BLOG

Digital Transformation for Financial Services: Three Reasons to Hit the Gas

Legacy companies are moving faster, keeping up with their fintech competitors.

While the financial services industry is undergoing almost constant transformation, fintech startups drive most of it. As these rising stars continuously find new ways to introduce customer-centric innovation, incumbent financial institutions are struggling to keep up. “The 2020 State of Digital Transformation,” a new report from Altimeter, a Prophet company, finds that even as these tech-savvy newcomers surge to record valuations, 68% of traditional financial services companies report that they are only in the early stages of digital transformation. And they say that COVID-19 has slowed their progress even further.

While validating the obstacles many legacy companies face as they navigate their way forward, this research makes clear that this is no time to slow down. The sooner companies lean in and accelerate digital efforts, the more revenue and market share they can reclaim from newcomers.

Fending off the fintech onslaught

There’s no doubt that capital markets are favoring these fintech startups. In 2019, KPMG reports that investment hit $135 billion. These companies are growing in scale and revenue, with 68 achieving “unicorns” status, a valuation of at least $1 billion, as of this past September, according to CB Insights. And while they span consumer banking, payment solutions, insurance technology and trading, they have plenty in common: They’re disruptive, customer-centric and digital to their core.

Chime, a neobank startup offering digital cash management services and debit cards, is one of our favorite examples. It has tripled its transaction volume and revenue this year, achieving a $14.5 billion valuation.

“The sooner companies lean in and accelerate digital efforts, the more revenue and market share they can reclaim from newcomers.”

And Robinhood, a commission-free brokerage platform, saw daily average trades skyrocket to 4.3 million in June, surpassing all traditional brokerage firms. Among the household names left in the dust: TD Ameritrade, with 3.84 million, Charles Schwab at 1.8 million and E-Trade at 1.1 million.

But some traditional banking institutions, such as Marcus, Goldman Sachs’ consumer banking platform, have also seen rapid growth during the pandemic. It’s grown to more than $27 billion in savings from 500,000 customers, indicating that even legacy companies can successfully transform into digitally-powered institutions.

How legacy companies can catch up on digital transformation for financial services

Altimeter’s report delves into how incumbents are trying to catch up. Based on an in-depth survey of 600 executives, including 137 in financial services, three clear imperatives emerge.

1) Move faster. The majority of financial services firms are still early in their digital transformation journey.

Altimeter’s research measures digital transformation through a five-stage model. First, companies make their case for investing in digital. Next, they develop foundations for more comprehensive investment, seeking to understand customer journeys and improve employees’ digital skills. From there, they build operations, digitizing them at scale. Fourth, they integrate these platforms to use data more strategically, and finally, optimize for growth, leveraging data and AI for great customer experiences.

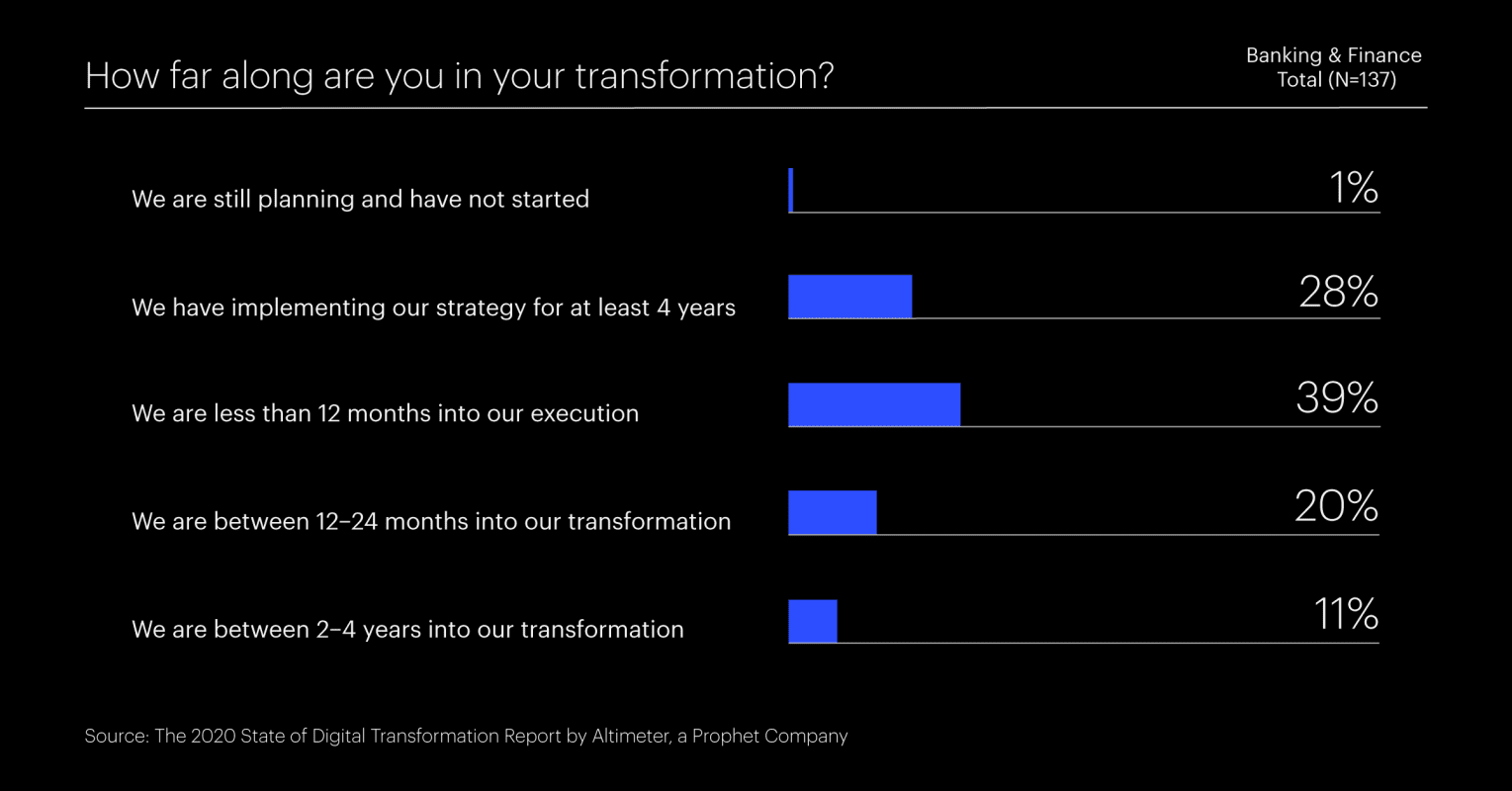

Only 25% of the companies in our study have moved beyond this to the final two phases. Financial-services execs say they are moving even more slowly. Some 68% say their companies are still in the first two years of their transformation journey, and only 38% say they’ve reached the third phase (building operations). That compares to more than 50% of healthcare, tech and retail companies.

And that’s far too slow for consumers. The latest banking satisfaction research from J.D. Power, for example, shows that the more digital the customer, the more significant the satisfaction gap. And dissatisfaction is highest among Gen Z customers, a fast-growing demographic.

Source: The 2020 State of Digital Transformation

2) Make new ways to reach customers a higher priority

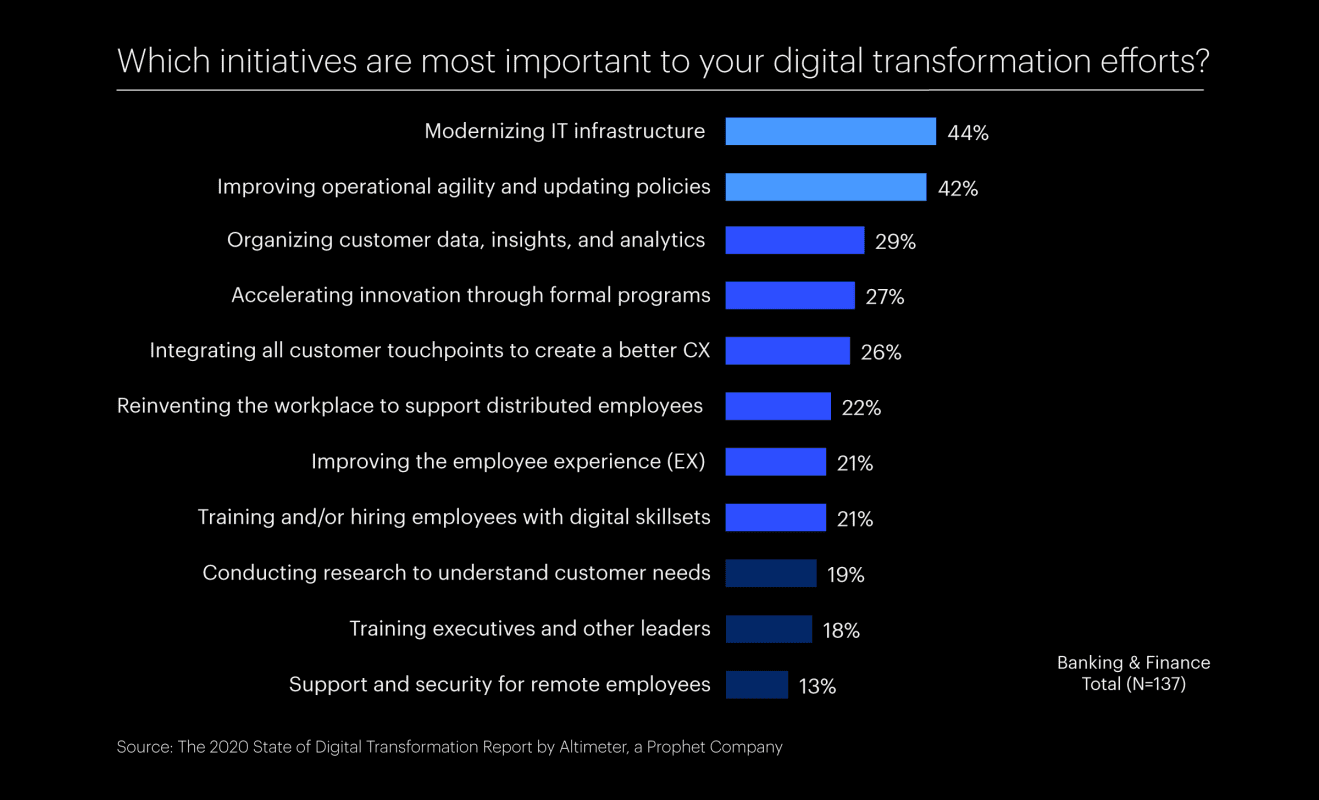

Optimizing internal processes is a compelling reason to pursue digital transformation, named by 40% of respondents and 33% name responding to COVID-19. And to create the resilience to navigate the current economic and health crisis, financial service executives recognize that their digital transformation should focus on improving operations and enable them to operate in a more agile and flexible way.

But our data suggest that these companies should give more weight to the many ways digital transformation could provide firms with opportunities to reach customers through new digital channels, particularly as more consumers look to engage primarily online.

As the market continues to change, and consumer preferences and tendencies evolve significantly due to COVID-19, financial services brands are picking up on the need to leverage advanced technology and data to become more flexible and agile.

Source: The 2020 State of Digital Transformation

3) Acknowledge new barriers

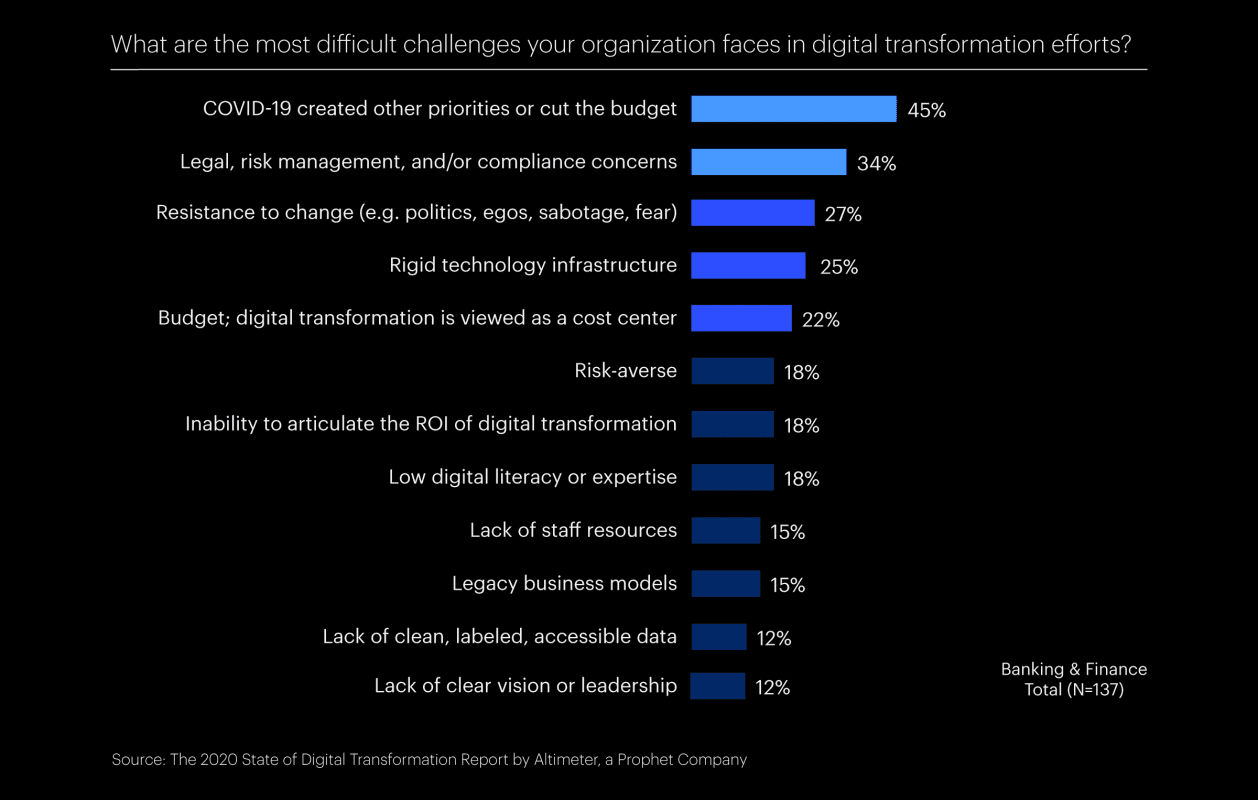

Transformation has not been easy, given legal hurdles and inherent resistance to change. And COVID-19 is creating new challenges. With urgent demands for supporting remote work and developing digital marketing and selling tools, the pandemic has hijacked many corporate priorities. In fact, 45% of our respondents say pandemic response and related budget considerations are the most significant challenge they face. And of course, traditional obstacles like risk management, resistance to change or rigid structures haven’t gone away.

FINAL THOUGHTS

The global economic and health crisis has impacted the way we think about digital transformation. This research underscores questions leaders within these companies should ask, to accelerate the transformation and achieve growth.

- How has your organization accelerated or reprioritized its digital transformation initiatives in response to the current environment?

- What obstacles are you encountering as part of that acceleration?

- Is your agenda building greater operational resilience for your business?

Prophet’s financial services practice has been partnering with many clients in accelerating their digital transformation journey. Please contact us to learn more.