BLOG

Unlocking Digital Transformation Success in the Middle East: A Human-Centric Approach

Human-centered transformations are crucial globally, but in the Middle East they take on a distinctly different imperative, shifting from technology to empowering people.

Digital transformation has come a long way from being a buzzword to becoming a fundamental for business success. But, digital transformation goes beyond technology; it’s an ongoing process where human issues and change management are just as central to a successful transformation process as the tech. And today, organizations are starting to understand that change comes from using technology to achieve human goals. They recognize that such change helps them to be more targeted in servicing customers, creating experiences and becoming more efficient, profitable and sustainable.

While human-centered transformations are essential all over the world, they take on a distinctly different imperative in the Middle East. The relationship-based culture requires a very human approach – business here is all about the way people connect.

The region has one of the world’s youngest populations, with about 60% under 25, which means most employees are digital natives. They run their lives using mobile technology and expect the companies they work for to do the same. They are more at ease with artificial intelligence and want all the entities in their lives, from government and employers to shopping and entertainment, to be convenient, automated and personalized.

There’s no ignoring the need to be digital. It is simply expected in every aspect of life. Yet technology is only one part of the solution. It frees up and increases the demand for organizations to provide a human experience. This is becoming more important every day: Yes, there are plenty of tasks tech can do better than people, from booking airline tickets to delivering groceries. But when it’s time for people to interact with each other, whether with colleagues or customers, those interactions take on outsized importance.

In the Middle East, this transition to a more human-centered business should foster the growth of the region’s relationship-driven culture by directing employees’ attention more toward the human elements of business. Organizations should allow their employees to use technology to help their customers and stakeholders achieve their goals.

And this is the crucial distinction: recognizing that humans drive the change in business – not technology.

Starting a Human-Centered Transformation

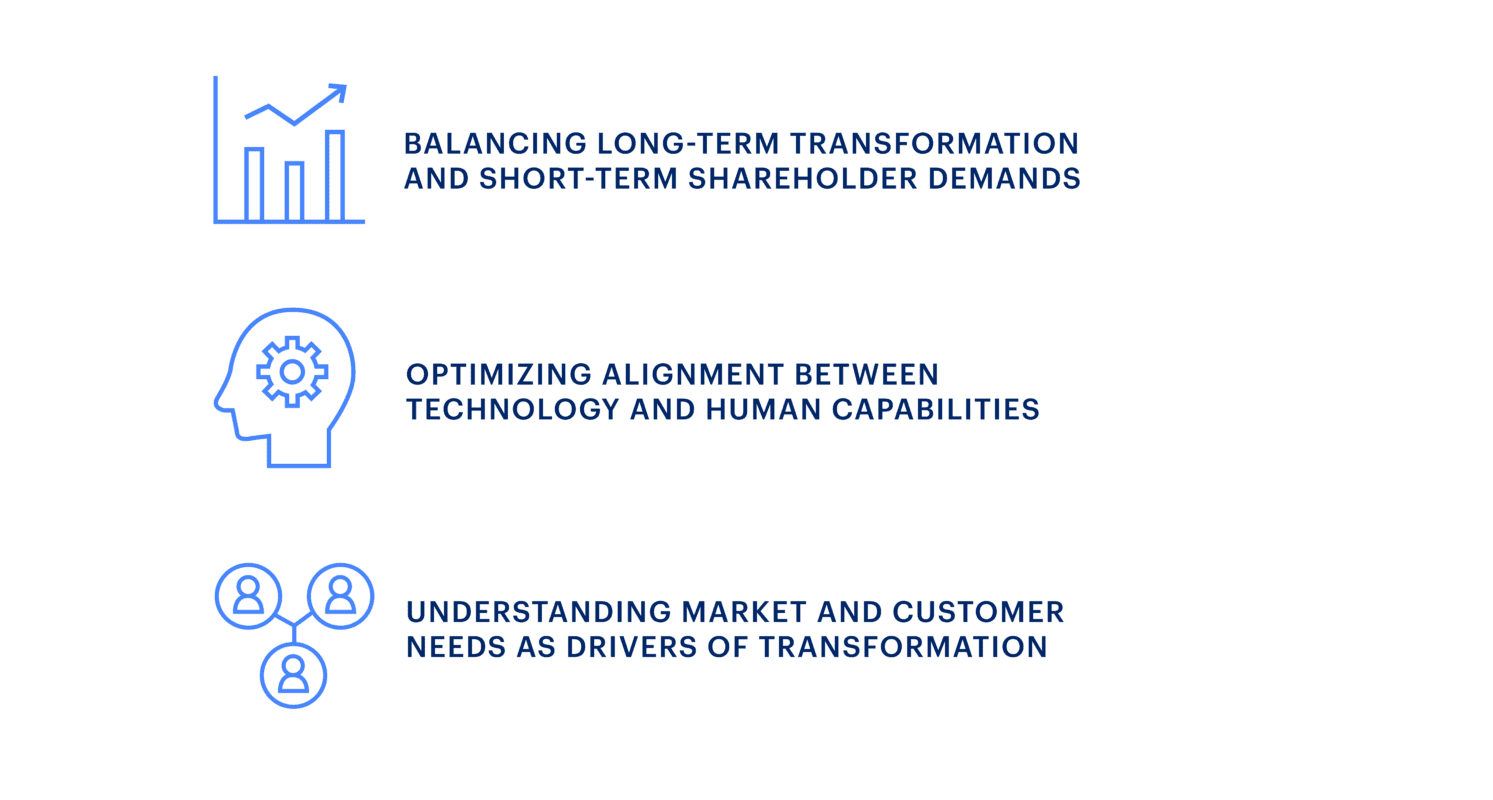

For the last five years, Prophet’s global research has explored how companies can leap from outdated ideas of digital transformation to human-centered change. We’ve found that sustainable change, the kind that leads to uncommon growth, works best by comparing every organization to the makeup of a human being. Every enterprise has DNA, a mind, body and soul. We call it the Human Centered Transformation Model.

These transformation efforts are powered by purpose, values, brand and strategy, which we consider an organization’s ‘DNA’. All enterprises need a clear and compelling ‘why’. That ‘why’ is the North Star, illuminating every effort, so every part of the organization pulls in the same direction. This purpose must be meaningful, a shared ambition that can unite and inspire people to embrace change for a better future.

Each organization also has a ‘mind’, including the talent, skills and capabilities to take it forward. The ‘body’ includes the organization’s shape, such as governance, processes and systems. And finally, each enterprise has a ‘soul’, the behaviors, beliefs and stories that motivate its people. These soul-based elements are especially important in the Middle East. They include symbols, rituals and a mindset that help ignite change and are deeply meaningful to younger workers.

Leveraging the Middle East’s Unique Advantages and Addressing its Challenges

Our research has identified the critical levers – fundamentals and accelerators – that can drive change. These are global findings. Yet there are some specific conditions in the Middle East that support rapid digital transformation and help bring people on the journey of change.

First, there is speed, urgency and ambition. The race to achieve the national 2030 vision, even as it expands toward 2040, is an amazing driver for change. People who run enterprises feel this vital purpose and are eager to achieve it. Employees are even more impatient.

Next, there’s a regional thirst for excellence, prestige and creativity, inspired by ambitious projects, whether it’s Dubai’s “20-minute city” goals, Saudi Arabia’s $500 billion bet on NEOM, or Egypt’s audacious plans for a new capital. These ambitious endeavors are not only shaping the future but also instilling a sense of collective national pride, fuelling the appetite for achievement and making people eager to join the journey towards a digital future.

The region also faces barriers. Similar to companies globally, some entities react reflexively in ways that are inconsistent or misaligned with their declared strategy, making it more challenging to coordinate and drive change.

Organizations are maturing and evolving all the time. Yet, even in flux, it’s essential to connect the dots strategically. Every change should arise from the enterprise’s DNA, relating continuous improvement to a broader agenda. This clear purpose is the North Star, helping companies see how that purpose translates into every employee and customer experience.

The region also faces workforce challenges due to the transient nature of talent, where professionals frequently change roles and locations. This dynamic environment contributes to fluctuations in productivity, as teams experience continuous turnover, impacting stability. This is why strategies that focus on talent retention, skill development and creating a workplace culture that aligns with the diverse expectations of the workforce are imperative.

These unique advantages and challenges make taking a human-centered approach even more important, ensuring it is tailored to your organization’s characteristics and strengths.

Beyond Cookie-Cutter Approaches: Honor Regional and Organizational Uniqueness

Studying transformation success stories and digital leaders in the West can be tempting. But that’s a mistake. Only Google can be Google. While it’s fine to be inspired by what others have done, organizations in the Middle East (and everywhere else) must remain authentic to their core identity. They should be driven by and centered around the unique group of individuals within their organization and guided by the strategic purpose they aim to achieve.

Cookie-cutter methods won’t create the far-reaching, long-lasting transformation required in modern marketplaces. But there are specific steps companies can take to begin this human-centered change in ways that build on what they do best, helping them create more robust, more agile organizations that better serve all stakeholders.

The Power of Leadership Excellence

Start by defining what good leadership looks like. Leadership values need to stem from the organization’s unique DNA. And while an enlightened CEO is required to initiate the transformation journey, the passion for the mission needs to be nurtured in leaders at all levels. Organizations in the Middle East need leaders who can work with many cultures and nationalities. They require the ability to co-create a dialogue about what the enterprise wants to achieve with this transformation, deciding how best to prepare employees for the changes ahead.

Again, there are inherent regional advantages. Organizations can create close-knit, enterprise-focused leadership teams using the power of the relationship-based culture. We see this inherently in start-ups, steering away from traditional hierarchies and driven by innovation, the emphasis is on collaborative cultures that nurture a sense of belonging and shared purpose among team members. Similarly, government entities in the region have increasingly recognized the value of cultivating strong leadership teams to enhance organizational effectiveness and establish relationship-based cultures that resonate with the diverse populations they serve.

While transformation efforts are still in the planning stage, leaders should remind themselves how much power they have over the outcome of any transformation effort. If leadership isn’t seen as fully on board with changes, efforts will never gain traction. Companies can increase the chance of transformational success by:

- Framing the transformation as a positive, modern journey. Make it clear that it helps build pride and furthers national goals, using context that is meaningful and relevant to all employees.

- Encouraging creative thinking. As Artificial Intelligence (AI) takes over more operational and administrative tasks, organizations should emphasize the human effort shaping these technological changes. AI can only predict. It can’t think or invent. Constantly seek out new ways to encourage human insight and innovation.

- Embracing diversity. Effective transformation in the Middle East requires working with locals, whose motivation and sense of purpose are linked to faith and cultural heritage. But it also requires international workers and customers. Organizations need to serve many segments, tailoring and personalizing every experience.

Build the Right Employee Value Proposition

As leadership teams coalesce around this pivotal transformation initiative, it’s crucial to sharpen every element of talent acquisition. That starts with updating the Employee Value Proposition (EVP) – the deal you offer those who join your organization. While encompassing salary and benefits, an EVP transcends these essentials, delving into the fundamental reasons why people come to work each day. A robust EVP that vividly articulates the organization’s purpose unveils the unique, compelling and meaningful aspects of the employee experience. Beyond merely enhancing talent acquisition, this refined EVP serves as a linchpin for retention. Engaged employees, drawn to a purposeful workplace, contribute to the transformational journey, propelling the organization toward unparalleled growth.

Given macroeconomic challenges, it’s a critical time for regional organizations to make sure these EVPs play across borders, attracting international talent. This can be time-consuming for companies not well-known in other parts of the world. And it often calls for new ways of thinking. For example, flexible schedules and work-life balance are now an expectation of many people in the West and must be addressed in recruiting efforts.

You can’t skimp on developing an EVP. Successful transformation relies on building new capabilities. And while some of those needs will be addressed by upskilling current employees, attracting talent with new skills and background is essential. The rapid expansion of AI tools has dramatically accelerated the demand for new skills.

Companies can’t afford to overlook local talent, either. The competition is intensifying as the Middle East region prospers and grows, especially relative to Western economies.

FINAL THOUGHTS

To meet the needs of the Middle East today and tomorrow, organizations can no longer rely on outdated ideas of digital transformation. Instead, they need to find new and better ways to use human-centered transformation, putting the right technology into the hands of the many people they serve. When enterprises put people before technology, all stakeholders benefit – employees, customers, community members and investors.

If you’d like to discuss your digital transformation effort, our expert team can help you in placing a human-centered focus at the heart of your approach.