BLOG

Unlock. Create. Execute: A Guide for the New World of Growth

Three Pathways and Five Strategies for Accelerating Growth

Growth is rarely easy. Based on conversations with senior business leaders across industries, we sense an increasing recognition that it has never been more difficult to generate and sustain growth. To be clear, we are talking about growth driven by customer interest and market demand, rather than the temporary variety driven by acquisition, cost takeout or organizational restructuring. The bottom line is that not even top performers can expect that continuing to do what got them to market-leading positions will deliver the next phase of growth.

Some of the common barriers – continuous cycles of tech-driven disruption, relentlessly fickle customers, talent mismatches – are well understood. However, less tangible and often overlooked factors – including lack of C-level clarity and confidence, short-term thinking and a history of unactioned strategies and plans – may be even more hostile to growth. Consider how senior leaders may lose faith in growth strategies when market opportunities shift more rapidly than the organization can pivot, refine its go-to-market approach or reallocate resources. Even when the right strategy is in place, limited ability to execute – or execute at the pace which growth now demands – may undercut returns.

Because markets move faster than ever, we believe sustainable growth results from:

- Unlocking compelling customer insights to inform growth strategies

- Creating relevant, impactful growth moves

- Executing faster and more efficiently

How Rapid Changes in Customer Behaviors Impact Growth

The customer often has the answer. In today’s volatile markets, growth comes either through a proactive insight-led and customer-back approach, which is more sustainable, or by riding the wave of macroeconomic or societal trends. Unilever proactively changed its portfolio strategy after scoping the impact of the weight-loss drug Ozempic on consumer behavior. Modeling the likely changes in eating habits, Unilever chose to spin off most of its ice cream business, retaining only a few key brands (e.g., Ben & Jerry’s, Magnum).

During the pandemic, companies like Peloton and Calm realized unprecedented growth as consumers re-evaluated their health and wellness priorities. Both companies have failed to make strategic, post-pandemic pivots to stay relevant.

For firms that don’t want to leave growth to chance or market timing, success starts with deep insights into customer needs, as Prophet research shows.

Insights From Prophet Research

Among innovative companies, 84% have a consumer and market insights capability.

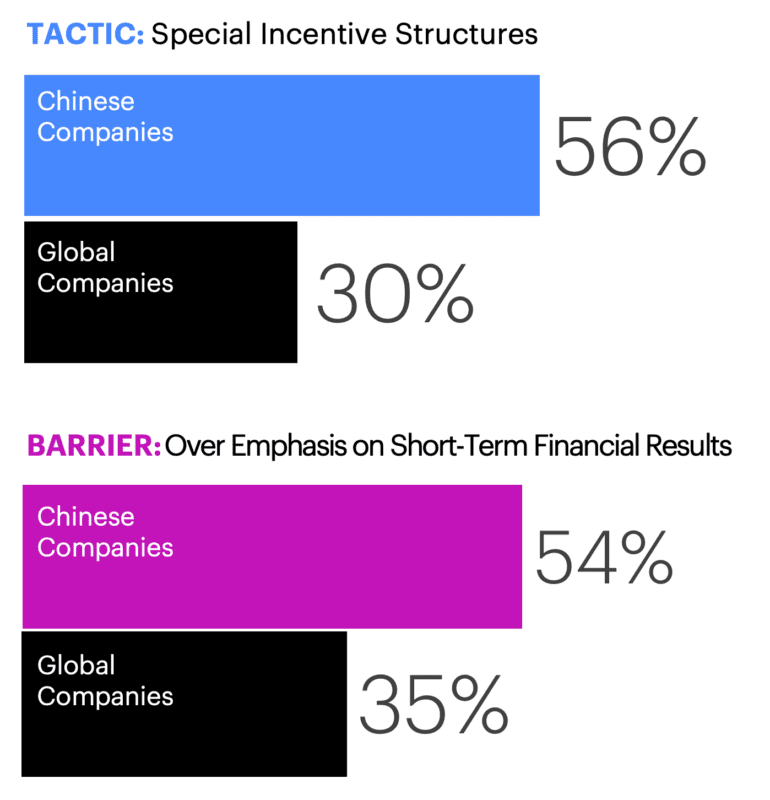

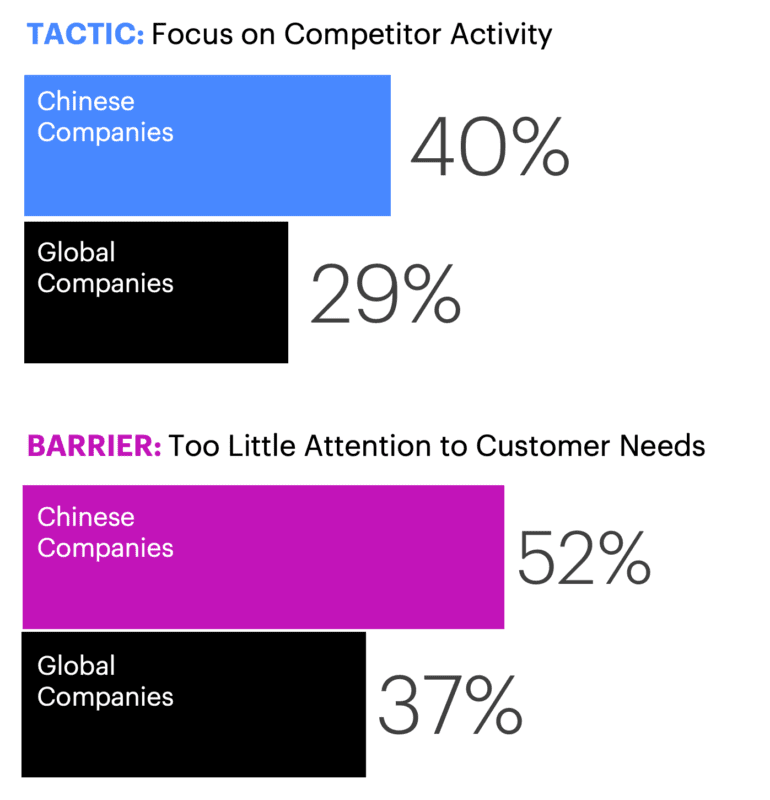

Among all companies, 37% of leaders say senior executives pay too little attention to customer needs.

In devising growth strategies, firms should factor in the impact of external macro trends on customers and the opportunities to provide new products and services to help customers navigate them. Even more broadly, executives should reflect on how these changes may influence who their customers are today and who they should be tomorrow.

Charting the right course forward requires thoughtful decisions across key growth drivers that go beyond customer insight. In other words, firms must ensure that their good ideas are converted from slideware to clear action plans supported by necessary capabilities. Among the questions to address:

- Who is our target customer?

- What products, services and experiences should we offer?

- Why should customers care about our products, brand and purpose?

- How do they perceive the value we offer?

- Where and when should we engage customers – via which channels, ecosystems, platforms and partnerships?

- How will we capture value?

- What is the optimal operating model to deliver?

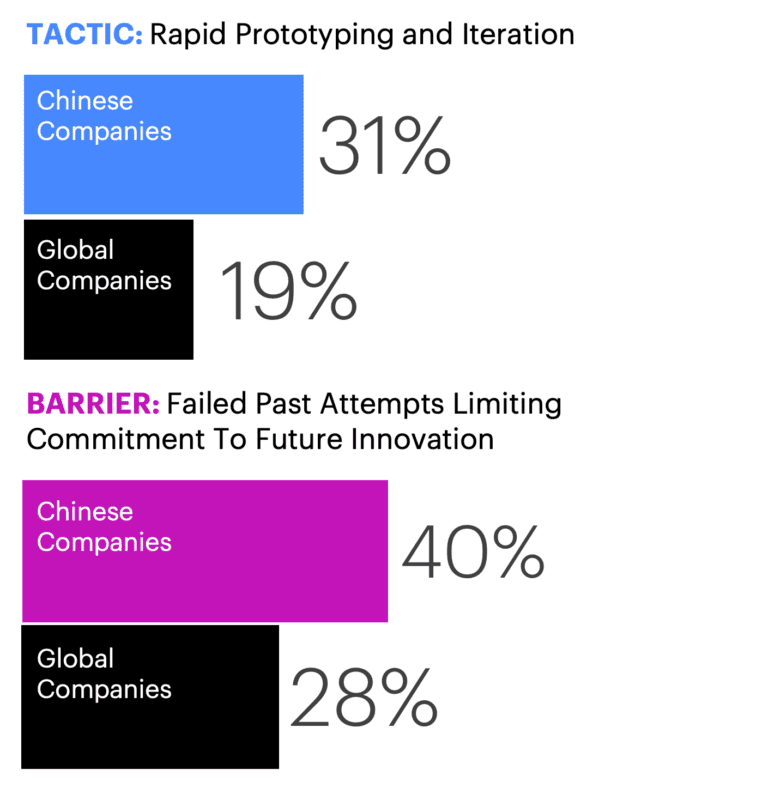

The answers to these questions have short- and long-term implications. The resulting commitments will be ones the organization can sustain for years at a time. They will also determine what firms should do next quarter. Ideally, a clear customer vision will inspire the organization for the future while attentive, dynamic management of action plans will help firms keep up with constantly shifting customer needs and preferences. Firms should plan for frequent refinements and calibrations based on continuous learning about customer behavior, market feedback and competitors’ actions. Prophet research shows that organizations that meaningfully assess and recalibrate growth plans at least monthly are twice as likely to be successful, resilient innovators. Too many firms still think of growth investments as a matter of annual planning.

What Happens When It’s All About the Short Term?

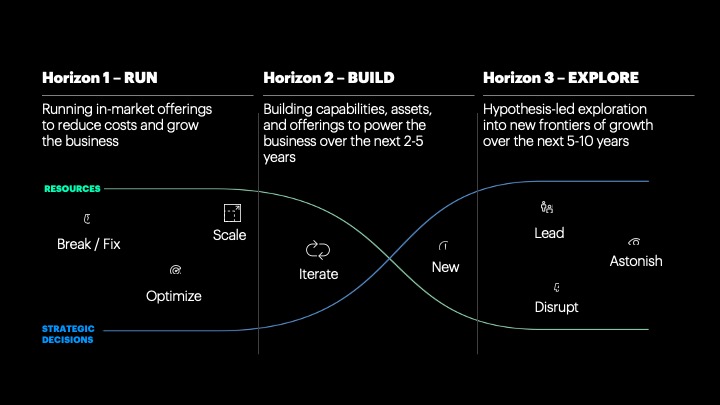

Unfortunately, immediate-term pressures – specifically that increasing revenue this quarter is always the top priority – may restrict investment in new offerings and thus narrow future horizons. According to Prophet research, 34% of business leaders say their firms overemphasize short-term results. A similar proportion, 37%, say their organization has no long-term planning process. “You’re constantly in this space of change,” one told us. “Plans are abandoned almost as soon as they are made. There’s no real plan because things just sort of happen.”

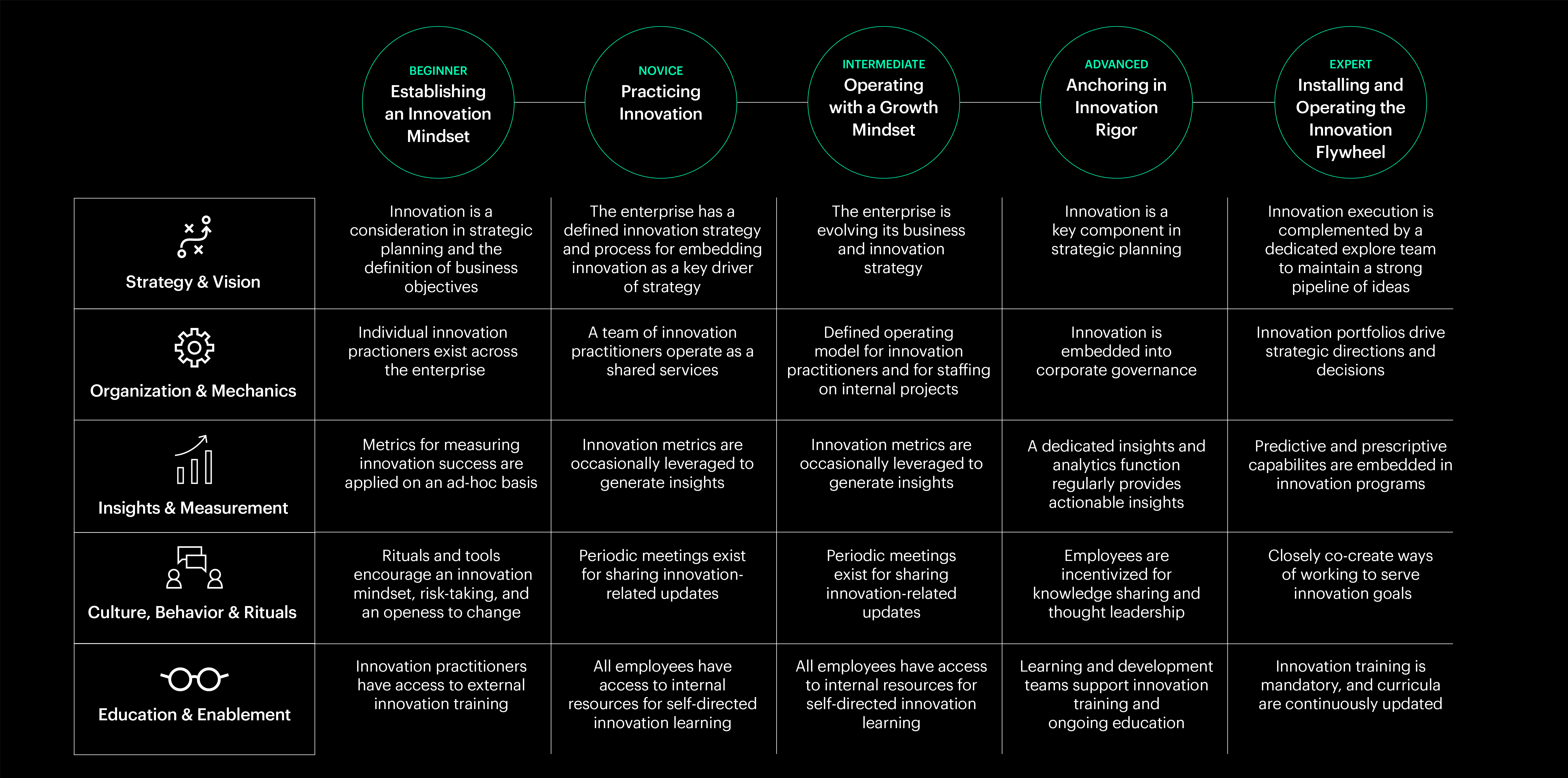

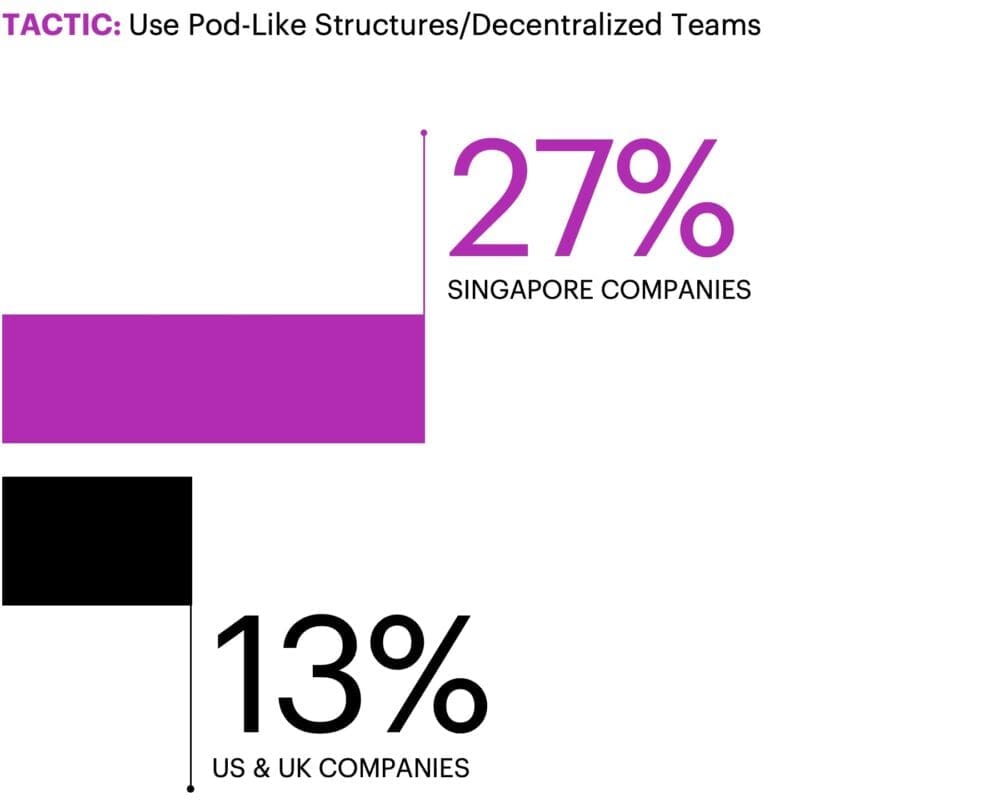

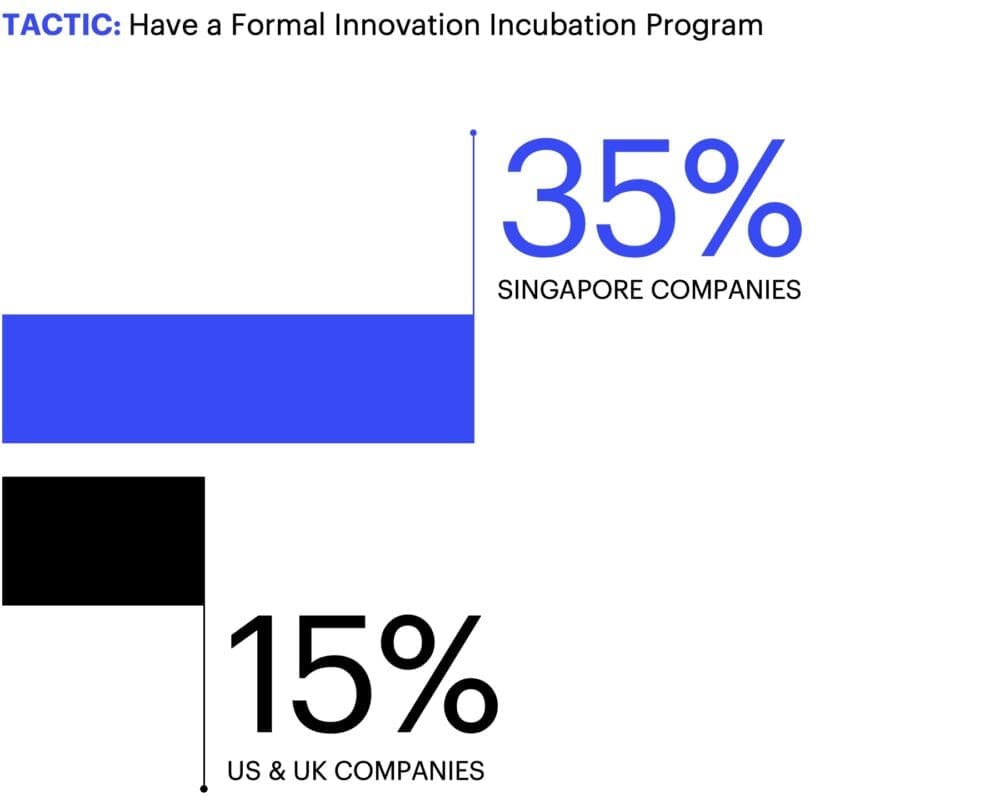

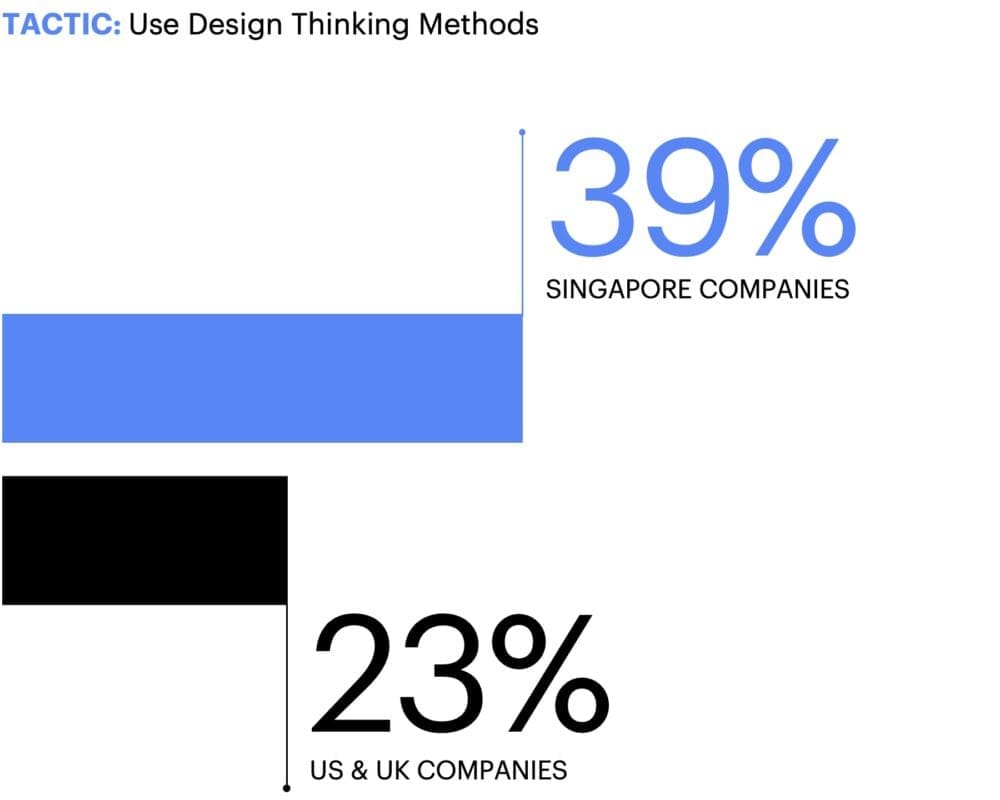

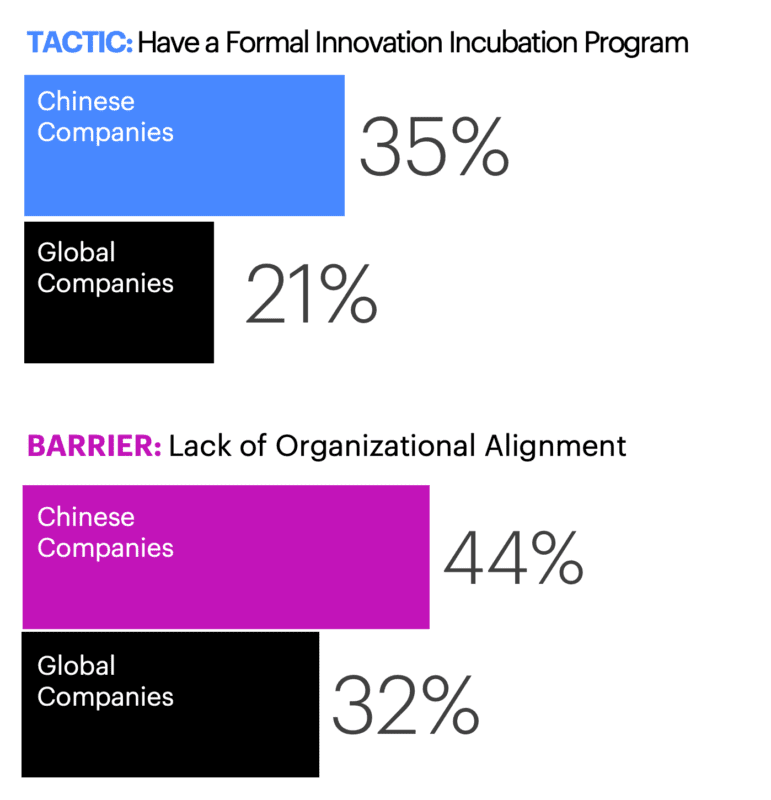

Such reactive postures are no surprise given the pace of disruption. They necessitate that firms build new capabilities even as they are running their growth plays. Those capabilities are often housed in agile, test-and-learn oriented and cross-functional teams, which have proven to be more proficient in delivering against growth objectives. Fully 80% of respondents in our global survey said design-led innovation teams are important, but only 37% said their organizations have such units in place. Developing these capabilities is not easy, of course, but they provide the foundation for self-funding innovation programs and, thus, sustainable growth.

Insights From Prophet Research

- 63%: organizations lacking design-led innovation teams

- 37%: organizations lacking a long-term planning process

- 2x: organizations that meaningfully assess and recalibrate their innovation moves at least monthly are twice as likely to be successful, resilient innovators

Pathways to Uncommon Growth

Strategies aligned to these pathways will manifest differently in varying contexts and sectors and they are not mutually exclusive; some firms will emphasize one, while others will experiment with portfolio approaches that include all three. Boldness and creativity can be different makers for these approaches; the bolder the growth strategy, the more likely firms will differentiate themselves in competitive markets.

1. Expanding beyond the core. In this approach, businesses narrow in on customer needs to enter a new market or customer segment, offering complementary products or services to meet a broader range of customer needs. This approach requires the least risk tolerance and least amount of change within a business. And it’s likely to produce quick wins. For example, through the height of the pandemic, companies developed products and services to reduce transmission and care for the ill. Today, companies are looking beyond point solutions and specific problems to focus on more holistic views of respiratory health. Large pharmaceuticals with separate products in testing, treatment and prevention of upper respiratory infections have reorganized their product portfolios around complete and cohesive solutions offered through retail channels.

2. Venturing into adjacent territories: This approach is about uncovering value in products, services and experiences that are closely related to existing strategies. It requires a moderate risk tolerance and degree of change as it explores efficiencies based on existing strengths and capabilities. When done right, firms find differences from the core business but still share commonalities and avoid channel conflict.

One financial services company coordinated loan refinancing through third-party aggregators. Realizing it had a unique capability to simplify fragmented lender requirements for consumers, it saw an opportunity to own more of the customer relationship. Prophet helped the company refine its value proposition, create a product roadmap and launch its first pilot into market, all while building the product, technology and marketing teams needed to sustain the effort. As a result, the company remained vital through a volatile inflation and interest rate environment, deploying its direct-to-customer capabilities to launch new services, reach new markets and grow its relevance.

3. Pursuing net new growth from innovation and emerging customer demands: This is the boldest approach, the one most associated with breakthrough innovations from true disrupters. It involves playing in novel markets or industries, creating forward-looking solutions that get ahead of emerging preferences and aspirations that have yet to fully manifest in mass consumer behaviors.

Not surprisingly, this mode of growth requires the highest level of risk tolerance, the greatest creativity and most substantial change as it pushes businesses to step out of their comfort zone to pioneer new offerings that anticipate customer needs. Companies often invest in cutting-edge technologies, enter new industries or markets undergoing disruption or create entirely new business models by bringing together an original set of capabilities.

Durable goods manufacturers – faced with acute supply chain disruptions, a long-term trend towards higher-cost, near-shore manufacturing and mixed results from interventions by smart home technology companies – might reasonably wonder whether they can successfully stand up a services model to future-proof their businesses. Spurred by Tesla, car manufacturers now consider the automobile as an updateable software platform, requiring the application of digital integration, user experience and technology expertise throughout design and production processes; they then sell subscriptions to unlock services like OnStar and Apple CarPlay. Appliance manufacturers like Samsung continue to grapple with the elusive promise of Internet-connected screens on refrigerators, washing machines and other home appliances. And manufacturers of entry and exit points, like doors and windows, can seriously consider their products’ roles in connected, smart security services.

Five Key Capabilities for Unleashing Growth

Once firms identify the right path to growth as outlined above, they must determine the best way to advance quickly, efficiently and purposefully. Too often, this step turns into a stumbling block. However, organizations that possess a few key capabilities and cultural attributes can create the capacity and build the organizational muscle memory to launch new products, devise new business models and execute other types of growth strategies repeatably. They’ll also enhance their ability to operate these new businesses efficiently and scalably. The keys to success are:

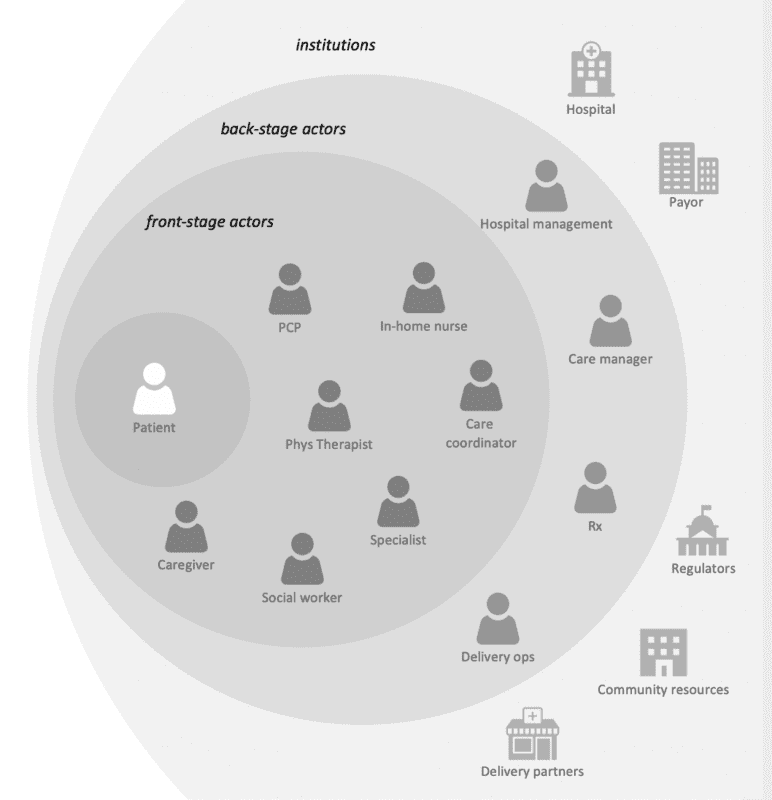

1. Using cross-functional GTM teams to achieve speed to market: When growth is everybody’s job, it may become nobody’s job. On the other hand, growth is too important to be left to small innovation labs or single functions (e.g., marketing, sales, product development). Rather, firms should build cross-functional teams charged with launching new products quickly. Even if the team is small, it should pull from finance, HR, technology, design, strategy and other parts of the organization. Why? Because all of those domains make important contributions to the development of new offerings.

2. Building a coalition of stakeholders for informed decision-making: To execute successfully, growth leaders must have a clear understanding of the critical path of decisions, identify the necessary data inputs to inform key decisions and maintain a steady pace against clearly defined milestones and gates. However, informed decision-making typically doesn’t happen fast enough, especially in large and complex organizations. Delays are especially likely when decision rights are unclear, contested politically or when a large number of stakeholders must be involved n. Ideally, growth leaders will develop a comprehensive coalition of stakeholders throughout the organization parallel with the work to ensure that everyone is on board with coming changes and understands their role in execution. Such a coalition can help ensure depth and alignment of key capabilities.

3. Making GTM innovation BAU (business as usual): Any organization seeking sustainable, customer-led growth must find ways to make the capabilities necessary for organizational reinvention, portfolio refresh and continuous learning part of business as usual. For instance, cross-functional growth teams should work within a well-defined go-to-market process, reflecting the reality that launching, operating and scaling new products and business are not “special projects” but an essential part of ongoing operations.

4. Moving at the speed of growth: Across both growth strategy formulation and go-to-market execution, speed is the name of the game. Some organizations are equipped to strategize and execute at speed, but many struggle. To make these plays work for your organization, you need to increase your organization’s speed to:

- Customer insight: understanding what they want, which channels they prefer and where they’re likely to go next

- Strategy: converting customer insight into strategic priorities

- Market: turning strategic ideas into in-market action

- Impact: accelerating the delivery of real-world results

- Capability: creating the foundation to scale and sustain higher levels of performance

Speed matters because organizations can only grow as fast as their ability to adapt.

5. Getting up to speed with AI: Faced with the need to go faster, many companies are turning to AI. One media company used AI to track consumer preferences, which led to the creation of a new business model centered on interactive and original content. AI tools are helping CPGs to develop prototypes more rapidly. A hospitality leader has embedded AI in enhanced search experiences to drive discovery and rentals of vacation homes.

While these applications make sense, leaders should recognize that AI is not a silver bullet to accelerate capability development. Rather, businesses need to understand the targeted ways AI-powered customers interact differently with AI-enabled employees. From that customer-back vantage point, organizations can look to create opportunities to optimize, enhance and reinvent engagement (Be on the lookout for upcoming Prophet research that reveals how consumers really feel about and use AI.)

One More Thing: Balancing the Risks and Rewards of Growth

Strategic discussions often emphasize the external barriers preventing firms from realizing the upside. The risks of growth – and the organizational appetite or tolerance of such risks – is less frequently examined. We believe this is an oversight. Senior leaders must attend to the necessary cultural aspects of unleashing growth, including management mindsets.

While everyone automatically says they want growth, they won’t necessarily be comfortable with the risks involved in launching new products, deploying resources, modifying operations and all the other necessary steps to achieve meaningful growth. As such, leaders would do well to explore just how “growth tolerant” their firms really are. That’s especially true of today’s dynamic, “high-VUCA” (Volatility, markets. When firms face high degrees of volatility, uncertainty, complexity and ambiguity, growth demands greater organizational resilience. In other words, senior leaders that help the organization become more flexible, adaptable and agile are laying the foundation for sustainable growth.

Acknowledgments: Marc Anderson and Griffin Olmstead

How Prophet Helps

We take a collaborate and human-centered approach to help leaders unlock compelling customer and market insights; create relevant growth moves; and develop the capabilities to execute faster and more efficiently.

FINAL THOUGHTS

Growth has become even more challenging to generate and sustain driven by customer interest and market demand. Even top performers can no longer rely on their past strategies to achieve the next phase of growth. Beyond well-known barriers like tech-driven disruption and fickle customers, less tangible factors such as lack of C-level clarity and short-term thinking pose significant threats. Sustainable growth now depends on unlocking compelling customer insights, identifying impactful growth moves, and executing strategies quickly and efficiently.