CASE STUDY

MetLife

Creating a differentiated retirement solution value proposition for the new generation of customers

Challenge

MetLife, one of the largest life insurance companies in the world, is committed to providing deep and meaningful values to its customers as a trusted life partner.

Prophet has been a long-term partner with MetLife to help the brand propel its customer-centric transformation across the globe. In China, we started by helping MetLife China develop the overall customer value proposition – “Global Protection, Human Care.” We have also developed a series of customer-centric value propositions and solutions, including health, wealth, and education, to accelerate its transformation ambition in China.

Retirement planning has been a rising need for Chinese consumers, given the aging population, declining fertility rate, shortage of public retirement funds and the shortage of retirement facilities in China. MetLife partnered with Prophet to uncover insights into Chinese consumers’ retirement needs and to co-create a distinctive and compelling retirement value proposition and solution that truly meets Chinese consumers’ retirement needs.

Solutions

Through our research, we found that younger Chinese consumers, between the ages of 30 to 45, feel anxious and uncertain about retirement.

To understand consumer retirement needs, we spoke to people from different life stages and household statuses. From there, we identified four consumer insights that create distinctive market opportunities for MetLife China to develop its retirement value proposition:

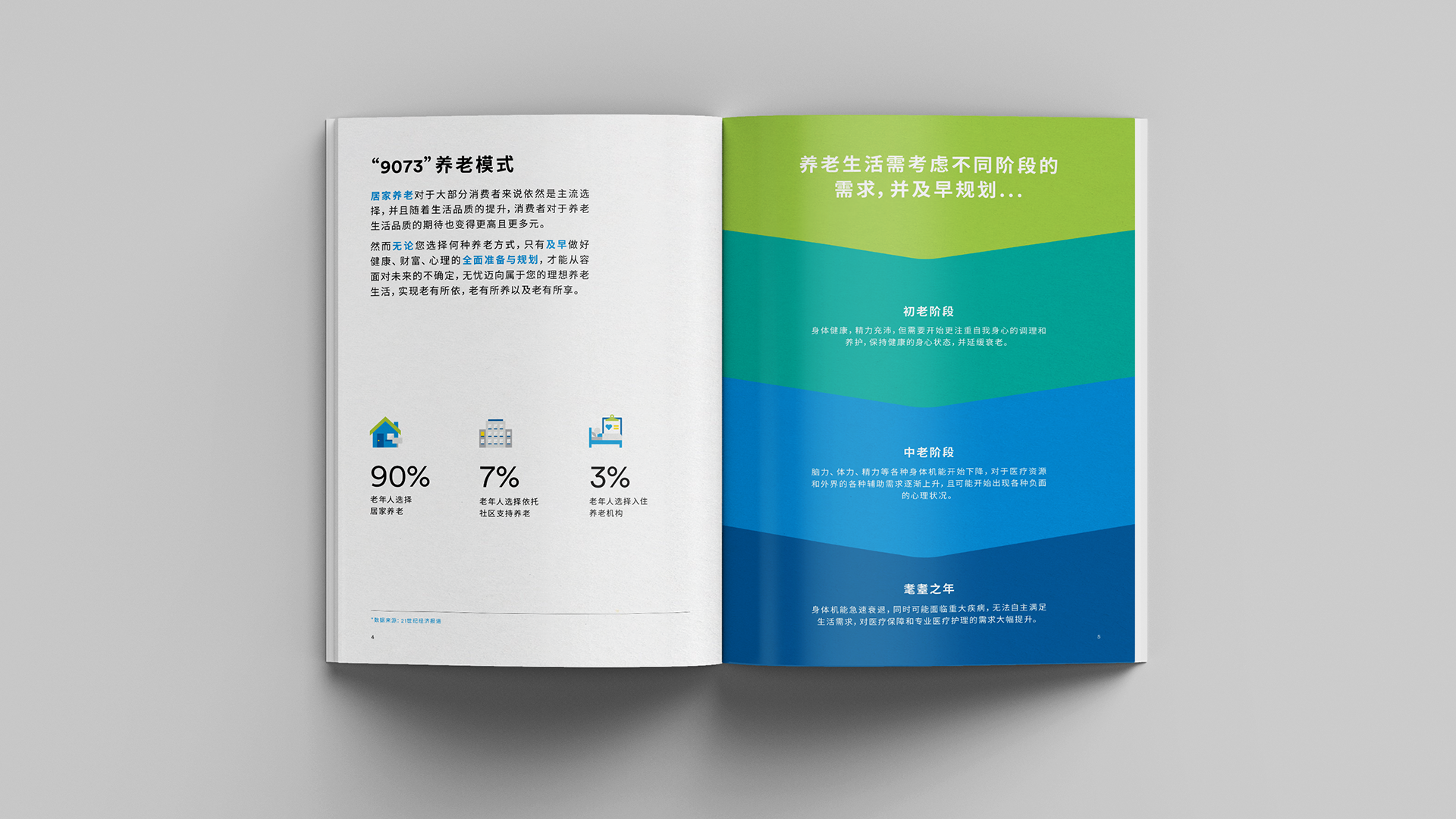

- Retirement preparation: First, retirement needs do not start in people’s 60s. Consumers want to start retirement planning early. Health issues often trigger consumers to start thinking about retirement planning. Protecting themselves from aging-related health issues has become a big part of their retirement preparation beyond financial preparation.

- Retirement services: In China, while most retirees prefer to stay in their homes for retirement, there’s a shortage of retirement services and facilities options. Consumers are less worried about covering their daily living expenses and medical bills and are instead concerned about access to quality services and facilities.

- Family support: For Chinese consumers, retirement is not an individual need but requires planning as a family. Most of them need to ensure support for their elderly parents before they can think about retirement preparation for themselves which still requires not only financial support but also quality retirement and health service support.

- Mental health: Retirement is more than just financial stability. It is also about the long-established life rhythm and goals. Many Chinese consumers feel a loss of identity and meaning after they retire. A critical part of ensuring individuals thrive in retirement is to figure out how to be mentally prepared and how to leverage the abundant free time to explore new hobbies, expand their horizons and socialize.

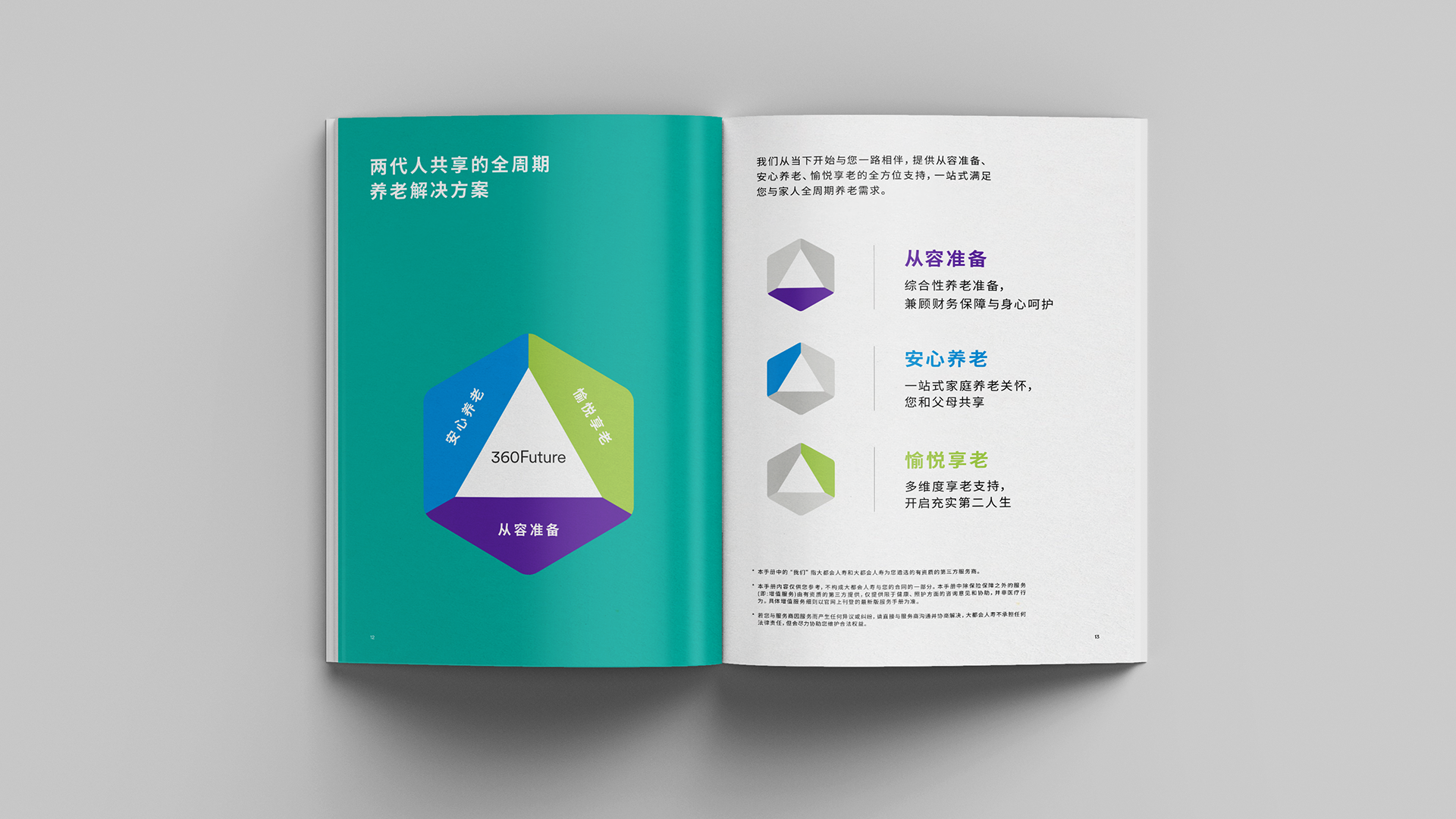

After gaining a deep understanding of these needs, our team worked with MetLife to articulate its retirement value proposition– “Helping you and your family achieve total preparation towards a fulfilling life post-retirement.” We also worked with MetLife’s key stakeholders to co-create the product, service and experience of the retirement solution and developed a clear roadmap to bring the retirement solution to life and for future upgrades.

Next, our design team created graphics to bring the value proposition to life visually by developing detailed design guidelines for the retirement solution to ensure its visual identity system is compatible with MetLife’s master brand visual system and architecture. Additionally, we have designed brochures and other communication materials for internal and external communications.

Results

MetLife China launched its new retirement solution, 360Future, in December 2022. Through a live-streaming launch event, MetLife shared inspiring stories and distinctive insights from their employees, customers and industry experts.

Prophet’s Associate Partner, Lily Wen was invited to join the panel discussion to highlight global and Chinese consumers’ unique challenges toward retirement. “Consumers’ retirement needs are multi-dimensional. Helping them develop the numerical financial goal alone can’t truly solve their worries, anxiety, and confusion toward retirement,” Lily said, “Financial service companies must address Chinese consumers’ holistic needs, by supporting their desire to secure their parents’ retirement while providing quality health and medical services beyond just financial security.”