BLOG

A Formula for Kickstarting Behavioral Change and Creating Lasting Organizational Habits

Unlock the secrets to organizational change with Behavior Kickstarters. Learn how rapid experiments can catalyze cultural shifts and drive impactful transformation.

We’ve all been there. We start the year with the best of intentions, convinced that this time will be different. However, as life’s demands and our ingrained habits exert their influence, our resolve weakens. Despite multiple attempts to restart, within a few months, we find ourselves reverting to familiar patterns.

And it’s no different in the workplace – in fact it’s much harder. Beyond the demands of their job, employees must also fight against the pull of the organizational system. A pull that is so strong that eventually most change efforts are pulled back to ‘the way things are done around here’ and ultimately fail. An IMD global study of 500 executives found that only 50% of attempts to change employee behavior are successful. So, in short, change in a busy, complex organization is hard.

So how do you overcome these powerful forces to successfully change behavior and build new habits?

We believe that change happens through doing, not talking. Moving from words to action. You can’t just click your fingers and suddenly become more innovative, creative and collaborative. Humans don’t work like that. You must poke a stick into the organizational system and be intentional about creating change.

The first step in this magical process is to start really, really small.

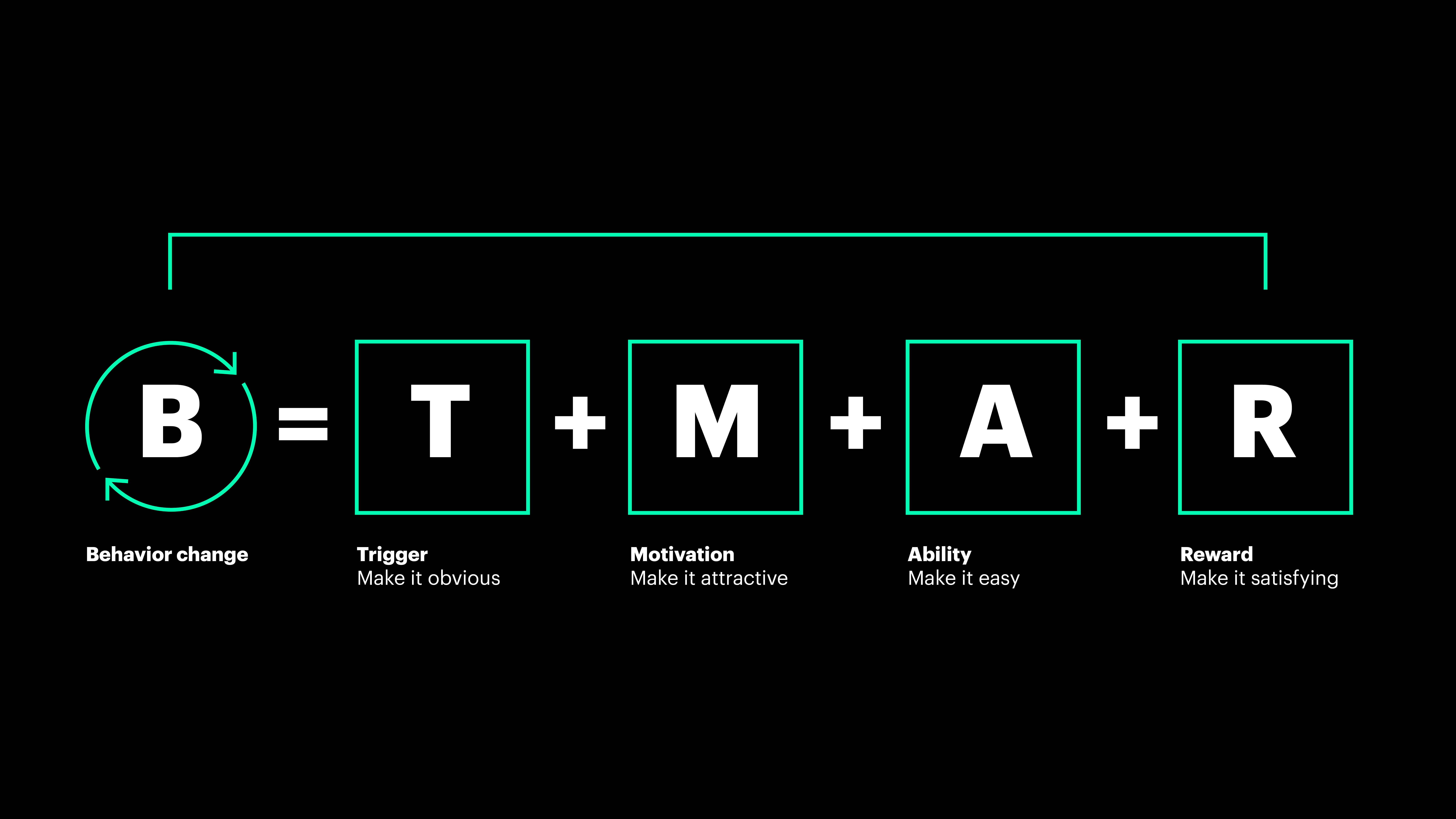

Behavior Kickstarters Formula

Behavior Kickstarters are rapid experiments designed to activate new behaviors and catalyze cultural shifts. Using a mix of behavioral science and experimentation techniques, our Behavior Kickstarters create a safe space for people to experiment with, and ultimately adopt new behaviors and build new habits. They establish the right conditions for people to try, fail, learn and grow.

While people are wonderfully different and unique, human behavior has followed consistent patterns since the dawn of time. Not only are we programmed to follow the path of least resistance, but our endorphins also encourage us to seek out the things that are satisfying. And we’re social beings, where the pull of the crowd can have a significant impact on our behavior and decisions. In other words, we only change our behavior when it is easy, feels good or when people we admire are doing it.

Our Behavior Kickstarter formula ensures the right ingredients are present for driving behavior change.

- Trigger – Make it obvious – Something that signals the need to start, gets your attention and shows the need to take action.

- Motivation – Make it attractive – Create an image in the mind of the user that makes them want to change.

- Ability – Make it easy – The easier a behavior is to do, the more likely it is to be done.

- Reward – Make it satisfying – If it feels good and has a satisfying ending, we’re more likely to repeat it in the future and form a habit.

While this formula helps us change in the immediate term, we also need to consider how we form new habits to embed the change. This is where experimentation comes in.

Unlocking Organizational Change Through Experimentation

Experimentation isn’t reserved for labs or innovation teams – it can be a powerful mechanism to drive sustained organizational change. Teams can use it to become more adaptive and to create a safe environment that allows people to try new behaviors and fail, and to apply learnings from their failures to change their approach and try again. Supporting this idea, our Catalysts research, How to Build an Adaptable Organization that Thrives During Uncertainty, identified ‘lowering the cost of experimentation’ as one of the five ways to build an adaptive organization.

The concept of experimentation is deeply ingrained in all of us. We just don’t apply it in an organizational context. Dave Snowden, founder and chief scientific officer of Cognitive Edge, sums it up beautifully, “The engine of all life on this planet has always changed in the same way. We try things, notice positive and negative patterns, amplify what’s working, minimize what isn’t.” Yet, despite being ingrained in us, the number of people who use experimentation is comparatively small. People seem to struggle to apply it to their day-to-day lives, meaning its potential is often left untapped. Michael Schrage, author of The Innovators Dilemma, uses a wonderful model for driving its adoption whilst solving real business challenges. Teams of five, each generate and test a solution to solve one of five challenges, over five weeks. The winning idea receives financial backing to be taken forward. Along with generating great ideas to solve real problems, this approach creates a fun, engaging way to understand the power of experimentation.

Like Schrage’s method, putting experimentation into practice with our Behavior Kickstarters is simple. We recommend a timeframe (~2-4 weeks) and at the end of that period, we reflect on how it went, what went well and whether we achieved the desired outcomes – using this data to define what could we do differently next time. Then, if needed, we make changes to the Kickstarter and go again!

A Kickstarter can take many forms. Ideally, it will be designed so it fits seamlessly into the employee’s day-to-day world – as part of existing meetings or a regular routine, like a morning cup of coffee, for example.

- Trying to make your teams feel recognized? Thank You Thursday: Every Thursday, send a short thank you note, acknowledging the efforts of an individual or team for that week (for something big or small).

- Trying to increase psychological safety? Poke Holes in This: Before sharing an idea, ask the team ‘Please poke holes in this’, opening yourself up to helpful feedback and encouraging vulnerability.

- Trying to increase collaboration? Don’t Rush Into it: At the start of your weekly meeting, spend five minutes with everyone sharing what they did over the weekend, building relationships outside of just work commitments.

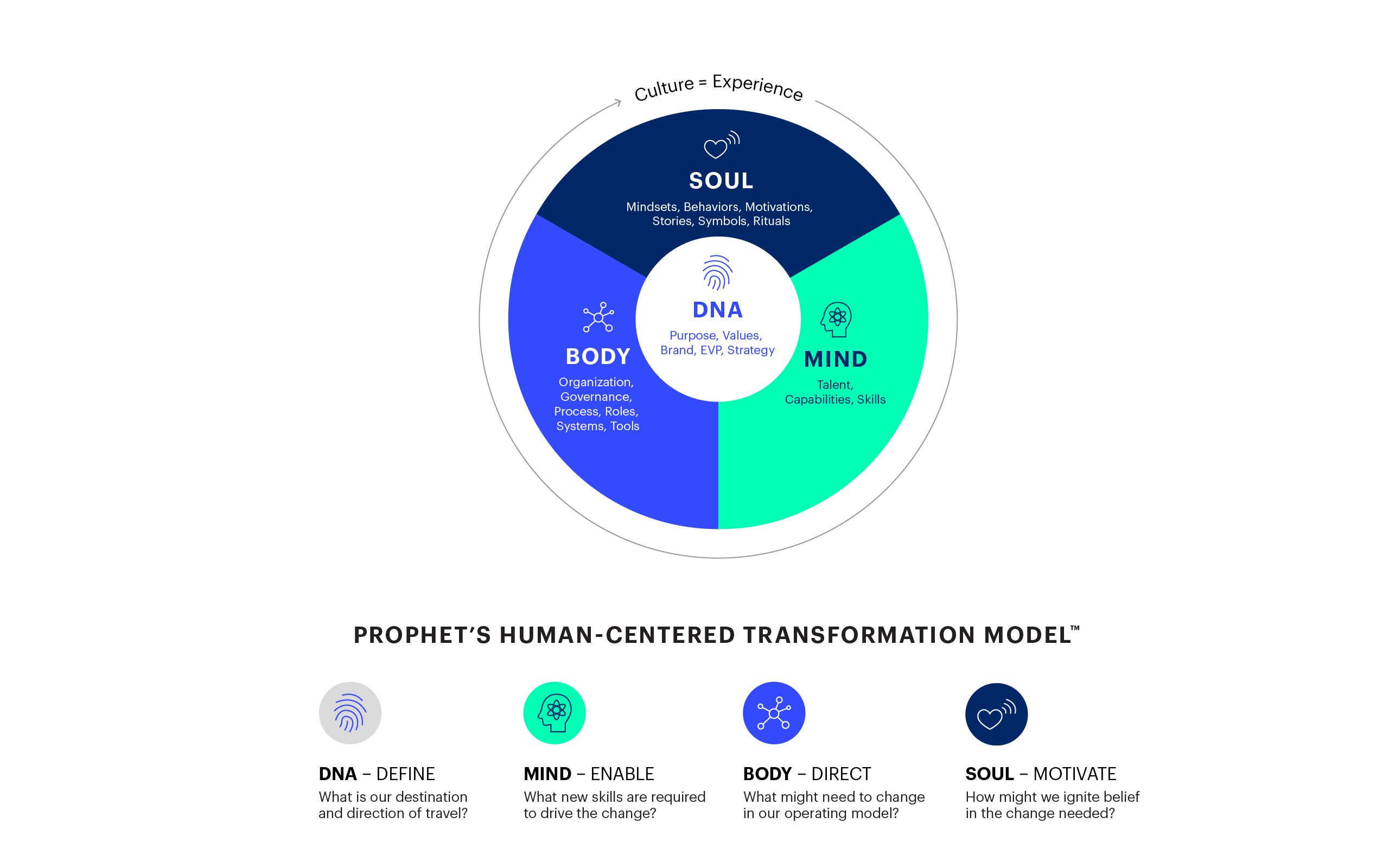

Prophet’s research tells us that, by targeting the “Soul” of the organization, we can activate and accelerate key transformation levers, such as ‘Developing meaningful mechanisms to enable employees to adapt.’ We mentioned earlier that beating the organizational system is difficult and most organizations don’t have these change mechanisms in place. Behavior Kickstarters do exactly that, equipping employees with a powerful method to grow, adapt and thrive in the ever-changing world we now find ourselves in.

The crucial part of this comes not in running the Kickstarter, but in equipping your teams with the permission and ability to constantly repeat it over time to embed the new behavior until it becomes a habit. Wendy Wood, author of Good Habits, Bad Habits estimates that we spend 50% of our time unconsciously repeating actions we’ve already taken. By intentionally repeating the Kickstarter, you train your brain by practicing new behaviors and building the pathways needed to create daily habits. For this instance, fake it until you make it – or in behavioral terms, fake it until you become it.

The idea of ‘fake it until you become it’ is not new, in fact, it is over 2,000 years old. Aristotle believed that people could not simply know, or study, how to be virtuous. To be virtuous, they must practice virtuous actions: first by imitating others who demonstrate virtuous actions and then turning those imitated behaviors into habits by performing them every day. You practice the behavior you want and then one day you turn around and discover you’re not performing the behavior, you’re living it.

The beauty of this transformational process is its ripple effect, fostering further change not only with individuals but also throughout the broader organization. On an individual level, the success of initiating the first Behavior Kickstarter inspires you to do it again (following our Behavior Kickstarter formula: we only change when it feels good). If you’re trying to get fit, and you feel good after your first 5km run, you might try 7km, or 10km and then maybe eventually a half marathon. At an organizational level, it can quickly become contagious. The stories of others successfully changing their behavior become the currency of change, creating a sense of envy that motivates others to do the same. Just like when we witness a good deed, like someone helping an elderly person with their shopping, we’re far more likely to carry out a good deed ourselves later that day.

“All big things come from small beginnings. The seed of every habit is a single, tiny decision”

James Clear, Author of Atomic Habits

To fuel a change movement across the organization, it’s helpful to share stories of how others are running their Behavior Kickstarters to reinforce these successes with recognition and celebration. This inspires others to initiate their own Kickstarter, setting off a chain reaction that swiftly builds into a potent force for change.

Change shouldn’t be isolated to those with ‘people’ or ‘culture’ in their title, or limited to company offsites and launches for new corporate values. The beauty of Behavior Kickstarters is that they’re accessible to everyone. Facilitating the adoption of new behaviors is a sure-fire way to accelerate change across your organization.

FINAL THOUGHTS

Some questions for you to reflect on: How is your organization living your values? How are you living them? Are there new behaviors or ways of working that are not currently being lived?

If you’re interested in finding ways to create a safe space, enhance collaboration, or ignite innovation and creativity, our experts are ready to help.