BLOG

How Shiseido Drives Uncommon Growth by Breaking Boundaries Through Customer-Centric Innovations

Uncommon Growth Leaders is an article series featuring bold leaders driving faster, smarter, more sustainable, more human and more actionable growth—what we call uncommon growth.

Carol Zhou is the Senior Vice President of Shiseido Group’s China Business Innovation & Investment and the GM of Ziyue Fund, Shiseido’s beauty-focused investment fund. She unlocks growth drivers across the globe by leading incubation efforts of internal new ventures, while identifying and investing in external emerging startups.

In our discussion, Ms. Zhou shared her in-depth perspective on the evolving consumer landscape and Shiseido’s global strategy for innovation and growth. Through continuous innovations rooted in relentless customer-centricity, including ventures into ingestible beauty and medical beauty categories, Shiseido focuses on creating compelling value propositions to continuously win consumer trust, and drive high-quality, sustainable growth.

How is Shiseido driving growth within your organization?

Carol Zhou: As an industry leader and the ‘Asian Skincare Expert,’ Shiseido is committed not only to shaping the future of beauty but also to deeply understanding and anticipating consumer needs—transforming insights into strategic brand excellence and sustainable growth drivers.

Growth is a long-term process, and the key lies in building an enduring brand through vision and consistency. Beyond packaging or storytelling, it’s about stewarding our core values at every touchpoint. Our goal extends beyond reaching a wider audience; we strive to cultivate meaningful consumer connections that inspire loyalty and mutual value creation.

Shiseido has been increasingly investing in the ingestible beauty (inner beauty) and medical beauty categories. In pursuing high-quality growth, what motivated the decision to redefine the traditional boundaries of the beauty industry?

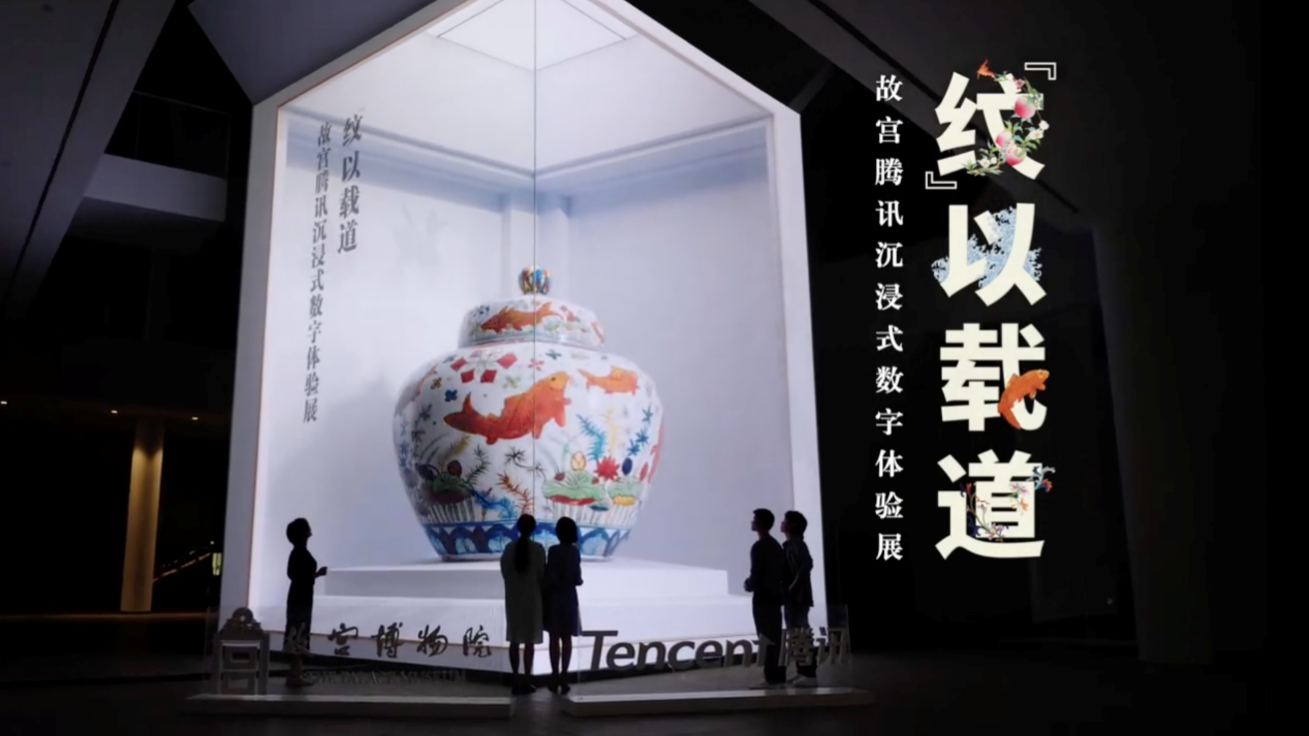

CZ: From my earliest days at Shiseido, our global CEO recognized China as both our most strategic future market and the ultimate proving ground for global innovation. This innovation extends far beyond product development—it’s about defining ecosystems, reimagining business models, creating unique consumer value and establishing enduring brand equity.

Our approach to innovation outlines two essential principles. First, comes our commitment to anticipating future trends and staying acutely attuned to market evolutions. Equally important is our dedication to protecting the brand’s core value, ensuring every innovation strengthens rather than compromises Shiseido’s long-term values and heritage.

The ingestible beauty category (beauty-from-within) came naturally to us. It represents the perfect synergy between Japan’s centuries-old philosophy of holistic beauty and China’s tradition of wellness harmony.

Shiseido launched its tech-driven ingestible beauty brand INRYU in 2021.

Medical beauty, in comparison, was a more challenging venture. Initially, there were internal concerns: Is this too radical? But after observing global beauty trends and consumer habits, we recognized that medical beauty is becoming an essential component of people’s daily skincare regimens, potentially displacing traditional premium skincare. As an industry leader, Shiseido must embrace change rather than cling to convention. So, we’re cautiously yet decisively exploring how to empower the medical beauty sector—seizing new opportunities while preserving Shiseido’s core DNA: “people-first” innovations blending “art & science.”

Shiseido introduced its first medical beauty brand RQ PYOLOGY in China.

Empowering the medical beauty industry is now a key pillar of Shiseido’s global strategy. We’re leveraging China—the world’s most dynamic and competitive market—as fertile ground for innovation, then scaling successful practices globally.

With shifting consumer habits, what challenges do you face in brand marketing?

CZ: We don’t react passively. Instead, we proactively build systematic consumer insights and development capabilities, laying the foundation for sustainable, long-term growth.

With unprecedented information transparency, consumers’ decision-making processes have radically evolved. They no longer passively accept brand narratives—instead they proactively investigate and demand substance. For example, proof points such as ingredients, clinical data and scientific validation are scrutinized, revealing a new generation of discerning consumers. Thanks to platforms like TikTok (Douyin) and RedNote, consumers are often better informed about industry trends than marketers. This shift is rewriting the rules of brand marketing.

In the past, branding was a “one-way broadcast.” Corporations had control over channels with carefully crafted brand stories. Today, the narrative belongs to consumers—they share, educate and influence. Brands must evolve into enablers. This shift in power dynamics presents new challenges. With people’s attention spans shorter than ever, the pressure is on; brands must deliver value, instantly.

But the real test isn’t to grab attention—any brand can do that with flashy campaigns. The true measure of success is converting buzz into lasting brand equity: loyalty, advocacy and repeat purchases. Shiseido focuses not just on communicating our core values, but on fostering continuous dialogue with consumers, reinforcing trust through delivering product quality and customer experiences.

Shiseido launched “ULTIMUNE FOUNTAIN,” a sustainable refill service for the iconic Ultimune Power Infusing Concentrate, promoting sustainability while boosting loyalty.

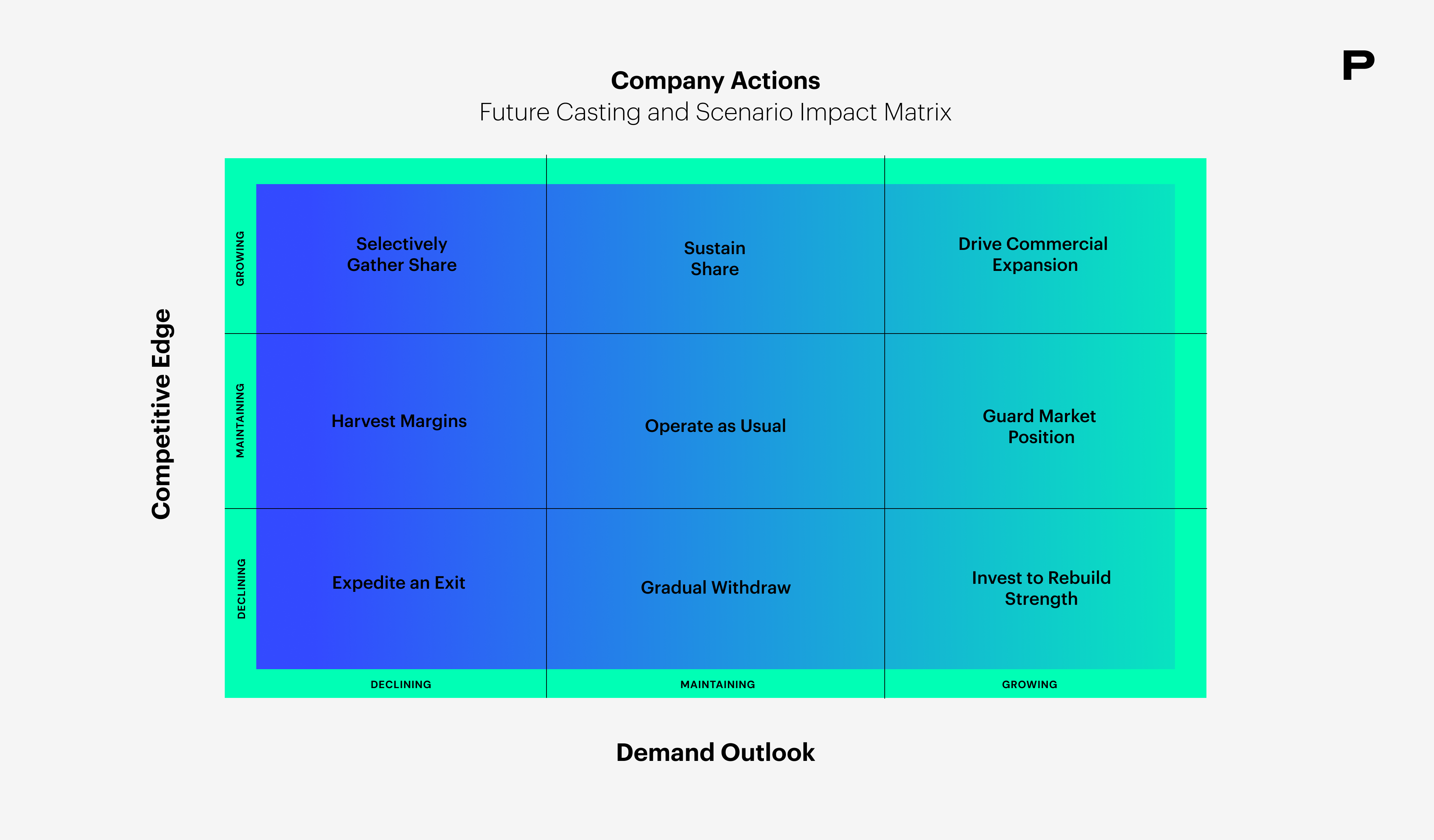

Amid market uncertainties, how does Shiseido reconcile bold innovation with risk mitigation when entering new sectors and ecosystem partnerships?

CZ: We take a test-and-learn approach—validating concepts through controlled pilots before scaling, ensuring systems and strategies mature in lockstep. At our core, we prioritize high-quality growth, rejecting short-term tactics like price wars or short-term traffic grabs and instead delivering authentic value that earns long-term loyalty.

For instance, in medical beauty, we noticed gaps in the consumer journey—the experience from pre-treatment to post-care isn’t seamless. So, we’re exploring how Shiseido can enhance this holistic experience by integrating into the customer journey beyond providing specialized products. By partnering with clinics, we hope to help elevate their services and experiences, therefore increasing retention and customer lifetime value.

Agility is also critical amid the fast-changing landscape. Internally, we strive to streamline cross-functional collaboration and accelerate decision-making. Externally, we cultivate strategic partnerships that complement our capabilities across the customer journey, allowing us to rapidly innovate in high-potential areas while maintaining our commitment to excellence.

Finally, what metrics do you prioritize when measuring marketing success?

CZ: When assessing brand performance, I prioritize customer retention—particularly the repurchase rate—as one of the most critical metrics. More importantly, beyond broad brand awareness (which often correlates with marketing spend), I place greater emphasis on meaningful brand recognition among precisely defined consumer segments.

This requires a sophisticated approach across different stages of the marketing funnel. At the upper funnel level, we focus not just on impression volume, but on expanding reach through precision targeting. We develop specific consumer personas based on our brand strategy, extending beyond basic demographics to incorporate lifestyle patterns and purchase drivers. For instance, ingestible beauty consumers may be primarily motivated by wellness consciousness or fitness routines.

At the lower funnel, our emphasis shifts from short-term conversion (which can be artificially inflated through promotions) to driving repeat purchases and long-term value.

Carol Zhou

SVP, China Business Innovations & Investments; GM of Inner Beauty & Wellness Division

Shiseido

As the SVP of Shiseido Group’s China Business Innovation & Investment, Ms. Carol Zhou helps unlock the next growth drivers for the Group across the globe by leading incubation efforts of internal new ventures, while identifying and investing in external emerging startups.

Ms. Zhou successfully led the launch of Shiseido’s first ingestible beauty brand, INRYU, in China. As the head of Shiseido’s ingestible beauty division, she will further expand the brand portfolio in this category to deliver greater value to increasingly sophisticated beauty consumers. Additionally, as the General Manager of Ziyue Fund, Shiseido’s beauty-focused investment fund, she continues to concentrate on high-growth sectors in the Chinese market, exploring new brands to enrich the Group’s business portfolio while creating synergies with existing brands.

In April of this year, Ms. Zhou introduced the Group’s first high-end biotech skincare brand, RQ PYOLOGY, in Shanghai, offering a full-cycle medical beauty and skincare solution, fusing medical-grade efficacy and cosmetic elegance. The brand will partner with premium specialized beauty clinics to provide safer, more effective, and precise full-cycle skincare solutions for Asian skin through high-performance medical beauty products and outstanding customer experiences.

Ms. Zhou has held senior management positions at several multinational corporations, including Unilever, L’Oréal Group, Burberry, and Marriott International, where she led brands in cross-regional and cross-sector global strategic innovation. She graduated from New York University’s Stern School of Business and holds an MBA from the Hong Kong University of Science and Technology.

Ms. Zhou successfully led the launch of Shiseido’s first ingestible beauty brand, INRYU, in China. As the head of Shiseido’s ingestible beauty division, she will further expand the brand portfolio in this category to deliver greater value to increasingly sophisticated beauty consumers. Additionally, as the General Manager of Ziyue Fund, Shiseido’s beauty-focused investment fund, she continues to concentrate on high-growth sectors in the Chinese market, exploring new brands to enrich the Group’s business portfolio while creating synergies with existing brands.

In April of this year, Ms. Zhou introduced the Group’s first high-end biotech skincare brand, RQ PYOLOGY, in Shanghai, offering a full-cycle medical beauty and skincare solution, fusing medical-grade efficacy and cosmetic elegance. The brand will partner with premium specialized beauty clinics to provide safer, more effective, and precise full-cycle skincare solutions for Asian skin through high-performance medical beauty products and outstanding customer experiences.

Ms. Zhou has held senior management positions at several multinational corporations, including Unilever, L’Oréal Group, Burberry, and Marriott International, where she led brands in cross-regional and cross-sector global strategic innovation. She graduated from New York University’s Stern School of Business and holds an MBA from the Hong Kong University of Science and Technology.

FINAL THOUGHTS

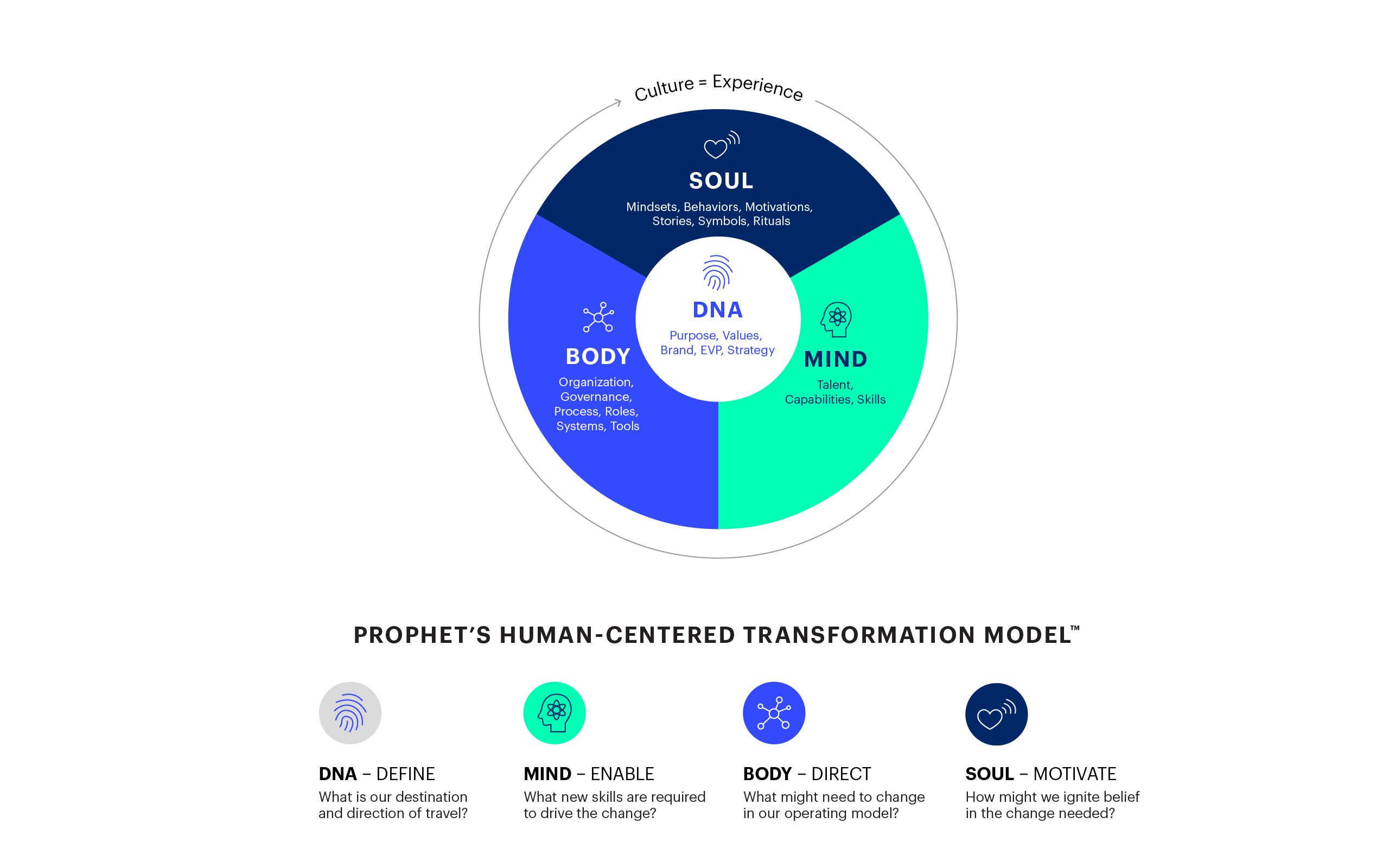

Prophet helps clients unlock Uncommon Growth—the high-impact growth that is sustainable, faster, smarter, more human and more actionable, requiring organizations to increase speed to market while building the right capabilities, culture and business models to outpace disruption and drive lasting impact.

Rooted in consumer insights and business outcomes, we create strategy that’s sharp, focused and pragmatic. Explore how we can partner with your organization to drive real growth.