Blockchains and the tokenization of assets allow marketers to unlock new forms of community development and value exchange with consumers. In this article, we outline how marketers will need to re-evaluate brand building in Web3 based on nine observations. To do this, we’re drawing perspectives from the recent launch of Moonbirds, a non-fungible token (NFT) developed by PROOF Holdings.

While many likely don’t know Moonbirds as a brand, we’re using it as a case because we admire the brand-building mechanics this project is demonstrating within new Web3 possibilities. Moonbirds is an Ethereum-based collection of 10,000 unique Profile Pictures (PFPs). Each token doubles as membership of sorts, granting owners access to an exclusive Discord (a server where owners chat and hang out) along with unique in-real-life (IRL) events and digital membership benefits. The brand mirrors and further builds on proven tactics leveraged by NFTs like Bored Ape Yacht Club (BAYC) from Yuga Labs.

For context, Moonbirds launched on April 16, 2022, raising $66 Million in a matter of hours. In just 48 hours from its launch, it became the top traded NFT by volume, created more than $210 million in additional secondary sales and had a floor price of $62,000 (the cheapest bird available for purchase). Additionally, Moonbirds is already pushing into popular culture. Celebrities like Jimmy Fallon have even changed their verified NFT profile pictures on Twitter.

Though it’s the early days of brand building in Web3 with Budweiser, Taco Bell, Campbell’s, Adidas, Twitter, Gucci and countless others having launched NFTs, we can see why many of these big brands have been comparatively less successful in adopting some of the new rules of brand building.

Let’s use Moonbirds to illustrate nine brand-building lessons for Web3.

People are at the Heart of a Brand’s Reason to Believe (RTB)

Moonbirds was built out of PROOF Holdings which had already successfully launched PROOF Collective, a proven NFT community. The belief in the team – Kevin Rose (Revision3, Digg), Ryan Carson (founder of Treehouse), and Justin Mezzell, an experienced artist, illustrator, and product designer – is the core of why there is a demand for this project. At Prophet, we talk a lot about human-centered transformation. So, much of a brand’s success in Web3 will be built around having strong people committed to building the brand in addition to driving demand, engagement and the overall experience.

Leaders that Drive Brand Content Development and Community Engagement

Content and community for Moonbirds have been largely driven by its founders. Kevin is an avid podcaster (Proof, Modern Finance) and Ryan is one of the more prolific people on Discord and Twitter. Ahead of the launch, they’ve been on a roadshow translating the brand’s vision and building demand and understanding of the project. Web3 brand building will require a greater emphasis on leaders’ ability to be the marketers building demand for their brands vs. the legacy approach of the most junior or outsourced teams managing customer relationships, content creation and communications.

Evolved Monetization Strategies Pushing Perpetual Brand Building

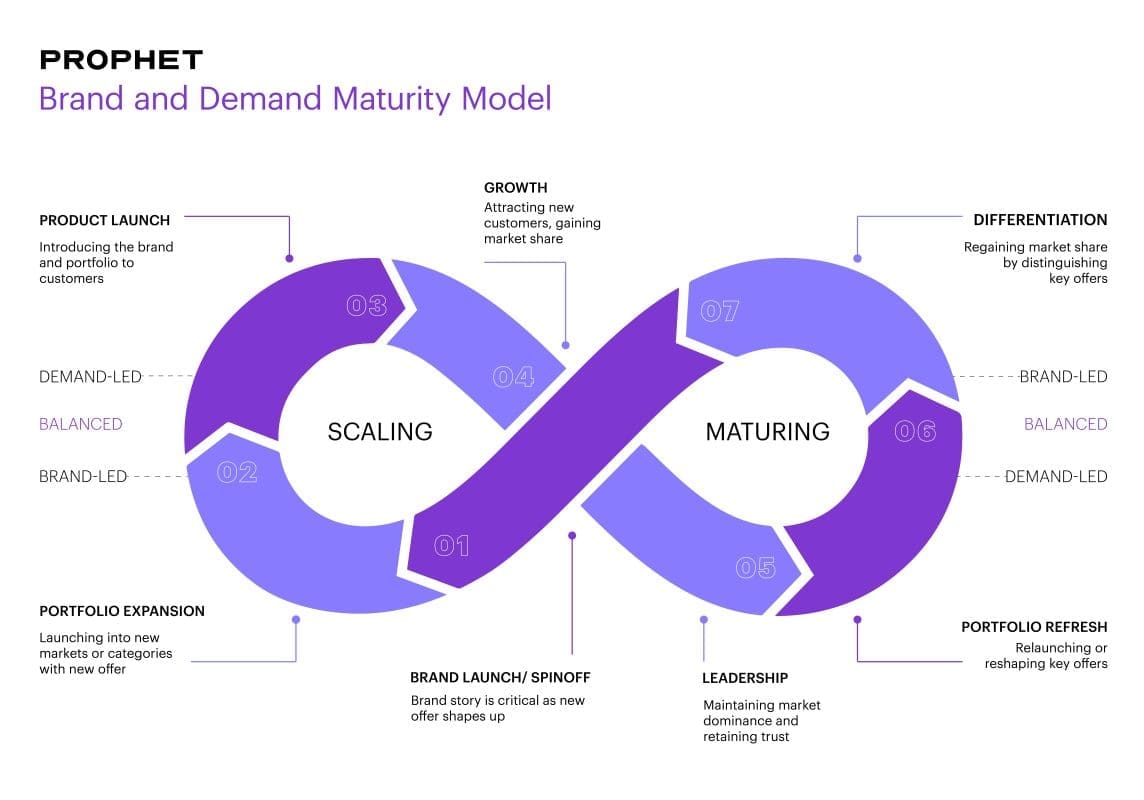

Moonbirds is committed to reinvesting all raised funds in delivering for the community. This means that token holders are delivered value ahead of the brand capturing it. Over time, Moonbirds allows PROOF Holdings to build valuable infrastructure like new technologies, a strong team, community and much more which can be monetized in the future. Tokenizing these assets broadly contradicts the “create demand and sell” model of traditional commerce in favor of developing an always-on, brand-demand flywheel – one that creates ongoing value for a community of token holders. Web3 will push business model design to create sustained demand that engages communities gated by tokens. This will allow brands to collect perpetual royalties in a brand-demand flywheel.

Influencers Become a Rising Channel for Brand Building

Moonbirds unlocked a host of ecosystem partners beyond PROOF’s 1,000-member community to grow the brand. This includes some of the most influential bloggers, vloggers, podcasters, social posters and other Key Opinion Leaders (KOLs) in the space. As media is becoming increasingly decentralized, brands will need to partner and engage KOLs to play a very important role through longer-form audio, video and visual content.

Community Shares in Brand Marketing and Brand IP Ownership

Moonbirds (and other Web3 projects) violate a long-held brand-building belief on Intellectual Property (IP) rights being sacred to the brand. Every owl in the Moonbirds collection is owned by the community member that buys it. These owners have unique rights that unlock new possibilities; from making it their digital identity to designing clothing, to creating a gin brand featuring their unique owl. Some creators go as far as putting brand-built IP for owners into full creative commons (CC0).

“Prophet sees the next wave of brand building in Web3 where marketers rethink IP ownership and its value exchange with their communities.”

While this won’t happen in all industries, Prophet sees the next wave of brand building in Web3 where marketers rethink IP ownership and its value exchange with their communities. These communities will play a powerful role in the brand’s marketing army, sharing in the monetary reward, and helping the brand unlock uncommon growth.

Disruptive Design and Brand Visual Identity Systems

On the surface, Moonbirds design is basic pixelated art. That choice was deliberate so the art itself can live fully on the blockchain. What’s innovative about each bird is a design system that stretches the visual identity of the Moonbirds parent brand into unique community expressions of the owl for each community member. This flexible design system allows for many permutations. The process for building these also involves greater inclusion using a panel of diverse team members to inform design decisions. While not all Web3 brand building will result in individual NFTs, the design will stretch brands into more flexible, disruptive, inclusive, and adaptive visual systems that allow the brand to be more self-expressive, community-minded, and unique.

Continuous Brand Feedback Loops

Moonbirds leverages the 1,000 members of PROOF Holding’s PROOF Collective community to build the brand. These members became an idea engine and feedback loop that drove continued innovation for the Moonbirds launch. Decisions large and small were sourced to make the project more exciting and successful. We see a future of brand building in Web3 that doesn’t purely rely on smart product teams and strategists building brands, but also on open-sourced innovation and rapid, continuous feedback loops from brand communities that shape a number of brand-based decisions and capabilities.

Brand Roadmaps with an Ongoing Sequence of Innovative Activations

Moonbirds’ day-one announcement included a set of innovative experiences and activations they had planned for the communities. These included community meetups along with other IRL events, exclusive merchandise and access to a new version of the Metaverse called Project Highrise. Many legacy brands that have launched NFTs have fallen short by not thinking through such ongoing engagement and gamification or play with their communities. The best brand building in Web3 will solve the Brand-Demand equation by using a series of unique, ongoing and inspiring activations that will propel the brand and communities forward.

Moats Build From a Brand’s Unique Capabilities

Well-known personalities such as Alexis Ohanian (co-founder of Reddit), Tim Ferriss (best-selling author), Gary Vaynerchuk (entrepreneur), along with artists like Snowfro (also ArtBlocks founder), Xcopy, Larva Labs and Justin Aversano make up a partial list of the powerful network built by the founders of Moonbirds. This network allows the team to drive unique relationships and brand activations that can’t be achieved by others. One such signal for Moonbirds was the development of birds with unique space helmets, possibly getting special private tours of the SpaceX facility. We believe the future of brand building will rely on connecting tokenized goods like an NFT into gated access passes to both digital and physical products and experiences that only your brand can uniquely provide. These sources of value will be the true moats for brand building in Web3.