CASE STUDY

Moneyfarm

Helping a robo-advisor expand to new markets

Challenge

Moneyfarm, one of Europe’s largest digital wealth management companies, had its sights set on entering the German market. When Allianz Global Investors bought a stake in the robo-advisor, the two companies set plans in motion to launch a new multi-asset product in the local market following demand from digitally-native savers and investors.

Prophet was enlisted to facilitate this expansion and to harvest the potential of Moneyfarm’s move into Germany and beyond.

Solutions

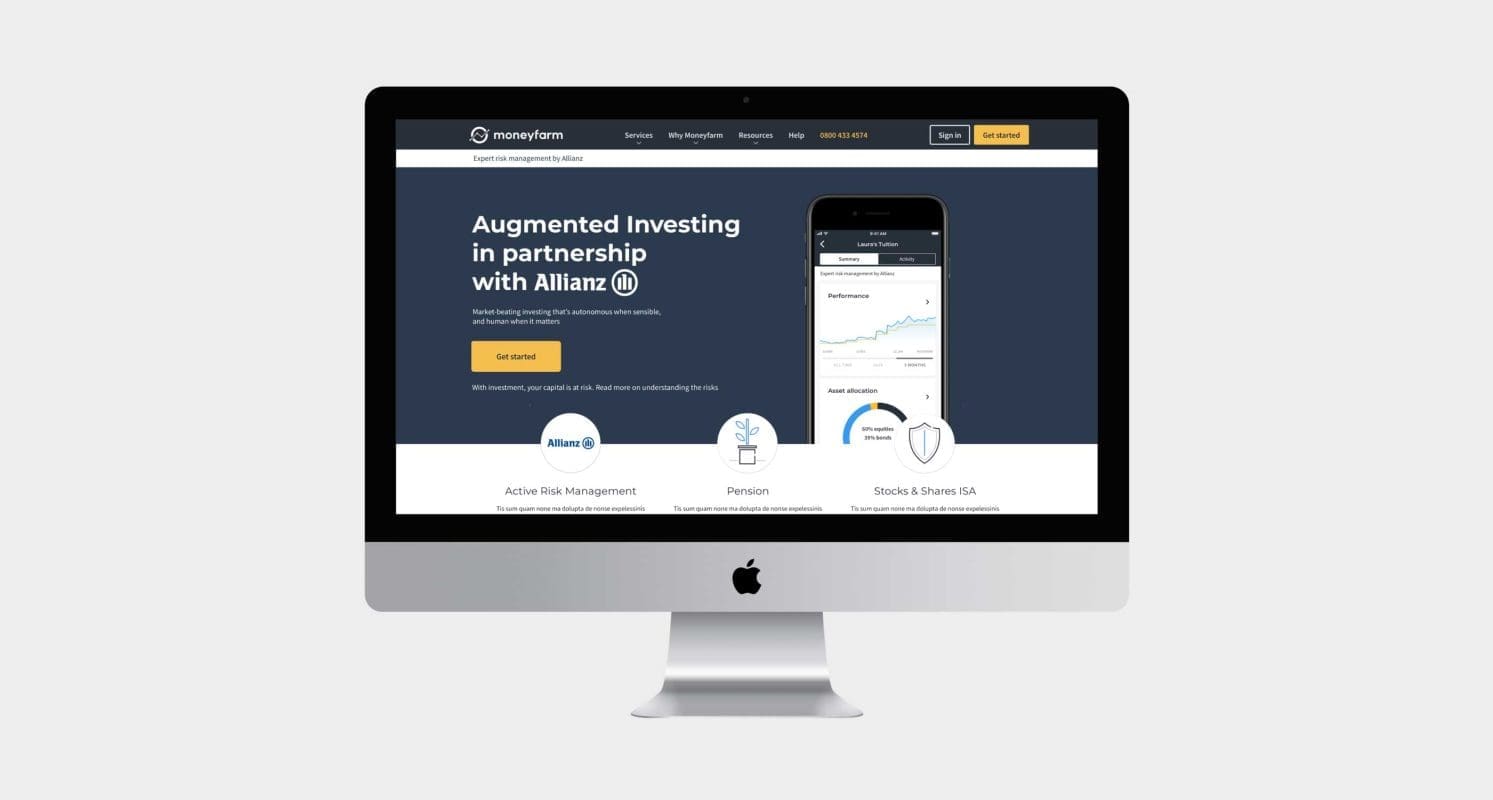

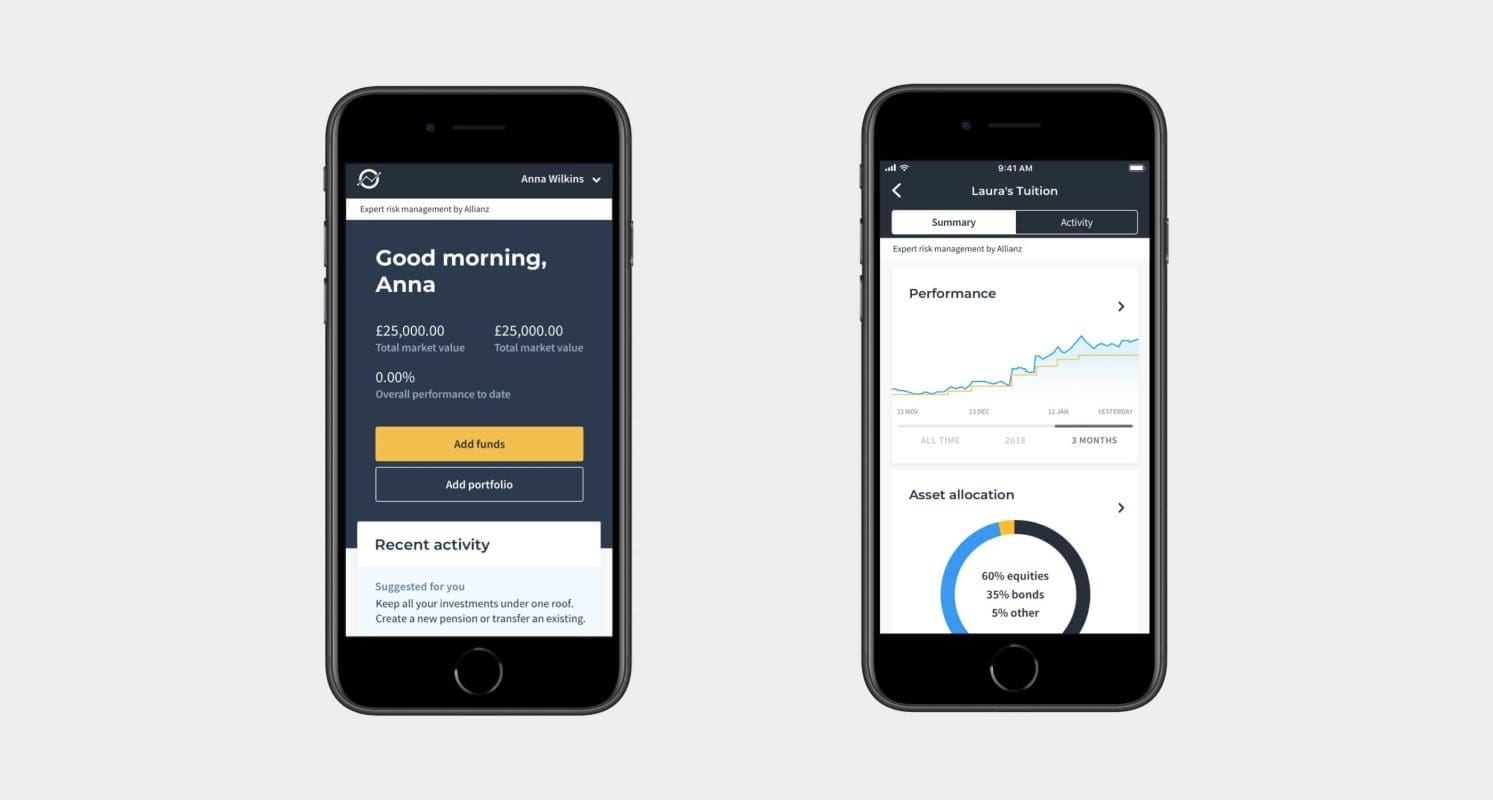

We set to work developing an intuitive way to communicate the benefits of this integrated partnership.

The goal was to establish an endorsed brand architecture solution that maximized positive equity transfer between the traditional financial services brand and the fintech start-up; leveraging Allianz’s solid reputation and high awareness in the German market and Moneyfarm’s strong tech and innovation credentials.

We then worked to craft and distil a value proposition and go-to-market strategy specifically tailored to the needs of German customers and the products available to them. Communicating the unique benefit of active returns at passive prices delivered by human expertise with robo-advisory efficiency and precision.

Results

Armed with a brand and strong value proposition that clearly communicates the strategic alliance, Moneyfarm is well on its way to achieving its growth plans. Just one month after its launch in Germany in June 2019, Moneyfarm saw a significant jump in client activation and investments of over one million.

Not only is Moneyfarm well on its way to achieving its growth plans in this new market, it’s also broadening the availability of digital wealth management in a cost-effective and accessible structure.

“Prophet helped us at this crucial moment in our company’s history as we looked to define and execute the right strategy to realize our growth ambitions.”

Giovanni Daprà

Co-founder and Chief Executive at Moneyfarm