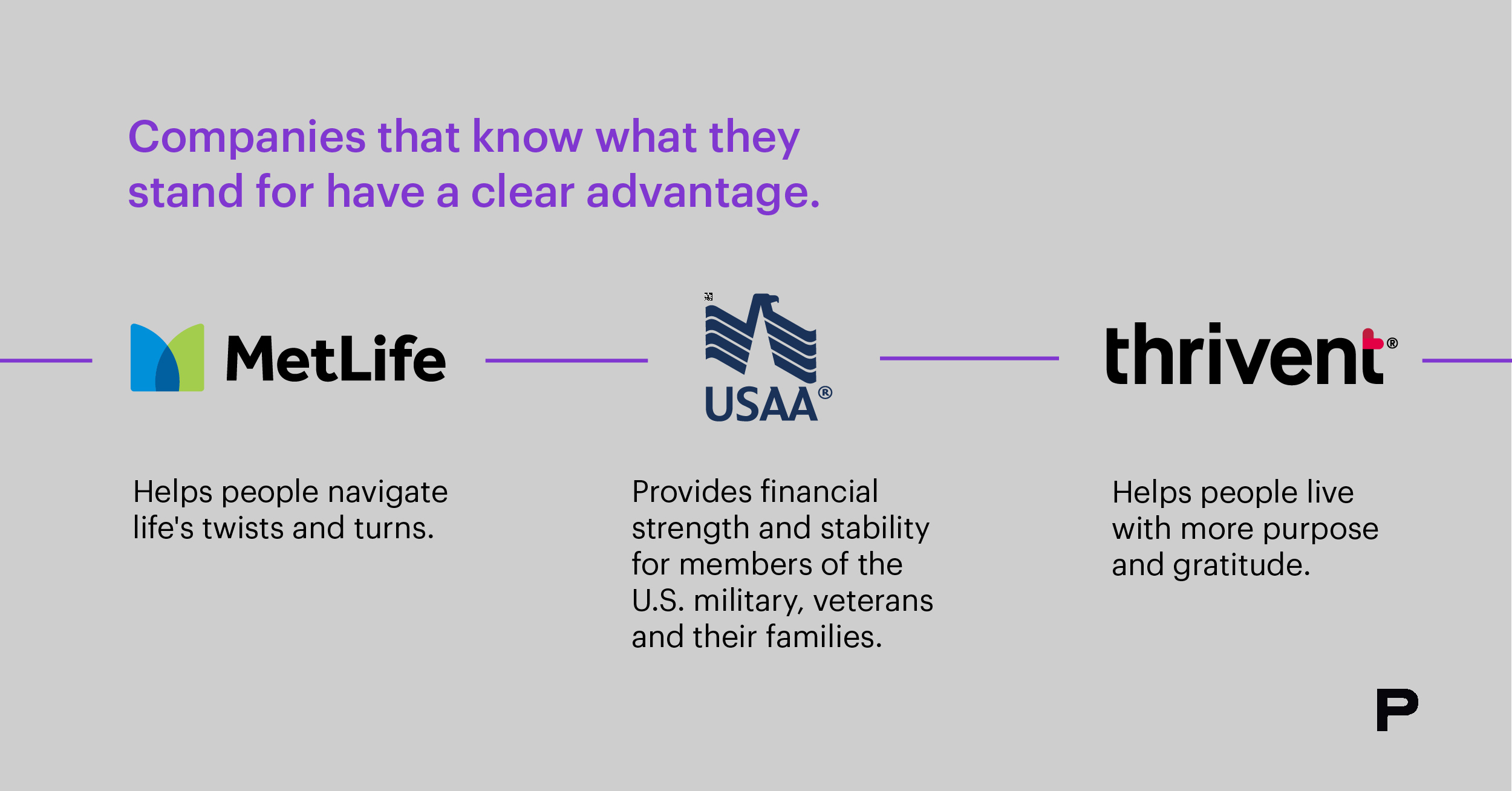

The importance of a company’s purpose has changed dramatically in the last several years. It is no longer enough to establish purpose-driven brand messaging. Companies need to align everything they do to their customer’s values. The growing demands for progress on racial justice, climate concern and social issues no longer come just from consumers. Investors, employees and other stakeholders expect purpose-led thinking too.

But how do you make your purpose part of your organization’s DNA? Part of the operating model that is core to how stakeholders hear, see and feel the business? Prophet’s Human-Centered Transformation Model serves as a framework for effectively aligning the way your purpose and values are integrated throughout your organization.

Customers and stakeholders want to see corporate purpose defined in a more meaningful sense. They expect products, services and experiences that align with what matters most. It has become a core component of a brand’s reputation and relevance.

Example Winning Strategy: Define your purpose-driven operating model

Financial services brands that are leaning into driving purpose throughout the organization are positioning for the future. Some firms are beginning to build purpose-driven operating models, incorporating purpose into project charters and establishing “Purpose Teams” into the project management structure.

ESG commitments continue to be a focus of a brand’s purpose, promise and principles. Aspiration, an online financial services company and Certified B Corp, is a favorite example. Its “Leave your bank, save the planet” positioning allows customers to decide how much they will pay for services. It has even built a mobile tool to help customers assess their overall impact on climate change based on where they shop and how they invest.

While ESG was once about compliance and risk mitigation, we believe it is now a requirement for unlocking uncommon growth. And the companies having the greatest success with their ESG strategies are the ones who have created authentic changes in the culture of their full stakeholder ecosystem.

Financial services firms can maximize their impact by choosing ESG-driven growth strategies that are specific, ownable, applicable and measurable.

Invest in Humans Over Technology

Today, companies have more technology at their disposal than they could ever use in a coherent customer journey. It takes a combination of sensibilities and methods to create value. Humans–not digital tools– are better at building these interactions.

Humans–the roster of employees and all stakeholders–matter more than equipment. That being said, in no way should we diminish the importance of the continued digital transformation across the industry. At its recent Investor Day, for example, JP Morgan revealed it would spend a staggering $14.1 billion on technology this year. However, the firms that will win in the future are those that can also build an organizational focus on the humans using the technology.

Example Winning Strategy: Build a compelling employee value proposition – develop an EVP that:

1. Articulates what makes your company an awesome place to work and to grow a career

2. Improves how your company wins in today’s talent marketplace

3. Develops an enhanced foundation to support future talent needs and can evolve in line with future business and brand strategy

Leading companies are using technology to focus on pattern recognition, then inviting humans to understand it and put the relevant insights in context. Technology is great. Human capital is greater.

These companies are also actively working to decentralize, freeing human capital by shaking up organizational structures. Decentralized companies emerge from recessions with higher levels of innovation and more resilience, adapting better to changing conditions.

Prophet’s research has shown that this human-centered approach leads to greater levels of innovation, especially in the financial services industry. The key to it all? Finding ways to heighten avenues of cross-organizational collaboration.

Define Your Brand’s Role in Embedded Finance Era

Customers need financial services, but they do not need the current legacy construct of delivering those services. Whether you use Affirm to buy a mattress, the Starbucks app to buy a latte or a Lyft for your transportation needs, embedded finance is all around us and presents an opportunity for financial services brands to extend into other industries, such as healthcare and retail. According to recent research, the U.S. embedded finance industry is expected to grow at a CAGR of 23.5% from 2022 through 2029, reaching $212 billion by 2029.

Long viewed as a transactional element of the customer journey, we are now seeing an expansion of use cases. Take DriveWealth as an example. It is working with healthcare companies to offer comprehensive investment advice as part of healthcare savings accounts. And with the emergence of companies such as Column, billed as the “only nationally chartered bank built to enable developers and builders to create new financial products,” we are poised to see an exponential increase in use cases that cut across all industries.

What does each of these companies have in common? They have defined the next market battleground using a combination of platform and design thinking, focusing on the value of activating ecosystems. So, it is easy to understand why incumbent banks, insurers and investment managers feel threatened. However, they should not.

As the industry moves from linear finance to embedded finance, understanding your organization’s role in the new value chain created by this disruption is the first step.

Will you play the platform-creator role? How should you think about the allocation jobs-to-be-done? How will you control the experience customers have with your brand?

The faster financial services leaders realize the value of delivering an omnipresent financial services experience in people’s daily lives, the faster that value can be achieved for both the customer and the enterprise. The concept of Time to Value (TTV) will play a critical role in the embedded finance era.

By positioning an organization’s brand and core capabilities around its aspirational role in the evolving value chain, companies can embrace the embedded finance era.

If you are a senior financial services leader and have not yet embraced the implications of the pivot from linear finance to the embedded finance era, you are putting your organization at risk of lagging behind in the next growth curve.

FINAL THOUGHTS

Just as “buying the dip” can produce above average returns in your stock portfolio, financial services brands can prepare themselves for turbulent markets by committing to an offensive strategy through this current economic downturn. Finding new and uncommon ways to build embedded finance era strategies, aligning more closely with customers’ values and investing in human-centered transformation – even as investments in technology continue – will help accelerate growth as we move into the next economic cycle.