BLOG

3 Ways to Build Brand Relevance for Financial Services in 2020

Consistency, trust and emotional engagement can help companies impress and inspire their audiences.

Financial services companies have a relevance problem. Consumers – who will often be heard enthusiastically talking about everything from kitchen appliances to Band-Aids – yawn when they think about banks and insurance companies. Our research shows that consumers are more interested in just about every other category compared to the companies that are working to safeguard their financial stability and helping them plan for the future.

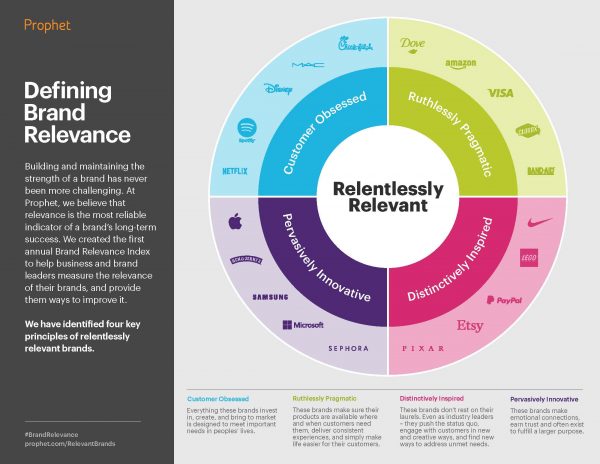

It doesn’t have to be that way. At Prophet, we’ve spent years exploring the science of relevance, surveying 51,000 global consumers each year about thousands of brands. Our Brand Relevance Index quantifies how indispensable a given brand is to people in their daily lives. And we do it by ranking each brand against four key drivers of relevance:

- Customer obsessed: brands that know you better than you know yourself

- Distinctively inspired: brands that win your head and heart, often with a strong purpose

- Pervasively innovative: brands that find new and inventive ways to engage

- Ruthlessly pragmatic: brands that are right where you need them, making your life easier

We’ve found that relevance drives business impact – the most relevant brands outperformed the S&P 500 average revenue growth by 230% over the past ten years. We help clients use these insights to be more relevant in their customers’ lives by engaging with them in ways that build more excitement, trust and loyalty, whilst also building their bottom line.

Why Do Financial Brands Disappoint?

Companies like Apple, Amazon and Netflix consistently dominate our ranking, generating almost endless brand love. But financial services brands have consistently underperformed compared to other industries. Only one brand – Intuit TurboTax (No. 37) – breaks into the top 40 in our U.S. index. And just four more – PayPal (No. 43), Vanguard (No. 44), USAA (No. 46) and Zelle (No. 48) – manage to sneak into the top 50. While consumers do find financial-data companies moderately relevant to their daily lives, property and casualty insurance, life insurance and retail banking occupy the three lowest rungs of all 27 categories we measure.

Familiarity isn’t the problem. These are brands with high levels of awareness. And, in the case of retail banking, consumers constantly interact with these companies, from paying their mortgage to buying their morning latte. But, there are three primary reasons people feel so detached from these brands:

They’re Inconsistent

Except for financial data services, where 77% of consumers say companies deliver a consistent experience, people say financial services companies are all over the map in terms of their performance. For instance, only 29% say retail banking and investments are consistent, 23% for P&C insurers and just 15% for life insurance companies.

They’re Not Trustworthy

The days when people found financial service companies inherently honest and reliable are long gone. Amid daily headlines about privacy scandals, security hacks and breaches, consumers rank trust as the second-most important attribute for financial data services. Assessed simply on trust, some soar – PayPal, TurboTax, Vanguard and Fidelity are seen as the most trustworthy of all brands. But others fare terribly, with Wells Fargo, Liberty Mutual and PNC among the lowest-performing brands.

Indispensable? Yes. Inspirational? No

Consumers certainly understand that financial services are essential. When we rank brands by “Meets an important need in my life,” for example, TurboTax comes in third, and Visa, Vanguard and Fidelity are in the top 20. But, all stumble on measures of inspiration and emotional engagement, and our data shows that those misses can create a real risk of customer turnover.

3 Ways to Increase Brand Relevance

In our work with financial services companies, we’re helping clients focus on the levers most likely to boost relevance. Take a look at three ways we’re guiding brands to develop richer, deeper and more meaningful relationships with their customers:

1. Impact When It Counts

Brands like Zelle and PayPal have made consumers’ lives infinitely easier by being there for them at every single payment moment that matters. Both brands score more than 95% for “makes my life easier.” Many financial services companies are failing to address the pain points in the customer experience journey. Increasing focus should be given to simplifying processes and exchanges and identifying opportunities to create those all-important memorable and meaningful moments for customers that are tailored personally to their needs and to their lives.

2. Tap Into the Power of Purpose

We help cultures and organizations evolve to find a higher order purpose, that is unique to their company and genuinely resonates with customers and employees. As consumers, particularly younger ones, flock to brands that support their commitment to sustainability and fairness, financial services companies must stand for something more than profits.

Among insurers, for example, brands like USAA and Aflac have built strong relationships by making consumers feel that they can connect on more than just a functional level. USAA, for example, with its deep commitment to the military community, earns an enviable 99% on “has a set of beliefs and values that align with my own” – the third-highest of all companies we track in the U.S. And Aflac and Vanguard aren’t far behind. By comparison, only 1% say that is true of MasterCard.

3. Cultivate Emotional Engagement

With the right experiences and innovations, financial service brands can radically improve their emotional connections with consumers. We might even argue that they have an inherent advantage here, given how often customers interact with their brands.

“We help clients use these insights to be more relevant in their customers’ lives by engaging with them in ways that build more excitement, trust and loyalty, whilst also building their bottom line.”

FINAL THOUGHTS

We’re realists. Will paying a quarterly car-insurance bill ever make someone as happy as seeing a Pixar movie, shopping on Etsy or going to Disneyworld? No. But companies as varied as AARP, Lemonade and John Hancock have made sure that each touchpoint makes consumers “feel emotionally engaged”. By comparison, only 21% can say that of TurboTax, and just 13% about Visa.

There are many roads to relevance. Let us help you find the ones that will resonate most with your audience, and translate that into meaningful revenue growth, talk to our expert consultant team today.