BLOG

How to Effect Culture Change in Financial Services

By dialing up agility, empathy, inclusivity and curiosity, companies can inspire effective transformation.

Financial services companies have been pursuing transformation for years, but the events of 2020 have only underscored the need for these firms to rapidly evolve. In a few months, the world has achieved years of digital progress, shining an unflattering light on the many companies that lag. Many legacy financial services organizations, hierarchical and slow-moving, stand to lose as much as 35% of banking revenues to more tech-savvy rivals. That’s on top of an estimated $1 trillion in losses the sector may give up as a result of COVID-19.

Legacy companies are difficult to change by design. They were built for capital longevity and regulatory compliance, not agility and innovation. But they can’t afford to stand still. The ones that are making the most progress are moving forward at two speeds. First, they’re executing multiple plans at lightning pace to get teams and market positions back to “normal.”

But they’re also operating at a second speed, radically reimagining their future. They know that to survive, they have to innovate. And they have to create change throughout the entire organization – to transform, in the truest sense of the word. Prophet’s Catalysts in Action: Applying the Cultural Levers of Transformation report analyzes how companies around the world are achieving that transformation, identifying four essential pathways of change:

- Defining the Transformation

- Directing the Transformation

- Enabling the Transformation

- Motivating the Transformation

Here we dive deeper into each of these pathways with some industry examples:

Defining the Transformation: Driving Clarity

This step establishes a unifying ambition that is powerful and actionable, and that appeals to all levels of leadership.

We recently ran research with hundreds of leaders to study the cultural levers of transformation, including 100+ from financial services companies, who were more likely than average to say that their initial transformational efforts are proving effective.

But there are still roadblocks. Financial services companies often stumble when developing a transformation mission that is clear and actionable throughout the organization. It’s essential for leaders to get key stakeholders throughout the enterprise on board with the transformation plan in order for it to succeed.

Capital One, for example, has achieved extraordinary success by committing to a clear technology mandate. With a rallying cry of ingenuity, simplicity and humanity, the mission makes as much sense to thousands of software engineers and cloud executives as it does to customer-service representatives. Not only does Capital One excel among its peers, but its recruiting clout is on par with the best tech firms.

Directing the Transformation: Adapting the Operating Model

Financial companies, with their complex hierarchies and sprawling brand portfolios, often find that changing their operating model to support these ambitions is daunting. It involves overhauling governance, processes, roles, systems and tools. But these changes are essential: All parts of the organization need to line up with this leaner, faster thinking.

“Many legacy financial services organizations, hierarchical and slow-moving, stand to lose as much as 35% of banking revenues to more tech-savvy rivals.”

American Express offers an example of successfully directing the transformation. When it decided to shift its operating model away from relying on merchant fees to increasing card use, it re-engineered itself so that all functions could support the company’s new goals. That means decisions can be made quickly and laterally, without hierarchical delays.

But others struggle, in part because once a plan is prepared, executives are reluctant to share those roadmaps throughout the business. Our research finds that financial services companies tend to restrict these blueprints to the C-Suite – only 34% make it visible to the broader organization. That guarded attitude impedes financial-services companies from successfully adapting their operating models. Everyone needs to know where the company is headed in order to direct the transformation

Financial-services companies do have some advantages, though. Compared to other industries, they are more likely to update their roadmaps often, with 42% evaluating progress on a weekly basis compared to 31% in other industries. They’re also better at developing key performance indicators – 78% believe KPIs were well executed and measured transformation progress well.

Enabling the Transformation: Building a New Talent Model

None of these changes can take hold if the right people with the right skills aren’t in place. That requires shaking up methods of finding new talent and developing skills and competencies among current employees.

This includes hiring a diverse workforce and learning to listen to what they say. Leaders “who are inherently inclusive and collaborative and encourage good ideas to surface from wherever” are critical, says Mary Ann Villanueva, head of brand culture and engagement at Citi.

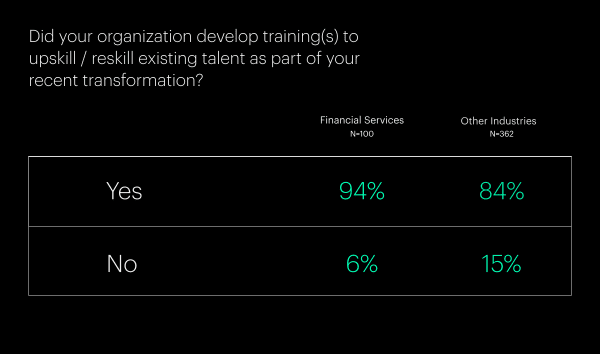

Our research finds that financial services companies are somewhat more willing to train and upskill employees than other sectors. One recent home run comes from JP Morgan’s $11 billion annual investment in tech, including an army of 50,000 technologists. That powered it to record results before the pandemic and continues to fuel the company’s exceptionally resilient performance so far this year.

Motivating the Transformation: Inspiring the Change

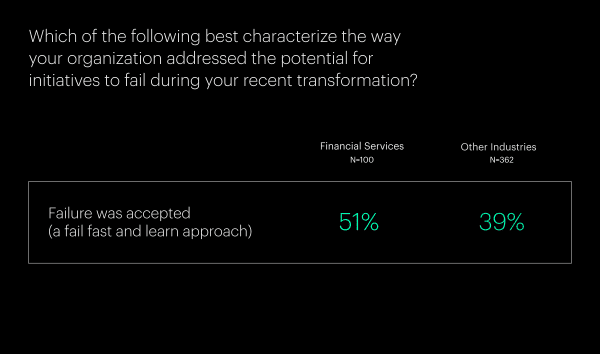

This aspect of change requires leaders throughout the organization to bring the transformation plan to life. In companies that are successfully transforming, executives don’t just talk about change – they exemplify it in ways that inspire employees to become evangelists for the new ways of working. Above all, they cultivate a tolerance for failure. Missteps are inevitable and failure is where an organization often finds opportunity. When teams fear failure, they seek broad consensus, which slows decision-making.

“We’re trying to enable employees to fail on small things, such as experiments in the innovation lab, to achieve success on the big targets,” Trung Vu Thanh, head of digital banking for MB Bank Vietnam, tells our research team. “We’re trying to push to the limit and use innovation, as more ideas will help.”

It’s hard to find a better example than USAA in this realm. USAA is best known for its intense focus on families and pride in military service. But its commitment to customer-centricity is so deeply ingrained into the test-and-learn culture that employees submit more than 10,000 customer-experience improvement ideas each year. Almost 900 are so good they’re patented. (And 25 of them came from a security guard, who – like all employees – is also a customer.) It’s an organization that draws its strength and energy from trying to find new ways to excel.

FINAL THOUGHTS

Taken together, these four pathways – harnessing curiosity, agility, inclusivity and empathy – can help financial services companies navigate their transformation. They build deep cross-functional engagement and collaboration. When combined with a shared sense of purpose, they can follow the transformative path to uncommon growth.

If you want to learn more about how our expert team can help your company accelerate change by transforming from the inside out then contact us today.