BLOG

Five Healthcare Shifts: Pandemic Pressure Creates New Possibilities

As patients speed-race through their own digital epiphanies, they’re demanding consumer-centricity in healthcare.

Healthcare organizations have long acknowledged they’re digital slowpokes. Businesses aren’t likely to disrupt themselves until they have to. However, COVID-19 forced–and perhaps freed–them to accelerate change in ways they couldn’t have imagined.

And while much of the progress providers, payers and life-science companies have made in the pandemic’s early months is surprising, it also underscores problems we’ve been talking about for some time. With patients speed-racing through their own digital epiphanies, they’re demanding consumer-centricity in healthcare. And the more digital experiences become normalized–buying groceries online, taking app-based Spanish lessons or dressing up for Zoom weddings–the more they expect from healthcare.

“With patients speed-racing through their own digital epiphanies, they’re demanding consumer-centricity in healthcare.”

In 2019, Scott Davis and I published a book, Making the Healthcare Shift: The Transformation to Consumer-Centricity, and we think it’s more relevant than ever. Based on more than 70 in-depth interviews with healthcare executives at companies like Pfizer, Novartis and Eli Lilly & Company, Mayo Clinic, Anthem and Intermountain Healthcare, followed by a survey of 240 global healthcare leaders, it outlines the five most critical changes organizations need to make to keep pace with demanding consumers.

There are many ways the pandemic has accelerated the shift towards consumer-centricity. Virtual care is perhaps the most obvious example.

“We’ve done 400,000 virtual visits so far in 2020, up from approximately 20,000 visits last fiscal year,” says Nick Patel, M.D., Chief Digital Officer at Prisma Health, in a recent interview with Prophet. “I didn’t expect to hit numbers like that for many years.”

For Prisma, a nonprofit healthcare system in South Carolina, COVID-19 continues to accelerate digital transformation in dizzying ways. Patel says his teams are learning to use data differently, linking virtual visits to chatbot follow-ups, sending devices to patients’ homes and expanding in-office virtual health solutions. “I don’t think I ever thought I’d see that level of adoption in my lifetime.”

All five of these healthcare shifts are intensifying and organizations need to pay attention or risk business disruption from unexpected places:

First shift: From tactical fixes to a holistic experience strategy

Pre-COVID, healthcare organizations often started enhancing consumer experiences with one-off initiatives. But the pandemic has made it clear that experience strategy can’t just be based on location–the idea that treating people well only when they are on the premises falls apart in a virtual universe. Of course, it’s critical to make the physical experiences meaningful. People expect safe and respectful treatment. They want to see COVID-era innovations, like streamlined check-ins, minimal wait times and practical text messaging.

But attention to experience must extend far beyond the four walls of the provider’s office. It must encompass virtual-health offerings, accessible patient portals and mobile experiences that are at least as good as other non-healthcare brands.

Our book highlights how Geisinger Healthcare, Piedmont Healthcare and Intermountain Healthcare are making this shift by breaking their business models, writing manifestos and increasing investments.

Second shift: From fragmented care to connected ecosystems

Payers, providers, device and pharma companies had been making limited progress on their ability to collaborate, awkwardly stitching together fragments of the healthcare journey. But COVID’s destruction of the healthcare economy underscores just how inefficient their operating models are. U.S. hospital systems are drowning in losses of $323 billion this year. And provider compensation is under pressure, with 97 percent of medical practices reporting negative financial impact.

My prediction? I believe these losses will continue, illuminating the absurdity of healthcare operating models, with overcrowded hospitals losing more money than ever. And that will make organizations fight harder to transform toward value-based reimbursement. This healthcare trend will become obvious to all as organizations continue to strike partnerships across the ecosystem that enable the success of these new reimbursement models. And from the current chaos, they will find their way to a business strategy that is more stable and orients financial incentives with the wellbeing of patients.

In our book, we illustrate how companies like MyFitnessPal, Zocdoc and Eli Lilly & Company are developing wrap-around solutions that embrace consumers all the time, not just when they’re in a provider’s office.

Third shift: From population-centric to person-centered

After years of talking about how data would lead to more personalized healthcare, the pandemic is finally bringing that data-driven healthcare trend and promise to life. With the increase in digital interactions, providers are getting closer to integrating personal preferences with primary research, behavioral data and clinical insights, producing a more holistic view of patients.

Increasingly, consumers are driving this healthcare shift. They recognize that it’s smart to give up their data–as long as they get something meaningful in return. An example we love: The Multiple Myeloma Research Foundation, devoted to finding a cure for cancer of the blood, partnered with Prophet to launch the MMRF “CureCloud.” Based on free at-home genomic testing, the digital dashboard displays personalized treatment options for myeloma patients, democratizing access to clinical insights. Customer research uncovered that the most important benefits to patients in a partner like MMRF is personalized communication and recommendations in exchange for their data–including insights they can bring to their providers for smarter care.

Our book looks at how companies like Medtronic Care Management Services are learning from personalization wizards like Spotify and Netflix, making sure people get content and messages just right for their condition.

Fourth Shift: From incremental improvements to pervasive innovation

We think the most beneficial byproduct of COVID-19 is that it has shown healthcare organizations how fast they can move and that they don’t need to settle for small tests and micro-progress.

As an example, Advocate Healthcare, a large Midwestern health system, used the approach of starting with a minimally viable product, or MVP, when introducing the radical idea of same-day scheduling. With the goal of improving both access and flexibility, it started with just one area–mammograms. “Call Today, Be Seen Today,” tripled the number of appointments made and increased awareness of its breast cancer efforts. More importantly, it showed the entire organization that this shift could be made and that it was well worth the effort.

A team from the Carle Illinois College of Medicine, a partnership between the University of Illinois and Carle Health, developed a prototype for a new ventilator in days, as did the Massachusetts Institute of Technology. Gilead got FDA approval for Remdesivir in weeks. And accelerated trials have us holding out hope for effective vaccination in 18 months, not the usual four years.

One pharma exec put it to us this way: “If Dyson can pivot from making vacuum cleaners to ventilators in 10 days, we should be able to get an email campaign approved in less than 80.”

Business models are also flexing. Sales reps have lost physical access to providers, so the digital marketing healthcare trend is intensifying. Companies are stepping up their e-commerce offers, from medical devices to pharmaceuticals, targeting healthcare clients and consumers.

Our book examines the ways executives from companies like Teva Pharmaceuticals, Tonic Health and Boehringer Ingelheim are accelerating the corporate approach to innovation.

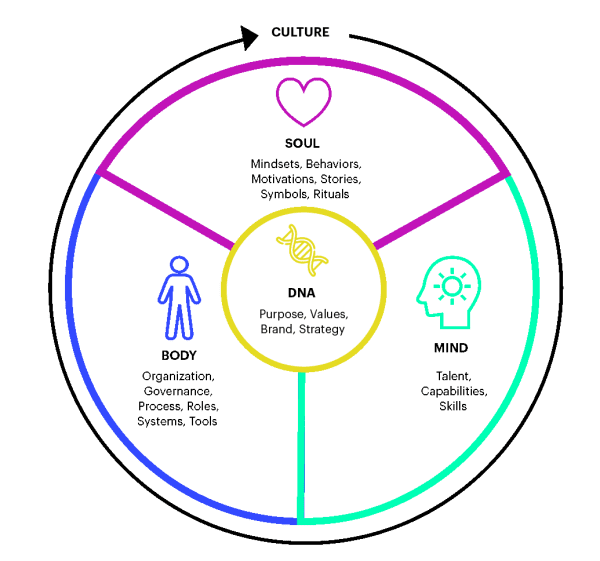

Fifth shift: From insights as a department to a culture of consumer obsession

With the world changing rapidly, tracking consumer preferences and expectations matters more than it did six months ago. Organizations are beginning to explore ways to build what we call Insights Operating System (IOS), to help organizations get to the right insights, drive the right decisions at the right time and win with the right consumers.

As enterprises pursue this new consumer-centricity healthcare trend, they have to stop relying on occasional research reports to shape their path forward. They must recognize that there are signposts to the future in every patient and customer interaction.

Our book looks at the ways companies like Novant Health and Amgen are striving to become constant listeners, so they can respond faster to emerging needs.

FINAL THOUGHTS

Healthcare organizations should all be shifting toward this consumer-centricity. If you’d like help staying up to date with healthcare trends, building an Insights Operating System, elevating the innovation process or improving personalization efforts, contact Scott or Jeff today.