BLOG

The 5% Margin Growth You’re Missing by Overlooking Product Portfolio Strategy

How to Maximize Profits and Reduce Costs by Prioritizing a Customer-Centric Product Portfolio Strategy.

In competitive business landscape, an inefficient product portfolio can significantly impact a company’s bottom line. Our experience shows that companies lacking a customer-centric product portfolio strategy and failing to manage their portfolios proactively can lose up to five percent in product margin. Moreover, these companies often incur 10-20% higher portfolio management costs than their peers who prioritize product portfolio management.

The Foundation of an Efficient Product Portfolio: Understanding Your Customers

A successful product portfolio strategy starts with a deep understanding of your customers. It’s crucial to know:

- What customer segments are there? What are their goals and needs?

- How do they choose products? What dimensions influence their decisions?

- What is important to them? Are we prioritizing features based on an “inside-out mindset” rather than actual customer preferences?

- What are the decision-making hierarchies? Which aspects come first, second, and third in their buying process?

The answers to these questions should shape how you structure, build, and rationalize your product portfolio. They also guide how you allocate marketing budgets and internal resources, design packaging, organize store layouts, and structure your website.

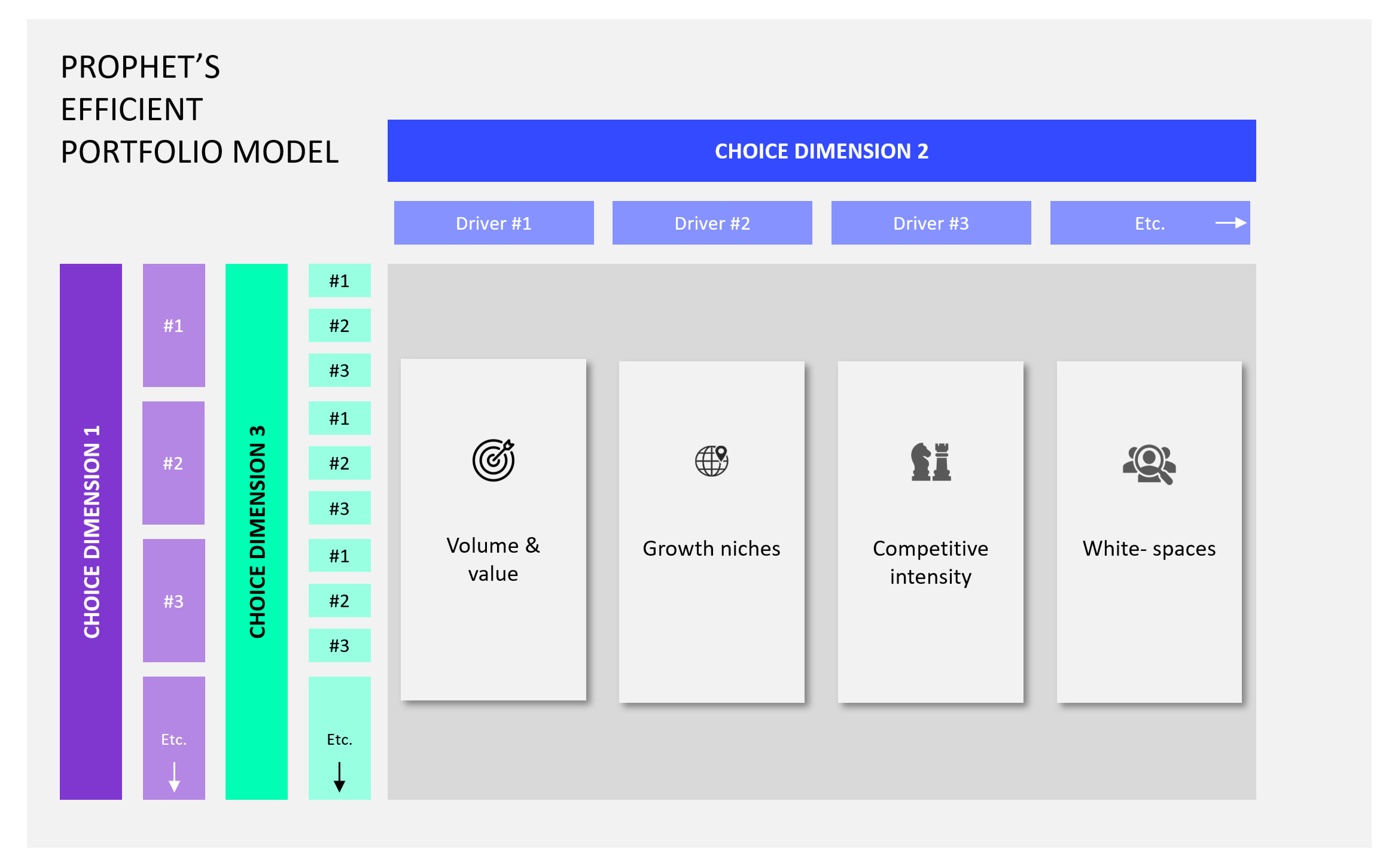

In this article, we share our thinking on how to create a customer-centric Portfolio strategy, using our Efficient Portfolio Model (Exhibit A.)

Exhibit A

The Pitfalls of an “Inside-Out Mindset”

Many companies falter by adopting an “inside-out mindset,” in which internal perceptions and engineering priorities drive product development. For instance, engineers might focus on technical features that seem crucial from a development standpoint but are not key factors in customer decisions. This approach often leads to overly complex portfolios that are hard for customers to navigate, potentially hampering sales and driving up management costs. And when the inevitable portfolio rationalization comes about, they rely on rough rules of thumb such as the 80/20 rule to remove the long-tail, rather than using customer-centric criteria.

Aligning Product Development with Customer Needs

Successful companies start with a thorough understanding of customer needs and behaviors, which inform the critical product dimensions. Customer research is essential to identify these “drivers of choice.” Effective methodologies we recommend include: Contextual Inquiry, in which participants are observed while they perform tasks and describe what they are doing; and Discrete Choice Modeling, in which the importance of different product dimensions, such as brand, price, size, and specific features, are quantified.

By identifying choice dimensions and mapping them on a matrix, companies can analyze the market to identify key volume and value pockets, as well as growing or declining niches. Comparing the existing portfolio against these matrices allows companies to determine which products to keep and prioritize, which to potentially discontinue, and where new opportunities lie. This strategy provides long-term guidance and direction for R&D teams on where to focus future product development.

Case Study: Streamlining for Success

For one of our FMCG clients, a detailed analysis revealed that 80% of the sales volume and value in their category were concentrated in three product hotspots across most markets. Based on this insight, we developed a product portfolio strategy that emphasized a “core” portfolio focusing on these hotspots. Additionally, we suggested an “excite” range of propositions to complement the core products, driving customer engagement and creating a buzz (Exhibit B.)

Exhibit B

Portfolio deployment guidelines were then developed to help markets roll out the product portfolio in the most impactful and efficient ways, depending on their specific context (e.g. new vs established markets, competitive intensity, etc.) (Exhibit C.)

Exhibit C

Leveraging Multi-Brand Strategies for Efficiency

For companies managing multiple brands, this analytical approach can also identify opportunities for efficiency. By defining clearer roles for each brand in terms of the product territories they cover, companies can streamline their portfolios, potentially migrating propositions to align better with brand strengths and market opportunities.

FINAL THOUGHTS

In conclusion, managing a product portfolio efficiently is not just about cutting costs or maximizing current product margins. It’s about understanding your customers deeply, aligning your offerings with their needs, and making strategic decisions that drive long-term success. Don’t leave money on the table—invest in a well-managed product portfolio strategy and unlock significant margin improvements.

Talk to us about the new world of growth.