BLOG

Defining the Digital Future of Financial Services

Asset-light thinking, “little” data and bundled services are all responding to changing customer needs.

Remember when “digital”, to most banks and financial institutions, simply meant getting online? Mobile apps, online banking, digitized systems for claims, servicing, etc. – this was the first wave of the digital agenda. But those days have quickly moved into the rear-view mirror, as new enablers and disruptors present opportunities, and challenges, for financial services firms to tackle.

“New enablers and disruptors present opportunities, and challenges, for financial services firms to tackle.”

Here, we’ve highlighted the four differentiators that financial services organizations should be considering over the next 5 years and beyond. We have identified the A, B, C and D of disruptive forces seen from the perspective of the customer, the key shifts affecting them, and consequently how financial services companies can adapt to these disruptive factors to drive their business forward.

A: Asset-Light: From Ownership to Access

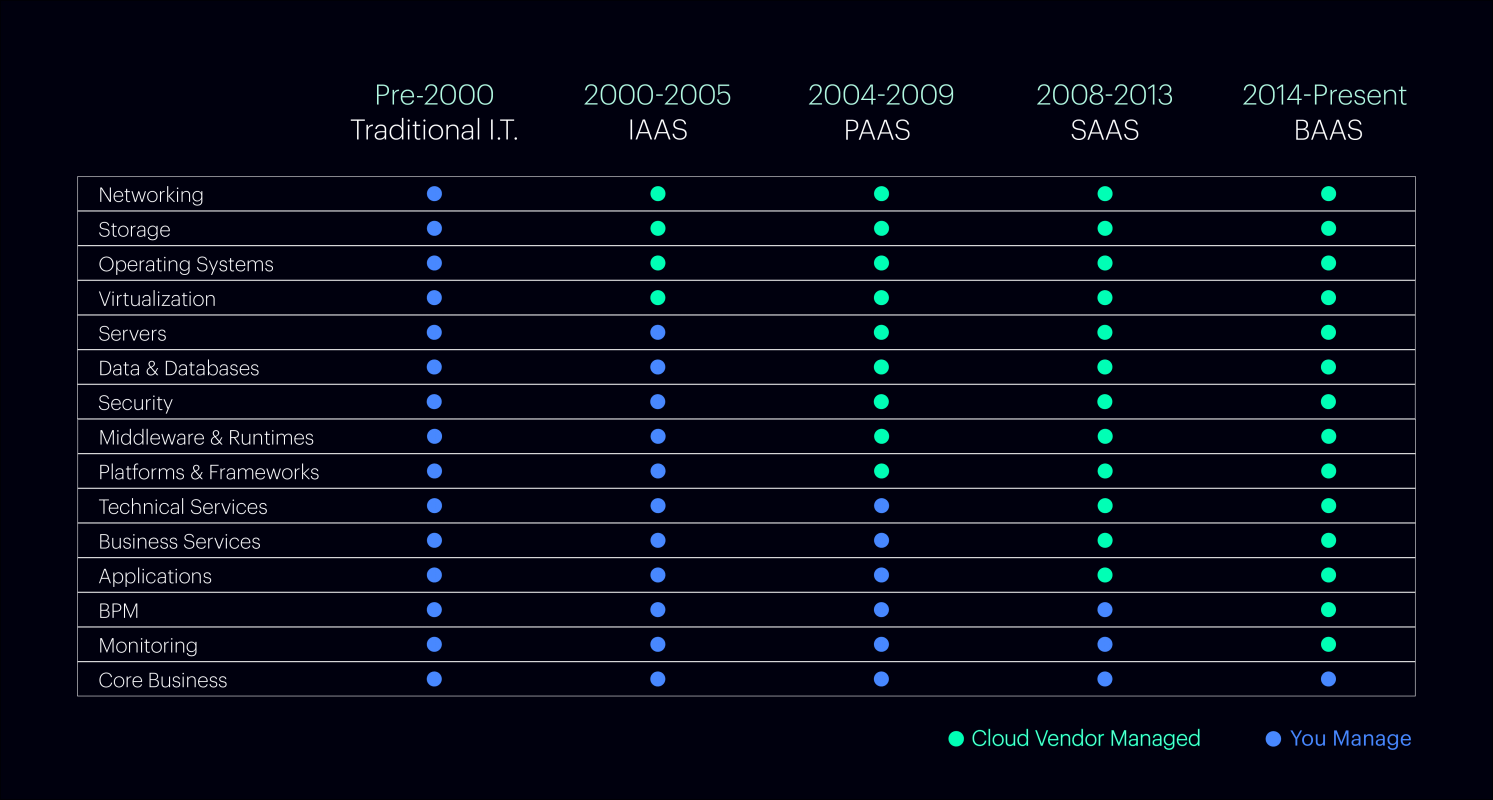

Banks that will succeed in the next 5 years will make the pivot towards being asset-light. First, this will require becoming asset-light as a company, e.g., smaller real estate footprint, fewer branches, less human staff in place of e-tellers, and so on. It used to be that you had to build it all yourself. Then, you could rent IT-as-a-service (IaaS), and over time you could rent products-as-a-service (PaaS), and eventually software-as-a-service (SaaS). Today, you can pretty much “rent” the entire business-as-a-service (BaaS), freeing you up entirely to focus on your core business. This is why asset-light companies have an advantage – they focus their full attention on their core business while building and scaling faster than ever.

Why Build the Foundation When You can Rent it?

But beyond the physical footprint, asset-light also means adapting to a customer who is more asset-light than ever – fewer houses, mortgages, cars, etc. Creating a more flexible and adapted product range to meet the needs of today’s asset-light customer will require a re-think of your firm’s product and service offerings.

B: Bundling: From More to Less

For years, big banks were a one-stop shop for all your financial needs – from your first savings account to credit card investments, mortgages, loans, and wealth management. These financial institutions had advantages in size (assets under management and customer count) and their global networks added a multiplier effect. They also had strong, globally-minded compliance systems in place to manage the difficult regulatory environment. So, they were hard to disrupt…if you tried to disrupt them in aggregate.

To overcome this competitive advantage, companies disrupted piece by piece, niche by niche, service by service. In the past 10 years, we’ve seen an emergence of niche players who entered the market and disrupted a very specific part of the value chain — Monzo (debit), Robinhood (investing), WeChat and Momo (payments), Revolut and Transferwise (FX), Stripe (B2B), etc. And they won share by being asset-light, freeing them up to deliver a better, more convenient (and sometimes affordable) experience.

But these niche players are no longer babies – they’ve grown up, raised billions, acquired millions of customers, and over time, have begun offering more comprehensive bundling of services.

For the first time since the fintech market took off 10-15 years ago, the big banks are no longer being disrupted in niche areas, they’re facing bigger threats as these formerly-niche-players bundle a more comprehensive set of services. It’s a global trend that customers are far more likely to refer a friend to a fintech than to a traditional bank.

So, today, who’s David and who’s Goliath?

C: Community: From Insular to Interoperable

For nearly a century, banks have thrived as closed systems, keeping data and assets in-house. But the rise of digital gave way to a new way: open source. It started in software, but over time open source became foundational to pretty much all businesses, none more so than financial services.

Meanwhile, openness isn’t just a customer nice-to-have, it’s becoming a regulatory norm. APIs that build and bridge communities and financial ecosystems will become a must. In this environment, financial services firms will need to strategically identify which data sources to share, based not only on what they can monetize, but what customers expect from a financial experience today.

But take note: openness is NOT about creating connections. It’s not simply enough to connect player A to player B.

Success comes down to creating community, which is about much more than connections. It’s about experiences. It’s sticky. Connections are a commodity – anyone can get access to APIs and connect things. But those who really create community do so in a way that creates stickiness, retention, loyalty. There’s a real value exchange, a real reason to come back time and time again.

D: Digital Identity: From Big Data to Little Data

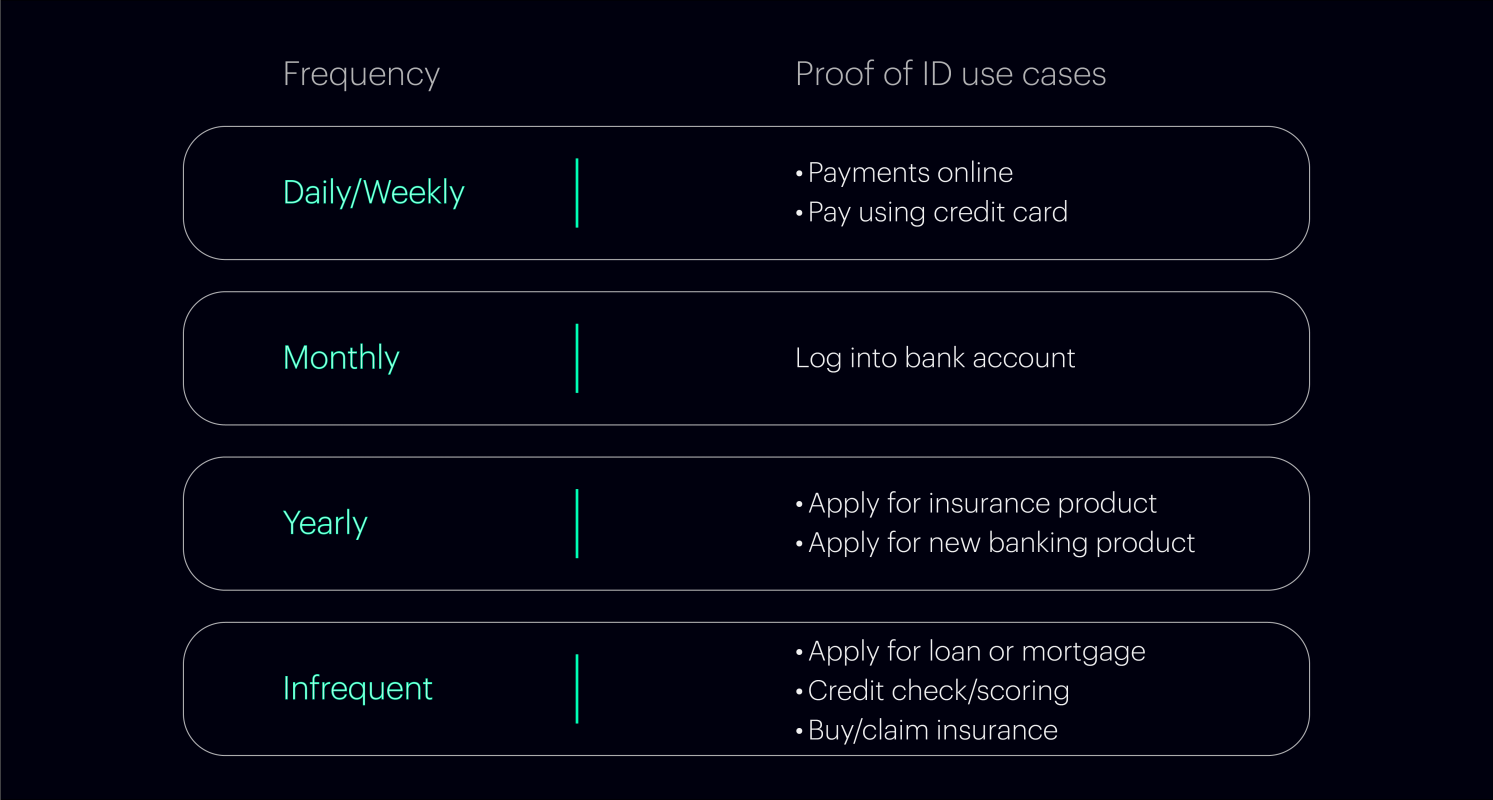

For the past decade, the hype has been on big data. Collecting as much data as possible, storing it, and analyzing it. But the value actually lies in the “little” data — the data exhaust that you as a n=1 give off every day. Your daily schedule, shopping choices, patterns of travel, temperature preference in your home or car, physical health, emotions.

Google coined the term “ZMOT” a few years ago, with the idea that there was a single/zero moment of truth. That critical point when a decision is made. However, the reality is with little data, there are millions of moments of truth. When viewed in aggregate, they provide a much more compelling and interesting perspective of a person’s overall digital identity.

Millions of Moments of Truth

Companies that track, analyze and engage around “little data’ will be – and already are – the big winners, because they know you fully, not just in the realm of their industry or one-off interactions with you. They are becoming stewards of your digital identity.

FINAL THOUGHTS

As we undergo a shift from placing value on share of wallet to share of data, financial services companies are uniquely positioned to be those stewards of our digital identities. What we spend, where we travel, what we save, who we transact with, financial services companies are entrusted with millions of data points. And as trust in social media firms erodes, financial services firms are strongly positioned to be the owners of our digital identities for years to come.

If you would like to assess where your financial organization sits on the path to transformation, and where it can go next, connect here.