BLOG

Brand and Culture: At the Intersection of Uncommon Growth

When brand and culture align, organizations gain credibility, differentiation, and sustainable growth.

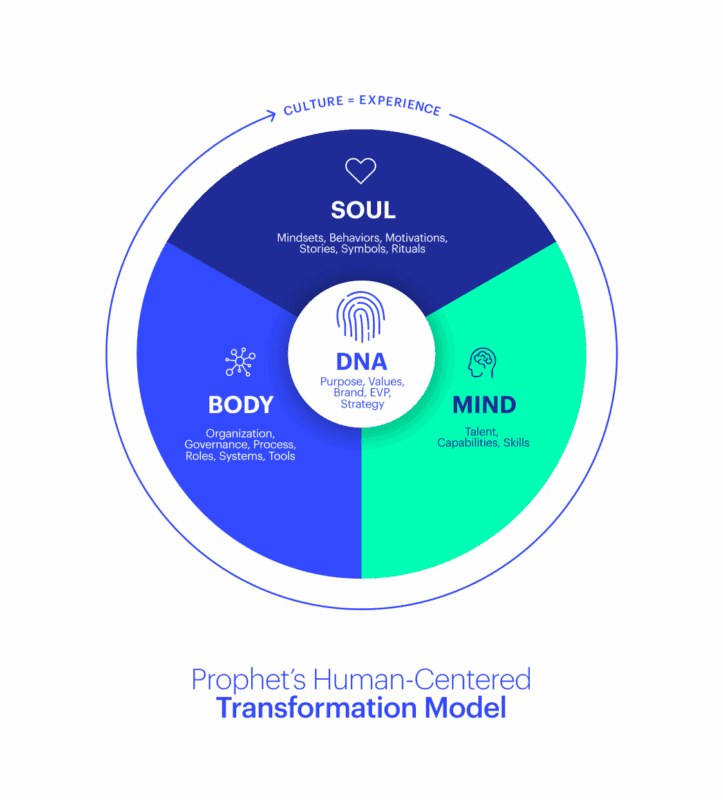

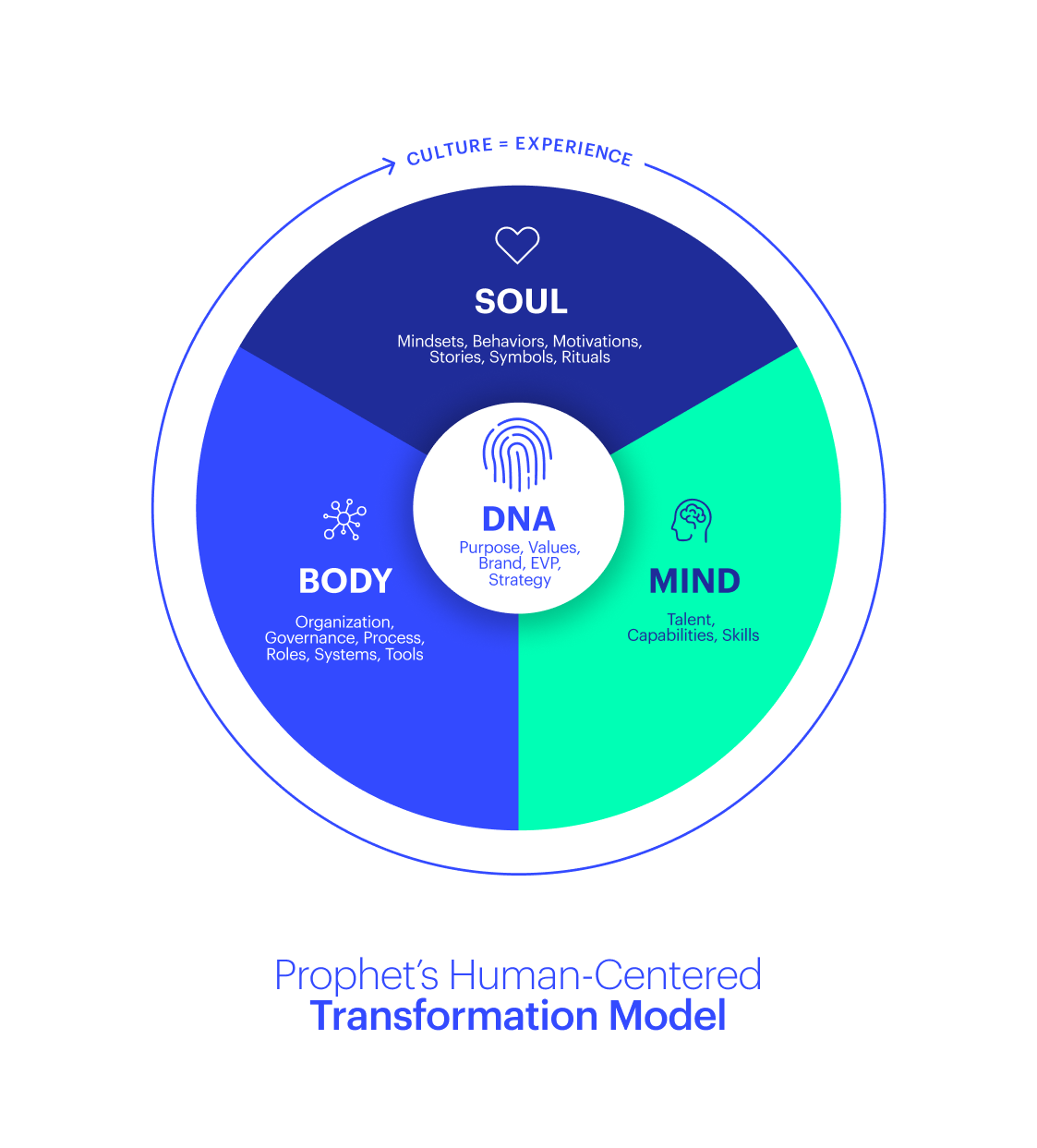

Innovation may spark growth, but credibility sustains it—and that credibility comes when brand and culture are working as one. Once treated as separate, brand—the external articulation of promise—and culture—the internal reality of behavior—are now inseparable. Their integration is essential for authenticity, differentiation, and long-term resilience. At their intersection lies the potential for uncommon growth—growth that is faster, more sustainable, and deeply human. Organizations that recognize this interdependence are better positioned to deliver consistent experiences, inspire trust, and achieve sustainable success.

Defining the Relationship

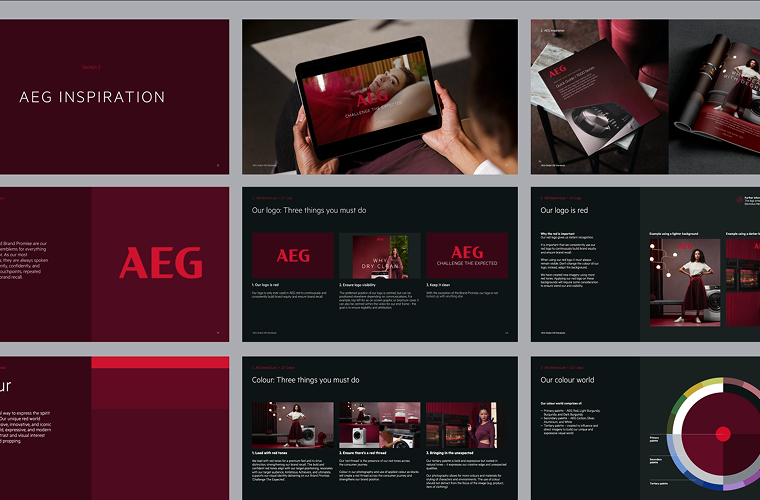

A brand is more than a logo or tagline; it is the collective perception people hold of an organization, shaped by every interaction and experience. Culture refers to the shared values, beliefs, and behaviors that guide how employees work and interact. Brand answers, ‘Who are we to the world?’ while culture answers, ‘Who are we to each other?’ When they reinforce one another, employees live the values and customers experience them authentically. This alignment strengthens trust, attracts talent, and enhances reputation.

Example: Salesforce promises to be a trusted digital transformation partner. Its *Ohana* culture emphasizes trust, customer success, innovation, and equality—making the brand’s promise credible in every client interaction. This alignment not only fuels customer loyalty but also attracts talent seeking purpose-driven work.

Executing the Promise

Brand shows up in expression—design, messaging, voice. Culture shows up in behaviors—leadership choices, systems, daily interactions. When they diverge, credibility is lost, and the promise risks becoming superficial. Employees are often the first to sense these gaps; if they do not feel empowered to deliver, customers inevitably see through the disconnect. When alignment is achieved, however, it becomes a multiplier of uncommon growth, ensuring that ambition translates into performance and perception into loyalty.

Example: Siemens’ brand, *Ingenuity for life*, is supported by cultural initiatives that encourage collaboration, agility, and digital skills. This ensures employees can deliver credibly on its transformation narrative and maintain trust with both industrial clients and public stakeholders.

Culture as Competitive Advantage

Organizations today are not only evaluated on what they sell, but on how they operate and what they stand for. As markets shift toward values, experiences, and purpose, culture becomes a decisive differentiator. A hospitality brand, for example, can only deliver on its promise of warmth and empathy if those values are embedded in the internal environment. Employees who experience alignment between external promise and internal culture are better positioned to embody and extend those qualities to customers, strengthening both reputation and performance.

Example: Patagonia empowers employees to live its sustainability values through activism and company-supported programs. This alignment strengthens its purpose-led brand and builds loyalty among customers. Employees are not just ambassadors of the brand—they are co-creators of its meaning.

Evolving Together

Brand without culture is superficial. Culture without brand risks insularity. The strongest organizations treat the two as a feedback loop: culture informs the brand promise, and the brand promise reinforces cultural behaviors. This dynamic relationship must evolve as markets, technologies, and stakeholder expectations shift. Leaders who intentionally nurture this cycle ensure their organizations remain relevant and credible over time, even as conditions change.

Example: American Express promises premium service and trust. Its culture empowers employees to solve problems with a customer-first mindset. This loop sustains both loyalty and pride, allowing the company to consistently deliver on its positioning as a relationship-driven brand.

The Leadership Imperative

Alignment is not accidental—it requires leadership. Executives must act as the bridge between brand and culture, embedding values into governance, incentives, communications, and daily practice. Leaders are uniquely positioned to signal priorities and reinforce behaviors that make the brand real. When leadership embodies the connection, alignment cascades across teams and functions, creating momentum that drives both internal engagement and external performance. In many organizations, this leadership accountability has become the single most important factor in sustaining relevance and unlocking value.

Example: At Target, CEO Brian Cornell linked the brand promise of affordability with style to cultural renewal. He raised wages, invested in engagement, and embedded inclusivity—ensuring the external promise of helping families discover everyday joy was fully supported internally.

FINAL THOUGHTS

The organizations that win tomorrow will treat brand and culture not as parallel efforts but as one unified system. This alignment provides clarity of purpose, cohesion of action, and consistency of experience. At its best, it is the catalyst for uncommon growth—growth that is resilient, differentiated, and deeply trusted by all stakeholders. Together, brand and culture create the foundation for trust, differentiation, and enduring success—an essential advantage in a world where credibility is the ultimate currency.