BLOG

Brand-Demand Love: Achieving Success and Satisfaction Together

Informed by the conversations we’ve had with CMOs across industries, this fourth installment from our Brand-Demand Love blog series explores how to integrate brand and demand marketing capabilities to win in a complex and dynamic landscape.

Even in the most complimentary relationships, financial matters are often a source of significant stress. For brand and demand-gen marketing teams to achieve the fully integrated and highly productive marriage we have been describing so far in our series, they must address the potential friction points involving budgeting, investment and performance measurement.

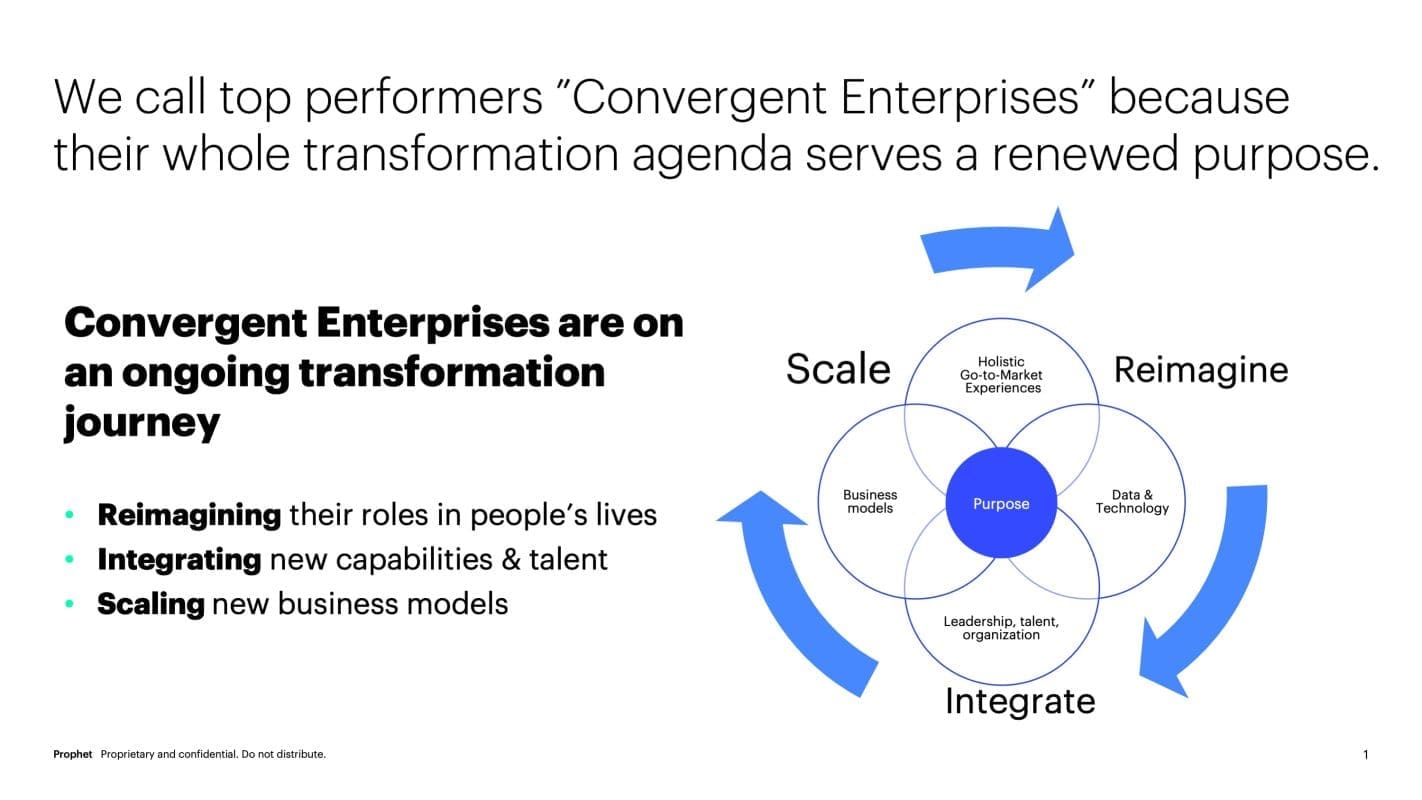

Agreeing on big-picture goals and investment priorities is the first step, followed by defining metrics to track performance. Receptivity to new approaches and flexibility to adjust as needs change is also key. As our research with marketing leaders has made clear, these issues are critical to unleashing uncommon growth through more effective and agile marketing capabilities across the customer lifecycle. Brand and demand teams ultimately share a pocketbook and prosper (or struggle) together.

Building Balanced Budgets and Allocating Investments Equitably

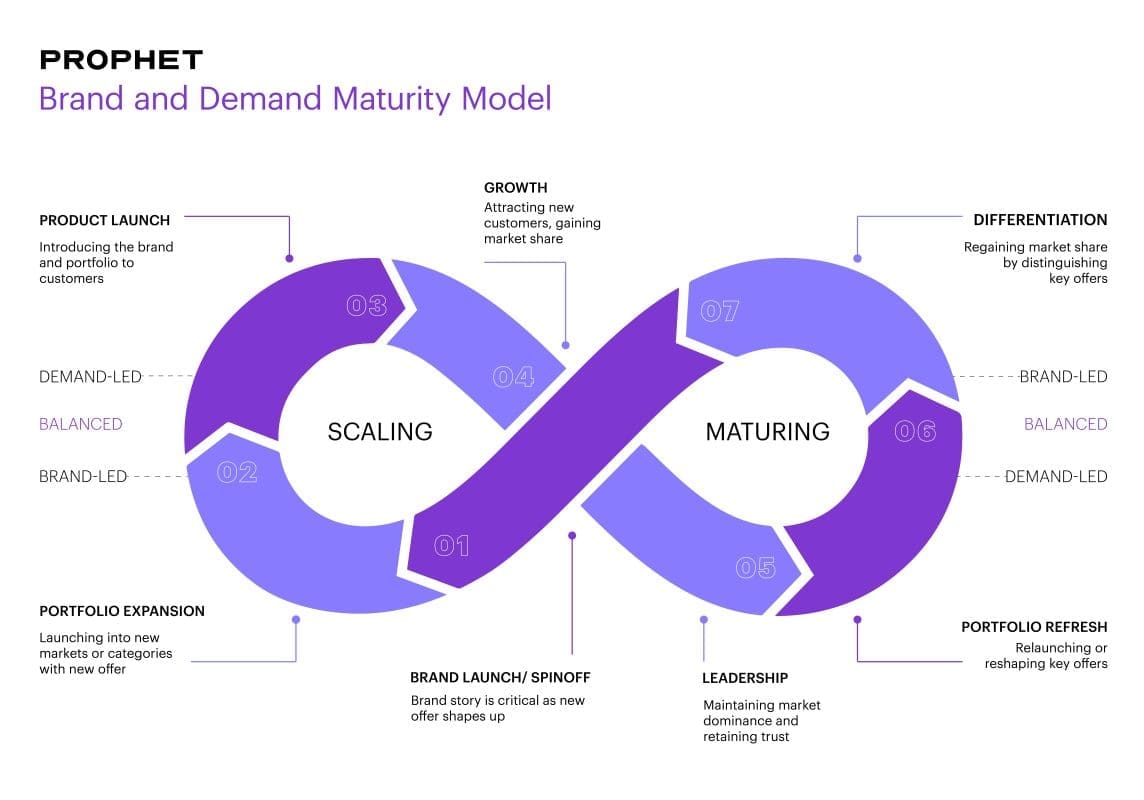

Many marketing leaders confess to being “obsessed” with finding the right investment mix. There is no shortage of conventional wisdom on how to allocate budgets and balance the investment mix. One common industry standard is the 60/40 rule, an investment recommendation proposed by Binet & Field’s 2013 study. The thesis: Allocating 60% to brand and 40% to demand yields the most effective balance of near-term acquisition and long-term performance.

Such rules of thumb seem to offer quick, evidence-based solutions. They also help defend brand investments, as many marketers want—and feel an urgent need to do—as e-commerce and digital have gained the upper hand in budget battles. However, this may not fully account for the variables of consumer behavior, broader market trends or the unique business contexts faced by different organizations. Modeling investment and measurement decisions against product lifecycle stages (e.g., product launches, mature offerings) can help marketers track progress toward specific goals.

Marissa Jarratt, chief marketing officer of retailer 7-Eleven, seeks to manage marketing investments like a portfolio. She balances higher-risk bets that offer big potential upside while also making safer plays that bring more predictable returns. “This is becoming more of a science,” said Jarratt. “We’ll take risks if we think it can drive a target downstream impact or outcome.” Such a balanced view of risks and rewards helps optimize the media mix across funnel stages and seasons.

Sudden market shifts put a premium on agile planning and budgeting. As Ashley Laporte, director at communications firm RALLY, told us:

“It’s not about finding the perfect proportions to balance brand and demand but finding a flexible framework that understands how everything connects.”

Mastering the Metrics and Digging into the Data

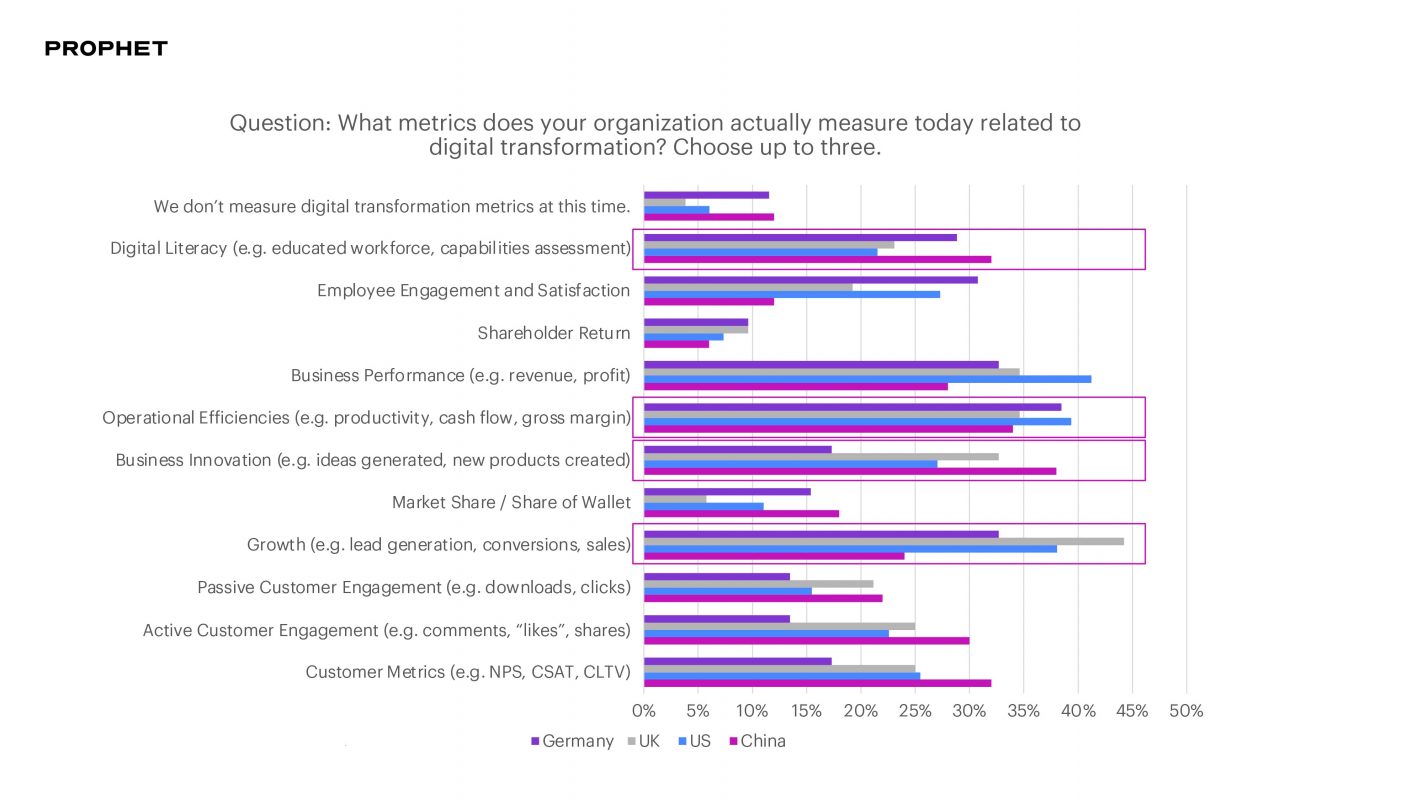

Performance metrics and attribution models continue to proliferate and evolve. There has been a pronounced shift away from brand surveys toward more agile measurement approaches. The leaders we interviewed expressed uncertainty about which metrics and KPIs are the most accurate and how to enable insight-based decision making.

Even firms that can transcend traditional difficulties in measuring brand performance face challenges. As Jennifer Warren, VP of global brand marketing at Indeed, told us, “Business and finance leaders want to know how a 2% lift in consideration translates to sales and revenue.” Such visibility is difficult to achieve, as is determining ROI on long-term, multi-year brand investments. Marketers are now being asked to develop KPIs to measure the effectiveness of purpose-driven strategies around sustainability, for example, or diversity and inclusion efforts.

Despite the challenges, being data-driven enables marketers to speak the language of the business. As Portia Mount, VP of marketing, commercial HVAC Americas at Trane Technologies, put it, “When financial leaders say, ‘let’s cut all the brand stuff and just do demand,’ our job as marketers is explaining what the impact will be if we shut something down.” Better performance data and stronger customer insights make for more productive conversations in explaining that choosing between brand and demand is not a zero-sum game.

“I don’t think that there is a silver bullet for measurement,” said Tyrell Schmidt, U.S. chief marketing officer, TD Bank. “We are really careful not to oversell performance, which is easy to do because it always drives the fastest results.”

A Shared View Builds a Shared Stake

Demand-gen leaders also face challenges in tracking performance as major tech companies like Google and Apple work to shift away from the use of cookies. Consumer goods firms struggle to get point-of-sale performance data from partners (e.g., e-commerce platforms and big-box retailers) and look to fill the gap with third-party data (e.g., credit card records, basket analysis). The bottom line: as much data as marketing leaders have, they are always looking to attain the most relevant data.

The lack of alignment between brand and demand adds another layer of complexity. Today’s “incongruent” KPIs result from a lack of incentives to “play nice,” according to one CMO. Ideally, rich data and aligned KPIs are used within an agile budgeting and forecasting model that incorporates multiple time horizons (annually, quarterly, daily) and enables opportunistic, real-time adjustment.

Integrated performance dashboards accessible by both brand and demand teams have enabled some firms to generate holistic insights by combining both short-term (e.g., search data) and long-term (e.g., Net Promoter Scores) metrics. These efforts reflect the need for marketers to experiment and innovate in their approach to financial matters. At Prophet, we recently partnered with a health services client to develop an integrated performance dashboard across brand, demand and customer experience teams, enabling a cross-functional understanding of campaign performance.

Summarizing the Questions You Need to Ask

Looking ahead, brand and demand teams must commit to open communication and engagement to achieve a strong and harmonious relationship. When it comes to financial matters, flexibility is also key. In order to pave the way to a household of shared finances, you need to ask the right questions and the following are worth considering in setting the right investment priorities and measuring the effectiveness of collective efforts:

- How much impact does brand marketing have on conversion?

- What impact do customer acquisition efforts have on brand perception?

- What’s the appropriate level of investment across brand and demand without sacrificing overall performance?

- What do specific metrics tell us? Which metrics are most meaningful and why?

- Are we measuring campaign performance holistically and across the funnel?

- Do we have a shared view of brand and demand and how they connect to the business in the short and long term?

- Are key measurements used to inform annual planning cycles?

The new research report, “Brand and Demand: A Love Story” is here! Learn how today’s Brand and Demand Generation leaders are bringing their functions together to drive greater impact.

Download today!

FINAL THOUGHTS

In our next post, we’ll look more closely at how to set up a “happy household” – that is, organizing teams and building the right capabilities so brand and demand can have a comfortable nest for their life together.

If you’d like to learn more about how your organization can overcome common challenges while integrating brand and demand marketing capabilities then get in touch here.