The 2021 Prophet Brand Relevance Index® (BRI), recently launched and as we sift through the top performers, it’s clear to us that relationship-driven marketing strategies are powering the strongest companies.

Now in its sixth iteration, the BRI is based on four core principles of relentless relevance, measuring whether a brand is customer-obsessed, ruthlessly pragmatic, pervasively innovative and distinctively inspired. But a year of pandemic, social unrest, political upheaval and economic uncertainty is causing some brands to soar and pushing others entirely out of the conversation.

To understand how consumers measure the most relevant brands, we closely study the specific relevance dimensions in the top-ranked brands. We see three clear consumer marketing trends executives can tap into, regardless of industry and category.

The “right now” consumer need: Lean into how you can help, then execute relationship-driven marketing

Organizations that are confident enough to jump into a pressing need, solve it fast, and communicate effectively are among the year’s biggest gainers. Top brands demonstrated an embracement of the relationship-driven marketing mindset.

Johns Hopkins Medicine, No. 8, vaults into the Index for the first time, primarily due to the creation of its widely-used COVID-19 dashboard. Launched in late January last year, when many people felt they weren’t getting the answers they needed from the government or media sources, it quickly became not just a trusted data provider, but also a source of daily contact.

As Black Lives Matter protests swept the world, many companies did little more than slapping a black box into their Instagram accounts. But Xbox, No. 19 and one of the Index’s biggest gainers, responded differently. It tightened rules around hate speech, sparking meaningful conversations among gamers worldwide.

And to pass the time during the pandemic, millions of consumers turn to KitchenAid, No. 3. It increases adoration by leveraging its Yummly food platform, with 26 million users and more than 2 million recipes, it elevates fans from mere cooks to domestic divas.

“Right now” thinking also includes launching new products and services that speak directly to the moment. These new offers go well beyond features and functionality. They address important emotive needs–and consumers reward that thoughtfulness. Chick-fil-A, No.39, is the only restaurant in the top 50. That’s a credit to compassionate introductions like family meal kits, well outside its quick-serve wheelhouse.

Content marketing: Keep your audiences engaged with core products & services

The most relevant brands are content juggernauts, using new agile processes, techniques and channels to create sprawling ecosystems. And these ever-growing hubs reach well beyond their central customer base, finding unexpected avenues to acquire new and potential customers. In doing so, they don’t just remain top of mind: They become constant companions.

“The best marketing and sales organizations have been focusing on speed skills for years now, reengineering both organization and culture to add more flexibility.”

Peloton, No. 2, isn’t only relevant because of its bikes, treadmills and the fact that – as gyms and fitness studios closed – people needed digital sweat sessions more than ever before. Its incredible rise started long before the pandemic and is directly linked to a smart, relationship-driven and agile content strategy, providing a constant stream of workouts, a “virtuous cycle,” built into a system that allows them to constantly retouch the content. With its commitment to supporting content throughout its lifecycle, its classes by now welcome millions of at-home meditators, yogis and weightlifters over and over again.

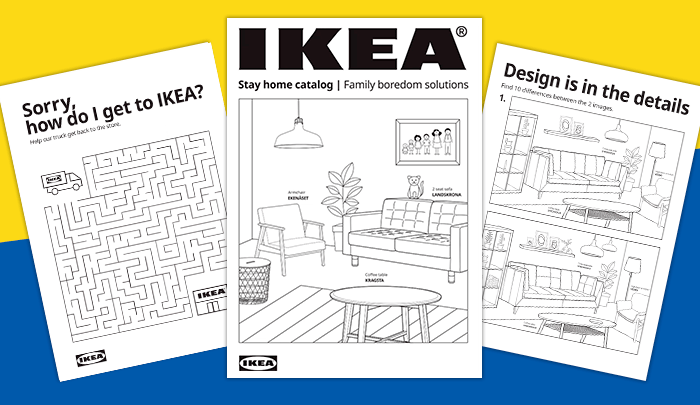

Coming in at No. 5 LEGO recognized the pandemic’s effect on adult’s normal social and leisure activities, the creative outlet brand for kids introduced several grown-up art projects, including Andy Warhol style murals and the Botanical Collection… LEGO also leads by creating an entire digital content ecosystem around its products, from movies to minimovie series and microsites designed around LEGO storylines, innovative tools and processes to drive customer-generated content.

Message molding: Shape the conversation

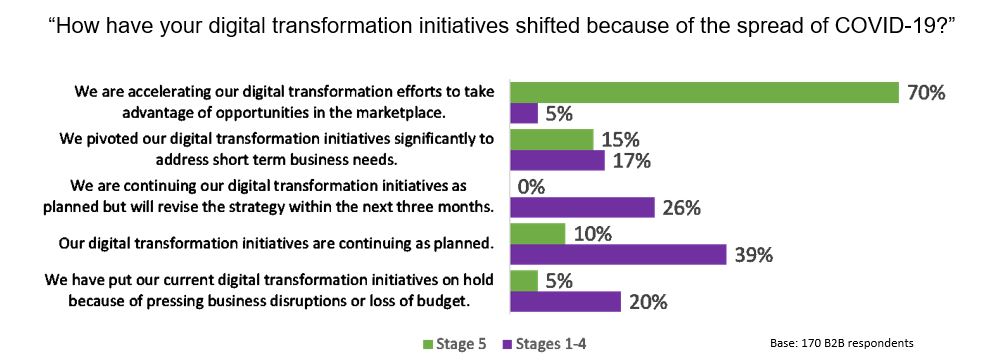

The best marketing and sales organizations have been focusing on speed skills for years now, reengineering both organization and culture to add more flexibility.

These brands entered 2020 more agile than their competitors. But as events unfolded, it became clear just how essential this is. Our BRI is filled with examples of brands as nimble as ninjas, continually updating their messages and flexing their agile muscles.

Take Sephora. It rises 36 places to land at No. 33, an astonishing gain in a year where industrywide, makeup sales plunged 19 percent. Few nights out give consumers little reason to buy cosmetics, however, Sephora keeps gaining relevance, with messages focusing on beauty as a key part of self-care.

Amazon, No. 10, offers a different example. Its sales are skyrocketing, reflecting the surge in e-commerce. Yet it recognizes that many consumers question its lack of transparency around employee health. So, it’s running an extensive ad campaign explaining the many ways it is working to protect its front-line workers.