BLOG

Do My Customers and Employees See the Same Brand?

Turns out the secrets to staying relevant with consumers also attract and retain the best workers.

You’ve invested untold fortunes to create a customer experience that cements loyalty in your brand. You’ve invested a similar fortune building an employee experience to attract the best and brightest and become an employer of choice. But are you telling a consistent story? Do your external and internal brands share the same DNA? Are your customers inspired in the same way as your employees? Or do you feel at risk when your employees talk to customers?

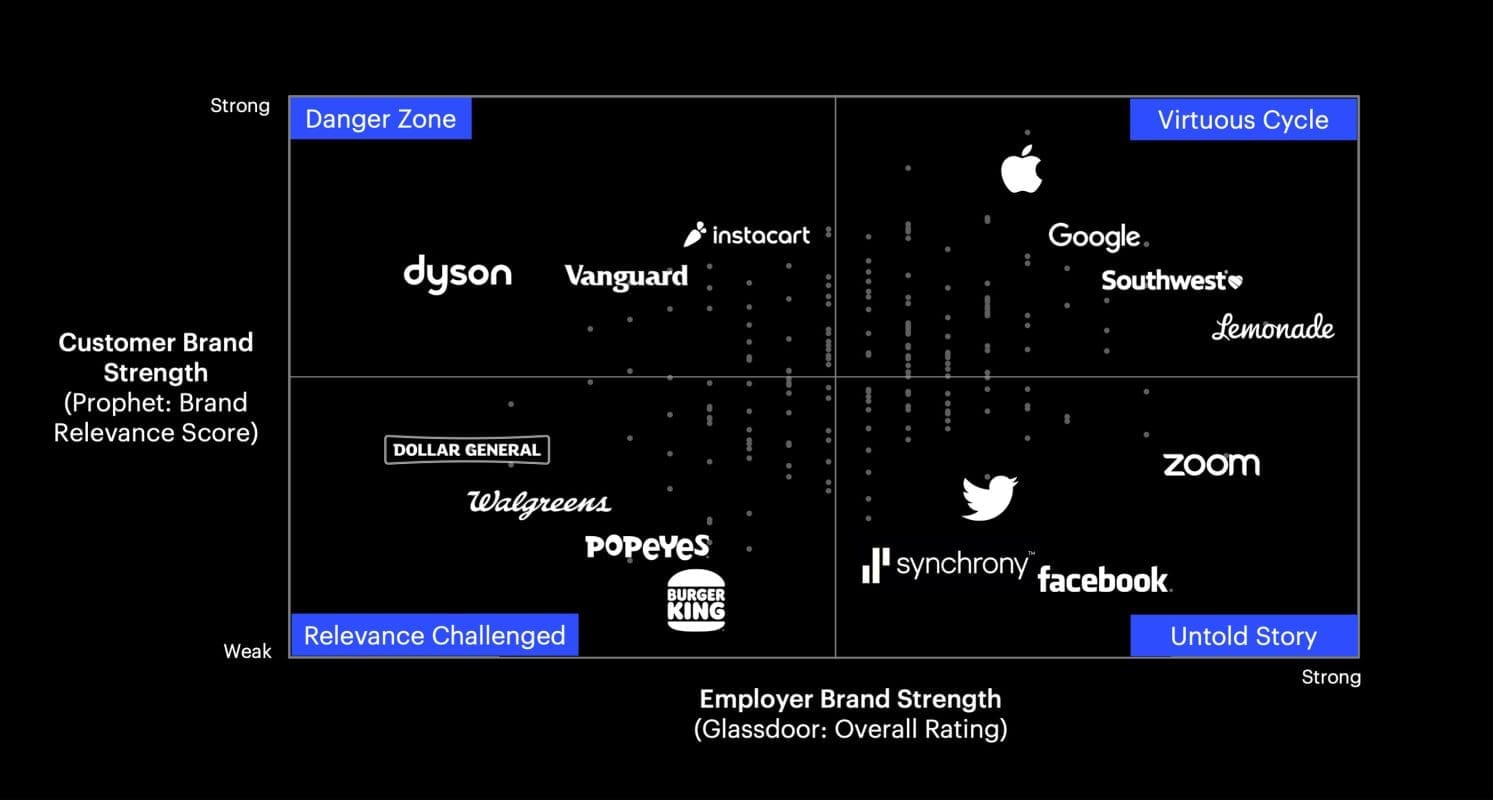

Prophet is in a unique position to answer these questions. Our Prophet Brand Relevance Index ® (BRI), a survey of over 13,000 consumers rating 228 brands across 25 industries, provides a proprietary view of the brands most relevant to consumers’ lives. And at the same time, we’ve leveraged open API data by Glassdoor, the independent authority on employer ratings, to track data for over 750 companies across 50+ industries. Plotted together, they tell a fascinating story.

The Customer – Employer Brand Connection

As you might expect, companies with strong customer brands tend to have strong employer brands. Think Apple and Google. And vice versa: weak customer brands tend to have weak employer brands. Think most convenience retail and quick-serve restaurant brands (although not all).

Arguably the key to Southwest’s success – and 40 straight years of profitability – is how tightly employee purpose is woven into the very fabric of the customer experience. In stark contrast, Uber’s journey in its early days is a cautionary tale: despite owning over 80 percent of the rideshare market, #deleteUBER was born when the company was perceived to be mishandling employee engagement.

We believe a major driver of this relationship is what business columnist David Mattin calls a glass box. Whether it’s by choice or brute force, customers have unprecedented access to a brand’s inner workings – its finances, its operations, its people. And now more than ever consumers are looking for and influenced by, their clear view. In Edelman’s 2020 Trust Barometer Study, 90 percent of customers agree brands must protect the well-being and financial security of their employees and their suppliers, even if it means suffering big financial losses until the pandemic ends.

“90 percent of customers agree brands must protect the well-being and financial security of their employees and their suppliers, even if it means suffering big financial losses until the pandemic ends”

Where Does Your Brand Sit?

We have plotted customer brand strength, as measured by the 2021 Prophet BRI against employer brand strength, as measured by Glassdoor’s overall company rating to produce the chart below.

The model produces four scenarios worth exploring to understand what it might mean if your brand sits in one of these quadrants:

Virtuous Cycle (top right)

These brands have it down. They inspire and deliver. They disrupt, with purpose. Visionaries who never lose sight of what matters. With a focus on delighting customers and employees, from the inside out, it’s no surprise that brands like Apple, Google, Southwest and Lemonade have hit the bullseye of relevance.

Relevance Challenged (bottom left)

In the other corner, brands like Dollar General, Walgreens, Popeyes and Burger King are struggling to get points on the board. If there is one thing that healthcare, retail and quick-service restaurant brands have in common, it’s that they seem to be in a constant state of disruption – kicking up a cloud of confusion on all sides. Customers like navigating new user experiences and revolving doors of discounts as much as employees like enforcing them.

Danger Zone (top left)

While happy customers are the key to a brand’s growth, unsatisfied employees can be its undoing. For companies in this quadrant, there is a fundamental disconnect: what should be a point of pride around customer excitement is not translating into employee excitement. Many of the brands in the danger zone are renowned for innovation, taking risks to accelerate value in the customer experience. But the employee experience has not kept pace, creating extreme risks for brands with high-touch customer interactions.

The Untold Story (bottom right)

Given the recent scrutiny of social media brands, it may seem surprising to see Twitter and Facebook stay strong in the hearts of employees. But despite intense external pressure, employees remain committed to the company’s purpose. We see an opportunity: to uncover what is driving employees; frame that passion for customers and help them see the brand in a new light. When the brand’s story is aligned with a passion in the culture, both employees and customers become brand advocates and vested in the success of the business.

FINAL THOUGHTS

Brands need to have a true purpose that shines through, inspiring customers and employees alike. When employees believe in a company, it translates to trust and relevance for all external stakeholders.

Are you interested in aligning your customer and employer brands and getting the most out of each of them? Our Brand and Culture experts can help, reach out today and hear how we are helping clients just like you.