Major challenges to life and the planet are mounting. Many of them, like extreme weather events, are only a precursor to far greater threats to life as we know it. Sustainability is the solution to these challenges, but time is not on our side. Progress towards the UN Sustainable Development goals (SDGs) set in 2015 – “to end poverty, protect the planet and ensure that by 2030 all people enjoy peace and prosperity” – has been disappointingly slow – not least because the scale of collaboration it requires across government, business, the non-profit sector and the public is immense.

Against this background, we want to know what should be done, what can be done and what action we can take now, not simply as consumers, employees and investors but as people. As we increasingly choose brands for their commitments to make a difference, business leaders are sharply focused on their Environmental, Social and Governance (ESG) activities to build sustainability. Shareholder returns are no longer an accurate measure of success. Now organizations must create value through their ESG efforts for all their stakeholders.

There has been a varied landscape of responses to these challenges. Organizations in some sectors have, by their very nature, long been conscious of their mandate to operate, such as those in mining. Some organizations like Unilever have been progressive, acknowledged consumer demands and adopted the UN SDGs early, while others were built for ESG – from The Body Shop to Patagonia. However, many more are still searching for the appropriate growth journey that embraces and integrates ESG in the post-pandemic world.

Reconciling Sustainability and Growth

Sustainable growth is now a widely accepted mantra. However, it is far more complex to achieve, as organizations must balance the demands of diverse stakeholders with those of the environment. And automation, digital and data are accelerating the scale and pace of business transformation.

These challenges aside, we firmly believe ESG will become an increasingly important driver of growth and transformation. How an organization defines and activates its ESG strategy within its overarching growth ambition should influence every facet of its operations. Strategy and vision are one thing. But ethics and behavior prove the intent. Culture and organizational ways of working are “the rubber” where ESG strategy “hits the road”.

It’s a mistake to dismiss the alignment of sustainability and growth as an “internal” challenge. Given the complexity of partnerships and stakeholder engagement that ESG commitments bring, the need for organizations to build effective internal and external working relationships has never been so great. It’s a phenomenon and fundamental need we describe as “heightened collaboration.”

“We can’t make people want to save the world – we don’t define the rules. But we can show people what we can achieve, when we work together.”

Larissa Alghisi

Chief Communications Officer, Julius Baer

In this report, we explore heightened collaboration in-depth, outlining its character and composition and how it is achieved. We will also see that without this collaboration and the action it drives, ESG strategies can flounder and fail and are easily dismissed and discredited as greenwashing.

Prophet’s Position

Prophet is a global consulting firm that believes in unleashing the power of people, businesses and brands to move society forward and unlock uncommon growth. Within our Organization & Culture practice, we believe that uncommon growth begins by unlocking the full potential of human-centered organizations.

For the past four years, Prophet has conducted a major study, “Catalysts,” across the globe to examine culture and transformation – identifying the key levers within an organization’s culture system that achieve effective and sustained change.

Unpacking the Power of Collaboration

In “Catalysts: The Collaborative Advantage,” we looked closely at what it means to collaborate effectively. Collaboration in the workplace is a long-standing challenge. However, it is more relevant than ever, as organizations need to solve increasingly complex challenges and develop more holistic customer solutions faster.

Our findings revealed that despite optimism amongst senior leaders, half of all organizations still struggle with effective business-wide collaboration, even in face-to-face environments. With remote and hybrid working well-established, there’s a clear need to add muscle to this organizational skill.

“ESG will do a lot of good for a lot of businesses. But it is going to result in significant changes in how organization operate in terms of governance and processes, all of which will require a great deal of collaboration across teams”

Shari Hofer

Chief Marketing Officer and EVP, Wiley

Heightened Collaboration and ESG

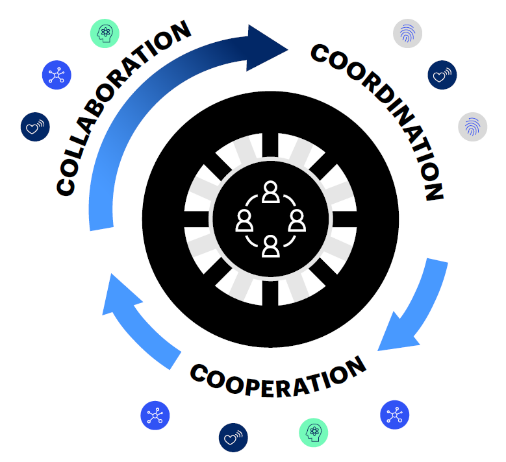

More positively, our research underscores collaboration’s power to unlock the potential of more human-centered organizations. Working together effectively brings clarity and purpose to both the organization and its individuals. And collaboration’s power to accelerate transformation is captured in the report’s key takeaway: our Collaboration Flywheel.

Against this backdrop and our hypothesis that heightened collaboration is essential to deliver ESG strategies and the multi-stakeholder engagement they require, we reached out to business leaders globally. We spoke with 15 senior leaders to examine the links between the Catalysts report findings and their increased relevance to the ESG agenda. They were drawn from various industries and geographies with backgrounds in sustainability, strategy, supply chain, marketing, HR and front-line operations.

This research validated our hypotheses, uncovering some key lessons on enhancing collaboration in service of ESG.

Emerging Research Themes

Four key themes emerged from our exploration. All of these build on the original levers identified in our Collaboration Flywheel, but they have particular relevance to achieving heightened collaboration in service of ESG.

Before we begin, a note on language. “Collaboration” was often used in the research to describe ways of working that are only part way, in our view, along the Collaboration Flywheel. These are more accurately “coordination” and “cooperation” rather than fully-fledged and effective collaboration. Most organizations involved are well-versed in coordination but acknowledge that bureaucracy and silos continue to challenge their ability to “give ground” for a bigger ESG cause.

Theme One: Persuasive Passion

Effective collaboration is often founded on a strong and inspirational leadership style. Leaders with purpose, who work towards a focused agenda and model a consistent organizational mindset, set a clear and accessible example to follow. Naturally, leading by example is only part of the equation, but commitment and energy spark true collaboration. We often respond to passion and chemistry before the process. A leader who displays pace and conviction can have a magnetic effect on their colleagues, catalyzing collaboration pervasively.

As well as inspiring others, these leaders must persuade colleagues to get behind shared goals and develop mutually beneficial ways of working. ESG goals are cross-stakeholder and sometimes require difficult conversations to balance conflicting needs. We shouldn’t underestimate how big an issue ESG is for organizations. It’s either embedded in what they do and what they stand for– so leaders are naturally at the forefront–or it’s about a change journey with leaders stepping up to set ESG priorities, align the organization around specific goals and find shared approaches that reconcile different agendas. Either way, priorities, goals and approaches can be identified with coordination and promoted with cooperation, but they can only ever be achieved with the momentum of collaboration– the momentum that so often begins with the energy and focus of a persuasive leader.

Client Spotlight: Polestar

As a leader in electric vehicles, ESG has always been part of Polestar’s DNA. Sustainability is omnipresent in the organization. Polestar is truly a global company with a global R&D function that includes teams in Sweden, China and the UK. And it is this global outlook that helps it drive collaboration in very different cultural markets.

Its CEO embodies the business’ passionate style of leadership. Polestar hires driven people with strong team skills, which the CEO channels by role modeling a very clear ‘one organization’ mindset with ESG at its heart. So, what does this style of leadership look like in practice?

“He is so clear on the purpose of Polestar: it has to be a cohesive experience all over the world. So, he is extremely clear our brand also has to be consistent wherever we are. One Polestar Experience, One Polestar Brand. He’s constantly driving the organization to think as one brand.”

Monika Franke

Head of HR, Polestar

From the Polestar example, we learned that when leaders visibly champion, reinforce and celebrate steps on their ESG journeys, they create a pull toward more effective collaboration.

Leaders like this build a movement, but that’s not all. They also create safe spaces to explore and challenge ambitions that can seem daunting to many—environments where individuals feel able to explore the connections with their own belief systems.

Theme Two: Personal Purpose

ESG collaboration starts with and requires true commitment from each individual. ESG-related initiatives tend to resonate with people’s values and identities, even more so than other work. Whether it’s improving the environment or creating a more diverse and inclusive workplace, ESG topics intrinsically motivate people, and they often feel deeply personal about them.

As a result, organizational cultural change around ESG is fueled by the personal belief systems of individuals. The challenge for leaders is to channel these personal beliefs to drive collaboration by ensuring individuals can see their values reflected in the ESG strategy.

What we consider the DNA of an organization – its purpose, values, EVP and strategy—is growing in importance for employees. It influences their motivations to join, perform and stay with companies. Now organizations have the opportunity to develop ESG-focused strategies that attract like-minded talent whose personal beliefs align with their ambitions.

- 86% of employees prefer to support or work for companies that care about the same issues they do.

- 38% of employees would look for a new role if they thought their organization was not doing enough on ESG Issues.

- 93% of employees who said their company was making a strong positive impact on the world were planning to stay in their jobs. For employees who did not agree with that statement, only 43% were planning to stay with their employer.

Developing and implementing a comprehensive ESG strategy and embedding it in organizational DNA can be challenging, particularly for those organizations in which sustainability is not inherently linked to the value chain. However, for organizations with a resolute focus on ESG, the long-term potential for accelerated change, enhanced engagement and talent acquisition are substantial. Aligning employees’ personal values with a clear organizational commitment to ESG will build satisfaction by creating a sense of belonging to a wider collective with a shared set of values.

Client Spotlight: Liquid I.V.

Sustainability has been a guiding principle for Liquid I.V. from the very beginning. As an international wellness brand redefining rehydration, it has used sustainability to shape its relationship with the brand’s own talent as well as its partners. Liquid I.V. has a refreshing, non-corporate approach that emphasizes energy, transparency and personal impact with a stated aim to grow, profit and inspire positive change. The prospect of becoming independent changemakers attracts new talent, and employees are given the opportunity to leave a legacy.

Signature employee experiences include:

- Placing sustainability at the center of their work so that each day starts with a focus on purpose. This allows Liquid I.V. to create a powerful ripple effect through its efforts and successes in transparency, sustainability and giving back.

- An ambition to convince others that the impossible is possible and that there is an urgency in this work

- Monthly Net Positive conversations to confirm the “why” and explore the ‘how” together as a collective

- A focus on ‘making it work’ – to prove that a company can inspire positive change and demonstrate that sustainability is ‘the new way”

“[Sustainability/ESG] is the one area that I believe you do not pull back and hide information. It must be shared because it is a responsibility of every brand and every person.”

Sean Lavin

Vice President, Impact – Innovation, Global Sustainability and Giveback, Liquid I.V.

A focus on sustainability results in a collective of inspired individuals collaborating towards shared ESG goals to become a culture of changemakers. Liquid I.V.’s example shows that purpose-driven organizations with clear ESG goals can create inherently collaborative environments by channeling each individual’s commitment to sustainability. Its strong ESG stance and shared drive enable it to attract and retain talent. And not just any talent, but individuals who tend to be ESG-minded and are naturally collaborative.

Theme Three: Shared Success

As we’ve seen, leadership behaviors and the connection with the individual belief system are critical to effective collaboration in service of ESG. However, while these catalyze effective collaboration, scaling and sustaining to achieve heightened collaboration requires more.

With any collaborative effort, individuals are occasionally required to “give away their LEGOs”: sacrificing their own ambitions to serve a greater good. Interestingly, this becomes more pronounced with ESG. Sustainability activities don’t always have easy-to-quantify commercial returns, but teams and individuals must make room for ESG efforts in their own agendas to advance the organization. In particular, ESG-related metrics must be embedded into incentive structures for ESG initiatives to succeed.

The strength of these goals and incentives varies between organizations according to their ESG credentials. Some companies, like Liquid I.V., have embedded ESG efforts into their business models. However, in other mature businesses, a passion for ESG may be present organically or within pockets of the organization, but it is not integrated into the culture. This prevents truly collaborative efforts. Such organizations must provide stronger incentives—a rewarding collaboration between teams and within them – to realize all the potential of these initiatives.

Client Spotlight: DSM

Successive CEOs have helped ensure that purpose has long been established at DSM. A global leader in health and nutrition, the business has a history of projects that support its ambition to “create brighter lives for all.” For example, since 2007, DSM has partnered with the World Food Programme to use micronutrients to enhance nutrition for pregnant mothers and their children. The program, which has a proven impact on the long-term healthy development of both mother and child, is so deeply embedded in the culture of DSM that it – and others like it – is often why employees join and stay with the organization.

To ensure its commitment to ESG has real meaning for its 20,000+ employee organization, DSM has embedded ESG and sustainability metrics within its incentive program for the pasts 10 years. Even at the highest levels of the organization, these metrics shape 50% of employee remuneration. And the organization continues to look for ways it can do even more. In 2021, it completed a full review of its remuneration policy to maximize its impact and prioritize sustainability within DSM.

“We make sure [sustainability] is embedded in the way that we reward people, to continue to bring the organization forward and contribute to more than just making money. It helps us attract and retain really good talent – people come to us because of who we are and what we’re trying to do.”

Cristina Monteiro

Chief Human Resources Officer, DSM

Transparency and openness are key to effective cross-organization collaboration in the service of ESG. Employees who do not have direct influence over shaping the ESG agenda may feel that sustainability is a large, vague and insurmountable challenge. Without clarity and openness, they may be less motivated to do their part, as they are unsure of what that looks like for them.

The first step in effective ESG collaboration is to dedicate time and effort to educating employees on the organization’s ESG-related goals, how they will get together and their role in that journey. Employees will be empowered to work more closely together with a clearer sense of the “why” and a greater understanding of their individual contributions to the overall goal. At the same time, clear ESG-related incentives will encourage the creation of new priorities, enabling heightened collaboration for sustainability across the organization.

Theme Four: Expansive Collaboration

In previous sections, we have seen how pivotal the presence of strong leadership, committed individuals and aligned incentives are to unlocking effective collaboration for ESG. Another catalyzing force is the ability to collaborate across ESG’s expansive stakeholder ecosystem, particularly its external stakeholders. In our research, we found that breaking down silos is especially important because the success of ESG’s goals and initiatives hinges on the engagement of external parties and partners, including the supply chain, partners and even competitors.

“[ESG] strategy cannot be a standalone effort within a business, because if it is, it will always be a siloed function. You have to truly integrate it in the business. For instance, together with our Chief Finance Officer, we share ESG targets that are tied to our overall compensation, and we are continuously looking for ways in which we can incorporate sustainability metrics into our investment decisions.”

Ezgi Barcenas

Chief Sustainability Officer, AB InBev

Change Fitness and Collaboration

Working within this ecosystem to meet ESG goals demands innovation and a high degree of what Prophet calls maturity in “change fitness”. We describe the more mature levels of change fitness as a state of “flow” or even “play.” This is when leaders recognize and are comfortable with the idea that they don’t have all the answers seeking out and embracing other contributors, including competitors. Organizations and teams exhibiting Change Fitness will embrace more experimental working styles to support continuous and disruptive innovation. Meanwhile, individuals will be better equipped to move fluidly between roles and teams to improve personal and business outcomes.

It’s worth noting that achieving change fitness isn’t always comfortable for leaders. It’s a “human-first” approach focusing on diverse contributions and devolved decision-making. This often conflicts with how leaders have been recognized for achievement in their working lives to date.

One example of a company that has a high maturity in change fitness is AB InBev, the world’s leading brewer. It pinpoints collaboration as the foundation of its respective ESG success, especially as it relates to its supply chain.

“External partnerships are a part of sustainability and have to sit at the heart of what you’re doing. You’re not tackling the problem for yourself; you’re tackling shared challenges and creating shared value.”

Ezgi Barcenas

Chief Sustainability Officer, AB InBev

AB InBev also recognizes the unique opportunity to work with others in the private sector, because advancing work in ESG is better for the business as well as the world. This list of partnerships includes NGOs, the UN, peers, the broader food and beverage industry, local authorities and governments and suppliers.

“These [sustainability] initiatives will help you solve a business challenge, but also help you tackle a societal problem as well…. Collaboration is required, and external partnerships are required, even if the project is internally focused.”

Ezgi Barcenas

Chief Sustainability Officer, AB InBev

Increased collaboration not only makes it possible to achieve your ESG goals but also fuels innovation and improves internal efficiency.

Conclusion

The increased focus on ESG in recent years has helped drive massive shifts in organizational priorities and mindsets. Businesses have started to move from catering to shareholders to caring for stakeholders; from risk mitigation to sustainable growth realization; and perhaps most importantly of all, from “me” to “we.”

“You are always looking for the spark to ignite and you particularly need it when collaborating on behalf of the planet.”

Rahul Malhotra

Head of Group Brand Strategy & Stewardship, Shell

Perhaps unlike any other type of work, ESG creates win/win possibilities for the business, its employees, its customers,and the planet. But to realize these possibilities for all demands the collaboration of all.