BLOG

Brand & Demand: Building a Data-Driven Modern Marketing Organization

Kate Price, Partner at Prophet speaks with Caroline Chulick, Head of U.S. Marketing at Hill’s Pet Nutrition about how to drive more return on investment (ROI) with your marketing.

Caroline Chulick is the Head of U.S. Marketing at Hill’s Pet Nutrition, a subsidiary of Colgate-Palmolive, where she leads brand strategy, media, data & analytics, integrated commerce and public relations for a premium pet food business.

Kate Price: Given the increased focus on accountability and ROI in marketing, how has your experience been, and what shifts have you observed in your approach to demonstrate impact?

Caroline Chulick: In my 20 years at Colgate-Palmolive, there has been a consistent strategic focus and commitment to driving ROI and measurement. However, recently there has been a noticeable shift in expectations and the way we approach demonstrating impact. With increased investment in brand building, there is greater rigor in tracking where these investments go. The key lies in aligning investments, tactics, and the entire funnel with well-defined business goals in the planning phase. The C-suite places trust in the marketing team to deliver results, but there is certainly a heightened expectation for faster feedback cycles. The cadence for presenting outcomes has increased, particularly in short-term, behavior-driven data, requiring a faster test-learn-pivot cycle. For marketing to be successful, educating senior leaders on evolving marketing approaches and technologies is a crucial aspect. There’s a general acceptance around continuous learning and our leaders understand that the traditional approaches may not be effective in the current landscape. And, we’ve found that they are always excited to learn more.

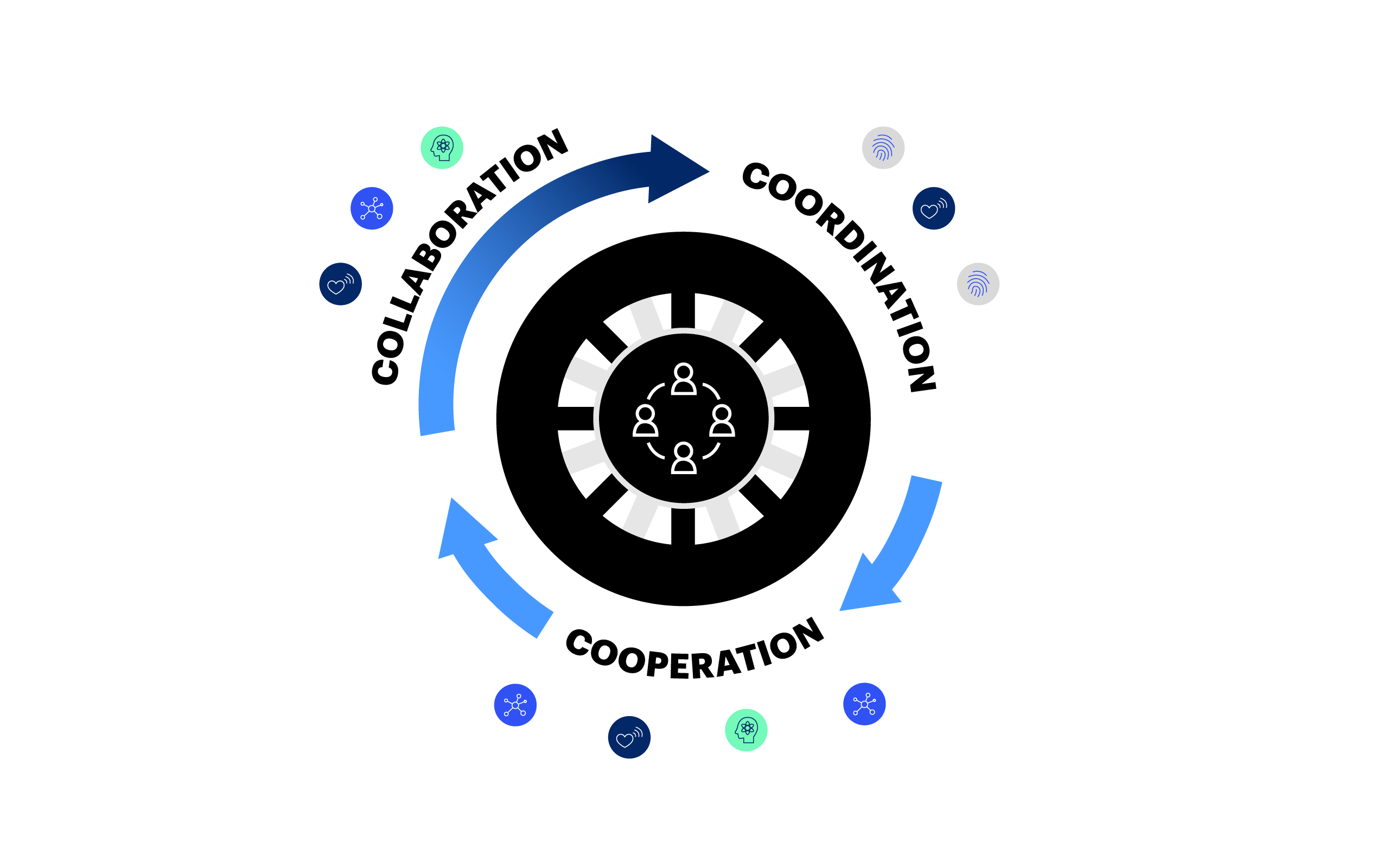

KP: Within your organization, how has cross-functional collaboration evolved, especially in terms of partnering with other internal business units?

CC: In the realm of CPG marketing, cross-functional collaboration has always been fundamental. However, the transformation lies in how this collaboration has evolved, particularly in the past three years. The game-changer is the increasing maturity of data within the organization. While traditional collaboration involved departments such as supply chain, sales, finance and legal, the difference now is the profound impact of data across every facet of the organization. Data-driven partnerships have become the norm, influencing how we go to market in areas like warehousing, frontline sales and end-user interactions.

As an example, we initiated a data partnership for media purposes, which unexpectedly transformed how we approached veterinary clinics in our sales strategy. The newfound data visibility allowed us to discern critical differences between two seemingly similar clinics. Through our data, we discovered that Clinic A was loyal to our brand and distinct from Clinic B, which was also ordered just as much from a competitor. This revelation reshaped how we engaged with each clinic, providing tailored conversations and sales strategies. The availability of this data has revolutionized not only how we approach the market, but also how we tier and equip our salesforce for more effective interactions.

These evolving dynamics in B2B marketing showcase the potential for leveraging data to achieve precise, personalized interactions akin to the one-to-one marketing approach in the consumer space.

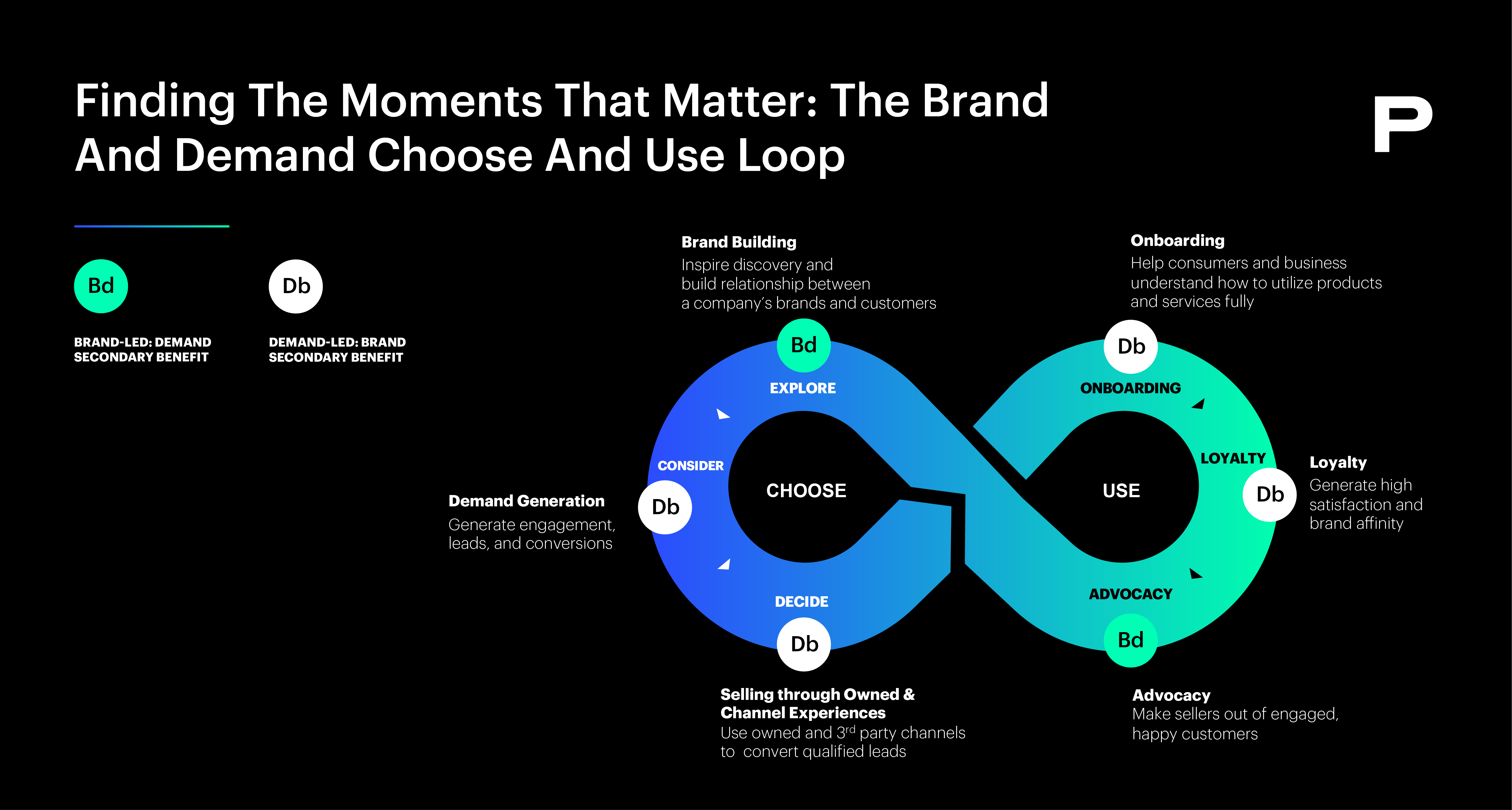

KP: We published a report called Brand and Demand: A Love Story which talks about the tension between the two functions. How do you balance your brand and demand marketing investments?

CC: The dynamic between brand and demand is a nuanced one for us. Brand, which has traditionally been associated with long-term equity building, now intertwines with demand, which is focused on short-term actions. For us, the two are interlinked, and we’ve observed that our short-term (ROI) for brand building is as impactful, if not more, than it is for product-specific initiatives. Our data-driven approach allows us to find a unique balance, where we test and optimize the mix to align with our brand’s specific strengths and audience penetration. For us, it’s the strategic fusion of both that typically yield the best outcomes.

An important component for creating an optimal balance is our team dynamics. Physical collaboration spaces and a culture of curiosity and continuous learning have been key in breaking down silos and fostering cross-functional collaboration. Our team operates with a shared understanding that we’re not just building a product; we’re crafting a brand, a lifestyle, and a connection with our audience. This distinction motivates our team, aligning their efforts to build equity and deliver a meaningful brand experience. The nature of our category, focused on pets and families, adds a layer of emotional engagement, creating a sense of purpose for our team.

We’ve also shifted our key performance indicators (KPIs) to encourage collaborative achievements, reinforcing that synergies between different strengths and focuses lead to more impactful outcomes. My role as a leader involves connecting these dots, facilitating collaboration and removing any barriers the teams encounter.

KP: In the report, we found four common principles of brand and demand: anchoring marketing investment in business objectives, experimentation, building a modern marketing organization and putting the customer at the center. Do you agree with these and how do you apply these to your organization?

CC: I do agree with these principles. Anchoring our marketing investment in business objectives is a fundamental principle that we actively embrace. Each year, we set ambitious goals, some with a short-term focus and others with a strategic, three-to-five-year horizon. The key lies in translating these objectives into actionable plans through what we call a brand growth plan. This plan serves as our roadmap, and KPIs are the compass guiding our progress. The process involves a continuous cycle of testing, learning, and pivoting, ensuring we stay agile and effective in achieving our business objectives.

As it relates to experimentation, it is not just encouraged. but ingrained in our culture. I recall a valuable lesson several years ago from an executive leader and mentor that came while I was working on a new direct-to-consumer project. He actually urged me to fail! The rationale was clear: if we’re not failing, we’re not pushing the company beyond its comfort zone. Failure isn’t a setback; it’s a sign that we’re challenging the status quo. Experimentation, accompanied by a willingness to fail, is vital for growth and innovation.

Building a modern marketing organization requires a dynamic approach. In my three years in the current role, I’ve repeatedly recognized the need to adapt our organizational structure. The pace of change and growth demands a constant pulse on the people, structure, tools, and resources within the organization.

Being customer-centric is not just a philosophy; it’s a way of life in our organization. Every initiative, product, or experience starts with a customer insight or a pain point that needs addressing. The commitment is to solve problems or make lives easier, ensuring that each effort is purpose-driven.

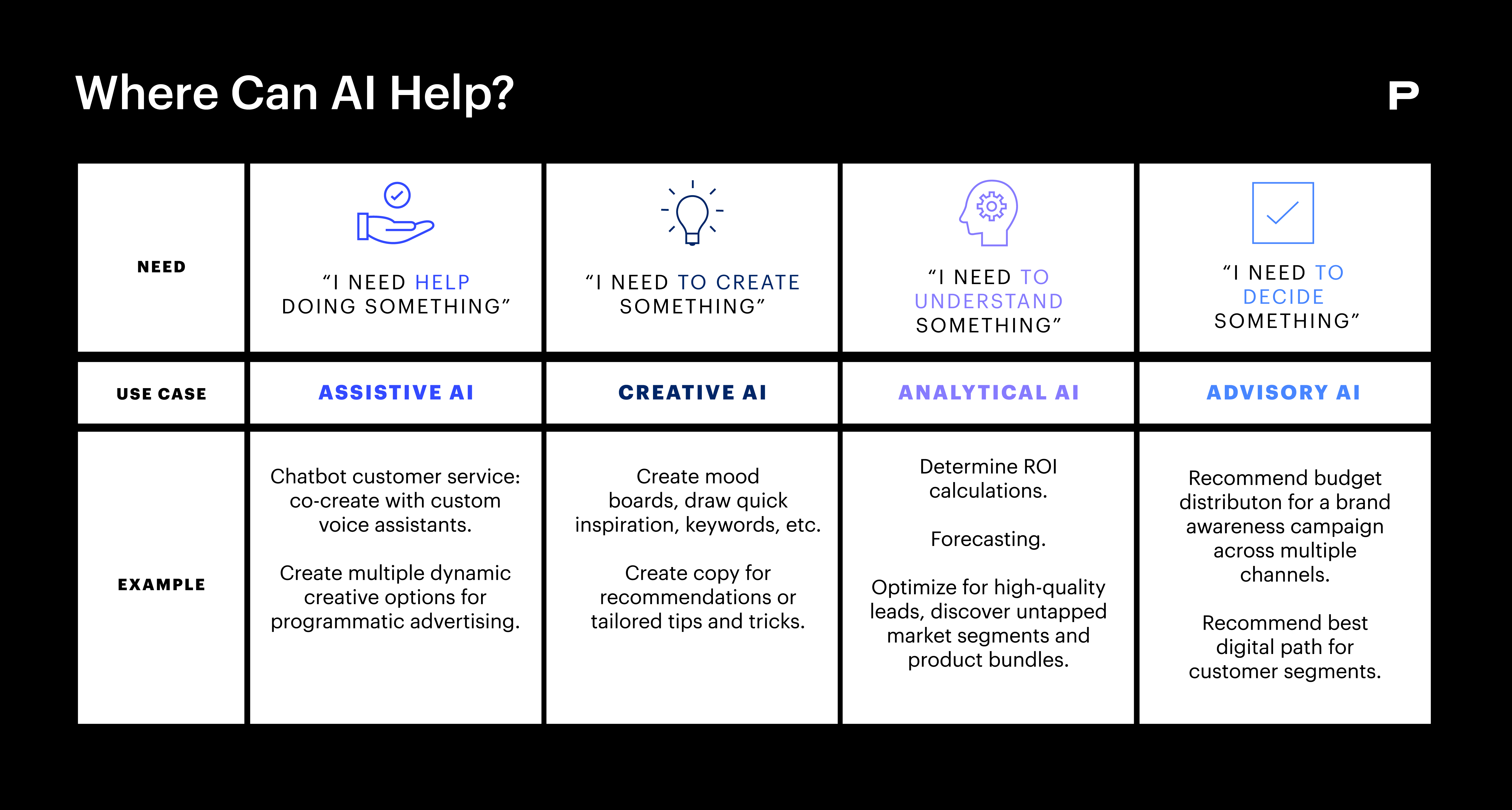

KP: What excites you about the market in the next couple of years, and how are you preparing your organization for upcoming shifts?

CC: What excites me most about the future are strategic partnerships and a focus on audience-first planning. We are actively seeking unconventional partnerships across the pet space, expanding our role from a nutrition company to a comprehensive pet health solution. Additionally, the shift to audience-first planning is a key evolution in strategy. This approach, which is rooted in understanding and addressing audience needs, goes beyond traditional campaign planning. The challenge lies in balancing the emotional and product-centered needs, ensuring that personalized, audience-centric strategies coexist harmoniously. The exploration of these new frontiers aligns nicely with our commitment to continuous innovation and adaptation to evolving market dynamics.

FINAL THOUGHTS

In the evolving landscape of marketing in a data-driven era, Caroline emphasizes the importance of aligning investments with business goals and fostering cross-functional collaboration fueled by data insights. While different industries have nuanced approaches to brand and demand marketing, she emphasizes the need for a strategic balance between short-term actions and long-term brand building. As we hear from Caroline and other marketing leaders, these continue to be reoccurring themes of driving marketing effectiveness in today’s ecosystem.

Ready to integrate your brand and demand teams? Schedule a workshop with us.