BLOG

The Future of Hospitality: 4 Key Insights for Asia’s Travel Boom

Hotel brands are embracing personalization, technology and sustainability as Asia’s travel industry reinvents itself post-pandemic.

Tourism in Asia is going through an identity crisis. By the numbers, it all looks good, with experts predicting a complete recovery, surpassing the pre-pandemic highs. However, the typical 2025 traveler bears little resemblance to those in 2019.

Travelers in Asia now have different expectations. They have new ideas about how to enjoy life, find entertainment and spend money. They want to protect the planet. They combine work and leisure travel in new ways and crave authentic experiences over standardized hotel chains. Those changes have pushed the hospitality sector to a pivotal moment of reinvention and adaptation.

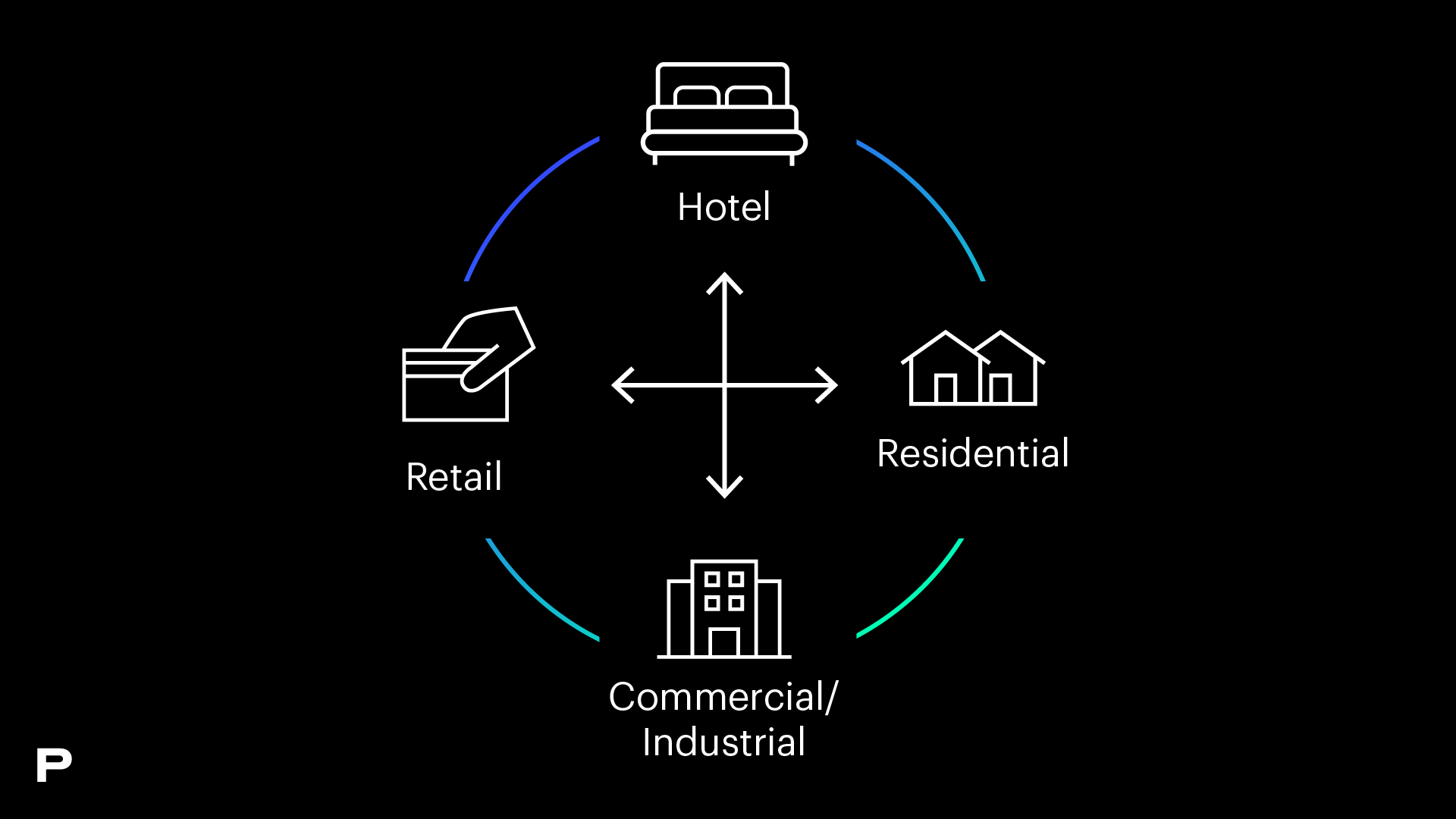

As tourism numbers rise, the opportunities are expanding fast. Tourism brands must shift their strategy to succeed, addressing four powerful trends. They’ll need to redefine all formats for richer personalization. Thinking beyond the hotel’s physical location, brands must offer diversified experiences from retail, cultural activities to entertainment which stand true to the hotel’s brand purpose. They’ll have to find new ways to use tech, becoming more human. And they’ll need to address eco-wary travelers’ rapidly evolving sustainability expectations.

A Look into Asia’s Travel Boom

Asia’s impressive tourism recovery is, in large part, driven by the reopening of China post-COVID. While domestic travel expenditure has slowed since the May holiday surge (28% growth over 2019), international travel was rebounding in full force during the golden week holiday. According to Alipay, the number of transactions made by its users in overseas markets during the first four days of the holiday (October 1-4) increased by over 60% compared to the same period in 2023. Malaysia, Korea, Thailand, Hong Kong SAR and Singapore emerged as the fastest-growing destinations for Chinese tourists.

Major hotel chains saw positive financial results globally, but a decrease in their China revenue. In part, that’s due to the oversaturation of the market, with chains focusing on price, and the softening of business travel. However, it’s also due to Chinese travelers’ evolving preferences that make the hostel and B&B sector more appealing.

India is also driving the rebound, with travel industry sources reporting that outbound travelers from India spent a record $17 billion in overseas travel, a 25% jump from the prior year. In Southeast Asia, Laos and Malaysia are up 20 percent and 17 percent, respectively, in year-over-year international travel spending.

As outbound excursions increase, countries are sharpening their offers. Japan, where visits are already well over 2019 levels, is gearing up to attract affluent tourists to lesser-known destinations, offering opportunities for an authentic experience of culture, craftsmanship and nature as a record number of foreign travelers come to the country.

Are you Ready for the Traveler of 2025?

Modern guests increasingly seek more purposeful, authentic and personalized experiences, prioritizing four key areas. They want:

Diverse and Richer Formats With Personalized Experiences

Experiential travel and cultural immersion have eclipsed the trend of checking off destinations in record time. Asian travelers are now taking their time, seeking wellness, spas, yoga activities and retreats, valuing health and relaxation in their travel experiences.

That has also given rise to a keen interest in hyper-localized boutiques or specialized resorts, whether focused on families, skiing, or spiritual offers.

Songtsam has tapped into this trend, with premium hotels designed to offer culturally immersive tours along the Yunnan-Tibet route. The Chinese hotel group brings together nature, outdoor adventure, meditation, village life and local countryside customs to form two “circuits” — geographically connected groups of properties that create a foundation for a multi-location trip. Over 90% of Songtsam’s employees are from local villages, guaranteeing a customer experience that reflects the area’s unique personality.

The growing trend of traveling for concerts and festivals fits neatly into this category. Analysts estimate Taylor Swift’s recent concerts in Singapore – six shows and the only appearances in Southeast Asia – likely brought in $370 million in tourism receipts in one week.

Cruising is also growing fast, allowing tourists to take their time and savor different regions. By 2025, cruise revenue in Asia is expected to reach $3.77 billion and grow at an annual rate of 6.17% through 2029.

Differentiated Hotel Experiences That Connect to Retail and Entertainment Platforms

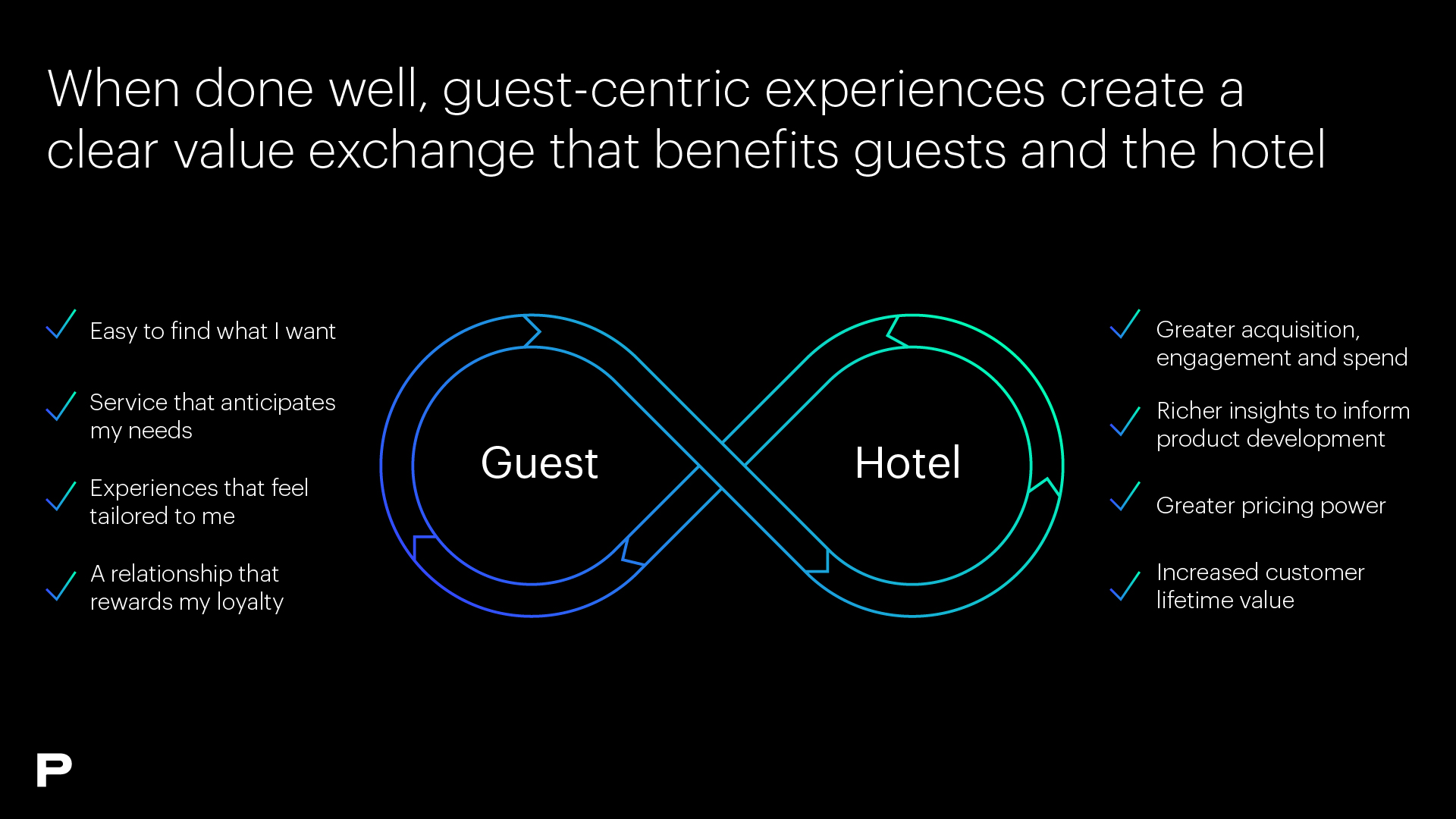

Modern travelers don’t just come to stay – they want to do. And increasingly, retail and entertainment are part of that experience. While some inherent challenges exist for hoteliers working in mixed-use properties, when done well, guest-centric experiences create a value exchange that provides meaningful differentiation.

Aranya Resorts has become a trendy destination for aspiring young travelers precisely because it knows how to combine commerce, culture, wellness and food with hotels and residential. It offers Instagrammable views, a concert hall, a library, diverse restaurants, luxury hotels, and retail stores that sell hip lifestyle brands.

Even without developing properties explicitly for these connections, hotel brands can create their recipe for differentiation by partnering and collaborating across the tourism ecosystem. That may include working with transportation, credit cards, retail and experience providers. Marina Bay Sands, a luxury resort in Singapore, for example, has tie-ins with MasterCard, Singapore Airlines and the Singapore Tourism Board. These connections allow the brand to offer collaborations like fly-and-stay deals, built around culinary festivals and a Lunar New Year dragon drone show.

Such partnerships make it easy for even mainstream properties to develop distinctive packages with less common destinations.

Human Experiences, with Seamlessly Integrated Technology

Travelers demand digital excellence when traveling. It’s how they prefer to book and pay for their trips.

Forward-thinking hotels are responding by accelerating their adoption of new technologies to tailor experiences and differentiate themselves. Ji Hotel, a mid-range hotel brand by H World International, incorporates customizable lighting, sound, temperature and IoT solutions, as well as room service and delivery robots. Digital control panels are voice-enabled and connect everything to the group’s H Rewards loyalty program app.

Since travelers are increasingly open to using GenAI to plan their travel, hoteliers such as Marriott and IHG are beginning to incorporate GenAI technology in membership programs to suggest travel itineraries, dining options and shopping spots.

However, many IoT and AI capabilities can come off as impersonable, especially to the more socially conscious Gen Z.

They want digital conveniences but are also in search of human connection. The trick is using advanced tech to make customer experiences feel more human.

Regenerative Travel That Prioritizes People, Planet, and Progress

Travelers, especially younger and more affluent, are increasingly aware of tourism’s heavy impact on the local community, culture and environment. They want to travel more sustainably and are willing to pay extra for sustainable options. They want to stay in properties committed to reducing waste, shifting away from single-use plastics, preserving cultures, and giving back to communities.

Built on a secluded peninsula on a private island, Nam Nghi is a boutique hotel catering to diverse audiences, with pristine beaches surrounded by lush jungles. Prophet designed a new positioning for the Vietnamese destination, helping it appeal to affluent nature-conscious guests. Their guests want authentic experiences that have minimal environmental impact. Centered around the positioning “Nurtured by Nature,” we delivered designs and ideas for touchpoints ranging from in-room amenities, food and beverage, and wellness options to digital apps to link them all.

CX Management is the Top Agenda for Hospitality C-Levels

The theme in all four of these trends, of course, is the importance of customer experience. From the smallest boutique to the largest hotel chains, it’s important to obsessively measure how well changing audiences are reacting. That requires making CX a key function, not just a supporting role, and establishing a clear guiding principle – an experience North Star – to ensure consistent, relevant and unique customer experiences. The goal is no longer customer satisfaction but customer delight.

- CX management is not to be treated as a supporting function, but as a core function anchored in the business and brand strategy.

- It needs a positioning and value framework that can and must be derived from the brand.

- When strongly intertwined with the R&D of travel & hospitality, CX management is decisive for identifying and driving innovations.

- The measurement of CX urgently needs a strong development push beyond the classic satisfaction and recommendation KPIs.

FINAL THOUGHTS

The travel and hospitality industry in Asia is experiencing a renaissance, driven by emerging trends in personalization, sustainability and tech innovations. As consumer expectations evolve, hotels must pivot and reinvent themselves to offer unique, immersive experiences that go beyond traditional services. By focusing on these key trends, hospitality brands can not only meet but exceed the needs of the modern traveler, creating lasting customer loyalty.