BLOG

Addressing the ESG Gap: Reconciling ESG Performance and Perceptions

Identify and address gaps in ESG performance and customer perceptions.

ESG is not just a feel-good initiative – it is a vital part of business and employee engagement strategies that drive growth in a world that increasingly needs businesses to address pressing global challenges.

Companies face pressure from multiple stakeholders to be more socially and environmentally responsible while being transparent about that progress. While there is a continued push by consumers and employees, regulators and investors are also pushing harder for ESG. The EU now requires companies to publish reports on the social and environmental risks they face (with the US not too far behind).

As a result, businesses have begun to invest more seriously in delivering against their ESG ambition and targets – aiming to create a tangible impact. But as the ESG focus strengthens, there is often a gap – between how companies perform on ESG, and what customers perceive of a company’s ESG strategy.

Evaluating the ESG Gap

The ESG performance vs. ESG perceptions gap is based on two questions: 1) How well is my company performing on ESG? and 2) How do customers perceive we’re doing on ESG?

The glaring discrepancy between these two questions has fueled the rise of “greenwashing” or “purpose washing” accusations against some companies, while the reconciliation of this gap has generated growth by leaning into customer preferences. As a result, it’s urgent that companies understand and evaluate their gap to maximize their ESG impact and tap into new opportunities.

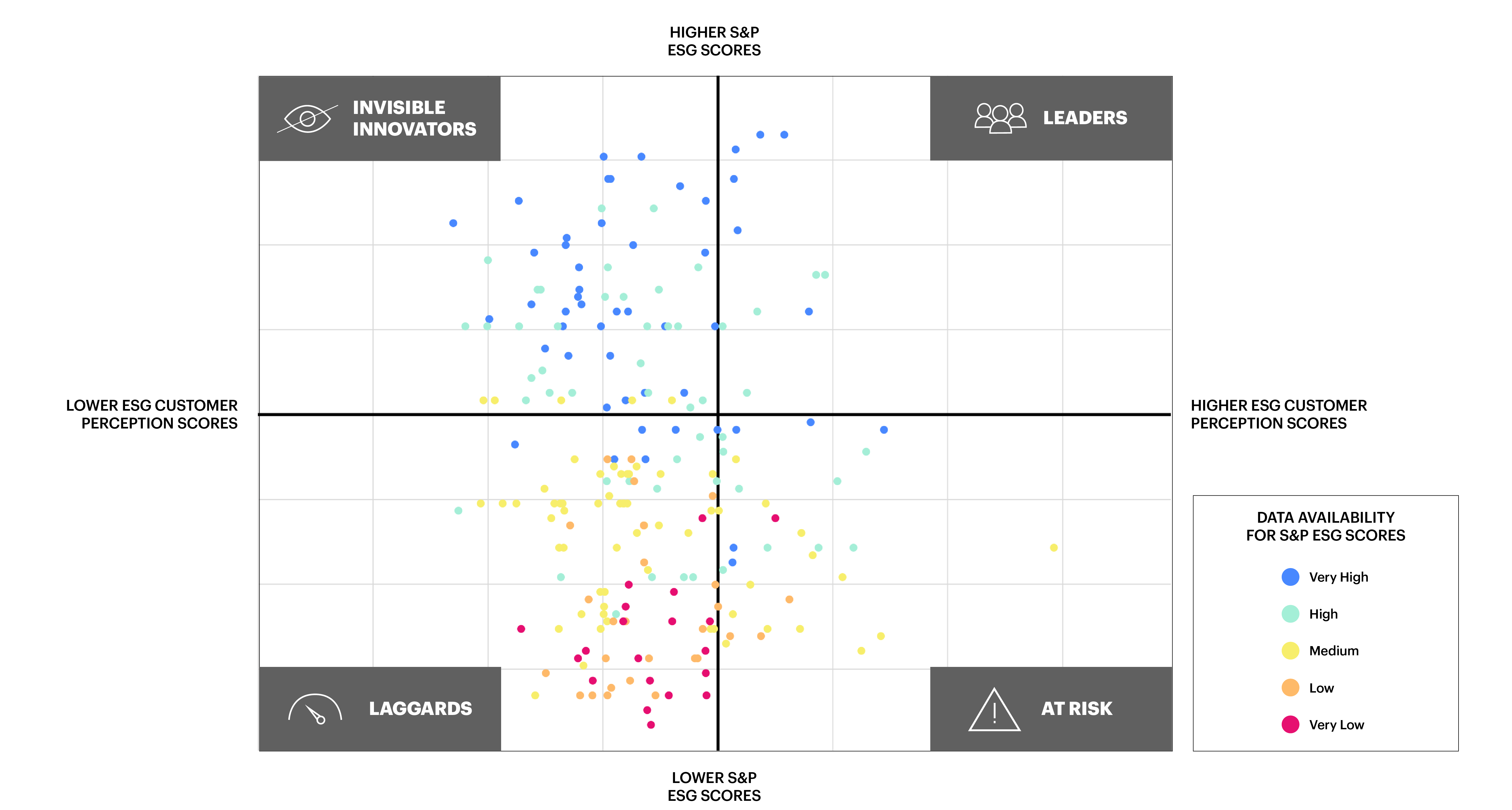

Note: Dots represent industries and companies included in the Prophet analysis.

Figure 1: ESG Performance vs. Perceptions example

ESG Performance

In addition to companies’ internal reporting, a wave of third-party ESG metrics and ratings (e.g., MSCI, S&P ESG Scores) have emerged. These scores measure how well a company addresses and manages risks in the areas of environmental, social, and governance. As a result, ESG scores should provide an unbiased, comparable view of a company’s ESG exposure to guide investors.

While these metrics aren’t perfect – they often leverage incomplete data and standard measurement processes have yet to be implemented – they provide much-needed visibility to external stakeholders and comparability across companies and industries.

ESG Perceptions

ESG performance scores measure what a company is doing across ESG initiatives – it’s another effort to be recognized and rewarded for that investment by consumers.

While many factors affect brand perception, companies are starting to integrate customers’ ESG perceptions into their analysis as ESG becomes a purchase influencer. For example, products making ESG-related claims averaged 28% cumulative growth over the past five-year period, versus 20% for products that made no such claims. Companies can look at data (like the Prophet Brand Relevance Index ®) to better understand what consumers think of their brands.

Using performance scores and customer perceptions of ESG, companies can start to understand if they are successfully communicating how their ESG agenda translates to additional value. Alternatively, these metrics can help companies determine if their words are ahead of their actions and if they are at risk of greenwashing or virtue signaling.

The Framework

By identifying the gap, companies can diagnose where they are in their ESG journey and the next steps for progress: Are they slow to adopt ESG and need to integrate it into all functions? Are they perceived by customers to be performing well on ESG but not living up to it? Do they have robust ESG programs but aren’t publicly recognized for them? Or are they ESG leaders?

To better illustrate the gap, we mapped customer perceptions and ESG performance scores, identifying four quadrants that companies may occupy. We will take a closer look at the automotive and retail industries, both of which have organizations that occupy all quadrants.

Overall, one theme emerges: Companies need to do better on ESG, both in establishing and executing ESG commitments and initiatives and sharing that progress openly with stakeholders.

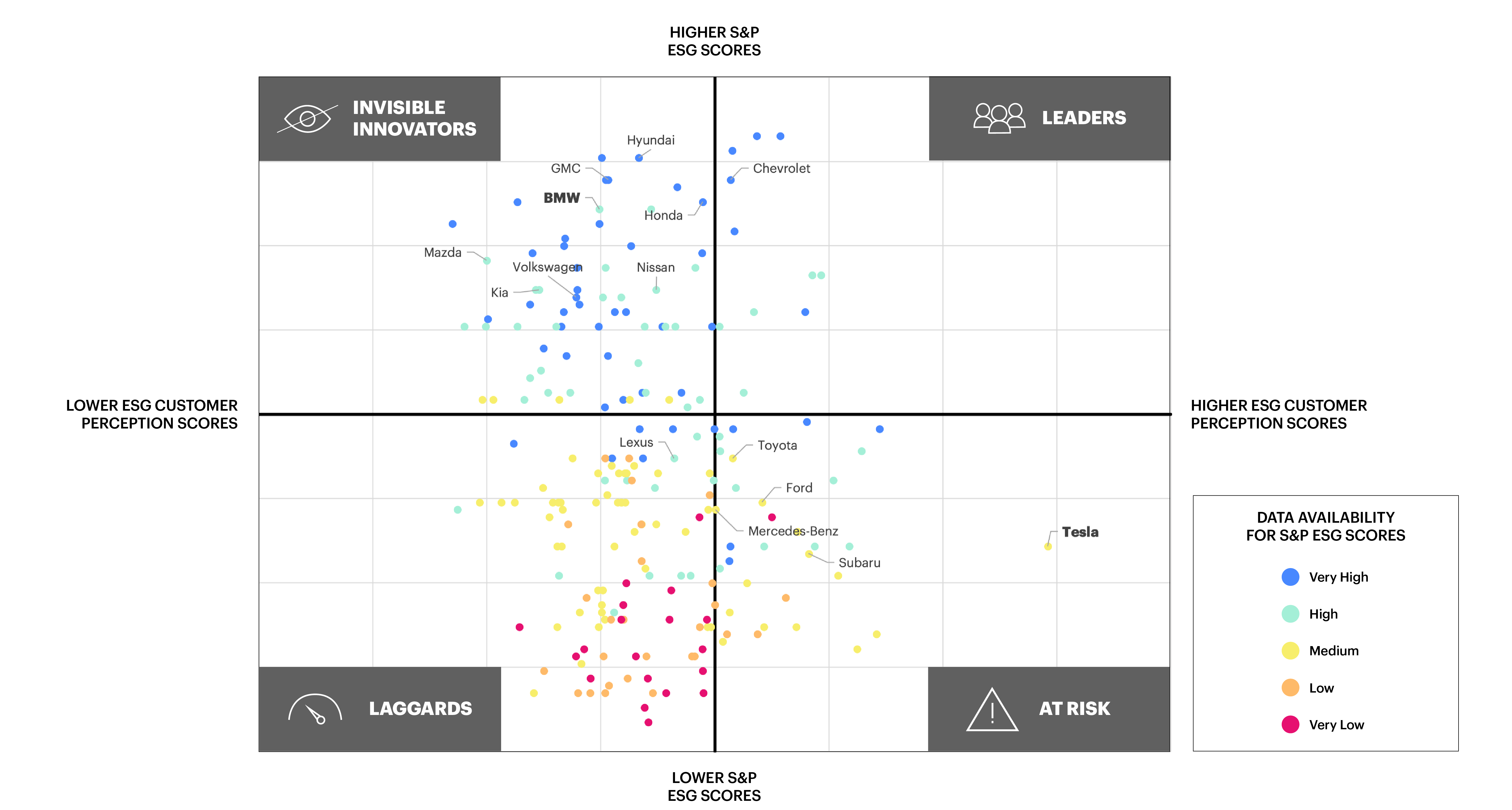

Figure 2: ESG Performance vs Perceptions: Automotive Industry

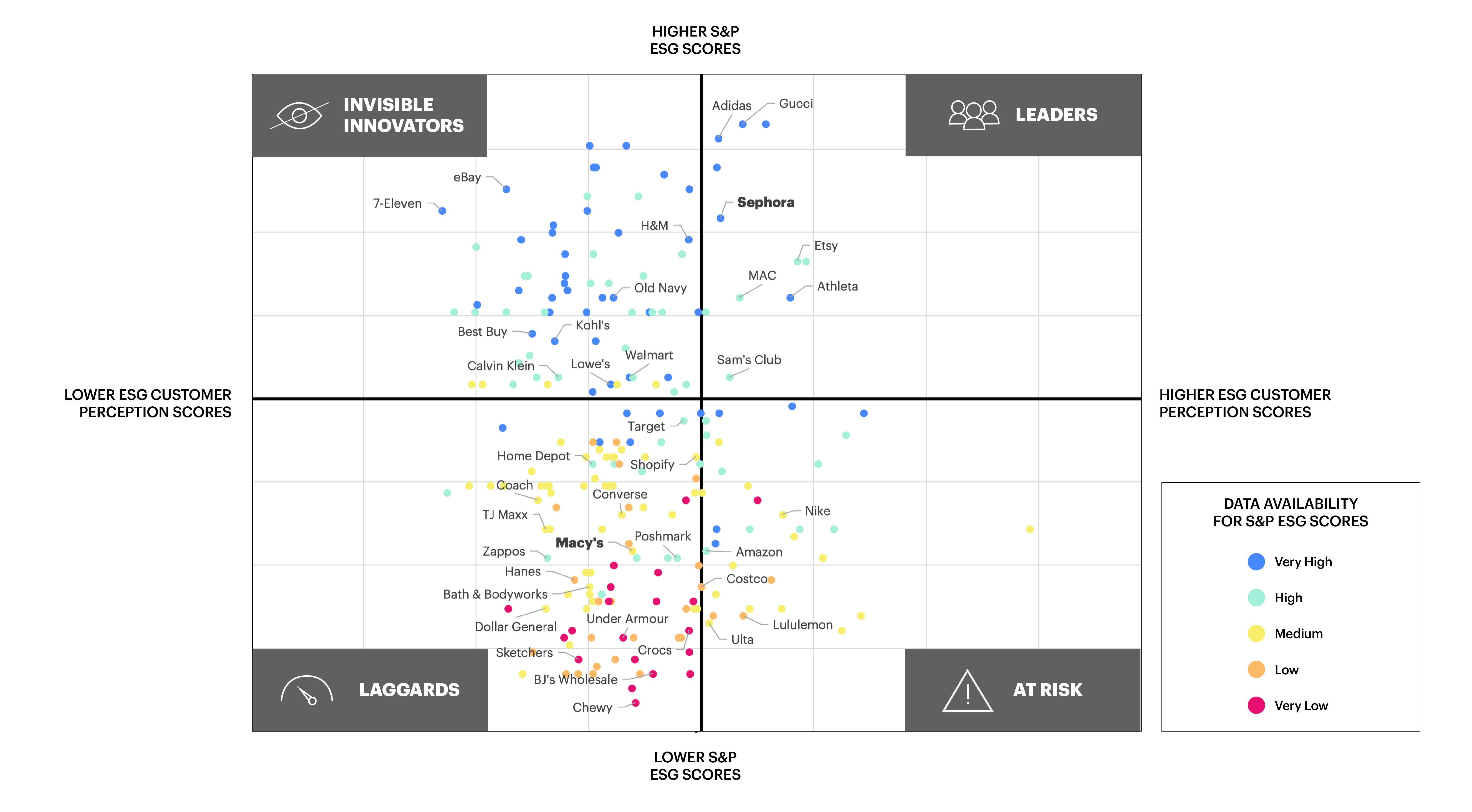

Figure 3: ESG Performance vs Perceptions: Retail Industry

Leaders (HIGH Performance/HIGH Perceptions)

What this means: Companies here are both performing well on customer perceptions and ESG performance scores. Some of them have found strong alignment between elements of ESG and their businesses. Others have leveraged an element of their business (a product or a component) to build credibility with consumers around an area of ESG (e.g., using recycled or renewable materials in a new product). Overall, these companies are born out of purpose, intertwining their ESG strategies with business strategies.

Who we’re seeing in this space: This is an aspirational quadrant not characterized by any one industry. The few inhabitants often represent the best of their category, having typically established ESG precedents for their industries.

For retail (see figure 3), Adidas, Sephora, Etsy, and Athleta live here. Sephora is known for integrating DE&I thinking not only into its internal culture and employee operations but is also committed to ensuring that its products are sourced from diverse businesses. It was the first retailer to dedicate at least 15% of shelf space to Black-owned brands and commissioned the first-ever large-scale study on Racial Bias in Retail to improve the shopper experience.

What to do if you’re here: Continue to make sustainable and socially responsible products, services, and investments in ESG. By seeking industry collaboration, companies can bring others along on the journey and strengthen the category. But while it’s great to have established leadership, companies here will need to be vigilant and make their leadership positions defensible. Other companies will see the benefit of being known as strong ESG performers and will strive to replace the current leader.

At Risk (LOW Performance/HIGH Perceptions)

What this means: This quadrant is characterized by high customer perceptions of ESG in contrast to low performance on ESG. ESG may be well integrated into the brand story through messaging, but there hasn’t been strong progress in delivering on that narrative.

Some are purpose-native companies that made ESG a core part of their brands, benefitting from the halo effect from their origin story, despite being unable to enact a robust ESG strategy as they scale. Other companies include strong consumer brands with ESG-friendly elements, but company performance on ESG doesn’t match.

As a result, companies here are at risk of being labeled as “greenwashing” or “virtue signaling” if customers realize the company’s ESG initiatives amount to statements with little evidence to back them.

Who we’re seeing in this space: Some companies may be unable to scale their ESG performance to align with their words. For example, Tesla (see figure 2), nearly synonymous with EVs as the pioneer in the space, was born out of the purpose to accelerate the world’s transition to sustainable, clean energy. However, despite this clear mission, the company has struggled to make strides in other facets of ESG – Tesla was removed from the S&P 500 ESG Index because of issues of racial discrimination within its workplace. Its CEO is famously outspoken for his anti-ESG rhetoric.

What to do if you’re here: Assess where to improve or build strategies to deliver on ESG promises and customer expectations. Commit to bold moves against top risks to show progress and authenticity.

To avoid widening the gap, companies should evaluate the validity of any explicit ESG claims in their messaging to ensure that they are staying true to their statements. ESG performance should be prioritized over ESG perception building.

Invisible Innovators (HIGH Performance/LOW Perceptions)

What this means: Companies here are performing well on ESG but aren’t recognized for their progress by consumers. This could stem from 1) not communicating ESG strategies to external stakeholders, 2) not coordinating ESG excellence with brand and marketing, or 3) believing that their customers might not prioritize ESG when they search for and purchase products. Some companies, like a QSR or CPG food company, might even be plagued by category stigma developed over years of a tarnished reputation.

We also see more consumer awareness of social and environmental efforts in lifestyle, fashion and entertainment categories – consumer-facing brands that play prevalent roles in culture and identity – rather than functional brands in the appliance and food categories. ESG expectations will also vary by the category of the issue. For example, some customers may think a transportation company should prioritize environmental issues over social issues.

In figure 1, we see a relationship between low ESG performance scores and low ESG data availability – illustrating that without robust data sets for third-party ratings, companies’ ESG scores will ultimately be hurt.

Who we’re seeing in this space: When we look at the rest of the automotive industry (see figure 2), there is an intriguing contrast with Tesla. There is a cluster of auto companies including Volkswagen, Mazda and BMW that have higher ESG performance scores but lower customer perceptions of ESG. This illustrates the necessity of not only delivering on ESG ambitions but communicating them well.

For example, BMW established clear goals such as reducing CO2 emissions by over 40% by 2030 and meeting climate neutrality no later than 2050. Additionally, the company aims to have 10 million fully electric vehicles on the roads by 2030, with all vehicles able to be fully recovered and reused for circularity. However, BMW’s lower customer perception of ESG illustrates that customers don’t know what BMW is doing to leave a positive impact on the environment, potentially leaving environmentally conscious consumers out of reach.

What to do if you’re here: Companies should build connectivity between their ESG and brand narratives for a cohesive story that touches all stakeholders. They should also start sharing their ESG data more openly to socialize their performance. If their brand is rooted in ESG, then they should follow up with the numbers to support it.

Companies should increase collaboration between the Chief Marketing Officer and the Chief Sustainability Officer. Shine a bright light on the elements of ESG that consumers care about. If companies don’t know if or what they care about, they need to find out.

Laggards (LOW Performance/LOW Perceptions)

What this means: Companies here are underperforming on ESG and are perceived poorly by customers with respect to ESG. This may mean that these companies still see ESG as a siloed function (like Corporate Social Responsibility) in the business. Companies here may also be in an industry where no player is focused on delivering against ESG. Or the company is lagging, relative to its more ESG-progressive peers.

As a result, there is ample opportunity to establish a strong foundation for growth in all areas of ESG.

Who we’re seeing in this space: Typically, larger, legacy companies – especially those whose businesses seem foundationally at odds with ESG – may run into these ESG challenges because they are slower to adapt. For example, the apparel and fashion industry (see figure 3) – which is responsible for 10% of human-caused greenhouse gas emissions and 20% of global wastewater – is now scrambling to reduce its environmental impact against the backdrop of the harsh effects of climate change.

Macy’s is one of the country’s most storied department stores, founded over 150 years ago. As the store looks to set itself up to rectify years of flagging sales, it has turned to ESG to fuel its future. In 2022, Macy’s announced that it will spend $5 billion by 2025 on three pillars of social purpose – people, communities, and the planet – to help shape a more equitable and sustainable future. Legacy companies like this are now realizing that success in the future is tied to meeting the needs of customers and employees, who want the organizations they purchase from and work for to be socially responsible.

What to do if you’re here: Look for quick wins to establish a foundation for ESG. Try to move performance first, but also evaluate the need to shift perceptions. Start sharing ESG data more openly to socialize ESG performance with stakeholders, emphasizing a commitment to accountability.

Set an ESG ambition and agenda to identify the next steps to start delivering on their goals. A transformation plan can help outline how a company must change for this new chapter of growth. Additionally, join industry or issue-based coalitions to build understanding, commitments, and relationships.

METHODOLOGY

ESG PERFORMANCE SCORES: In our analysis, we used 2022 S&P ESG scores to identify companies’ performance on ESG. Unlike ESG datasets that rely simply on publicly available information, S&P Global ESG Scores are informed by a combination of verified company disclosures, media and stakeholder analysis, and in-depth company engagement via the S&P Global Corporate Sustainability Assessment (CSA).

CUSTOMER PERCEPTIONS OF ESG: To determine customer perceptions of companies’ ESG performance, we leveraged our 2022 Prophet Brand Relevance Index ® (BRI) data. The BRI measures brand relevance – relevance encompasses all the elements required for a strong brand and healthy bottom line, including high demand, strong appeal and products and services that add value to a consumer’s life.

Prophet asked more than 13,500 consumers in the U.S. about the brands that matter most in their lives today. We measure their relationship to 293 brands in 27 categories, looking closely at 16 attributes.

FINAL THOUGHTS

Whether you believe ESG is strategic to your company’s growth or that your customers are prioritizing ESG in their purchases, it is vital to recognize and address any ESG performance and customer perceptions gap. Otherwise, your company may miss opportunities to connect with ESG-minded customers.

The first step to addressing your ESG performance vs. perceptions gap is understanding where your company is today. Once you’ve defined that, the steps we’ve outlined will help guide you toward ESG leadership.

This article is a part of our ESG Performance vs. ESG Perceptions series analyzing the gap between what a company does and what its customers think it does on ESG. Stay tuned for our next analysis featuring our new 2023 BRI data!