BLOG

Play is Back. What’s Next for Toy and Gaming Brands?

As people look for more and better ways to play–on their own and with their kids–innovation is essential.

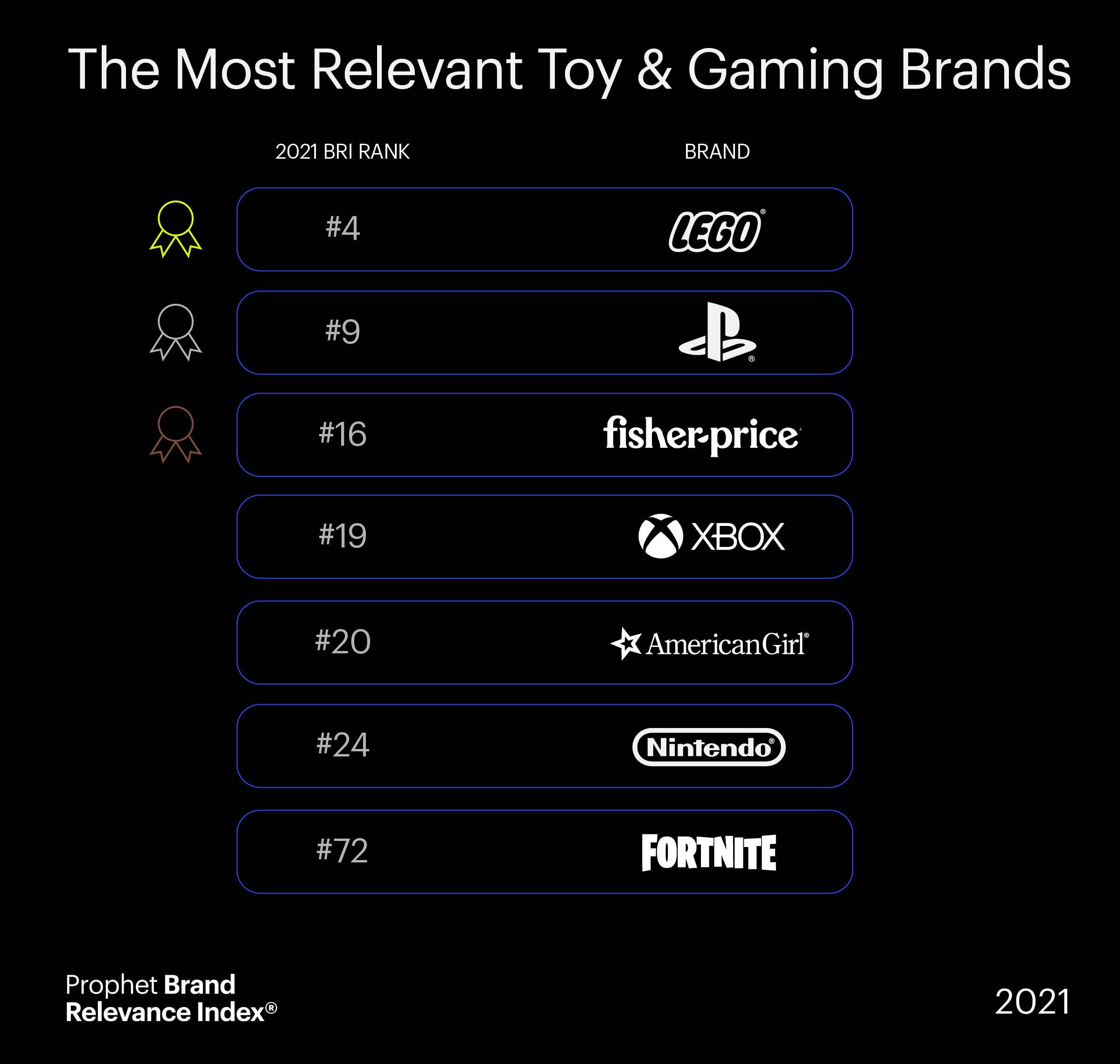

PLAY had a break-out year in 2020. While the world dealt with the pandemic, people sought ways to distract and entertain themselves. They craved escape from what felt like nonstop bad news and needed a little joy while staying at home. As a result, the brands that came out to play rose to the top of the 2021 Prophet Brand Relevance Index®. For the first time, five toy and gaming brands– LEGO, PlayStation, Fisher-Price, Xbox and American Girl–rose to the top 20 brands.

But it wasn’t just kids looking to find joy through play. Adults picked up puzzles, got their endorphin kicks from Peloton and connected with others on video games. And for their children, it meant stocking up on nostalgic classics, like Hasbro’s Monopoly and Mattel’s Barbie, as well as toys and activities that encourage learning and creativity.

It’s easy to say these gains in relevance for top toy and gaming brands are simply due to the pandemic. And yes, COVID-19 has undoubtedly been the catalyst, bumping game night back into living rooms and with so many more people saying, “I can’t imagine my life without this brand”. But there’s a deeper change happening. These toys and games aren’t just ways to pass time. They bring joy, comfort and ease into people’s lives–and they’ll want to hang on to that.

And while toy brands saw a bump in engagement over the last year, not every brand will maintain consumer interest. Toy and gaming brands need to find new strategies to build on sales momentum as the pandemic eases. With family life slowly shifting away from home, brands must find new ways to engage.

Four Clear Paths to Growing Brand Relevance (Even as the Pandemic Subsides)

Rethink Community

As the world moved toward digital everything, staying connected–especially when it came to play–became more critical. Digital gaming had its best year ever in the BRI. Besides PlayStation (No. 9) and Xbox (No. 19), Nintendo, Blizzard, Minecraft and Fortnite all made the Top 100, beating hundreds of other brands.

Roblox, which has been generating buzz because of its recent IPO, is winning with the 9-to-13 set by creating an entirely new category, which it calls “Human co-experience.” In many of its games, like MeepCity, kids don’t compete at all–they cooperate and simply hang out.

And Animal Crossing: New Horizon, which launched in March of 2020, isn’t just a lockdown obsession that propelled Nintendo to $1 billion in profits. Its simple whimsy enabled new ways of connecting with others. Public personalities, including Congresswoman Alexandria Ocasio-Cortez, played, engaging millions of followers. It even infiltrated the NFL, with the Detroit Lions using the game to reveal its 2020 schedule.

These digital gaming brands are changing conversations in their communities. As part of the growing Black Lives Matter movement, PlayStation and Xbox took on hate speech in a way that resonated with gamers around the world – proving that brand relevance can come from outside of the core business.

Genuine conversations between players also fuel the success of LEGO. Yes, it’s beloved because of the tactile nature of building–and the way kids yearn to create. But it does so well in the digital realm because its free content sparks online invention in new (and safe) ways. And its “Build & Talk” initiative, gives parents the tools they need to raise better digital citizens.

Reinvent the Flywheel

Kids hear about toys in new ways, so it’s important to be where your customers are. Many brands are embracing YouTube, using tactics those in other categories haven’t quite cracked. Due to the soaring popularity of “unboxing” videos, the most potent demand drivers are grade-school millionaires: Anastasia “Nastya” Radzinskaya, 6, has 67 million YouTube followers and is worth $20 million–and a deal with IMG to develop her own product line. Ryan (“Ryan’s World”) Kaj, with 28 million followers and an estimated net worth of $32 million. He also sells his own toys, working with Pocket.watch, a company pioneering this YouTube-to-toy shelf strategy.

Toy brands have become more reliant on these influencers. And there is also an opportunity to build authentic content. Taken together, content, community and commerce form a powerful trifecta for direct-to-consumer growth.

Ecosystems are expanding based on intellectual properties that can lead to mega franchises. Disney continues to master the cycle of media-to-toy merchandising. Still, older brands like Barbie and LEGO, and newer ones, such as PAW Patrol, continue to grow via the toy-to-entertainment route. What matters is that they are all finding avenues that are both authentic to the brand and create growth opportunities.

Lean Into Purpose

When it comes to measures of inspiration and purpose, toy and gaming brands did exceedingly well in our Index. To a degree, nostalgia is driving this admiration. American Girl ranks No. 4 in “Has a set of beliefs and values that align with my own”–only Johns Hopkins, Mayo Clinic and Peloton did better. LEGO and Fisher-Price also scored in the Top 20 on this metric. When parents can say, “I had one of those when I was a kid,” it’s easier for them to get excited about sharing a safe and familiar experience.

But nostalgia isn’t enough, and young consumers also demand pervasive innovation to be considered a relevant brand. For years, Barbie couldn’t quite shake off her controversial image as Ken’s girlfriend. But thanks to multi-media engagements, Mattel has resurrected her as an enduring role model, with multiple career paths–and creative content–that appeals to millennial moms as much as to little kids. Barbie, old enough to collect Social Security, is taking a stand on everything from white privilege to running for office to mental health, including a partnership with Headspace, the meditation app.

But best of all, Barbie is fun again. In 2020, Mattel says it sold a new Barbie Dream House every single minute not because of its past, but because it’s loaded with details that enchant kids right now.

Find Bigger Playgrounds

Adults want to play, too, and it’s important to understand just how fierce that longing is. The NPD Group reports that 79% of U.S. consumers have played video games during the pandemic. The fastest-growing audiences are people between 45 and 54 (up 59% for the year) and those 65 and older (up 48%.)

Grown-ups also crave a creative release, powering a surge in adult coloring books and a resurgence of paint-by-numbers kits. They snapped up extra-difficult jigsaw puzzles. And LEGO is targeting adults with new art projects and a Botanical Collection.

A year of play has reminded many adults how much they love to stretch their imaginations. The classic Dungeons & Dragons, a role-playing game that has been around since the 1970s, had its best year ever, with more than 40 million active players, an estimated 60% are 25 and older.

Toy and gaming brands that can help adults find new ways to relax, create, compete and blow off steam will stay connected, even when people begin to socialize more in person.

“Toy and gaming brands that can help adults find new ways to relax, create, compete and blow off steam will stay connected, even when people begin to socialize more in person.”

FINAL THOUGHTS

While top toys and gaming brands gained relevance during the pandemic, maintaining that close bond with customers will require new strategies. To continue to achieve uncommon growth, they’ll need to stay better connected, following consumers as they make their way back to schools, work and in-person social events.

Have you found a clear path to driving brand relevance? We can help – reach out today.