BLOG

Marketers’ 2023 and 2024 Planning Do-More-With-Less Bootcamp

Budget tightening is this year’s corporate mantra. Here are seven steps marketing leaders can take to drive meaningful growth with fewer resources.

Ask any marketer, and they’ll tell you that 2023 has been a year of budget cuts and canceled launches. According to Gartner’s CMO Spend and Strategy 2023 Survey, 75% of senior marketers reported being asked to do more with less. As budgets decrease, marketing expectations significantly increase, with 86% of surveyed senior marketers agreeing their organization must undergo significant changes in how they work to achieve their goals.

Right now, that near-universal do more with less directive is an especially bitter pill. Marketers still have whiplash from the last few years, with some businesses seeing massive contraction during the pandemic and others experiencing dizzying growth, resulting in competing interests between brand and demand. Many hoped for at least a glimmer of normalcy.

Between inflation and rising interest rates, the likelihood of a recession has become a daily odds-making game for economists. The risk is falling. Yet many, including CEOs, investors, legislators and consumers, are already entrenched in a `vibecession.’ They feel things are bad, even if economic indicators don’t support that view. In conjunction with the disruption of the last few years, it has become almost impossible for marketers to rely on historical planning processes and requires them to maximize flexibility, even as budgets and resources diminish.

This uncertainty isn’t necessarily bad news for the creative and agile marketer. After all, disciplined belt-tightening can allow marketing leaders to reflect, establish new ways of working, and find creative ways to deliver maximum value with their current resources.

As marketers look to close the year strong and head into 2024 planning, we’ve identified seven critical steps marketing organizations should take to strategically balance and blend brand and demand marketing agendas and inform next year’s planning efforts that are fast upon us.

1. Translate Business Objectives Into Quantified Customer Goals

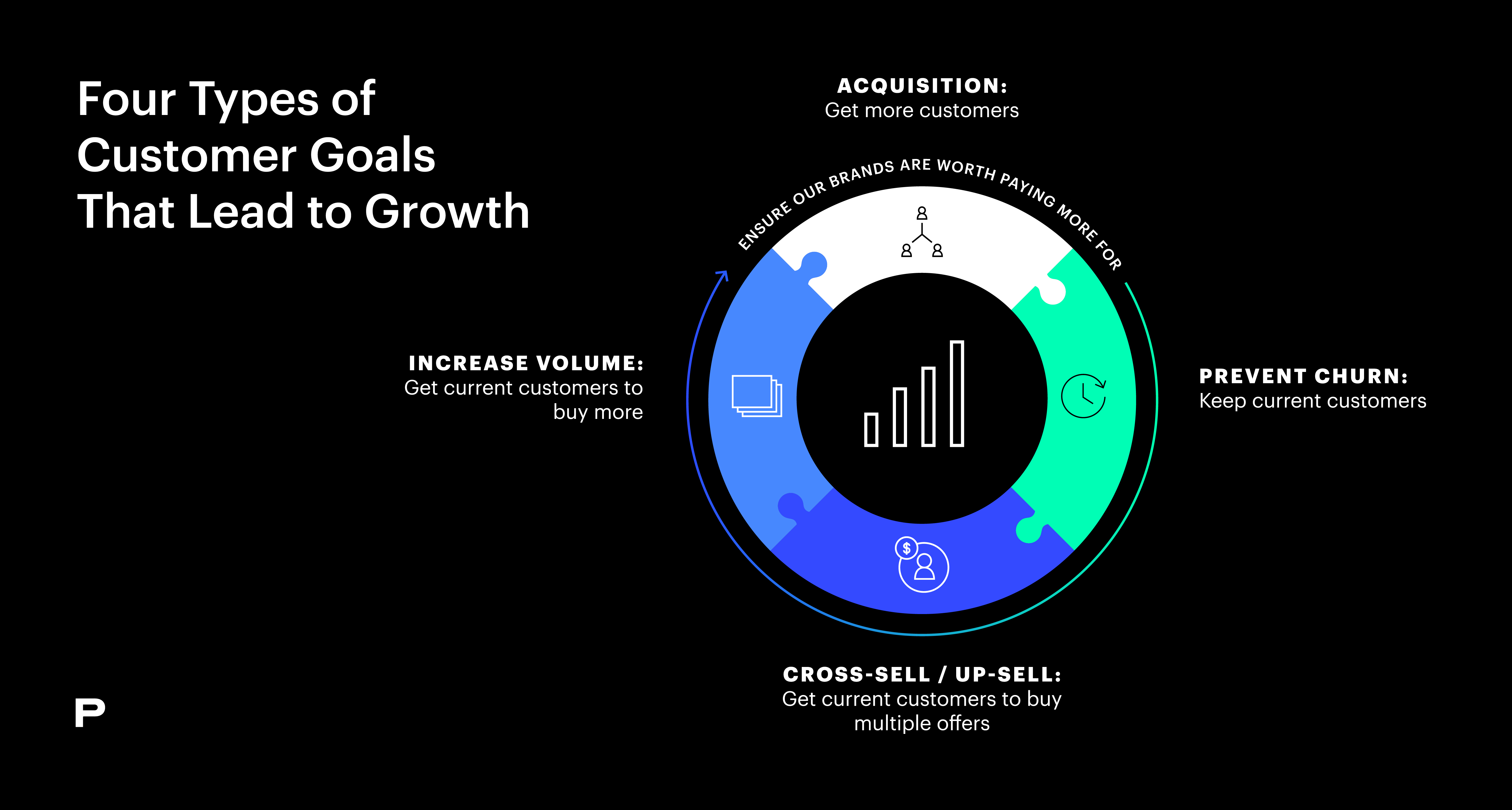

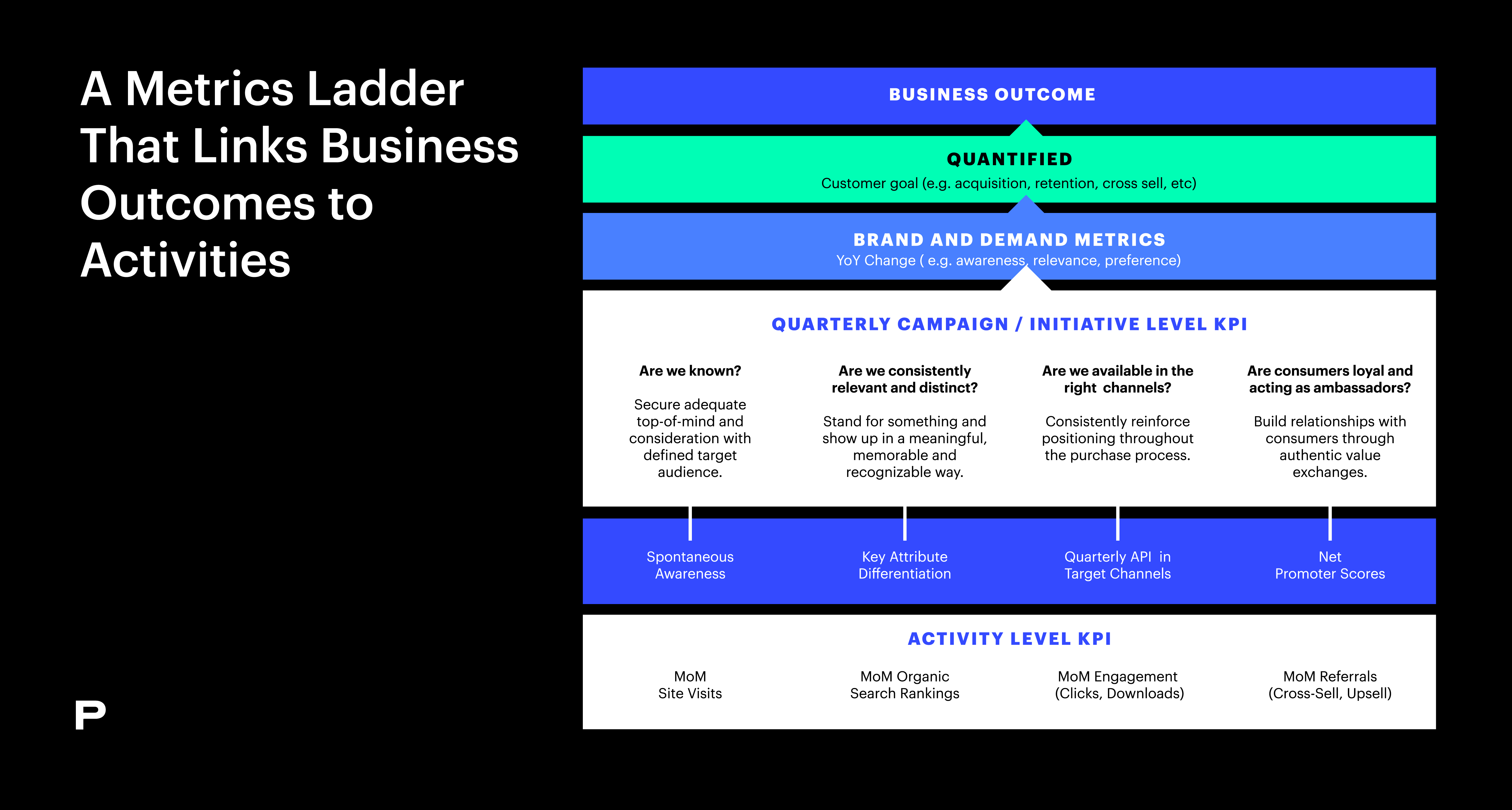

The first and most important part of doing more with less is to remain diligent in driving business outcomes with a customer-focused lens. All activity should point directly at delivering business value for the short and long term. Ensuring you have customer-focused goals based on acquisition, retention, cross-sell and upsell and making your brand worth paying more for is the foundation to maximize resources.

Once you have set your goals, you must regularly track and align your efforts to the business outcomes your organization expects marketing to influence or drive. To do this, we recommend developing a leading and lagging metrics ladder and establishing quarterly check-ins with your team. By doing so, you will know what is working in your marketing plan and feel more confident that every element of your marketing budget is maximized and driving ROI. And if you notice that marketing efforts are underperforming, you’ll be in a better position to quickly pivot your efforts.

Learn more on how you can anchor your marketing activities and investments in business outcomes in our global research report, Brand and Demand: A Love Story.

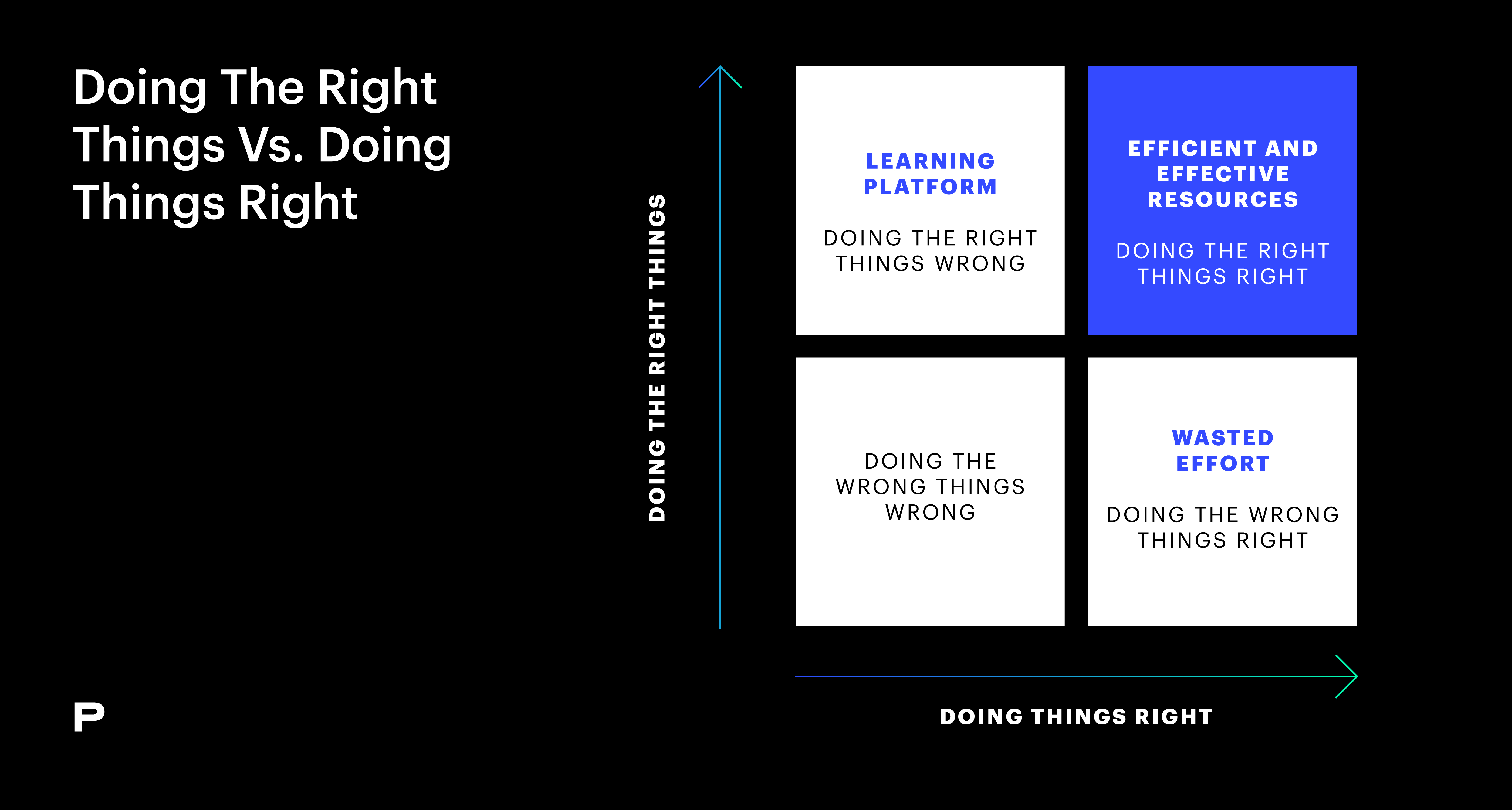

2. Do Fewer Things

Peter Drucker famously wrote, “Management is doing things right. Leadership is doing the right things.” The same is true with marketers. Every dollar works as hard as possible, but the success of your budget is dependent on whether you invested those dollars appropriately, which is why marketing leaders need to prioritize growth opportunities and continuously analyze and optimize to ensure those efforts are practical and efficient.

Obvious, right? But in a world where specialists and digital marketing skills are at a premium, many companies are overspending to build executional muscle in modern marketing tactics. But while they are actively improving their search and social skills, for example, they may lose focus on why they are in those channels in the first place.

Companies can do more things right by doing fewer things and staying laser-focused on driving business outcomes and customer goals. Before greenlighting any initiative, even small ones, you must ensure they support those goals. When calculating the cost of your marketing efforts, measuring the cost in dollars and the resources and time your team needs to invest in executing is critical.

Here are some key questions to help marketers prune the marketing calendar. If you’re feeling advanced, you can build a scoring system to help you prioritize.

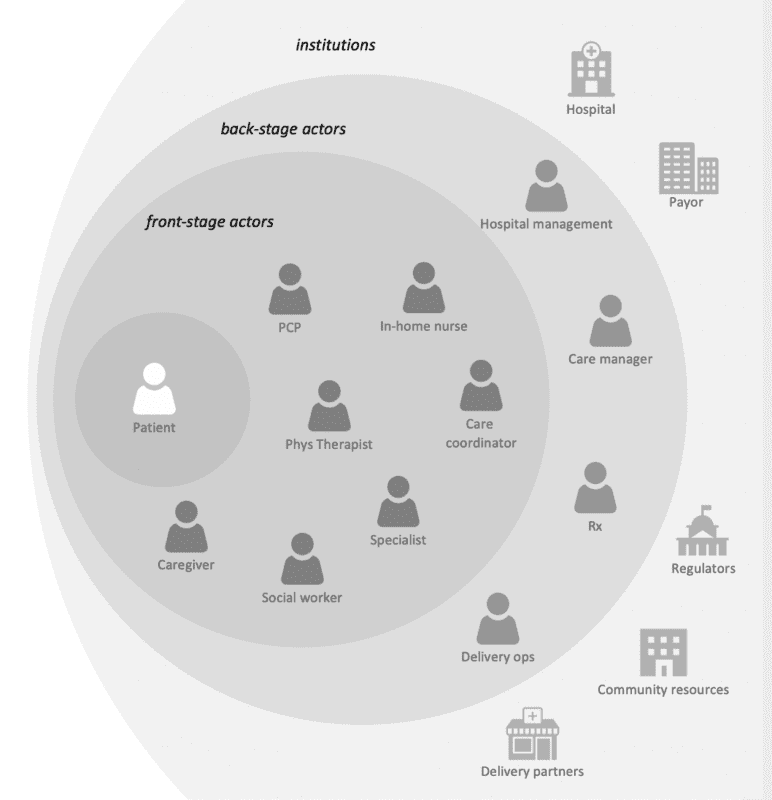

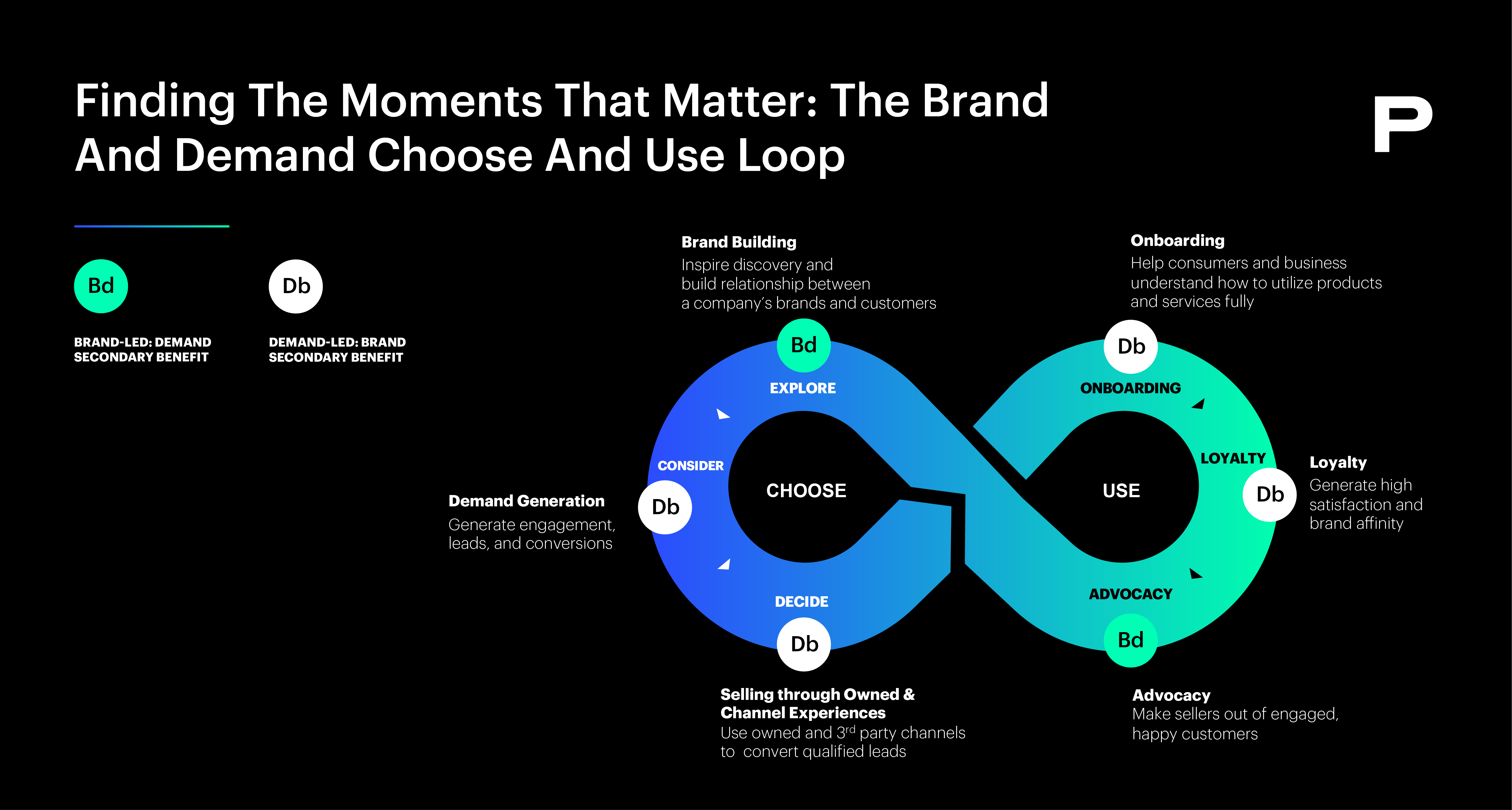

3. Prioritize Moments That Matter Most in Your Customer’s Journey

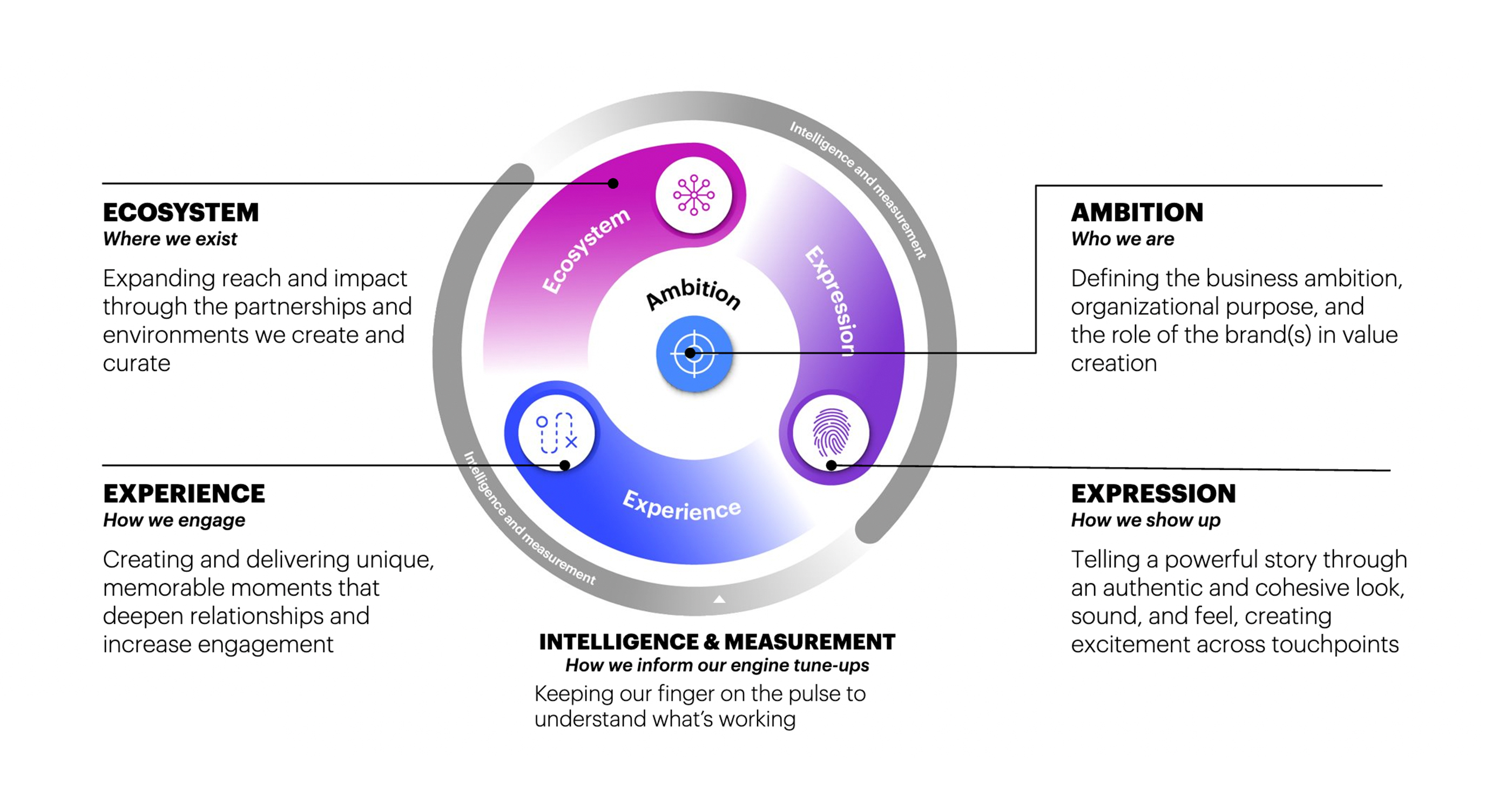

As our Brand and Demand: A Love Story report noted, journey-based planning has become critical in the digitally driven marketers’ toolbox. However, as marketers adopt this concept, many need to work harder to make the most out of every moment in the journey, which spreads resources too thin and splinters impact.

Studying the journey keeps organizations customer-centric and uncovers opportunities. But to maximize usefulness, marketers must decide on the most critical barriers to address and seize opportunities to build out the signature and memorable moments.

Prioritizing the moments that matter the most in the customer journey calls for tough choices, especially when you need to do more with less. Marketing leaders prioritizing customer acquisition will likely lean toward awareness and consideration moments, while those focused on retention and loyalty will probably lean toward post-purchase moments. One thing to note when prioritizing these moments is to make a list of those that you are choosing to ignore now. Eventually, marketing budgets will increase again, and the moments you deprioritize can be revisited.

Once you have prioritized your moments, you must ensure your teams leverage these moments for brand and demand opportunities. After all, doing more with less is sometimes doing two things simultaneously! By doing so, it will be easier for your team to make the right choices about the appropriate channels, experiences and messages you need to serve your customers and, at the right time, to drive results for your organization.

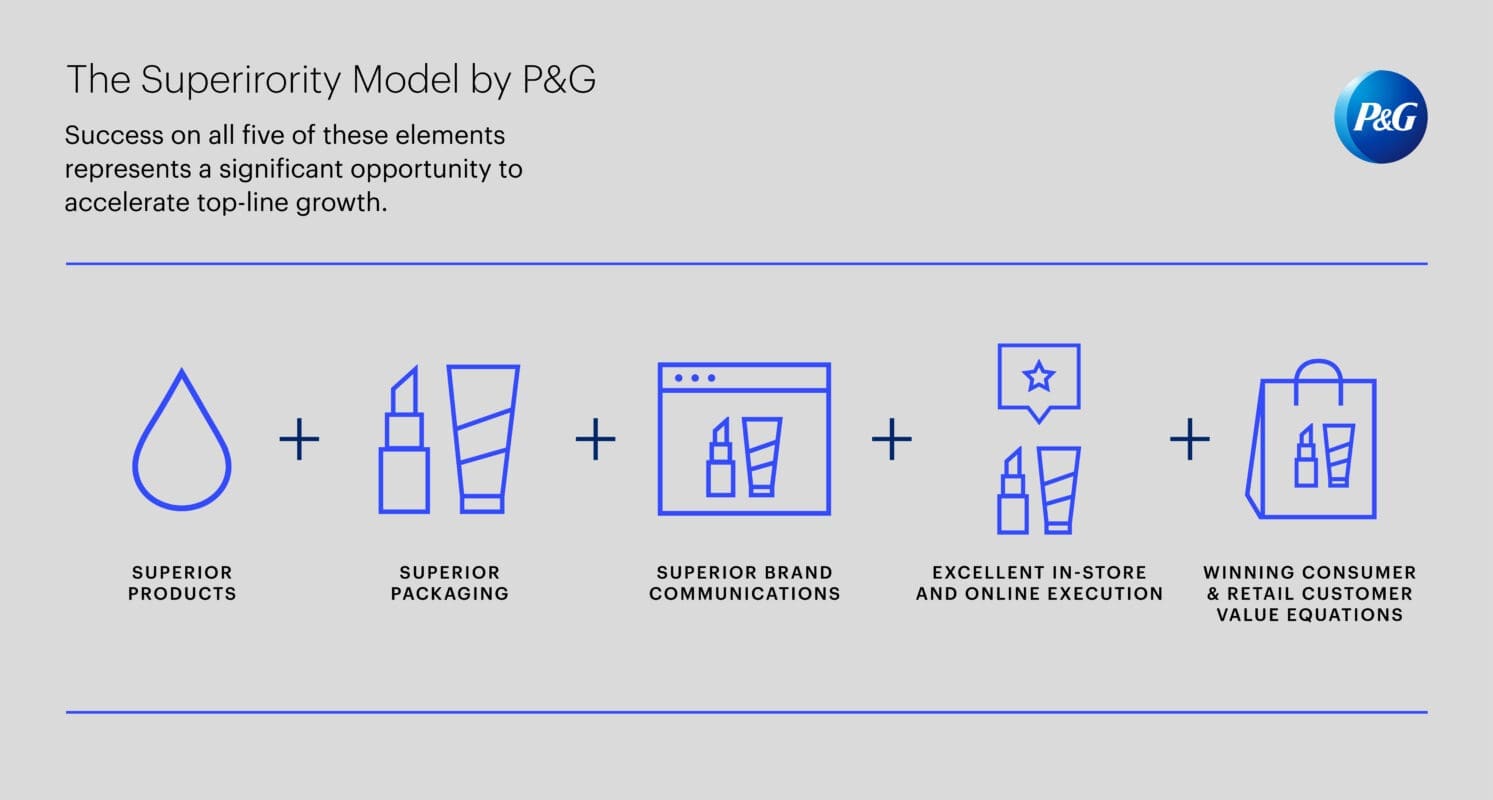

4. Sharpen Your Value Propositions- Superiority That Matters

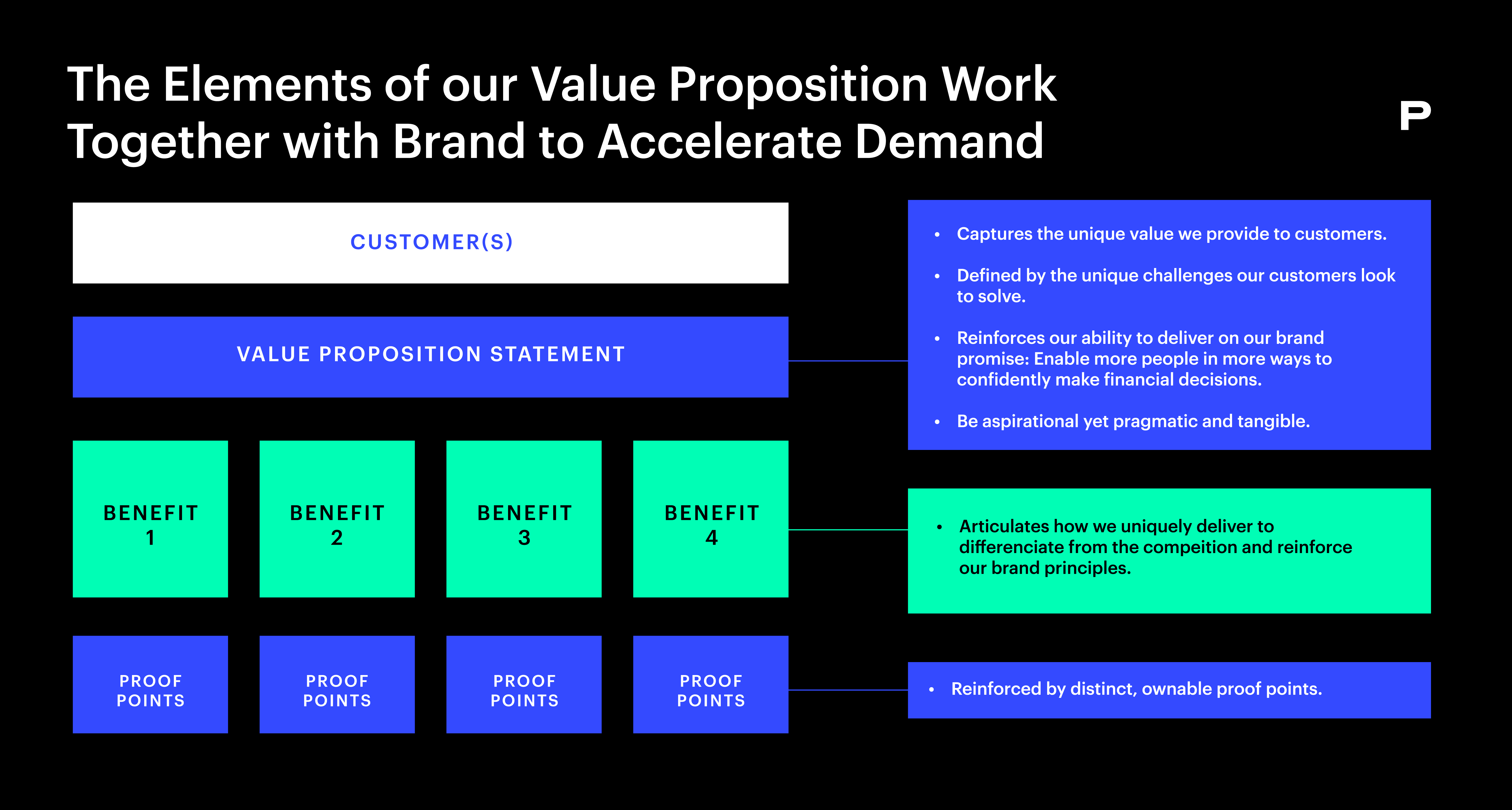

To stay relentlessly relevant and earn customer respect and loyalty, strong brands must deliver meaningful, purposeful connections that appeal to people’s emotions with distinctive brand Purpose, Promise and Principles. At this point, many brands clearly understand why they exist and what they do. Still, in this low-spending climate, where every dollar counts, brands should revisit how they think about functional benefits, quality and superiority claims.

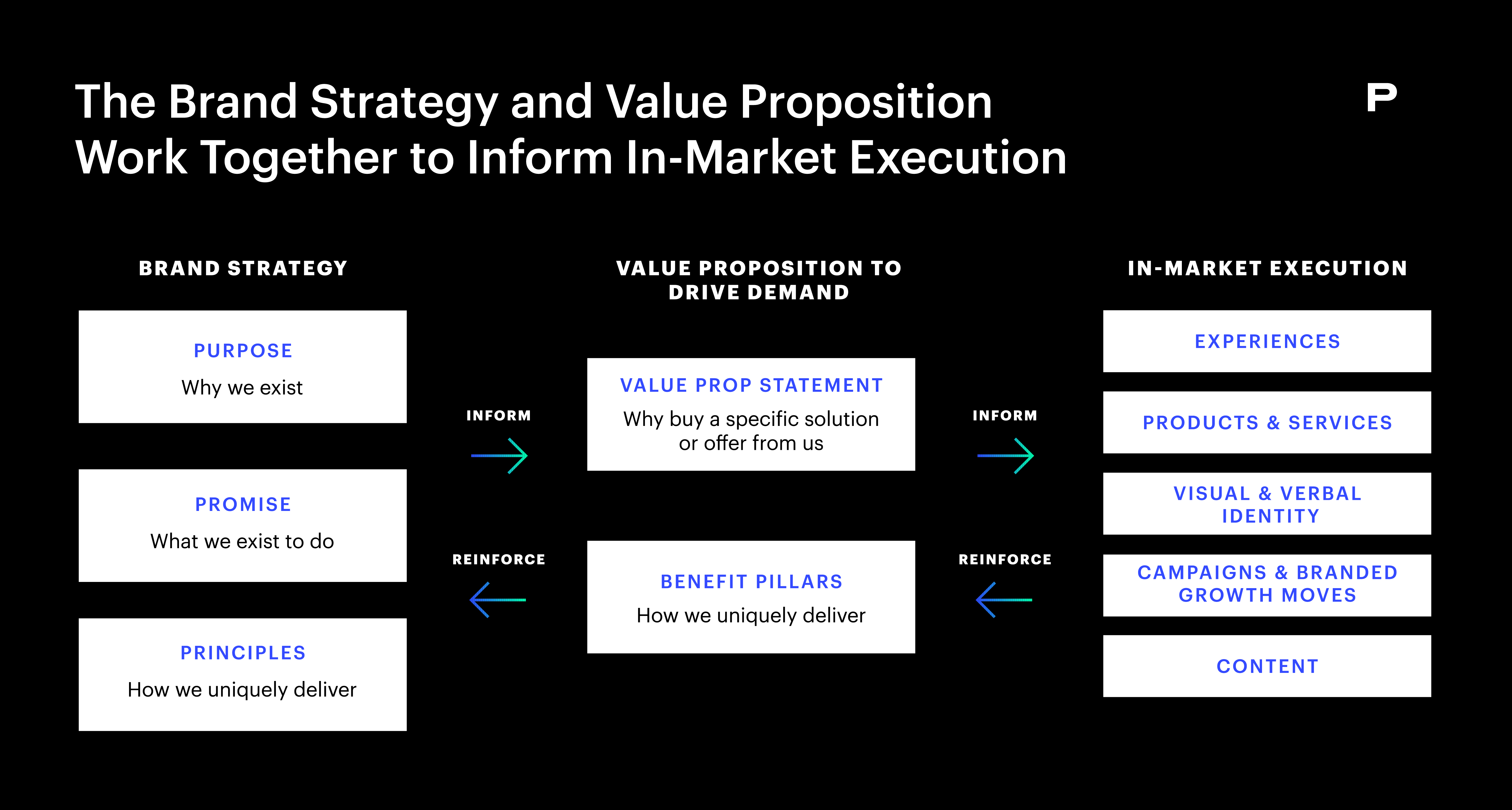

When budgets and resources are constrained, it is a best practice to revise and sharpen your demand-based value proposition at the umbrella brand and product level, ensuring that product-level promises are crisp, compelling and competitive. And, even more than that, based on things that your target audience can experience. Superiority in the lab or around the margins is one thing, but superiority that people can see and feel, that makes a real difference is another thing. Weaving those promises to reinforce and inform the brand story, and vice versa and ensuring that they are reflected across all in-market executions can boost short-term revenues, even as they support long-term brand health.

Revisiting your value proposition may mean returning to tried and true basics while challenging assumptions within your organization. It can also result in your team reconsidering old-fashioned benefits and features to sharpen your customer value story, which should evolve and grow as your customer needs change.

As you do so you should think through these critical questions:

- What are the specific tensions, meaningful benefit pillars and proof points that are critical to deliver on the brand promise?

- Do these need to change for different customer audiences?

- How can we uniquely deliver superiority that matters to customers?

- Are our proof points ownable and tangible?

- Are the brand and demand value stories tightly interwoven?

- How can you test and learn before market scaling?

5. Give Your Creative Assets a Make-over

In recent years, much of the focus for marketers has been on where and how communications are delivered. It’s impressive how far many have come as they build expertise in performance marketing, owned and earned media, SEO and SEM.

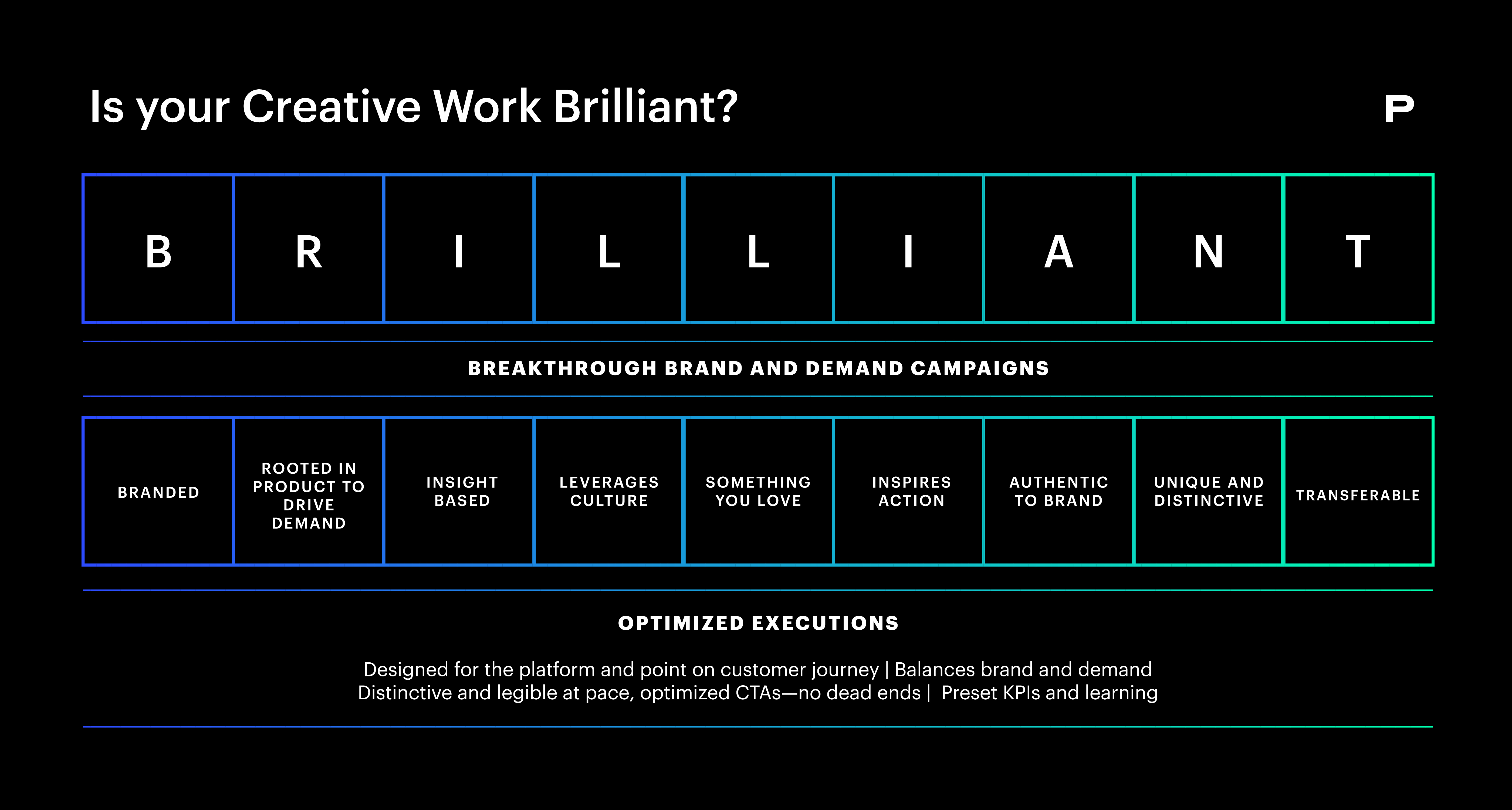

But many people forget that data shows the success of a campaign is dependent on the quality of the creative. Brilliant campaign ideas and breakthrough experiences are a must-have. Creative work at every point in the journey needs to be branded and rooted in demand-based product truths. It’s not enough to love an asset on the drawing board. It has to stand out in the specific context in which people will discover it.

During times when you need to do more with less, it’s a good step to build upon your basics. Below is a sampling of a few ways you can do this:

- Add more demand marketing strategies to your top-of-funnel efforts.

- Dial up your brand messaging during the purchasing stage of your customer’s journey.

- Sweat your call to action (CTA). You should vet and optimize your CTAs, even if you’ve used them a million times.

- Ensure every experience and touchpoint leads your customers to the next milestone in their journey and propels them to the conversion and loyalty stages.

On a side note, many marketers are integrating AI into their creative process to drive efficiency in their process and execution. We will touch on this more below.

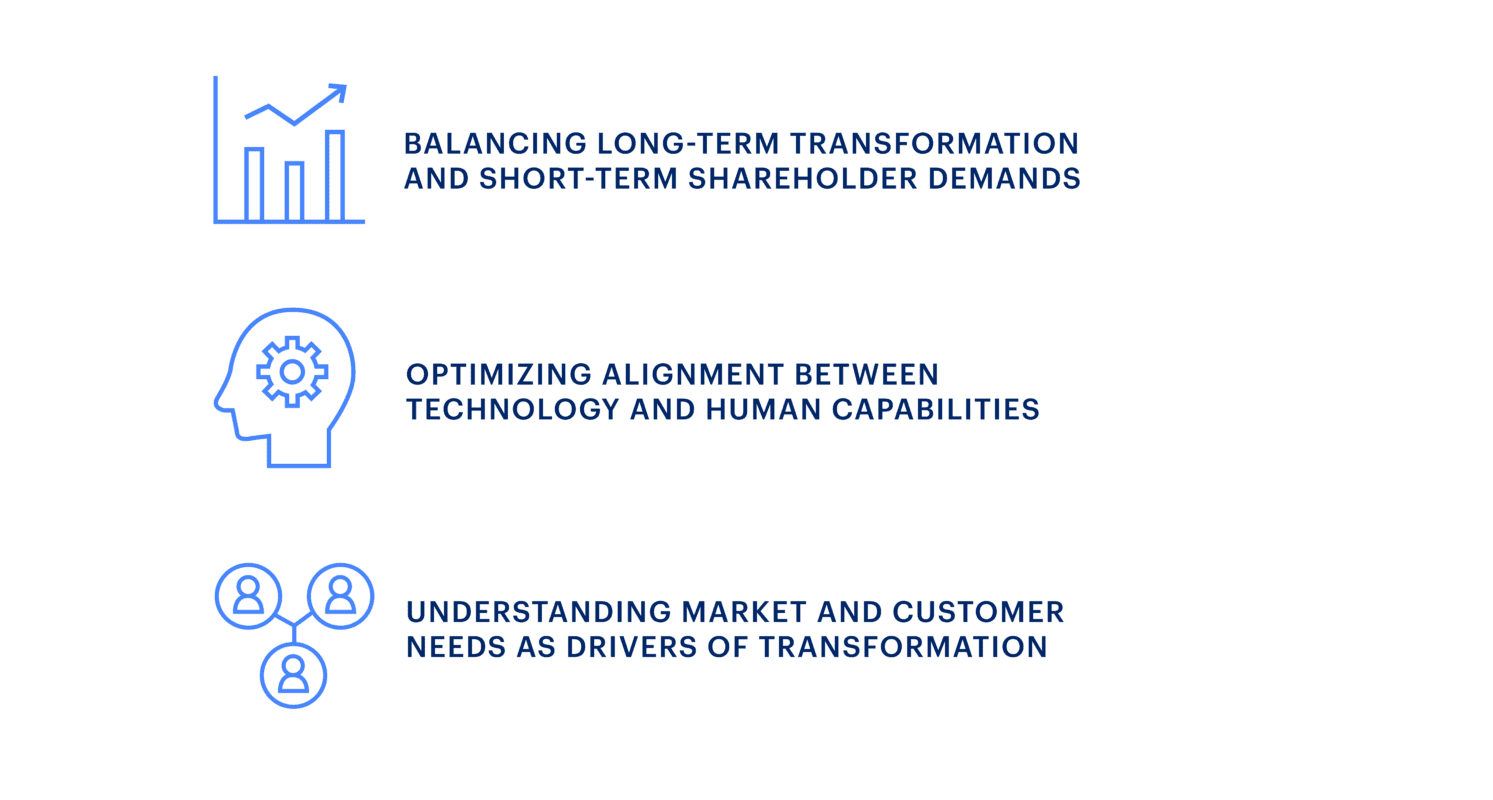

6. Leverage AI to Do More With Less

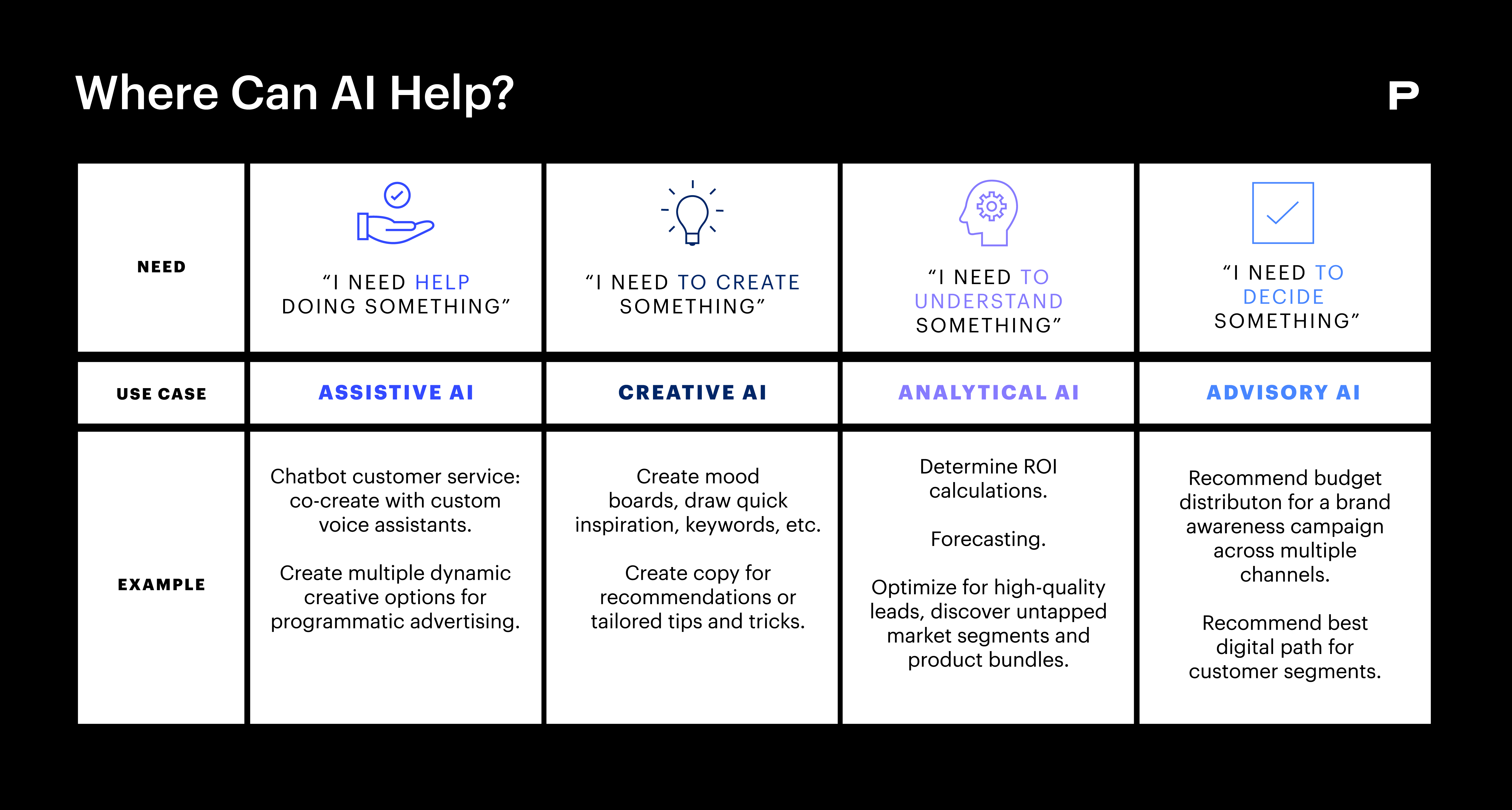

AI and machine learning, have played a critical role for marketers for several years. After all, both power programmatic buying, personalized messaging, predictive analytics, buy-now recommendations and chatbots.

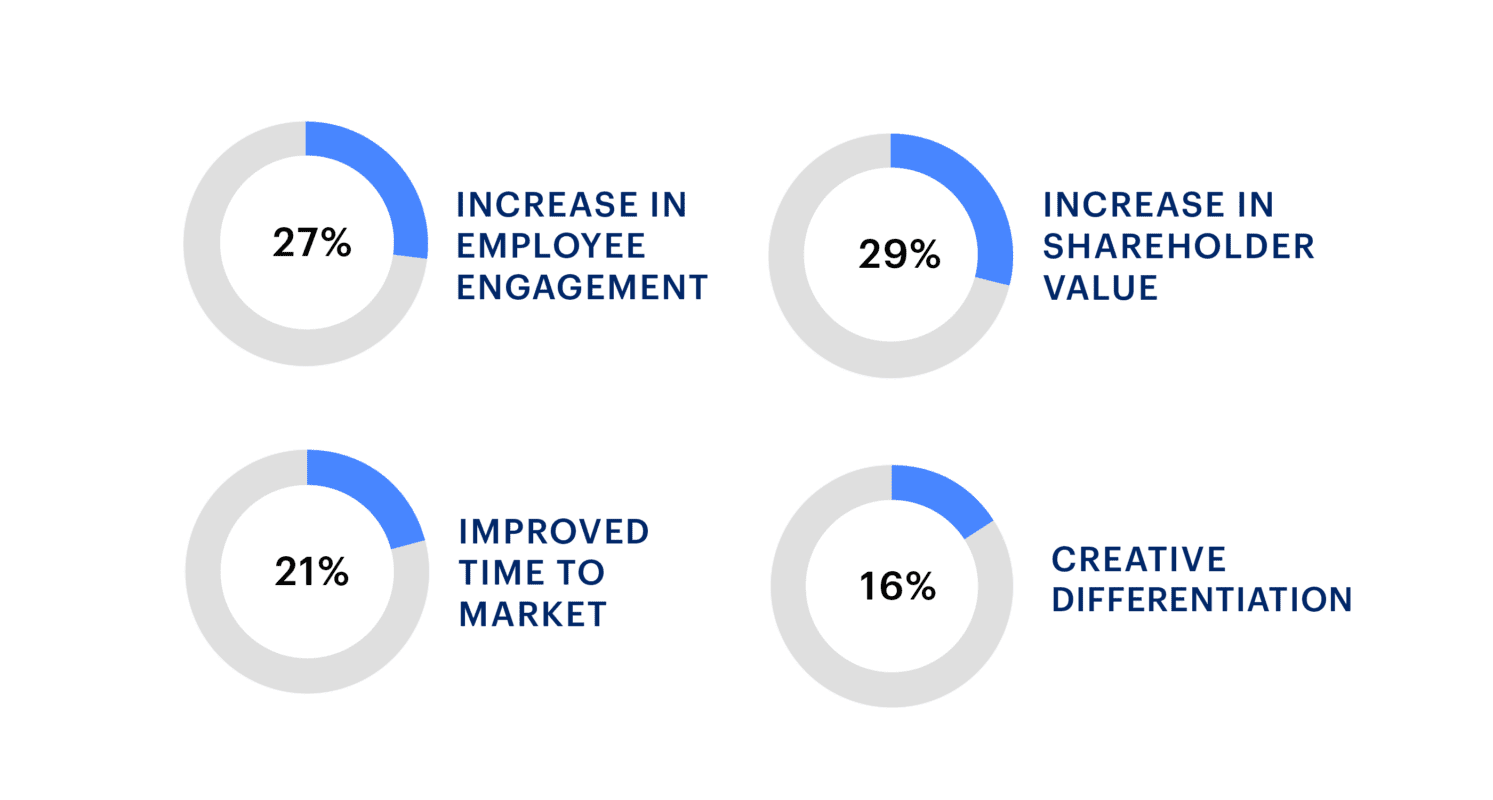

But, with the recent rise of ChatGPT and generative AI tools, businesses have begun experimenting with new ways to increase productivity and effectiveness. It’s becoming clear that the marketing teams that leverage AI tools can magically add more hours to their days.

While we are at the beginning stages of this new evolution of generative AI, we have identified four key areas of AI that can help support your marketing efforts and teams today.

AI is evolving fast, and marketers must remember that what they learned last week is outdated. Yet even in its infancy, it has the potential to save money, free up hundreds of hours and improve effectiveness.

7. Elevate Scenario Planning

It sometimes feels like we are working in patchy fog. Will the “vibecession” give way to a real one? Will do more with less be the bumper sticker for just a few more quarters or the foreseeable future? No one knows. But effective scenario planning can mean the difference between simply surviving unexpected curveballs or thriving because of them. It’s the difference between mourning and moving.

People often think of scenario planning as dealing with the long-term future for outcomes that are years away. But why not use it for the near term to proactively address scenarios that may jeopardize the ability to reach any prioritized goal? It can even be used at the level of an individual initiative to ensure quick response to in-market performance.

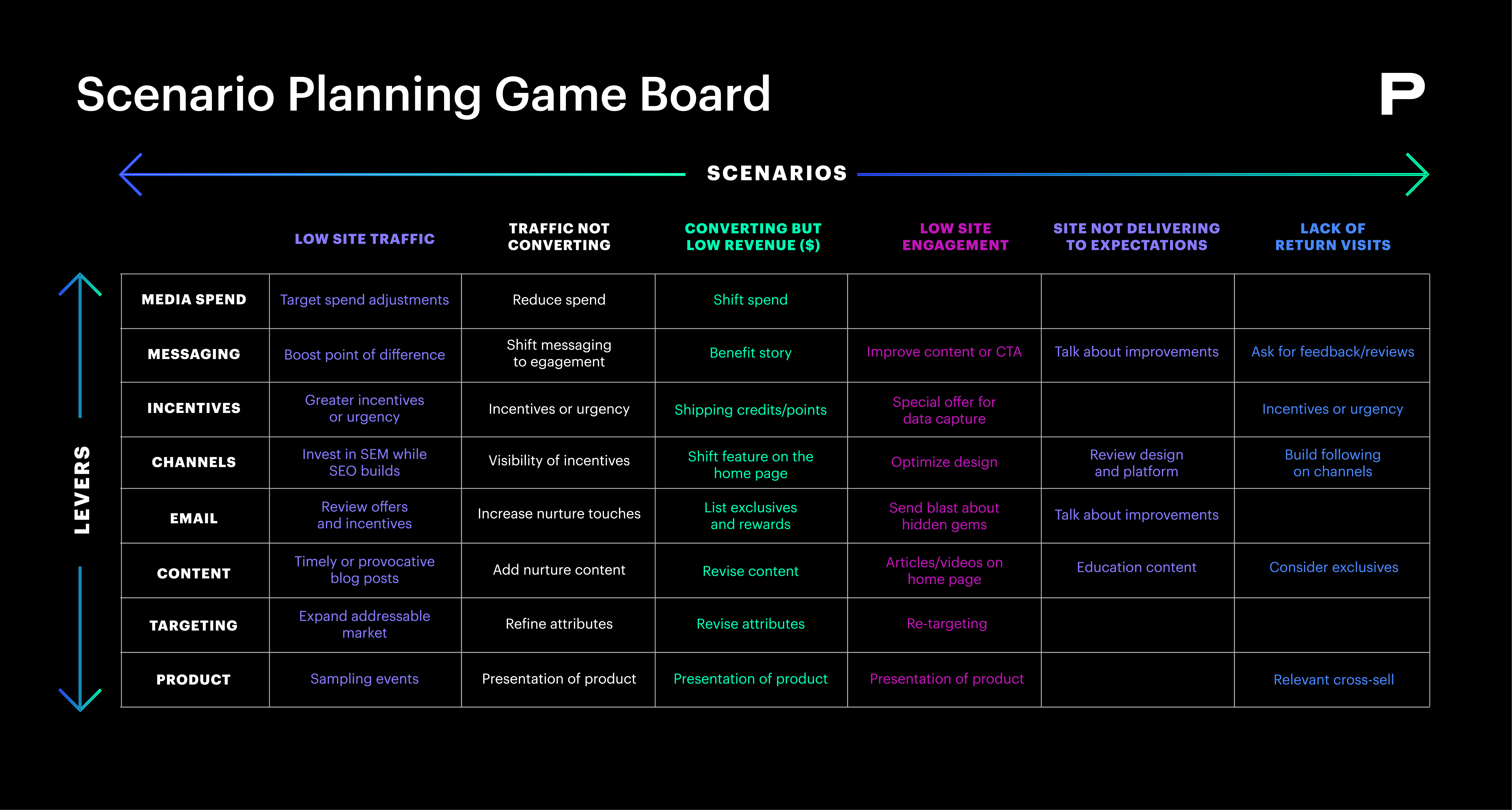

Think of scenario planning as a game. A game board like the one below can be used to help with thinking ahead on owned-asset performance. We recommend building a cross-disciplinary team to scenario plan for your next launch, campaign or initiative. You can use this gameboard to strategize how you might react to potential scenarios, such as shifting media spending, changing messaging or revisiting content and social strategies.

From there, teams can think about how best to codify and socialize the contingency plans, including the owners of levers.

The job isn’t over when the game board is completed. Identifying when, how and who is responsible for tracking and implementing is critical. Additional cross-functional planning sessions can allow follow-up on hot topics and assign owners to chosen levers.

Learn more about scenario planning in our recent AMA article.

FINAL THOUGHTS

Instead of thinking about doing more with less as negative, think of it as a path to unlocking uncommon growth. By intensifying customer-centricity, doing fewer things, focusing on moments that matter, sharpening value propositions and befriending AI, marketers can navigate the challenges of constrained resources and emerge stronger. These back-to-basic exercises increase impact, build resilience, and pave the way for meaningful long-term growth. Interested in learning how you can do more with less? Contact Kate Price or Mat Zucker to get started.