BLOG

The Way Forward – Key Tips to Reimagine Your Business in Southeast Asia

The future lies in an agile operating model, diversified delivery models and reimagined stores.

his is the second article of our two-part series “Digital Transformation in Times of Turbulence” originally published on Brandberries.

“What’s next? The future of shopping will continue to be conducted largely from the home, while remote learning, gaming, cashless and proximity payments will all ramp up and become the norm.”

Thriving in the post-COVID-19 future will ultimately require changes in how companies think about staying relevant to consumers while managing increased operational complexity, as well as potential delays in the rebound of demand and customer traffic. Combined with sales migration toward online channels and the renewed focus on value, these changes could contribute to margin compression. Moreover, there are certain behaviors that are likely to shift fundamentally, requiring reconsideration of the consumer proposition and companies’ go-to-market strategy and operating model.

What’s the “New Possible”? Four Tips to Reimagine Your Business

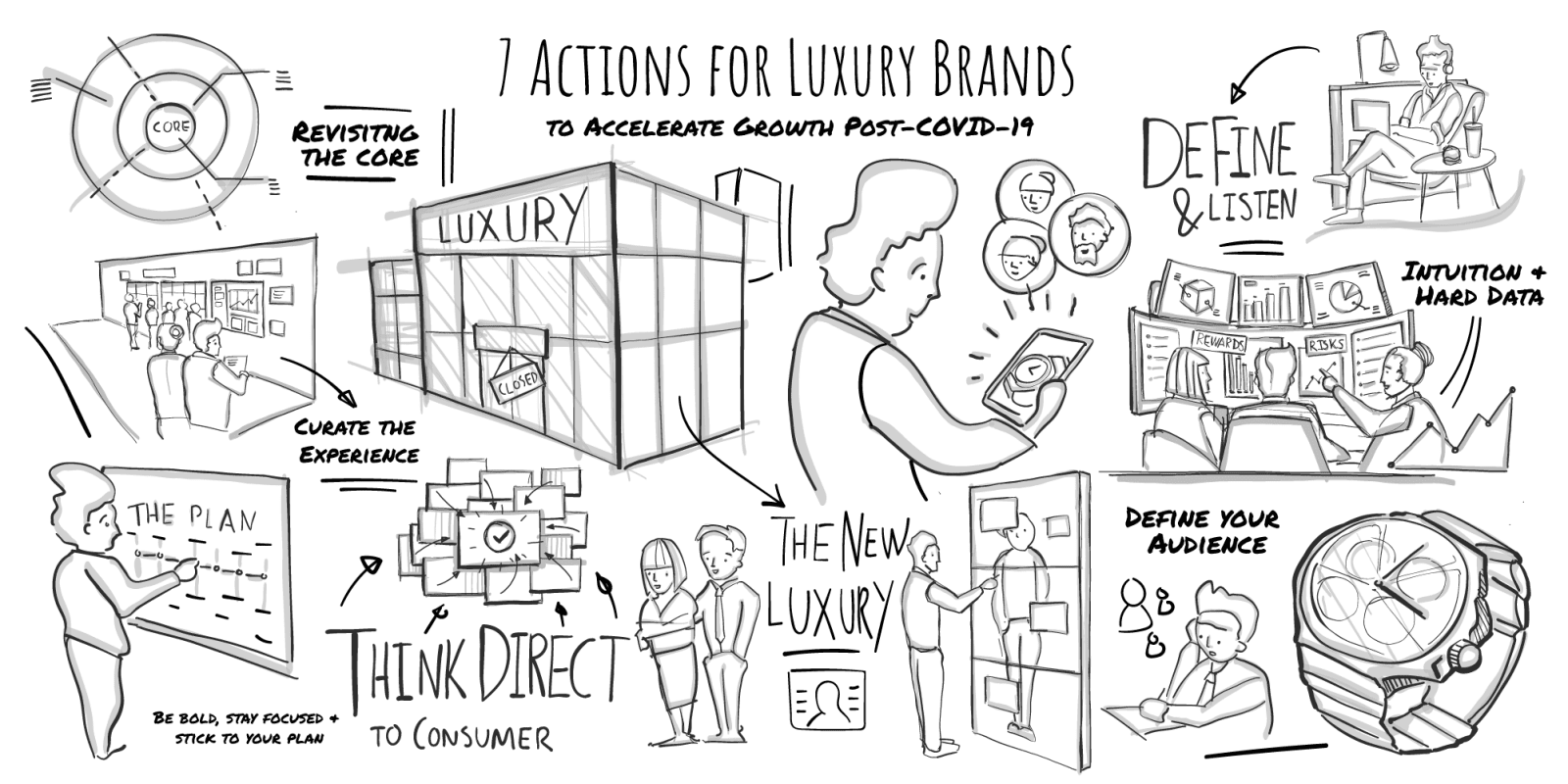

New attitudes toward physical distance, health and remote working will create opportunities related to therapeutic properties and mental wellbeing. Companies will work to diversify supply chains while continuing to invest in digital tech and virtual experiences to maintain engagement. Based on our research, there are four tips to prepare for the Next Possible:

- Rethink Role of Physical Store

- Rethink and Diversify Delivery Model

- Double Down on Digital

- Embrace an Agile Operating Model

1. Rethink Role of Physical Store

Although digital shopping has accelerated, physical stores retain appeal. Consumers in SEA expressed the desire to return to physical stores, particularly to shop for apparel, mobile phones and domestic appliances. Clobbered by the crushing effects of the pandemic, thousands of retailers from Bangkok to Singapore have rushed to set up online shops on big e-commerce platforms to stay afloat this year. Now shopping malls across the region are going virtual for the first time. The pandemic has pushed retailers to move beyond the traditional view that physical locations are primarily for in-store customer engagement. Promising new models have begun to take hold.

New Replica Virtual Mall

In Singapore, Marina Square Shopping Mall — nestled among luxury hotels and popular tourist attractions — is taking more than 30 of its tenants online with Lazada, the Southeast Asian arm of Alibaba Group. It’s the first shopping center in the city-state to create a mini virtual replica of its physical mall. This follows similar moves by Siam Center, a landmark shopping mall in Bangkok built in the 1970s, which teamed up with Lazada to set up its virtual mall with about 40 tenants. In Indonesia, more than 100 tenants of three malls by developer Pakuwon Group are going live on Lazada. Lazada, which operates in six countries in Southeast Asia, launched its virtual mall called Lazmall in 2018, allowing brands to set up their own online stores.

Bring an In-Store Feel to the Digital Experience

The inability to engage customers in a physical environment has pushed some retailers to bring more of the in-store experience online. First, leading retailers have substituted in-store personalized interactions with offerings such as virtual appointments, where sales associates use videoconferencing platforms to offer personalized attention to customers. Similarly, retailers are using live streaming to engage with customers and increase revenue and loyalty by sharing experiential content. Second, retailers have been developing alternative engagement models to take the risk out of digital-purchasing decisions. In apparel and fashion, for example, one of the main impediments to online purchasing has historically been the inability for customers to see how items would look on them. Jewelry brand Kendra Scott is tackling that problem by launching a new platform, Virtual Try-On, which uses augmented reality (AR), machine-learning and computer-vision techniques. Shopify, which allows its merchants to add 3-D models to their product pages, found that conversion rates increased by 250 percent when consumers viewed 3-D products in AR.

2. Rethink and Diversify Delivery Model

COVID-19 has heightened the importance of safe delivery modes, including curbside pick-up and aggregator delivery. Retailers have scrambled to launch services to meet this demand. Retailers are also reassessing store formats to support third-party delivery services. Some groceries are creating “speed zones” near the front of the store and stocking them with the most popular items to enable delivery companies to accelerate pick, pack and delivery of orders.

New Partnership to Enhance Convenience

Many retailers have explored strategic partnerships to enhance convenience for customers and boost sales. These new ecosystems allow retailers to gain access to new capabilities and extend their brand reach to new customers. There will be higher expectations for offline experiences to create even higher value beyond what can now (mostly) be done online. Customers can order from food halls or PD Pasar Jaya (Wet market) through Whatsapp in Indonesia, and goods will be delivered via Gojek. The Singapore government also helps food and beverage owners go digital through the Food Delivery Booster Package. Aprindo, which groups about 150 local and national retail companies with a total of around 45,000 outlets across Indonesia, launched a novelty “Park & Pickup” feature. It allows customers to order their groceries via WhatsApp or the Hypermart online store and pick up their orders at the parking lot. There’s no need to get out of the car because staff will deliver the goods to the car.

3. Double down on Digital

As consumers use more digital channels, it is important for companies to ensure that their experiences at each touchpoint are consistent, generate delight and further enhance companies’ understanding of consumers. This requires brands and companies to not only be open to shifting their marketing messages but also invest in analytics capabilities and reallocate financial and talent resources as needed.

Dial up the Acquisition and Drive Traffic to Digital Assets

Retailers can partially offset diminished foot traffic in physical stores by boosting investments in online acquisition. With more investment in online marketing, winners are adapting their strategies to account for shifts in consumer behavior.

Extend Digital-Channel Presence and Engagement

Shelter-in-place orders have led companies to test new methods of customer engagement. Many retailers with established mobile apps have cited record downloads, while others sought to make up ground quickly. In addition, while building and nurturing online communities are not new ideas, they have gained significant momentum. Retailers are augmenting direct customer interactions with engagement in apps and other relevant channels. Nike, for example, activated its digital community by offering virtual workouts and saw an 80 percent increase in weekly active users of its app.

Ensure That the Digital Experience Is Truly ‘Zero Friction’

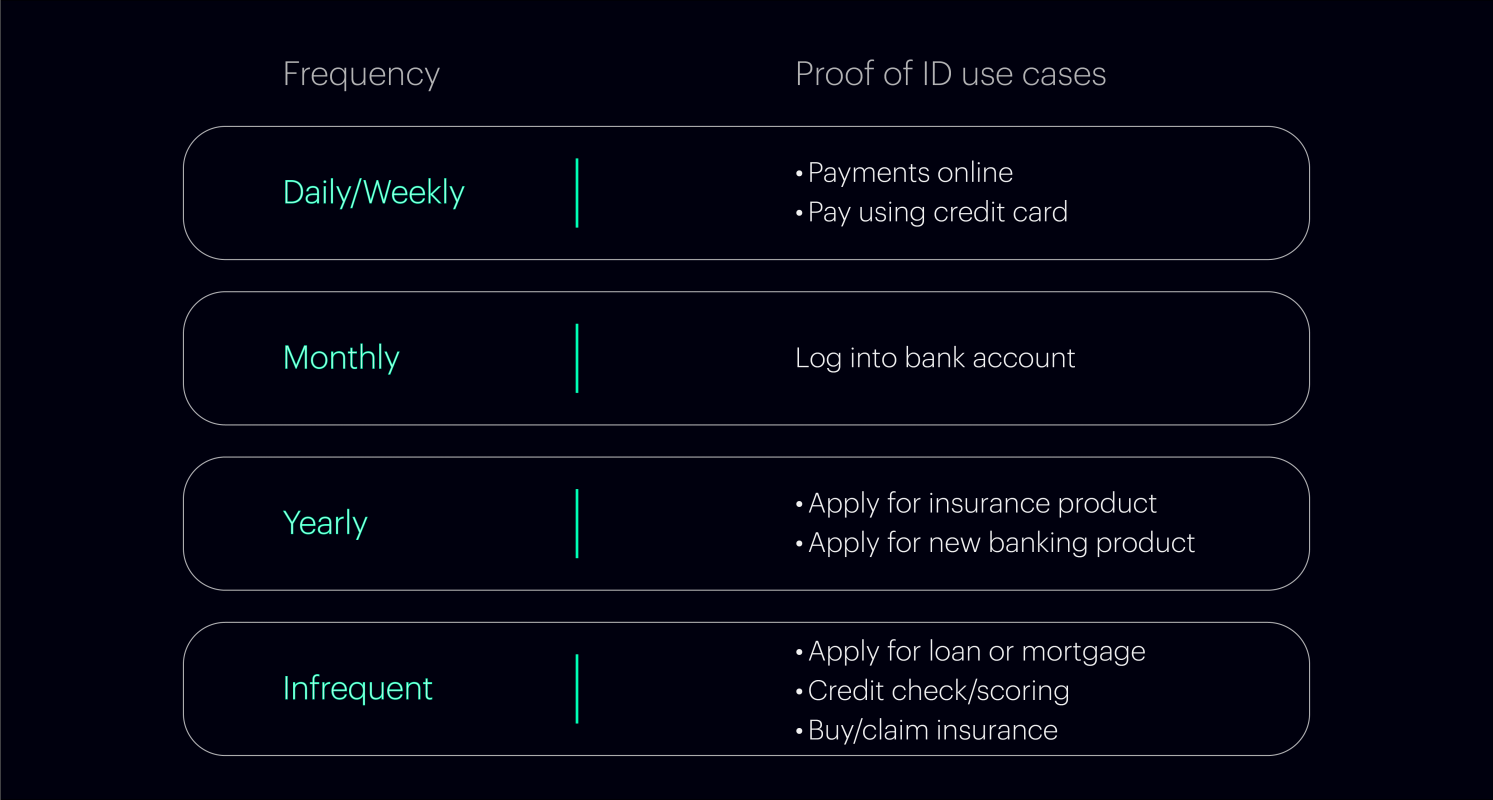

Customer expectations are rising for digital channels in terms of site loading speed, stability and delivery times. To keep pace, retailers should start by designing web pages that are optimized for digital shopping. For example, making the highest-selling (and ideally highest-margin) products easy to find helps to make the customer journey more seamless. The first page of Lazada listings receives nearly two-thirds of all product clicks. With more customers now engaging through mobile devices, retailers must ensure that all digital channels are integrated and offer consistent services (such as payment options) and experiences (such as shopping carts updated in real-time across devices).

4. Embrace an Agile Operating Model

The pace of change in the post-pandemic environment will force retailers to continually reassess their strategies. This approach requires more real-time insights on customers as well as a new agile operating model to harness these insights and put them into action. The next normal is still taking shape, and customer expectations will continue to shift in response. Retailers that focus on customer experience and respond with agility and innovation in their omnichannel experiences will fare better and strengthen their ties to customers.

Real-Time Behavioral Tracking

Before the pandemic, digital leaders were using data to optimize customer experience, gauge satisfaction, identify foot traffic trends and generate purchase recommendations. Winning retailers are moving beyond surveys as a mechanism for customer input and toward near-real-time tracking of consumer trends and behavior With the rise of digital in recent months, companies will have even more dynamic data at their fingertips, and they can use these data to extract immediate insights. For example, many retailers have seen an influx of new customers to physical stores (for essential retail) or digital channels. Winners will generate insights from these new customers and construct targeted retention plans, messages and offers to maintain the customer relationship in this era of brand switching and cost-consciousness. Social media is another channel that offers insights on rapidly changing consumer behaviors.

Agile Innovation and Test & Launch

By adopting agile practices alongside the generation of real-time consumer insights, retailers can more quickly re-calibrate their business model and offerings to meet consumer expectations. Retailers need to raise their metabolic rate—that is, the speed at which they process information and develop new offerings. The speed at which some retailers have been able to stand up new omnichannel models (for example, launching a new delivery business in three weeks) shows what a truly agile operating model can unleash. A rapid approach to tests and trials can enable retailers to launch offerings at scale more quickly and avoid losing share in the face of shifting consumer behavior.

—

This is the second article of our two-part series “Digital Transformation in Times of Turbulence”. Read the first part of our series here to learn more about the emerging consumer trends in the new normal in Southeast Asia.

FINAL THOUGHTS

As the saying goes, “disrupt or be disrupted.”

For those who think and hope things will basically go back to the way they were: Stop. They won’t. All businesses, especially retailers, that do not start embracing digital as part of their business strategy may see themselves left behind as their businesses falter.

Finally, shoppers still appreciate the “touch and feel experience” of physical stores. As such stores need to reimagine end-to-end consumer engagement on digital channels and seamlessly link online and offline experiences to radically accelerate in-store omnichannel integration. Companies that are both digital and offline, rather than one or the other, will be better positioned in the days ahead—especially if they can use both to create a mutually reinforcing customer ecosystem.

Contact us to learn more about what levers you can pull to reimagine your business for uncommon growth in the post-COVID-19 era.