BLOG

Top Digital Transformation Challenges in Financial Services

Collaboration and personalization can help legacy firms outpace fintech upstarts.

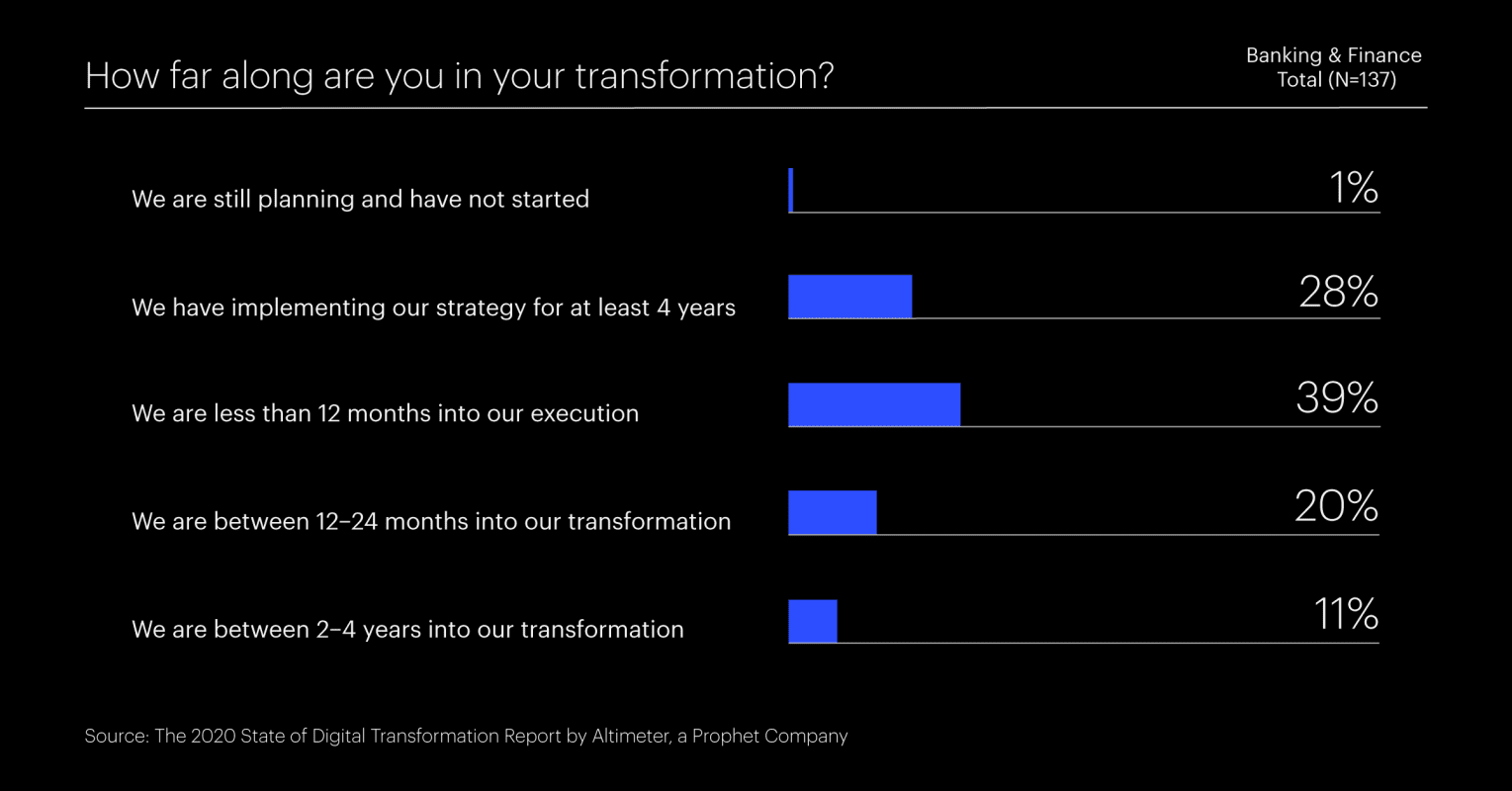

When it comes to digital engagement, some of the biggest names in financial services still can’t seem to move fast enough.

While upstart brands like Cash App, Alipay, Monzo and Robinhood rack up millions of new customers, many legacy financial services companies are plodding along. There is progress, but many digital transformation initiatives are underperforming.

“Many digital transformation initiatives are underperforming.”

There’s no question that companies like Capital One and USAA are breaking new ground. But despite increased spending, many others are lagging behind – both in how they think about digital transformation strategy and how they execute it.

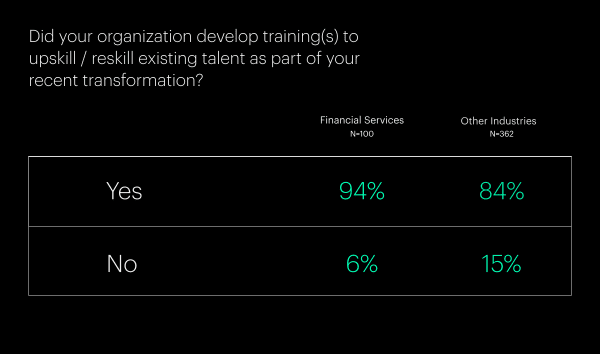

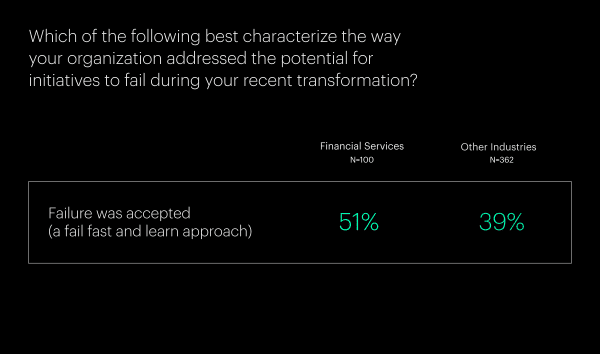

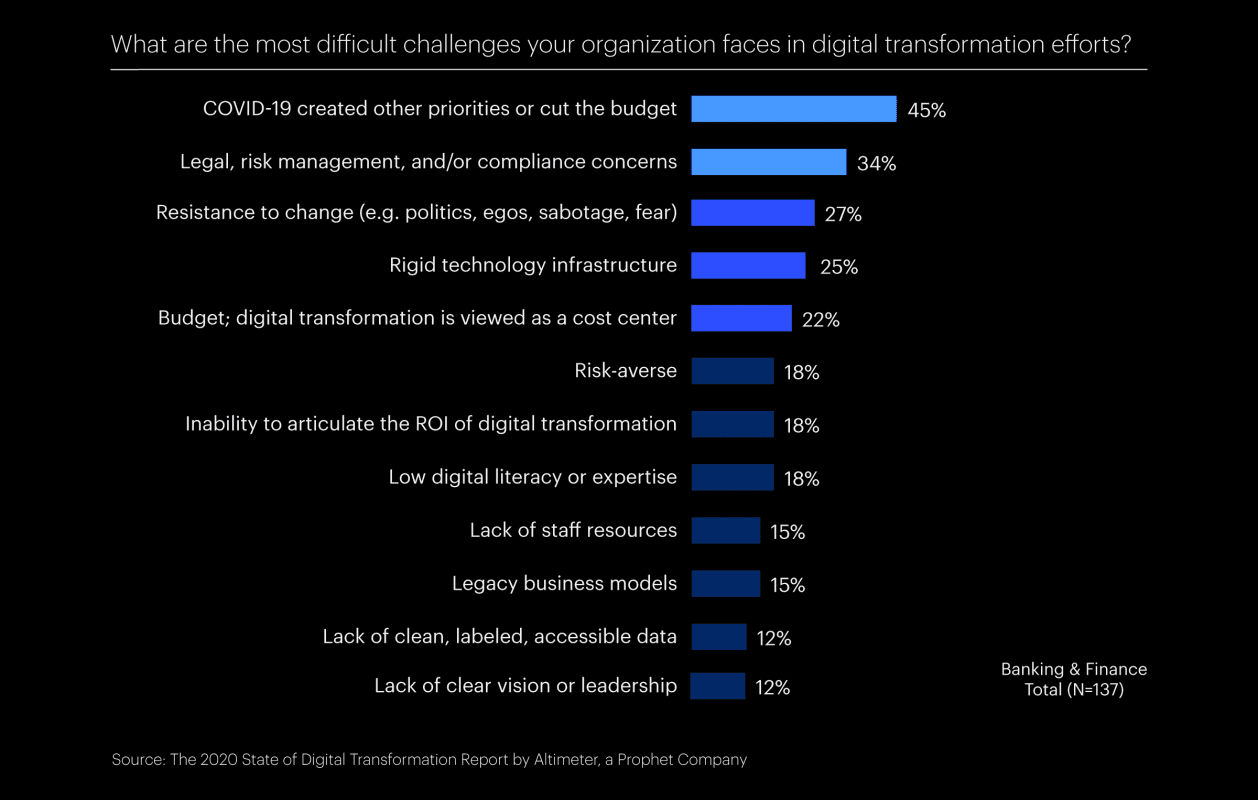

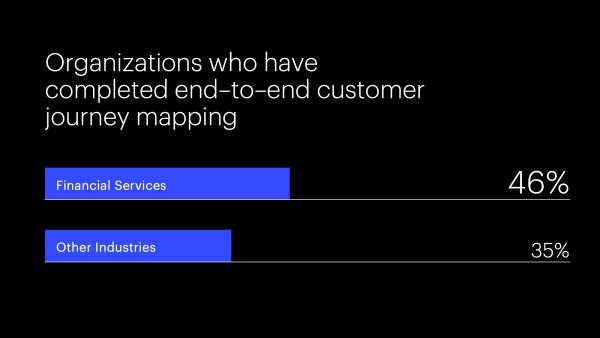

At Prophet, we wanted a better sense of what’s holding these companies back and how financial services compared to other industries. Our digital transformation research dug into the details of transformation, surveying 476 digital executives worldwide, including 150 who work in financial services.

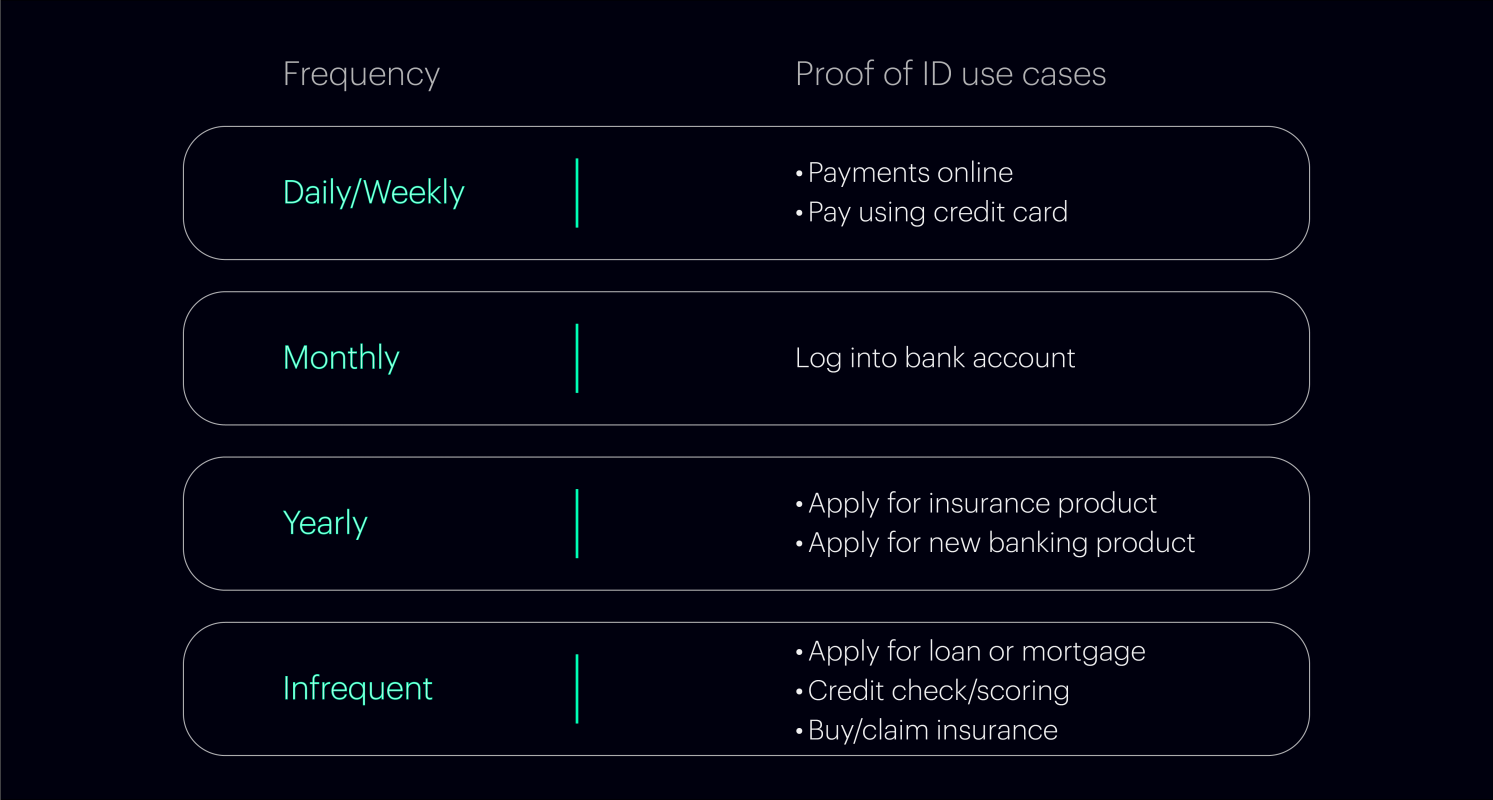

One major finding? If efforts are uneven, it’s not necessarily because they’re underfunded. Digital marketing budgets in financial services now comprise between 50 and 70 percent of marketing resources. That’s up from a range of 20 to 40 percent in 2018. And while COVID-19 is causing some firms to cut spending as part of overall cost reductions, most execs recognize the need for more digital marketing in an increasingly virtual world.

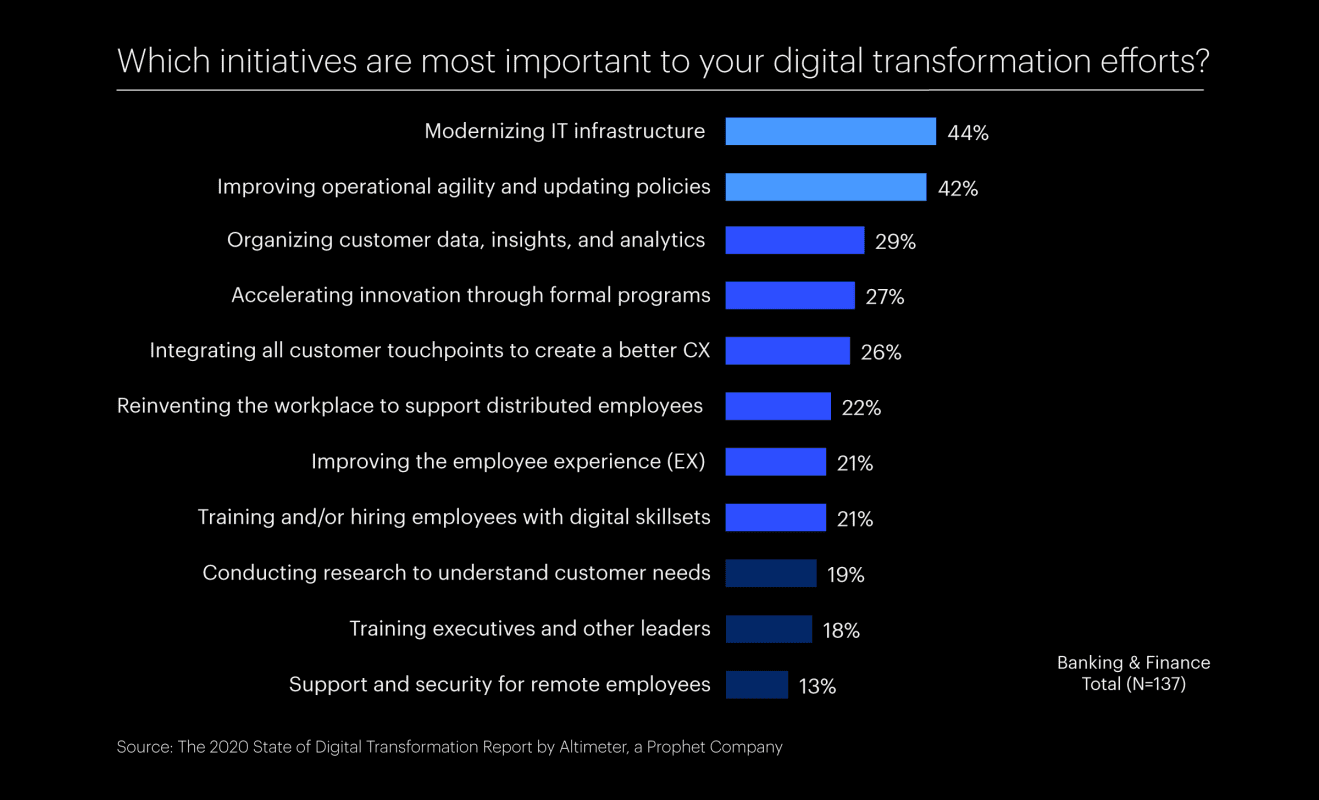

The 2020 State of Digital Transformation research uncovers three key digital transformation challenges found in the financial services industry:

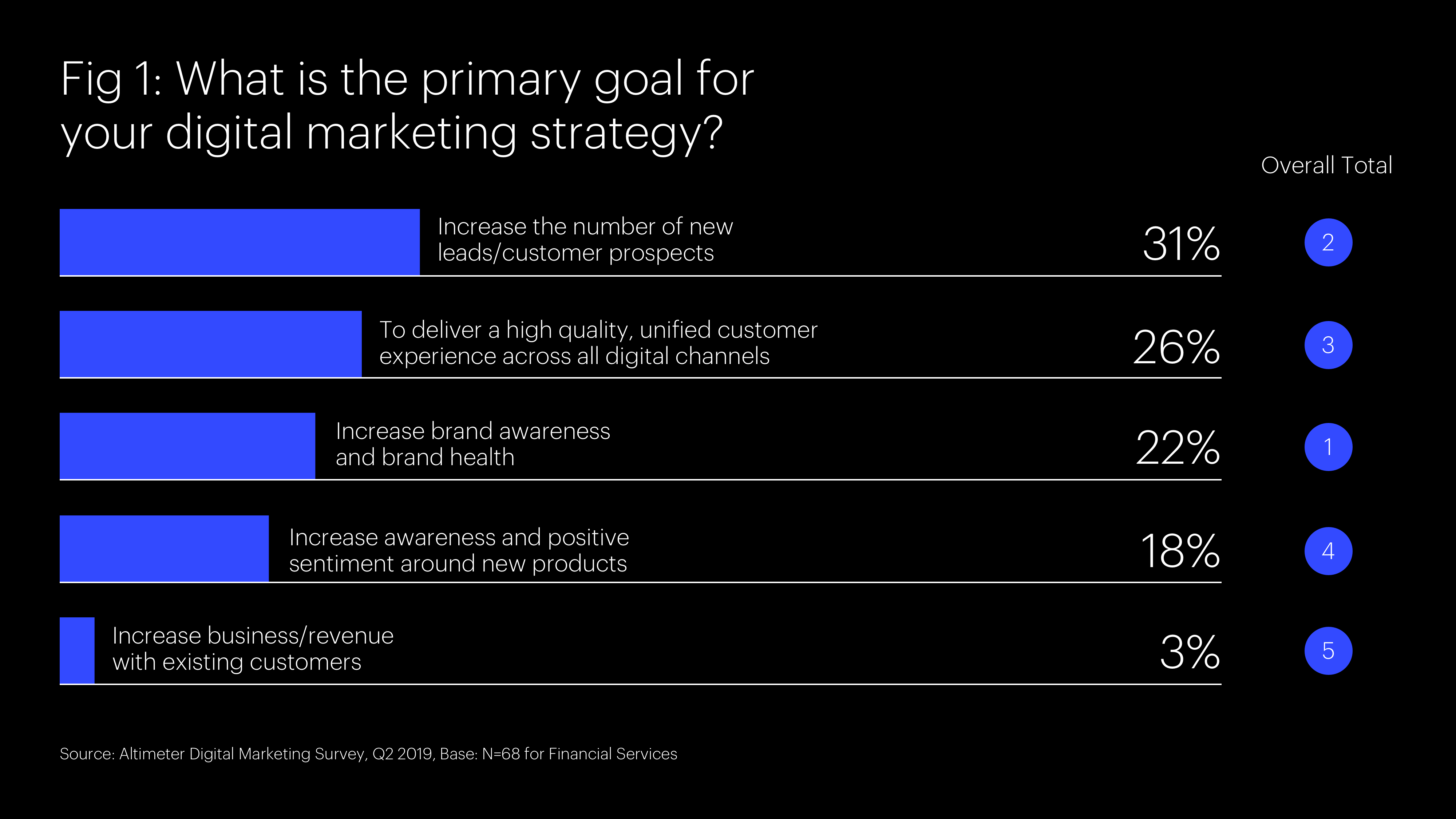

1. Missing Objectives

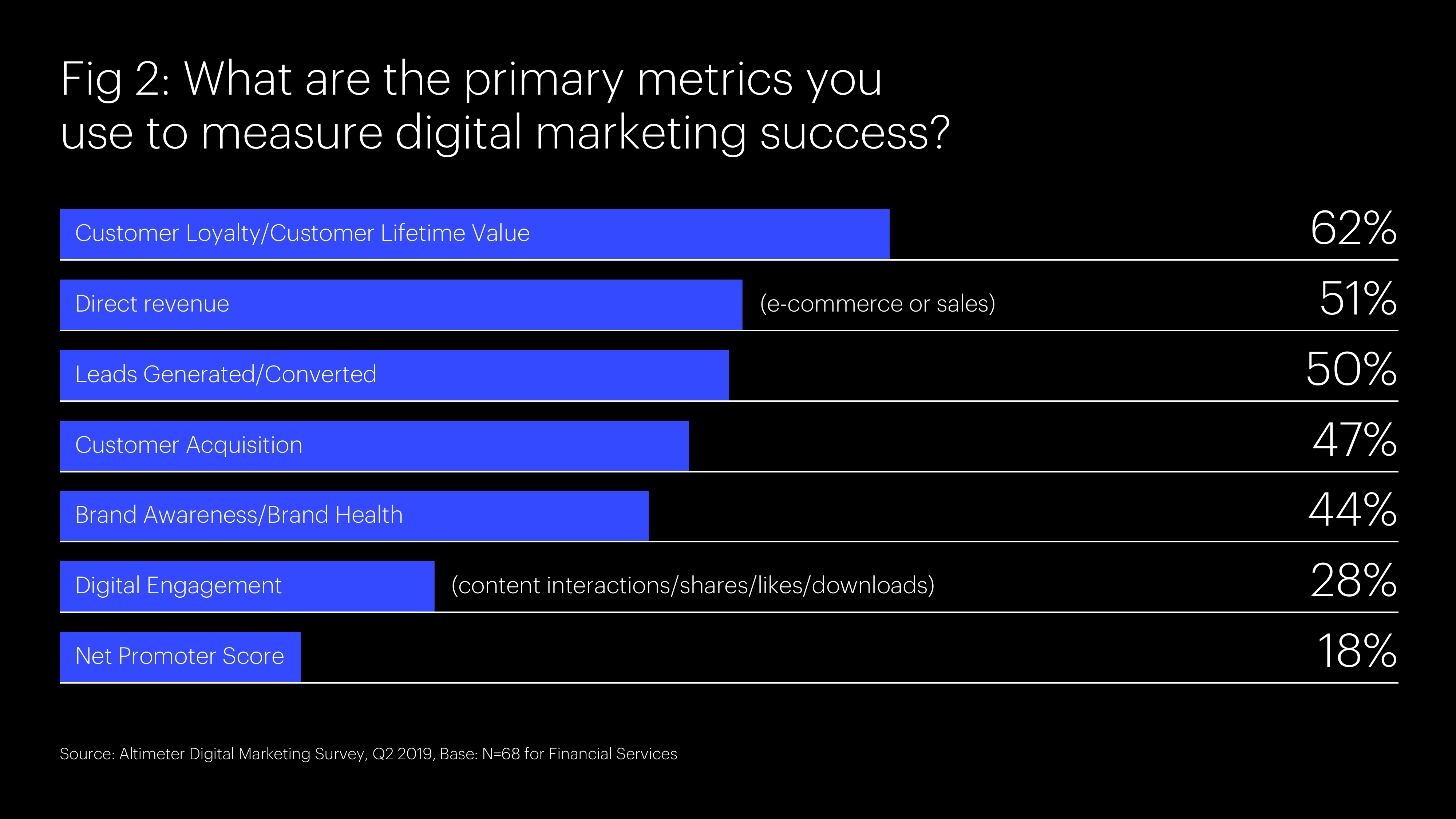

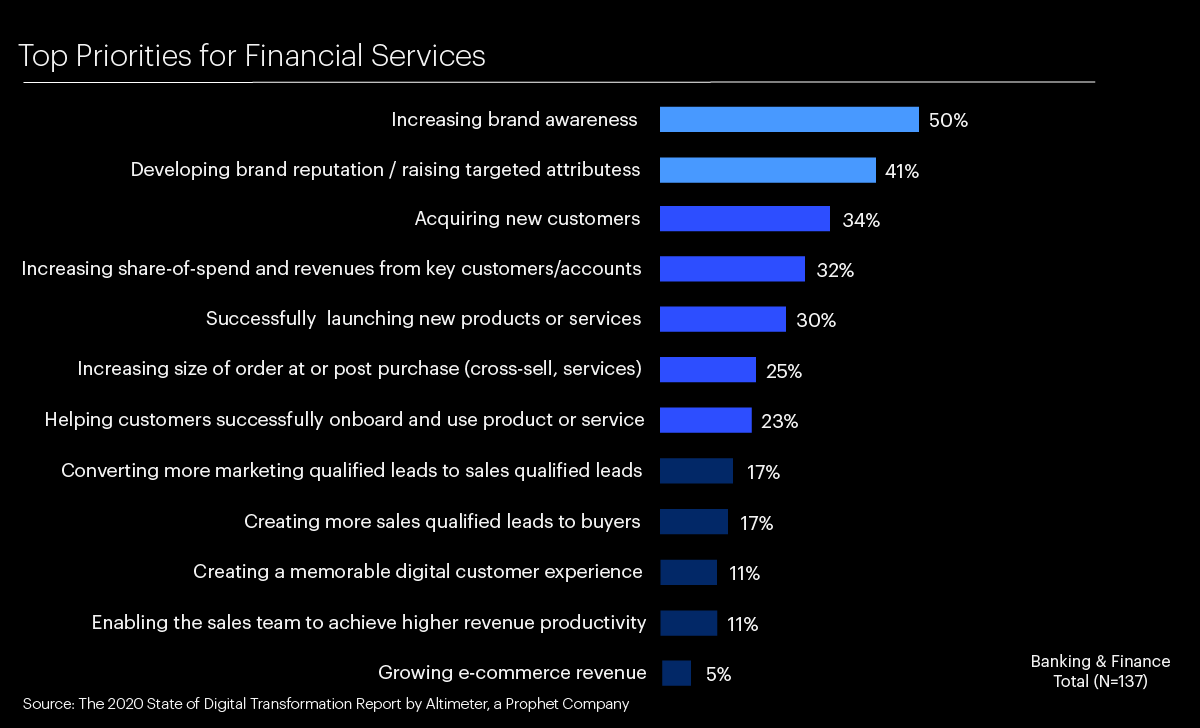

Financial services firms still focus on traditional marketing objectives, like increasing brand awareness or developing brand reputation. Those goals matter. But it often means that they pay less attention to higher-impact digital targets, such as adding customers (which ranks as the first priority across all industries) and increasing revenues from key customers and accounts (ranks as the second priority). And they lag even further behind financial disruptors, which use marketing to generate leads.

2. Gaps in Personalization

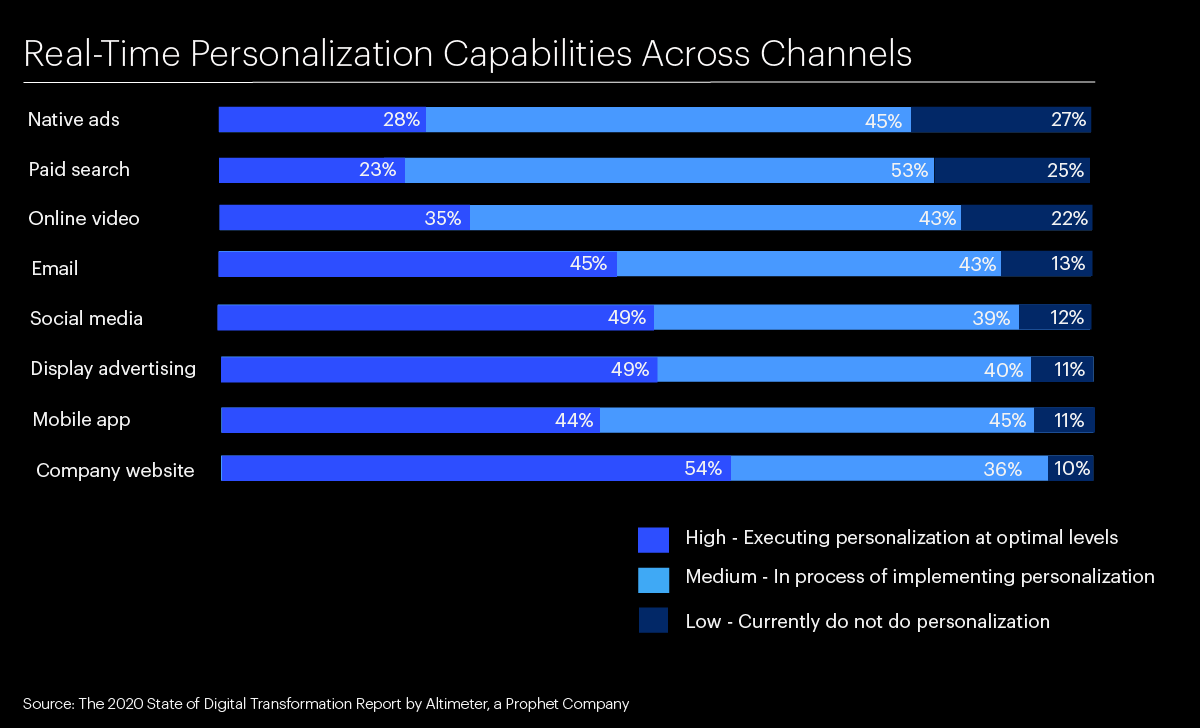

While almost half of the financial services respondents rank personalization as a top priority, the industry is lagging in delivering those experiences, something that is considered table stakes in other industries. While dynamic personalization is a key characteristic of digitally mature enterprises, less than half of financial services believe they can personalize at optimal levels. And 16 percent of firms don’t personalize at all across channels. There’s also a worrisome level of false confidence. Almost half do not use marketing technology (martech) platforms to scale personalization efforts, despite the general consensus that martech is needed to deliver optimal levels of personalization.

3. Lagging in Collaboration

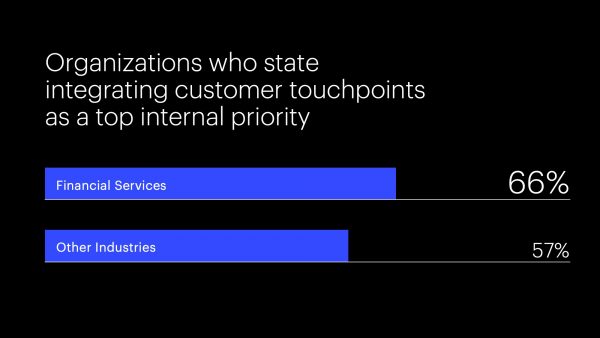

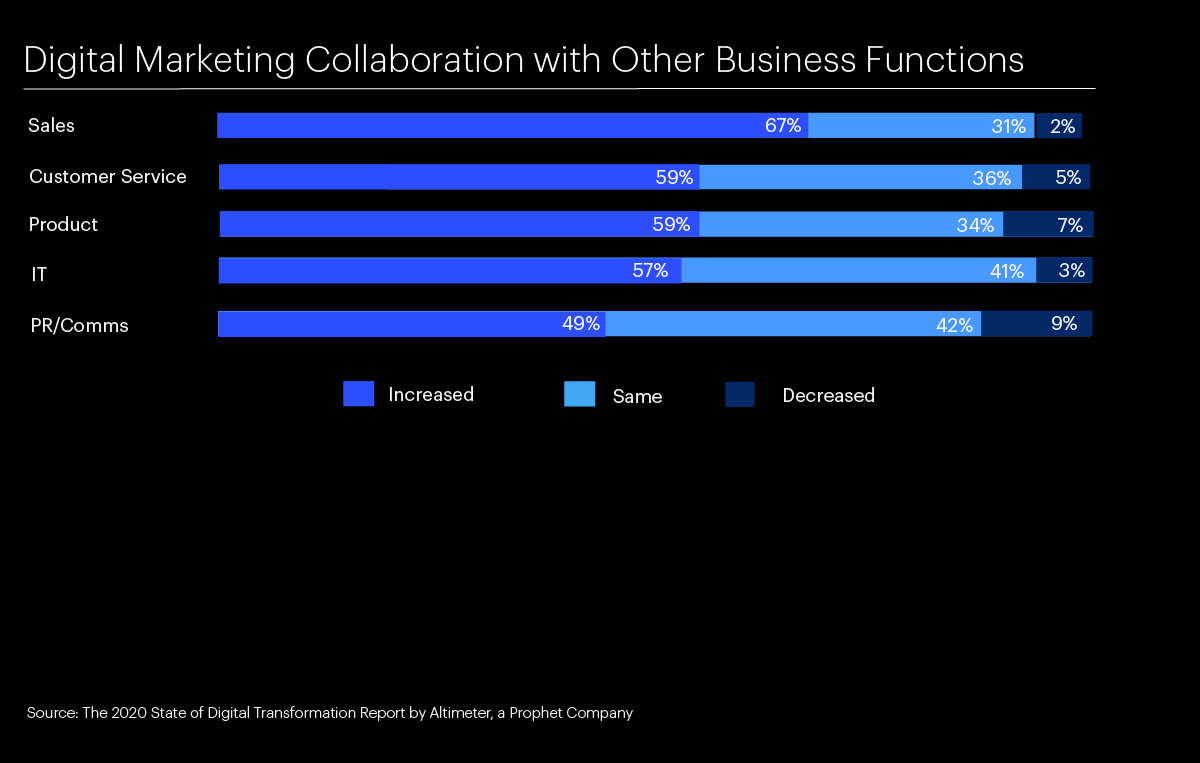

Certainly, marketing teams at financial services companies understand that it’s essential to work closely with other business functions, especially sales. They know they need to continue to prioritize this cross-functional collaboration. In the context of demand generation and B2B2C marketing, this increased collaboration is crucial to ensuring a lead doesn’t get dropped and is ultimately converted. About three-quarters of financial services respondents plan to invest in cross-functional efforts going forward, indicating that plans are taking this collaboration need into account. While the mindset and plans for the future are good news, it’s still worth noting these efforts lag in practice. About two-thirds of respondents increased collaboration with sales over the last two years, compared with 75 percent of respondents in all industries. Almost a third of respondents actually cut back on collaboration.

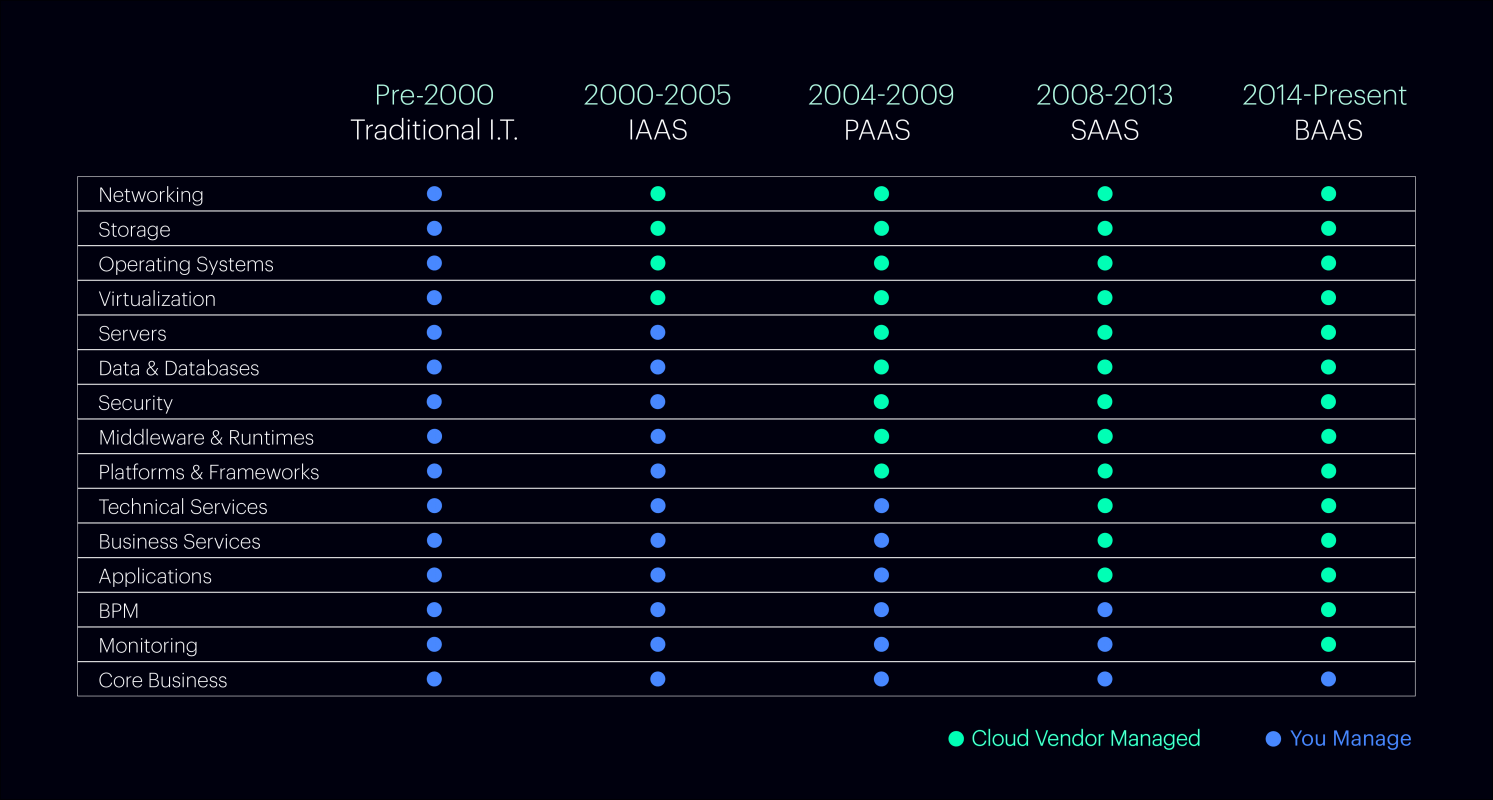

The Underlying Challenges: Integration Struggles and Skill Shortages

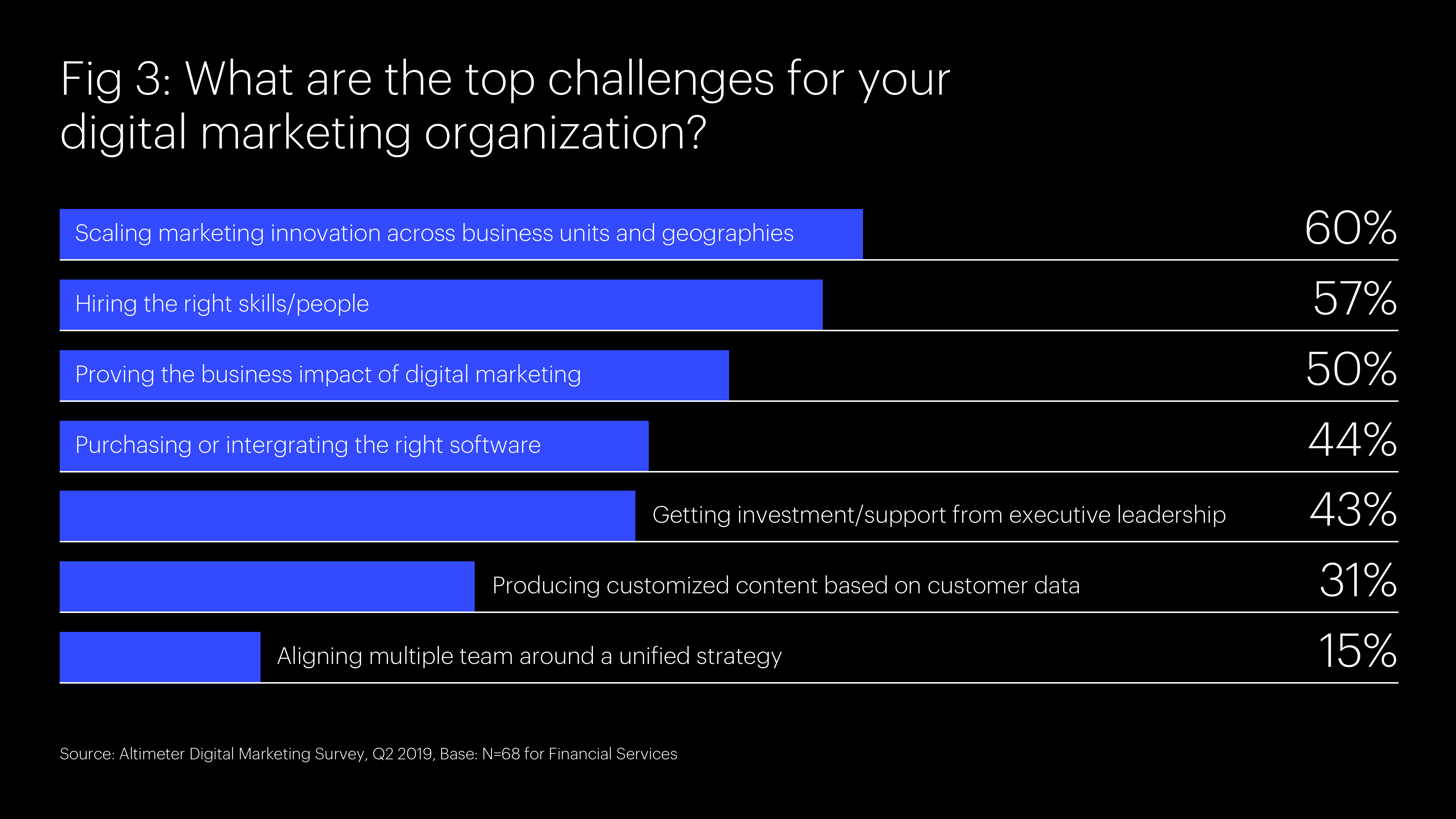

There are two underlying areas to address that are critical to solving the above problems. First, financial services still struggle to integrate the technology they already have. Almost half of all financial services firms say they lack the budget and integration mechanisms for their technology, specifically the martech stack.

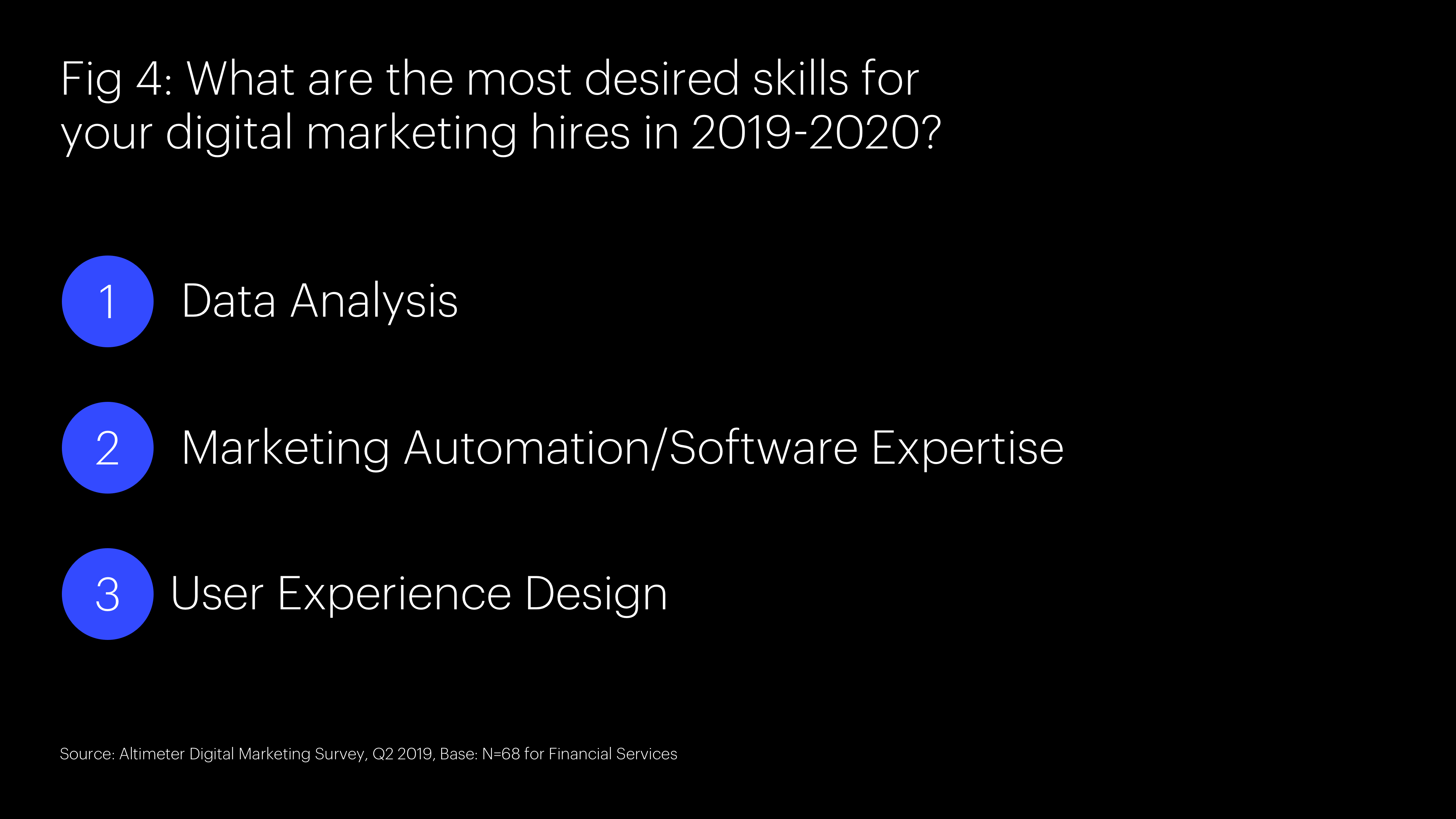

And second, finding and hiring the right talent is still difficult. More technical skills are central to digital marketing talent needs, especially data analysis, marketing automation and software expertise.

FINAL THOUGHTS

As financial services firms look to improve and accelerate their transformation efforts, here are five ways to increase the pace of change:

- Use digital marketing to drive growth through generating leads and acquiring more customers, rather than simply building brand awareness.

Integrate a marketing technology stack that enables personalization.

Prioritize cross-functional collaboration between marketing and other departments, especially sales, for the greatest business impact.

Focus on integrating martech into the existing technology stack by ensuring adequate budget and resourcing is in place.

Develop recruiting strategies and revamped employee value propositions to fill talent gaps, especially in the ability to make existing martech solutions work better.

Is your business equipped to compete? Our expert Financial Services practice can help to devise a clear strategy to move your business forward in 2021 and beyond, get in touch today.