BLOG

Brand and Demand: Diego Norris on the State of CPG Marketing

Mat Zucker, Senior Partner at Prophet, speaks with Diego Norris, CMO at Gimme Seaweed, on the evolution of CPG marketing and the impact of AI on marketers.

Diego Norris is the Chief Marketing Officer at Gimme Seaweed, leading the overall marketing strategy for the number one-selling organic seaweed-based snack.

Norris has over 20 years of experience in various marketing and innovation roles for leading CPG companies, including General Mills, Nestle Nutrition, Red Bull, Pinkberry and Campbell Soup. He has also spent several years in consulting, first at Deloitte, where he started his career, and later at Prophet, where he helped technology and healthcare companies build relentlessly relevant brand strategies.

Mat Zucker: Given the disruption of the last few years, marketers are often asked to take on greater accountability to demonstrate immediate impact and ROI of marketing investment while creating tighter alignment with the business outcomes. Has that been your experience? If so, how have you shifted your strategy to show impact?

Diego Norris: The push for Marketing to demonstrate immediate impact has increased significantly in recent years. However, this shift isn’t merely a response to increased demands from leadership, board members or shareholders. Developing high-performance programs that are tightly aligned with business objectives is also necessary.

In this context, the role of marketing data and analytics has become essential. It helps us identify the most valuable programs, assess the impact of A/B tests, and optimize our way to high performance.

At Gimme Seaweed, we’ve embraced this change with open arms. About a year and a half ago, we started capturing and manually aggregating marketing metrics by business objectives. Earlier this year, we were able to automate this process, which allowed us to get real-time marketing performance data. We are currently integrating AI to enable campaign management automation, the pièce de resistance in our plan for seaweed world domination.

MZ: How have conversations with your C-suite and board changed as you take on new accountability in driving and proving business value?

DN: The conversation with the C-suite and board has definitely changed in response to these new demands. A significant portion of our focus now goes into creating a shared understanding of what drives marketing performance in 2023 compared to years past. This helps lay the foundation for focusing on the right business objectives and KPIs.

Unfortunately, there’s a lot of noise surrounding Marketing today, including no longer effective legacy practices that continue to have broad adoption, well-intentioned but often misguided business partners, false prophets, lack of alignment on KPIs, and inconsistent metric definitions across channels, to name a few. This noise can sometimes make building a shared understanding between key stakeholders difficult.

In the midst of all this chaos, having solid data at our fingertips has proven to be extremely helpful. It’s like having a reliable compass that helps us navigate through the fog, bringing a dose of clarity and objectivity to discussions.

MZ: Within your organization, how do you partner with other internal business units and teams to unlock new opportunities for driving growth? Has this evolved in recent years?

DN: I am definitely seeing increasing levels of cross-pollination between functions, especially between marketing and sales. Several developments in the CPG industry in recent years are fueling this trend and helping blur the lines between these two functions. Most notably, the push for marketing to demonstrate its impact on sales, the emergence of retail media as a primary marketing channel, and retailers’ increasing focus on eCommerce, which relies heavily on digital marketing support.

For these reasons, many CPG companies, including Gimme Seaweed, now house eCommerce in marketing. This shift has facilitated the dismantling of silos, enabling a more fluid allocation of marketing funds to where performance is strongest. Moreover, it has fostered a tighter knit between marketing and sales, creating a symbiotic relationship geared toward unlocking new avenues for growth.

MZ: Last year, we published a report, “Brand and Demand Marketing: A Love Story” which speaks to the tensions between brand and demand marketing and why working in silos harms performance. We believe both are critical functions that need to work together to enable success. How do you balance brand and demand within your marketing organization?

DN: To me, the ongoing debate between brand and performance marketing seems a bit silly, almost like a misunderstanding of the fundamental aspects of a well-rounded marketing plan. It’s essential to recognize that these aren’t optional components you can choose from but integral elements of a successful marketing ecosystem.

To put it in simpler terms, let’s liken this scenario to farming. Think of brand marketing as the act of planting seeds, nurturing the ground for the next season’s crop, and setting the stage for future bounty, in other words, future demand generation. On the flip side, performance marketing is akin to harvesting the crops we painstakingly nurtured in the previous season, reaping the rewards of our efforts by capturing conversion-ready demand.

However, the catch here, and what most people overlook, is that in this metaphorical world, farms don’t have fences guarding them. This lack of barriers means anyone, including our competitors, can swoop in and harvest the crops we’ve nurtured with so much care. It’s a wild, open field out there, and a robust performance marketing strategy acts as our safeguard, ensuring we reap the benefits of our hard work without leaving room for competitors to cash in on our efforts.

But it’s a delicate balance. Performance marketing cannot be ramped up beyond the existing level of demand without facing diminishing returns. It’s about finding the sweet spot where we’re not leaving money on the table, yet not overspending to the point of undermining our performance.

I must admit, I am very appreciative when competitors neglect performance marketing. It essentially gives us the green light to bring our combine into their fields to harvest their crops. I like harvesting.

MZ: In the report, we found there are four common principles that most effective markers follow for success:

- Anchoring Marketing Investment in Business Objectives

- Experimenting to Win

- Building a Modern Marketing Organization

- Putting the Customer at the Center

Do you agree with these principles? Are there any examples you can share where you’ve been able to implement them?

DN: We practically live by those principles at Gimme Seaweed! Each of our marketing programs nests under one of three business objectives. And it’s the business objective that defines the KPIs that will be used to measure performance, not the program. Aligning marketing programs and metrics to business objectives keeps the focus where it should be, and this, in turn, accelerates growth.

An additional element that has proven incredibly helpful has been allowing working dollars of programs that nest under the same objective to flow freely where KPI performance is strongest. This makes these programs compete for funding and creates the conditions needed for continuous improvement. It’s a bit of a Darwinian approach that fosters the survival of the fittest strategies and maximizes value creation.

MZ: What are some top challenges you anticipate in the next 6-18 months? What are you doing to help your organization plan and overcome those challenges?

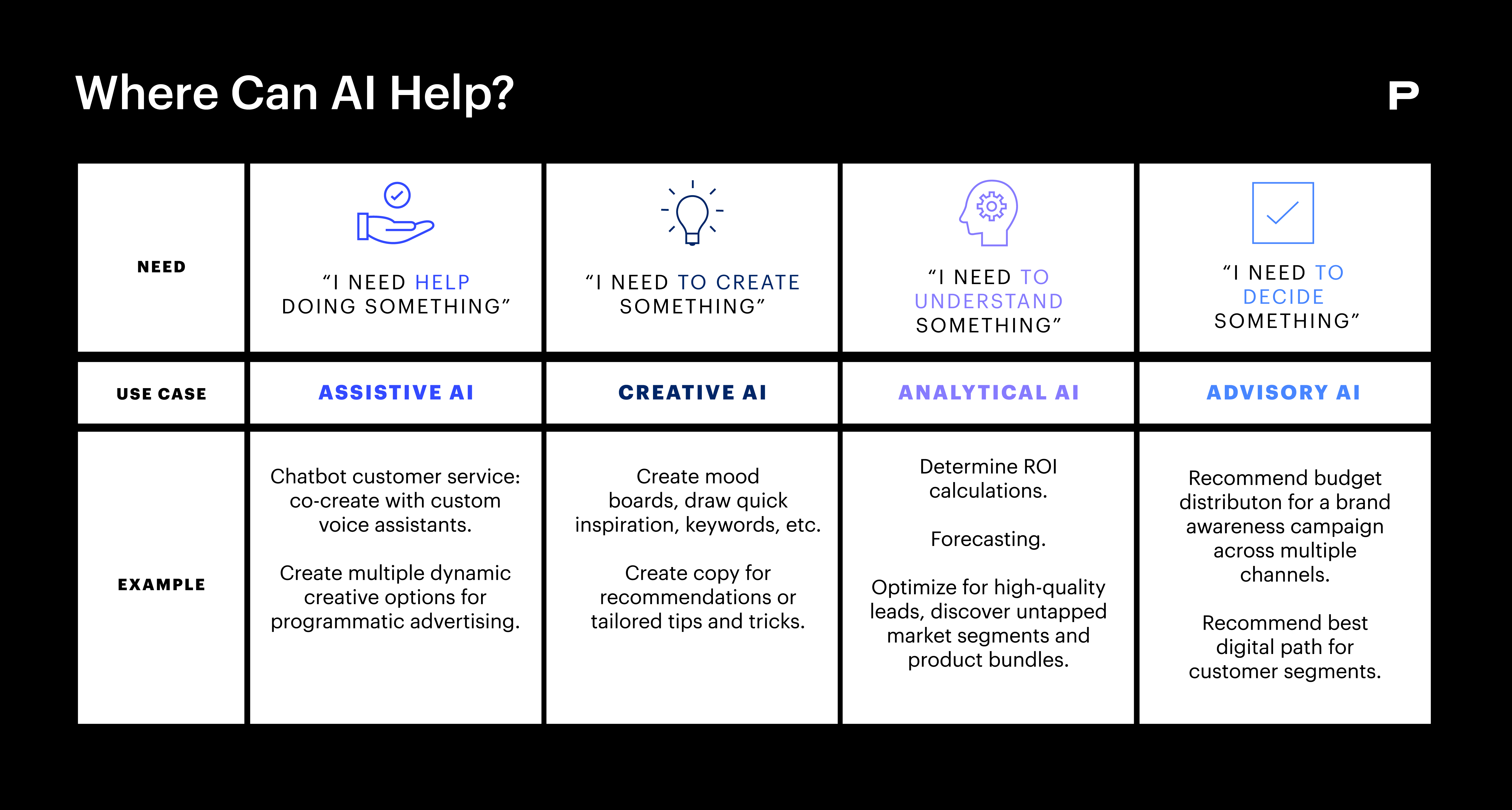

DN: Let’s tackle the giant, looming question that’s on everyone’s mind: the rise of AI and its profound impact on the marketing world. At the risk of oversimplification, CPG marketers have two big jobs to do. First, there’s the creative side of things, where we dive deep into brand strategy, target consumer selection, brand positioning, visual identity and the overall tone of our communications. Then, there’s the logistical side, where we focus on efficiently delivering these crafted messages to our target audience, navigating the intricate maze of marketing mix, platform selection, campaign management, data analytics, and marketing spend allocation.

Even though we’re still in the early stages of AI’s integration into marketing, it’s becoming increasingly clear that the logistical side of marketing is about to see a seismic shift. The intricacies of managing campaigns, analyzing data, and optimizing performance are about to skyrocket in complexity. Soon, it may become nearly impossible for marketers to handle these tasks without the aid of AI. The landscape is evolving so that those who embrace AI and its capabilities will have a significant edge over those who don’t. The divide is going to be stark, almost binary in nature.

At Gimme Seaweed, we’re not just watching from the sidelines but actively gearing up to stay ahead in this race. I envision three pivotal elements that will anchor our marketing endeavors in the coming months: access to real-time marketing performance data, harnessing the power of AI for data processing and analytics with well-defined decision parameters and leveraging AI for seamless campaign automation. With these in place, we aim to be agile, identifying and capitalizing on real-time performance opportunities. This approach will allow our marketing investments to flow toward areas of peak performance within each of our meta-objectives.

The current wave of innovation and the potential it holds is genuinely exhilarating. Every day feels like a new learning opportunity. I’m wholeheartedly diving in, eager to absorb as much as possible to help steer Gimme Seaweed towards the best possible future.

About Mat Zucker

Mat is a senior partner and co-lead of Prophet’s Marketing and Sales practice. He helps clients transform digitally, finding new areas of growth in marketing, content and communications. Previously, Mat was the Global Executive Creative Director at Razorfish, served as Chief Creative Officer at OgilvyOne New York and held leadership roles at R/GA and Agency.com. In addition to helping clients creatively connect and engage with their customers, he hosts two podcasts, Cidiot and Rising.

Are you interested in talking with Mat? You can contact him, here.

ABOUT THE SERIES

In our new series, Brand and Demand: The Interviews, Prophet experts sit down with CMOs and marketing leaders who are unlocking demand, driving uncommon growth and building relentlessly relevant brands to get their takes on the top trends, challenges and opportunities they face in today’s disruptive world.